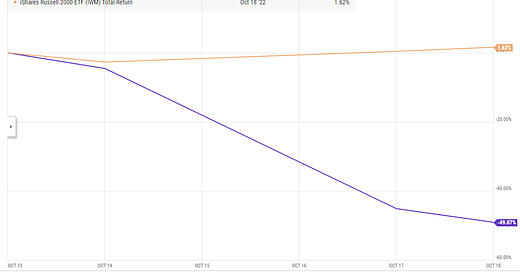

On Monday, rumors came out that CVS had walked away from a deal to buy CANO health. The stock has…. not responded well.

That massive drop caught my eye for a few reasons.

First, just the headliner: my rule of thumb is that when a rumored deal falls through, the target company’s stock drops ~25-30%. CANO’s ~50% drop is the largest “rumored deal drop” I can remember (I’m sure there have been larger; I just can’t think of any off the top of my head).

But the second is that the market seems to be pricing in no chance of a CANO deal happening at this point. I’m not sure that’s right; there are rumors that UNH and Humana were both looking at CANO. In fact, Humana has a right of first refusal on any CANO sale.

I’m not aware of many (any?) other publicly traded companies where a large strategic has a right of first refusal to a sale. I understand that term was struck in 2019, when CANO was smaller and not public…. but just the fact that Humana would negotiate for that term hints at how strategic CANO is. As does the fact that UNH, Humana, and CVS all seem to have taken a serious look at acquiring CANO.

So there appears to be a decent bit of strategic interest in CANO. And I’d guess CANO is a reasonably willing seller at this point. The first sign of that is they appear to have run an active sales process, but the shareholder base also seems pretty deal ready. Third point filed a 13-D earlier this year pushing for a sale (though, to be fair, they sold a bunch of stock in May and June), and Owl Creek sent a letter over the summer pushing for a sale as well.

Generally, my history has been that when a shareholder base pushes a strategic asset to sell, and the strategic buyers engage, that company ends up getting sold. Generally for a very nice premium.

But with CANO’s stock dropping ~50% on the “CVS pulling out” news, the market appears to be pricing no chance of a deal.

Which brings us to my big question: is the stock drop an opportunity, or is the market right and there’s no deal here?

I can honestly see both sides of the coin.

On the deal side, I’d refer you back to my “strategic assets shopping themselves tend to get sold” line. But just to build on that a little bit, let me tell you a story and then give a little more data.

A few years ago, a rumor broke that HD Supply was up for sale and Lowe’s was the buyer. HD Supply was a very strategic asset, and both Lowe’s and Home Depot (HD, which had previously owned HD Supply, thus the “HD”) were very natural buyers. Right after the rumor broke, Lowe’s put out a press release that said they were not buying HD Supply, and HDS’s stock stank. Several sharp investors noted that HD Supply had not rebutted the rumors, and that the most likely scenario is Lowe’s had been outbid by a strategic and was putting that release out to save a little face. Sure enough, a week later HD announced a deal to buy HD Supply.

I mention that situation because it’s possible something similar happened here. Maybe CVS entered late stage talks with CANO, and Humana unexpectedly decided to exercise their right of first refusal? Or maybe some CVS specific news caused CVS to pull out (CVS got a lower Medicare star rating last week, which could affect the economics of a CANO deal for them), so the deal was undone by a buyer specific issue and now CANO just needs to recircle up with the other strategics?

I’d note one other thing that suggests a strategic deal is still very likely here: the market for consolidation is very hot right now. CVS won a bidding war to buy Signify (SGFY; deal proxy here) in early September, and Amazon won a bidding war for One Medical (ONEM; deal proxy here). Press reports had at least CVS looking at ONEM, and SGFY’s proxy mentions UnitedHealth and Amazon looking at the company, along with several other unnamed bidders (I believe Humana was almost certainly one).

So there’s a lot to suggest that a strategic deal at CANO is still possible. In fact, it might even be likely. And if that line of “strategic deal still very likely” thinking is correct, then CANO is an absolute home run from this point. At ~$4.50/share, CANO is trading for well under 1x next year’s revenue. ONEM is getting acquired for almost 3x next year’s revenue, and peer OSH is trading for almost 2x next year’s revenue as a standalone business. Those multiples would suggest a strategic CANO deal could easily take place in the double digit stock price range.

