Professionally, I’ve had worse days than yesterday…. but it’s hard to remember many!

I am, of course, referring to yesterday’s block of the Jetblue-Spirit merger. I was very, very public in my opinion of the deal: I thought the Jetblue case was substantially better than the government’s (and better argued!), and the deal could / should / would be approved. That public stance included no fewer than four podcasts (Two with Lionel Hutz, Two with MDC) as well as countless (premium side) posts.

The court obviously disagreed (you can see the ruling here).

Big losers are never fun; invest long enough and you will inevitably have one (or more, likely, more than one). The temptation when you have a big loser is to just wallow in despair and call yourself dumb, and I did plenty of that immediately following the ruling (though I suppose the nice thing about having a very minor internet presence and taking a big, public bet is that you don’t need to call yourself dumb because there are plenty of people on Twitter who will do that for you!).

But the more productive thing to do when you have a big loser is step back and ask, “did I do something wrong? Was this bad process, or bad outcome?”

Everything in investing is about pricing and odds. I’ve seen more than a few trolls grave dancing on SAVE getting blocked / clearly having schadenfreude at someone else taking a big hit. My DMs / mentions are filled with those DMs: “This is what happens when you’re a merger arb tourist.” “This is what happens with group think.” “Of course Spirit failed; everyone thought it was going through and it was a fintwit echo chamber.”

It’s fine to believe all of that (though I’d suggest a little karma could be coming if you’re this happy someone else’s investment went against them); obviously I was quite publicly bullish (as well as a few other notable fintwit friends) and arrived at that conclusion after a ton of work… but perhaps some people did just see a sexy narrative with huge upside and figured “YOLO”.

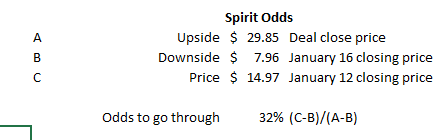

Still, the fact is the market was not pricing in a Spirit win. If you thought everyone was bullish Spirit, then you probably weren’t talking to enough people. And if you thought “everyone being bullish” meant Spirit was priced at some wild implied odds, you’d be sadly mistaken. Using yesterday’s closing stock price for SAVE (just under $8), the market on Friday was pricing in ~32% chance of Spirit closing (this is a bit of a simplification; there were some recut and DoT complexities on the back end, but they weren’t so dominant a probability or so likely to materially effect the final price that they’d materially change the probabilities below… for example, you could account for those by saying the stock traded to ~$25 on a win and you’d get ~40% implied odds to go through).

I’ll be honest; SAVE’s downside is actually ended up much higher than my downside. I thought Spirit would trade $3-5/share on a break, so my odds going out on Friday had this priced at ~40% to go through.

So yes, this decision went against us. All of the people who “told me so” that this was getting blocked were correct…. but it’s hard for me to give credit to *most* of the people who told me this was getting blocked. There was no real alpha in that stance given those odds; generally, I’d hear “o, that’s a big spread, big spread deals don’t close. You’re probably going to lose.” Cool, very insightful! Those bears were at the race track mouth betting on the favorite regardless of the odds offered (note: I did talk to multiple thoughtful bears, but most of them thought this was 30-40% to go through, so kind of in line with market, not a huge alpha short or anything)! The market was always saying SAVE was more likely than not to be blocked; I simply always disagreed. I thought JBLU had a better case and was ~70% to win; if you gave me the same odds tomorrow (30-40%) on a similar case, would I take the bet?

Absolutely. Losing sucks. But I would bet on a “better” case at underdog odds every time, and I’d just hope over a long period of time I’m right enough in my assessment to make money. Remember: if the market is offering you 5% odds of something and you think the true odds are 35%, you can make an awful lot of money taking that bet even though the naysayers will be right more often than not!

Given the level of work and odds offered, I feel pretty good that this was a good process. I’d happily follow the same process / conclusion again and just hope for a better result next time. Still, if I had to critique myself, in reading the judge’s ruling, there are a few particular areas I was dismissive of that the judge clearly harped on (and many of these are areas that sharp bears focused on).

First, the judge was clearly concerned about airplane / pilot / ATC staff shortages. I thought those existed whether or not Spirit got acquired, and that the testimony of lots of industry insiders that they would compete like crazy on the heels of Spirit getting acquired would rule the day regardless of shortages, but the judge clearly was skeptical of that testimony.

Second, I thought the judge would have trouble ruling against SAVE / JBLU given every industry witness seemed fine with the deal and testified they’d fill any competitive void left by Spirit, so the judge would have to write a ruling basically ignoring industry testimony. Obviously he didn’t have trouble with that!

Third, the government kept hammering home Spirit’s “special” place in the industry given their business model. I was very skeptical of that argument as it effectively opens the door to the government picking winners / losers / protected businesses (they could make the argument anyone was a special competitor and thus ineligible to be acquired), but it clearly carried water with the judge. I think everything in the below paragraph that comes after “Defendant Airlines provide ample evidence…. harms of the proposed acquisition will be offset, both by new entries into the harmed markets and potential pro-competitive benefits” is wrong from an antitrust perspective (and creates substantial appeal risk to the decision as well as poor precedent), but the story clearly weighed with the judge.

