Yesterday, I was reading my friend Alex’s (from The Science of Hitting) Q3 portfolio update (here’s a recent podcast appearance from him!). I hope no one accuses me of giving spoilers, but two of the stocks he’s long are Microsoft (MSFT) and Facebook (META, though I will probably refer to them as FB throughout this post).

Earlier this year, I did a post on finding stocks that could mirror the “epic” 10 year run that MSFT (and NVDA) had. Alex first bought MSFT in 2011, so he was there for that whole ride. Seeing that purchase date next to a long position in Facebook got me thinking: why couldn’t FB be set for the next MSFT like run?

Maybe that sounds crazy. But consider the checklist that set MSFT up for a big run

It was already one of the largest companies in the world

It was trading at ~10x earnings

People were worried their core product (Windows) was going to zero

Analysts were putting a huge capital allocation discount on the company as their CEO clearly didn’t understand the tech landscape, was pursuing the wrong strategies, and was lighting money on fire with awful acquisitions.

Compare that to Facebook today

It’s one of the largest companies in the world (just outside of a top 10 holding for the S&P)

It’s trading for ~10x P/E despite having ~10% of their market cap in net cash (I’m using rough numbers; the numbers are probably closer to 11x P/E and 7% net cash but whatever)

People are worried their core product (facebook) is dying, and there’s huge concern that all of their products are losing massive share to TikTok.

People are putting a massive capital allocation discount on FB as they worry the CEO’s pursuit of Metaverse domination is quixotic.

They say history doesn’t repeat, but it rhymes…. and the Facebook story above certainly seems like it rhymes quite a bit with the Microsoft story a decade ago.

And it might rhyme even more than you think at a glance. Fears of Windows dying have been around for way over a decade now, yet the core Windows / Office suite is still here and minting money. Similarly, fears of core Facebook dying have been around for years (you might notice the “core Facebook product” link I used above is from 2018; I did that intentionally just to show how long these fears have been around!).

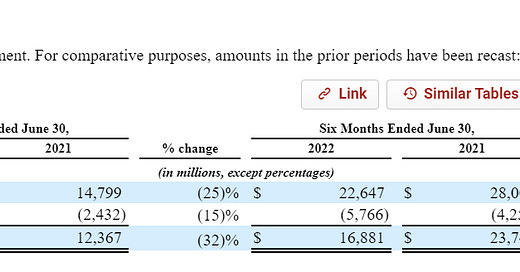

Plus, the Facebook story today might be even better than that headline “rhymes with MSFT” story. As mentioned above, Facebook today trades at ~10x P/E…. but that’s after accounting for an enormous investment into its (possibly failing) metaverse strategy. I’ve got a screenshot of their segment profitability for H1’22 below; you’d have to imagine that if their execution remains this poor eventually the vast majority of those Reality Labs expenses are going away / getting cut aggressively. Adjust for that, and Facebook is even cheaper!

And I’d argue both Instagram and especially WhatsApp remain under monetized, so you probably have several growth / profitability levers that will get pulled at each of those in the long run (making Facebook’s steady state multiple even cheaper!).

In my September links and ideas, I said “It doesn’t take much digging to find companies that are trading for <10x free cash flow while buying back shares pretty aggressively.” I was surprised by how many people emailed back and said they couldn’t think of any when Facebook is so big / visible / clearly hits that description.

Am I saying Facebook is clearly the buy of the century? No, obviously not! I don’t have a position currently; I just don’t think I have a real edge looking at the company, and there’s an absolute knife fight for consumer eyeballs / attention that every medium (social networks, video games, legacy media, etc.) is engaged in and I have no clue how that will turn out.

But it’s hard to argue that there’s not at least the potential for alpha at Facebook right now. If I’m lucky enough to be writing this blog in ten years (and I hope I am!), I think there’s a very good chance I’m writing an article on “looking for stocks that mirror the epic Facebook 2021-2030 run” and kicking myself for missing it.

