Is CVR prepping for a sale? $CVRR $CVI

I generally shy away from more cyclical companies. It’s not that I have an issue with buying companies whose results can swing based on a commodity price or something; it’s just that I don’t think I have much edge in looking at cyclical companies. Plus, I find it easier to think about / look at more consumer oriented companies whose products I have some engagement with. That said, I thought the recent CVR Energy (CVI; disclosure: long) write up on VIC presented a really interesting thesis, so I decided to step a bit out of my comfort zone and do some work on it. I’d encourage you to read that write up before reading mine, though I think my write up below does a nice job as a standalone write up as well. Enjoy, and if you’re more experience in the sector than me, I’d love to talk- my DMs are always open!

CVR Energy (CVI; disclosure: long) is a holding company controlled by Carl Icahn. I believe the company is undervalued today; more importantly, the synergies from a strategic player buying CVI would be large, and recent events make me believe a sale is likely to happen in the near term (next ~6-9 months based on the Tropicana timing discussed later).

Some background: CVI is a holding company with three main assets:

~83% ownership of CVR Refining (CVRR), a publicly traded limited partnership that owns two refining assets. CVI also owns / controls CVRR’s GP, though they do not have the typical LP / GP set up where they charge CVRR management fees and IDRs.

~34% ownership of CVR Partners (UAN), a publicly traded limited partnership that makes nitrogen fertilizer. Similar to CVRR, CVI owns / controls UAN’s GP but doesn’t get any fees from it.

Some holding company cash at the CVI level (the holdco consolidates both of the LPs, but it’s easy enough to back out those stakes and get just to the holdco cash).

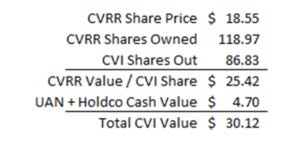

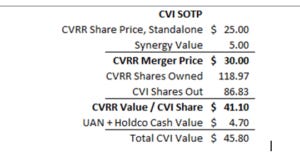

At current prices, CVI’s UAN stake is worth ~$1.70/share (at current market prices) and their holdco net cash is worth ~$3/share. Because the value from those two assets pales in comparison to the value of their CVRR stake (worth at least $25/CVI share and likely more), for the rest of this write up I’m effectively going to ignore those stakes (I’ll just assume they’re worth $4.70/share) and focus on CVRR.

Let’s start with the most obvious piece of this thesis: I think Icahn is prepping to sell CVI / CVRR. I base this on a few things:

Tender offer: Earlier this year, CVI did a tender offer for CVRR shares. In the offer, CVI and Icahn Enterprises offered CVRR unit holders the chance to swap their CVRR shares for CVI shares. By doing so, Icahn and CVI got their ownership interest of CVRR over 80%, which gives them a call right on CVRR going forward that would allow them to repurchase the remaining shares on CVRR at market price “free from fiduciary duties” (see p. 16 of their 13- I’ve included a clip of the 13-D below because their emphasize in that section is so interesting). That sets up a very interesting dynamic where CVI can take out CVRR shareholders at market and then immediately sell CVI for a premium to a strategic buyer.

The tender offer is, by far, the biggest “tell” for me that Icahn wants to get this thing sold. By swapping a few CVI shares for CVRR shares, Icahn has created more upside for himself if CVRR / CVI sell, as he can take the minority CVRR shareholders out at market (i.e. without a premium), effectively allowing him to keep more of the premium for himself.

Note the CVRR tender included the following line: “An exchanging unitholder will also participate directly in the performance of CVR Energy as a stockholder of CVR Energy, including any future premium that may be received by stockholders of CVR Energy in connection with a sale or other corporate transaction.” Maybe they just included that language as boiler plate legalese, but I would guess they included it because they are actively considering a sale. Importantly, if they do sell CVRR / CVI and use the call rights to avoid paying CVRR a premium, CVI could point to that line as part of their defense in a hypothetical lawsuit from aggravated minority shareholders.