Of course, there’s a “but” here. And that “but” is simple. It consists of two related points

CVS entered late stage talks to acquire CANO and walked. Maybe it was something CVS specific…. but this is a strategic deal in a consolidating industry, and CVS walked. It’s possible they saw something about CANO in due diligence that they didn’t like.

CANO is absolutely incinerating cash. Mainly they are doing so to grow, and you hope that growth is both accretive and strategic….. but they are incinerating cash nonetheless, and if they don’t sell themselves they will almost certainly need to do a massive capital raise, which could really dilute shareholders and sap a ton of the upside.

I’ll dive into each of those points in a second, but there’s one point they hint at that I want to just make explicit.

CANO has a lot of red flags. A lot of them. And the worry is that CVS saw a red flag in DD that made them walk away, and every other strategic will see that red flag, and eventually shareholders will realize they are holding the bag.

What is that potential red flag?

Well, first, CANO health went public through a SPAC. That’s a cause for concern, but not a smoking gun or anything… though I will note that Barry Sternlicht (the SPAC sponsor) called CANO’s CEO “the Elon Musk of healthcare” on the Despac call, which can be a massive point in CANO’s favor or detriment depending on how you look at Elon!

Second, CANO Health provides value-based healthcare. In Florida. The words “value based healthcare” and “healthcare in Florida” are instant red flags to healthcare investors; CANO has both of them!

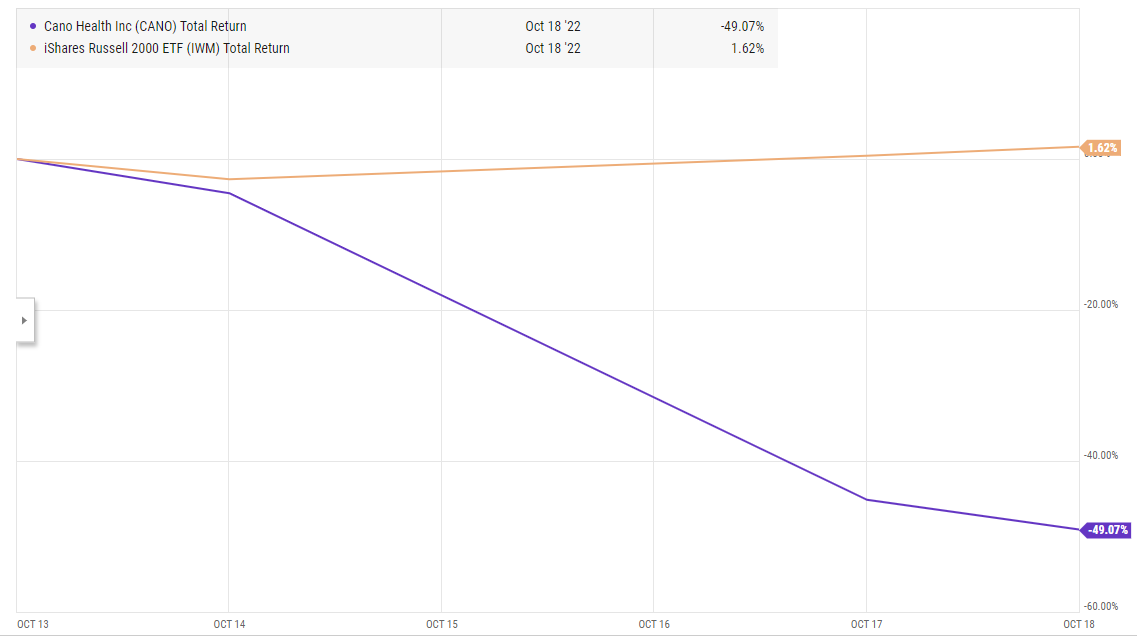

Why is value based healthcare a red flag? Basically, CANO gets paid a per member per month fee; their goal is to then lower costs to make a profit at that number. So a simple example is CANO would go to the government and say “We’ll provide unlimited care to all of these seniors for $100/month” and the government would say, “Awesome, it costs us $110/month on average to cover these seniors, we’d love to save money.” CANO would then make a profit by reducing healthcare costs (the classic example is doing a less costly thing early to avoid a more costly thing later; for example, intervening in someone’s diet early so that they don’t become diabetic). This chart (from their June investor day) probably shows what CANO is trying to do best: better care leading to less costly outcomes.

But that model can fall apart in three ways.