Although the Defendant Airlines provide ample evidence at the rebuttal stage that the anticompetitive harms of the proposed acquisition will be offset, both by new entries into the harmed markets and potential pro-competitive benefits, this evidence fails to establish that the proposed merger would not substantially lessen competition in at least some of the relevant markets. Throughout trial, the Government invoked the experience of the average Spirit consumer: a college student in Boston hoping to visit her parents in San Juan, Puerto Rico; a large Boston family planning a vacation to Miami that can only afford the trip at Spirit’s prices. It is this large category consumers, those who must rely on Spirit, that this merger would harm; the Defendant Airlines, though exceedingly well represented, simply cannot demonstrate that these consumers would avoid harm. Even if other ULCCs entered former Spirit routes at an unprecedented rate of growth (which, given the current restraints on airline growth, is unlikely), their entry is unlikely to be sufficient to protect every consumer, in every relevant market from harm.

Fourth, and sticking with the quote above, I didn’t think a judge could (or would) require every consumer and every market to be relieved of harm. In fact, I don’t think that’s the antitrust standard, and I think it presents significant appeals risk. The judge clearly disagreed.

Fifth, I thought the government’s experts were a disaster, and that would haunt them in a ruling. This was maybe the most surprising part of the judge’s ruling to me; he admits that the defendant’s “objections (to Dr. G) are correct” but still rules that Dr. G was a “credible” witness. Given the defendants objections were that Dr. G’s model was completely broken, I’m still not sure how to square the two.

Sixth, the judge did make some comments during the trial that said, “the evidence says there is harm from this merger.” I thought he was making those to make an effective question as he dealt with witnesses, but many pointed to those statements as a clear sign he saw real harm (again, I thought the defense did a very credible job rebutting the harm theory). I was wrong; bears were right.

And finally- I thought the judge had wide, wide latitude to order divestitures if he saw any harm, and he would take advantage of that latitude (even if I didn’t think it was necessary). Think there’s a plane shortage? Make Jetblue sell some extra planes! Worried about time for a competitor to come on? Make Jetblue promise to offer low cost fares until the competitor is there! The judge didn’t end up exploring any of that, and I thought in a worst case scenario he would. Wrong.

The most common bear case I heard was “antitrust is complicated. This is just one judge who has never had an antitrust case before. The combination of prices up + hot docs + government deference leads to an easy block, and some of the judge’s quotes are telling he’s leaning that way”

I thought that analysis was too simplistic by far, and a thoughtful judge would see through it… but the simplistic analysis carried the day here. (I saw one lawyer who described this ruling as a “paint by numbers” antitrust ruling, meaning you could make it simply within the letters of the law, but anyone who considered the facts of the case and spirit of it (no pun intended) would come to a different conclusion).

Obviously I disagree with the judge’s ruling. But, in court, the judge is god. Doesn’t matter what I think.

I loved the odds SAVE presented, and even knowing the outcome I wouldn’t change my bet / process. Yesterday was rough, but the year is young and the event book is rich. I thought Spirit presented great odds, and I hope to find more situations that present similar odds throughout the year. If I can, I’m pretty sure the results are going to be good, even if this particular case didn’t work out.

On to the next one.

PS- I talked to tons of antitrust people about this case, and to a person all of them said something like “you really can’t be more than ~70% confident in an antitrust case for one side or the other, because ultimately the ruling comes down to one judge and none of these judges are experts in antitrust, so they could get hung up on anything and make a wild ruling.” I’ve been thinking about that warning a lot today, and thanking them for their counsel: I actually thought the case was much better than 70% for JBLU, and that the judge would “get it”…. but I’d always end up tempering my enthusiasm just a tad given how many people who had done this for years would advice me you just can’t go over 70% on an antitrust case given the judge factor.

PPS- one other thing I’ve thought a lot about; I think the DoJ clearly got outlawyered here. I’m not the only one to think that; I had several lawyers read the closing arguments and they were unanimous JBLU’s were much more persuasive. I wonder if I was playing too much game theory with “this side’s lawyers are killing the other side.”

PPPS- the judge ended his ruling with the line below, which makes me want to vomit every time I see it. Clearly the judge knew that this would be a hugely influential case that will be cited for years to come, and he was trying to end with a flourish….. I think it’s generous to say the attempt fell completely flat, and I’d like to submit this montage of Trevor Noah dunking on Spirit Airlines as a rebuttal to the “there are those who love “ Spirit claim.

Brilliant write up. You’re right. The decision to go long $SAVE cannot be judged by the outcome but by the process. It is what it is.

Thank you Andrew for doing your post-mortem so quickly. Your honesty is refreshing and trust-building. For me, this trade hurt. I put a lot of time into reading the papers, and became personally invested not only in making money but in seeing the system reach the "right" result. Putting SAVE in the rear view mirror is taking some time. Reading your thoughts has been helpful.