In early July, I called Altice the “best” large cap stock. Since then, the stock has done one thing: go straight down. Today, the stock is gapping down again as the company guided to losing subs in Q3 at the GS conference.

I stand by everything I said in the first post (as well as the August update and this podcast). To sum up: yes, there are issues, but Altice is simply way too cheap. At current prices (~$22.50), Altice has an EV of ~$35B. They pass ~9.2m homes and LTM EBITDA is ~$4.5B, so you’re paying ~$3.8k/home passed or ~8x LTM EBITDA. Charter, the closest pure play, is trading for ~$4.5k/HP or ~12.5x EBITDA. That’s just too big of a multiple discrepancy, and given Altice is >5x levered any snap back in the multiple will have huge torque on the share price. I’m personally of the view that cable companies are worth >5k/HP or somewhere in the 13-15x EBITDA range; the low end of that range would put Altice’s stock well over $50/share.

To be honest, the most disappointing thing I heard from Altice at the conference is on capital allocation, as it sounds like they’re dialing back their share buyback (I believe they said the buyback program was being “re-evaluated”). For the company to go from hammering their share count (remember, they bought back >10% of shares outstanding in late December at $36/share) to slowing down when the stock is out of favor and the share price is much cheaper is incredibly disappointing.

Anyway, I didn’t want to spend more time discussing Altice’s valuation…. but I was kind of surprised by the degree of inbounds I got on Altice and the share price. The inbounds tended to come from three sources:

Friends who I talk to reasonably frequently wondering what the heck is going on

People I don’t know and don’t talk to tagging me on Twitter freaking out

Trolls and/or cable bears on Twitter dancing on cable’s grave

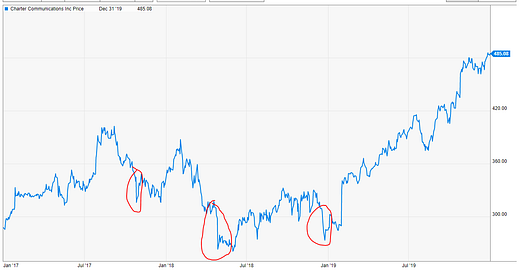

The last time I remember getting this level of inbounds on a cable name was on Charter (CHTR) in late 2017 / all of 2018. It’s easy to forget now, but at the time Charter was a very controversial name. Their financials were messy as they were integrating their massive Time Warner / Bright house acquisitions, and plenty of investors / analysts were still focused on Charter’s video business. The stock had three big draw downs, and during each of them I remember plenty of bears making fun of cable bulls saying the cable bulls were dumb Malone fan boys who had followed him into a position without thinking and didn’t understand that video was dead, fiber overbuilds would hamstring the cable business, and fixed wireless would destroy the business in the long term.

Today, Charter’s at ~$750/share, and most analysts / investors understand that video’s not really a draw for cable companies anymore. With the benefit of hindsight, a lot of those fears were overblown. If you weren’t massively long a cable company during those days, it’s easy to forget just how controversial owning Charter was or how worried people were about cable being a declining business. Seriously, some people thought these were terminal shorts. The third draw down I circled in the chart above happened right at the end of 2018; I remember in the midst of it BTIG published their predictions for 2019 and the #1 prediction was that Tom Rutledge (Charter’s CEO) would get fired in 2019 and the whole company would have to toss the towel in on their levered buyback model and admit that they had way overpaid for their share repurchases. The level of vitriol I’m hearing for Altice today reminds me of the panicked messages I was getting for cable right after that note came out.

A few weeks after that piece came out, Charter reported FY18 results and guided to 2019 capex coming way down as their integration program finally neared completion. The stock went from $290 to $345 in a day and went pretty much straight up for the rest of the year; it closed the year at just under $500/share. Instead of getting fired, Rutledge delivered on his vision for the combined Charter and made roughly a billion dollars from doing so (and I don’t mean that figuratively. His pay package literally called for him to make almost a billion dollars from executing on the merger and getting Charter’s share price over $500/share).

History may not repeat, but it does rhyme. And I’m seeing lots of rhymes from Charter in 2018 to Altice today. Yes, the story is a little hairier: Altice’s operational issues are largely self inflicted while Charter’s were merger / integration driven, and Altice doesn’t seem to have anywhere near as good a handle on the business as Charter did (among other big operational missteps, Altice keeps guiding to subscriber growth when they announce earnings and then having to pull back on that a few weeks later at conferences).

But the similarities are all there: bears are dancing on Altice’s grave on some short term issues, while bulls keep looking at the valuation and pounding their heads against a wall wondering how the market can be so sensitive to short term numbers and not pay any attention the the huge free cash flow or continued positive long term trends. Bears are laughing at Altice for lighting money on fire with their aggressive buybacks at higher prices, while bulls are incredibly frustrated that the company got aggressive buying back shares when the stock was dear and that the company seems to be way slowing down their buyback program now that the stock is out of favor (in 2018, Malone accused Rutledge of putting his hand in the cookie jar and buying back Charter’s shares when they were dear and not being aggressive when they were out of favor)… but ultimately bulls think the buyback at higher prices will be money well spent if the company can execute (remember, Charter bought back a ton of stock when their was some merger premium at $400/share in 2017. That looks awful when Charter was below $300 a year later…. but with Charter currently at ~$750, the IRR on that repurchase looks pretty solid!). And, like Rutledge / Liberty / Charter, bulls see Altice as a company with laser focus on maximizing the stock price in the long term (remember, all the key management team will make hundreds of millions of dollars if the stock can get to $60 by early 2026).

So yeah, Altice’s share price in the short term sucks. But I can promise you that Charter’s share price in 2017 and 2018 sucked too. Charter then turned out to be a massive opportunity for people who had belief in the cable business and the management team, as the stock has more than doubled in ~3 years since then. Given Altice’s issues are much more self inflicted than Charter’s, it’s hard to have quite as much confidence in the management team…. but ultimately, I think the story here will play out reasonably similarly, though perhaps with a little more upside given Altice is a little more levered and a little cheaper than Charter was three years ago.

Great write-up! Agree on everything. The free-fall today was definitely amazing and sharp. We'll see how it goes over the next few days. Added today and will continue to add, hopefully at around $21. That's a 3-5 bagger in 3-4 years. I definitely hated the comment from Goei about them "re-evaluating" the buyback program! WTF! At least finish up the current plan! It's incredible to read that commentary by BTIG in 2018. The guy that wrote is certainly limited (to say the least). Thanks for the great summary!

I was not following CHTR in 2017/18 but did CHTR have declining customer penetration for 36 months like ATUS? Also was there fear that Malone or Rutledge would take-under CHTR? TIA.