CANO can wildly underprice the business. Maybe they make money in the short term because their patients don’t need expensive care right away, but they’ll lose money in the long term when all of their patients need expensive care.

CANO can make money by cutting corners in healthcare, and eventually they get hit by a bunch of lawsuits and the government shuts them down

The government (and CANO appears to be much heavier on government business than peers) goes to you and says, “Great work reducing cost! But it only costs you $70 to care of these patients and we’re paying $100. Your margins are way too high; we’ll be paying you $80 going forward”

This is a bit of a simplification; I’m still getting a little up to speed on the business. But if you’ve followed healthcare services long enough most value based models that blow up blow up on some variation or combination of those three things.

The third red flag is that CANO has grown rapidly. And they have not only grown rapidly…. but they have grown rapidly through acquisitions. Again, CANO is a value based healthcare provider. Rapid growth is always going to be a little scary for them, but rapid growth plus acquisitions….. well, there’s a lot of room for funkiness there! (slide below from their Q2’22 earnings)

Related to “funkiness”, the last red flag is probably CANO’s cash flow and earnings statement. Look at those addbacks! Yes, you can make a reasonable argument for all of them…. but again, there’s a lot of room for funkiness / accounting shenanigans in there.

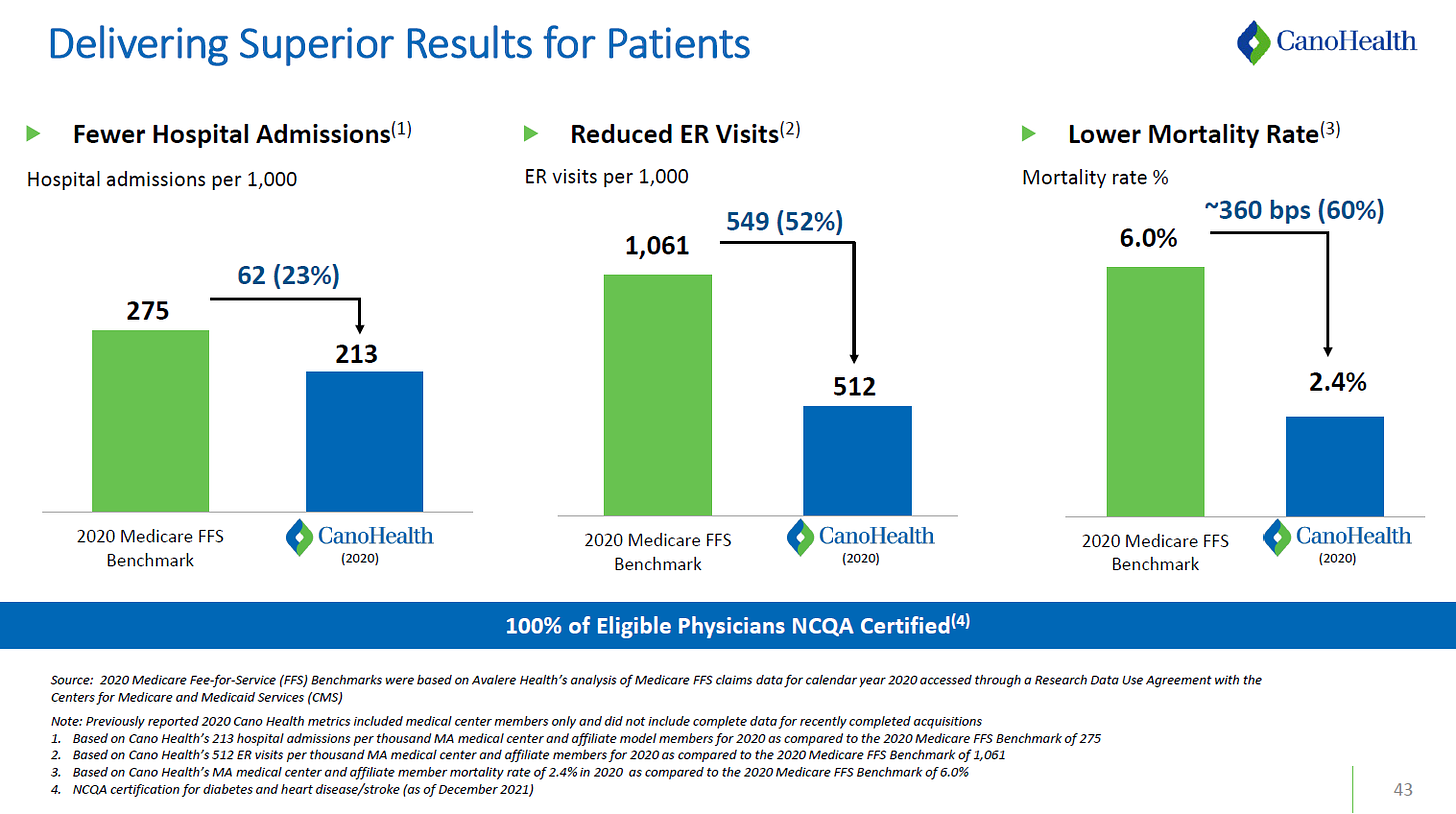

The earnings statements drives into the cash flow issues here. CANO is incinerating cash. Now, CANO would argue they are incinerating cash for a good reasons: investing cash lets them fund growth and open new centers, which in the long term will be very accretive. But it’s clear that CANO is going to need some cash in the near term to fund their business plan (look at their Q2 earnings call; almost every analyst asks some version of “do you need a capital raise this year” and “when will you go cash flow positive”). The ideal scenario is probably CANO sells themselves to a strategic and the strategic funds their growth; that appears to have been part of the logic for ONEM and SGFY selling themselves. But if CANO cannot find a deal, then they’re almost certainly going to have to raise a bunch of capital… and that’s likely to be very dilutive to shareholders.

I’d add two more things on the cash flow story here.

First, on CVS backing out…. again, the worry is that CVS backed out because they saw something in due diligence. Did they see that CANO’s cash burn is going towards uneconomical growth? Did they find something wrong in their quality of earnings / addbacks?

Second, on the capital raise, I’d just note the difference in language between their June 2022 investor day and their Q2’22 earnings call.

Here’s the quote from their June investor day (Note the “free cash flow positive in 2023”):