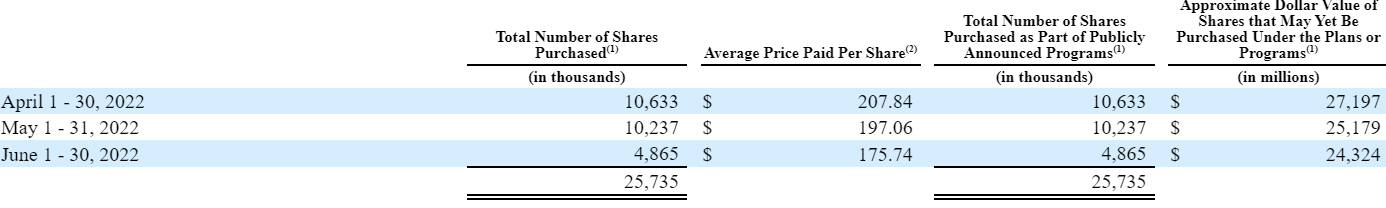

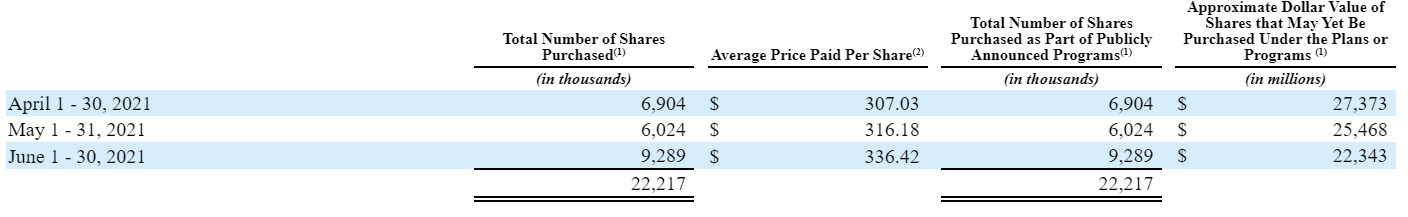

PS- one more thing while I’m here since it’s a pet peeve of mine. The market is skeptical of the metaverse strategy, and Facebook keeps plowing cash into it. Would I (and the market) rather that cash just get returned to shareholders and the Metaverse stuff get wound down? Absolutely… but Zuck’s history (buying Instagram and WhatsApp, starting Facebook, pivoting to Mobile) absolutely gives him the right to make an investment everyone else is skeptical of. But the share buyback pace at Facebook are just awful. Somehow, Facebook bought roughly the same amount of shares in Q2’22 (when their stock was <$200) as they did in Q2’21 (when their stock was over $300). Even worse, repurchases slowed dramatically late in Q2’22 as their stock drifted materially lower. This is not some levered, cyclical commodity company stopping buybacks as the macro environment worsens (though that’s generally bad capital allocation too! If you’re going to buy back stock when it’s high and then stop when it’s low, you shouldn’t be buying back stock at all); this is a company that throws off enormous cash flow and has a decent piece of their market cap in net cash. They should be buying back shares at a consistent pace and honestly accelerating it as the stock goes lower (repurchase charts below from FB’s 10-Qs).

I’m long the stock, but I do think it’s worth pointing out that the quixotic CEO discount deserves to be large given the share class structure.

Also MSFT did a lot of stuff right. The “rhyming setup” analogy is a bit like saying it’s a 3-2 count with one out in the 6th inning and yesterday another team in the same situation put up 10 runs. They do still have to execute.

But the potential is there. Maybe a better baseball analogy is that the they have runners in scoring position and are bunting for some reason. One can easily imagine expected runs going up if they just stop bunting!

But that’s up to Mark -- no activist can touch META, just like fans can’t replace their team’s manager.

Tom! makes a good point about the "quixotic CEO discount." Moreover, Microsoft's 10-year run was set up by 2 factors not addressed above. (i) Microsoft was dead money for 14 years under Balmer before Nardella took over. (ii) During the last ten years, all big tech enjoyed the tail wind of of investor sentiment in a manner that may not make the next 10 years an easy comparable period. That said, I've recently gone (very) modestly long META because it's such a good/sticky business an idiot could run it (thanks Charlie and Warren). Thanks for the analysis; completely agree with almost all of your points (particularly the share repurchases).