Here’s what they say ~2 months later in their Q2’22 call:

That’s a big, big shift in tone! Though, to be fair, the company continues to say they don’t need cash in 2022, so if they sell themselves now they can avoid dilution:

Anyway, that’s the situation.

Which brings me to my reason for posting: I’m actively trying to ramp up on CANO…. but I am sure that there are people on this list who have more knowledge of CANO than I do. If you’ve done work on them (whether as an investor, or from an industry perspective) and have thoughts on the points I raised, I’d love to hear them. Feel free to email me or slide into my DMs.

Odds and ends

Two more quick thoughts from the deSPAC merger call I didn’t have room for in the article

First, just wanted to highlight this section, because it shows how deep the relationship with Humana is.

Second, wanted to note the PIPE here. The SPAC sponsor PIPEs in $50m of his own money into the PIPE (alongside a group of respected investors). I wonder if that creates any “stock basis issues”, where the SPAC team demands any deal happens at a premium to deSPAC price. These are big boy investors so I think they could get over sunk cost issues, but I have seen deals that make sense fall apart because the sellers had irrational pricing expectations, so just figured I’d throw that out there.

Speaking of cost basis issues, the CEO was an aggressive buyer of stock last year. A lot of those purchases included the CANO warrants. I wonder if the fact he’s underwater on some of those purchases / bought into warrants creates some strange selling dynamics.

And while I did mention both Owl and Third Point as pushing for a sale, and that strategic assets with owners pushing for a sale generally get sold, it is worth noting that the board controls enough stock to control the company without regard for what minority shareholders want. I think the fact that they are already involved in a sales process tells you they are open to being sold, but there are lots of ways I could be wrong or that outcome could no longer be on the table! (from their proxy)

One thing to understand about CANO: if you believe the story here, the near term earnings multiple is almost irrelevant as so many of their properties are new. CANO would argue they have line of sight to their current portfolio earnings >$500m in EBITDA over the next few years just as all of their centers mature. CANO is a ~$3.1B EV at today’s prices; it’d be <$6B at a $10/share price. There would be massive synergies to a strategic buyer, and CANO has a huge whitespace to grow. I’d guess a strategic would happily pay ~$6B for a company with line of sight to $500m in EBITDA with those synergies and growth potential.

And the CEO argued at a recent conference the market is mispricing / misunderstanding just how large the near term growth tailwind from that maturation will be:

Andrew you also called out last year that the CEO was buying shares...on margin! Something just doesn't smell right with this one IMO.