Icahn’s recent history with Tropicana suggests a tender could be the prelude to a sale. Icahn and Tropicana did a Dutch Tender to take out a significant percentage of their minority shares in June 2017 (the tender closed in August) at ~$55/share. Icahn turned around and sold Tropicana to a strategic in April 2018 at ~$75/share. If you read through Tropicana’s merger background, you can see that two parties had reached out to Tropicana about a merger in February 2017, and, on June 15, 2017, GLPI (the ultimate buyer) again reached out to Tropicana and presented them with a confidentiality agreement to allow GLPI to proceed with due diligence. A week later, Tropicana and Icahn launched their tender offer at $55/share. So Tropicana / Icahn did that tender knowing full well there was significant and serious strategic interest in Tropicana. My guess here is that Icahn / CVI tender timing with CVRR followed a very similar timeline / thought process: they think now is the time to sell, and they know there’s strategic interest (either from general industry commentary or possibly from direct outreach), and Icahn / CVI did the tender / exchange now in order to capture additional upside for themselves.

Management: David Lamp was named CEO in November 2017. Everything he touches seems to get sold quickly. He was named CEO of Northern Tier in February 2014 and sold the company to Western Refining in December 2015. Once that merger closed, he joined Western Refining as President / COO; Western was sold roughly a year later to Tesero (which soon became Andeavor). Clearly, David is no stranger to M&A or selling companies!

Very related to the management point but worth highlighting separately: CVI updated all of their executive teams’ Change of Control agreements on September 13. Updating CoC agreements is often the first prelude to a company getting ready to sell itself.

So based on the tender offer and Icahn’s history with tenders, the management team, and the change of control agreement, I think it’s likely CVI and/or CVRR are sold in the near future. Assuming that’s right, what would CVI be worth in a sale?

Well, our first take could just be to value CVI at the market value of their CVRR shares. CVRR is currently trading for ~$18.50/share. CVI owns ~81% of CVRR, or ~119m shares of CVRR, and CVI has ~87m shares outstanding, so CVI’s stake in CVRR is worth ~$25.35/CVR Share at today’s market prices. Add in the ~$4.70/share in holdco cash and UAN shares, and CVI would be worth just over $30/share.

With CVI currently trading for ~$39/share, that valuation would suggest CVI is way overvalued. However, I don’t think using CVRR’s current market price makes any sense. Post tender / exchange, CVRR is an illiquid publicly traded partnership that CVI can call at the market price at any point in time. I think it’s fair to argue that CVRR’s trading price going forward will incorporate a whole bunch of factors outside of their intrinsic value; honestly, I’m not sure how you’re supposed to value a company with that type of call option attached to them.

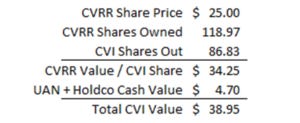

So let’s look beyond CVRR’s market price to value them. A decent starting place for what CVRR is worth would be to look at the price Icahn and CVI paid to swap CVRR into CVI. At the time they announced the swap, the CVI exchange valued CVRR at $27.63; by the time S-4 came out the exchange valued CVRR at $24.26. For simplicity, let’s say the exchange valued CVRR at $25/share (towards the lower end of the average of those two); if CVRR is worth $25/share, than CVI’s stake is worth ~$34.25 and the whole company is worth ~$39/share.

I think even that valuation is conservative. My main point here would be to look at Icahn’s history: if he’s buying something, it’s probably at the lowest end of a conservative estimate of fair value (and likely below even that!). Again, Tropicana had incoming strategic interest and Icahn did a tender at $55/share a few months before selling the whole company for $75/share. If Icahn is buying at $25, my guess is fair value, particularly in a sale, is substantially higher. That could hold particularly true for CVRR, as there would likely be substantial synergies if CVRR was bought by a strategic.

It’s tough to say exactly how much in synergy would exist if a competitor acquired CVI. I reviewed a lot of industry mergers to try to ballpark a number, and a lot of the mergers include much softer synergies like “cost of capital” synergies when giving out a synergy number. In addition, many of the refining companies own retail C-Stores as well as refiners, which makes comping to CVRR (which is basically all refiner) even harder. That said, I think the synergies would be pretty substantial.

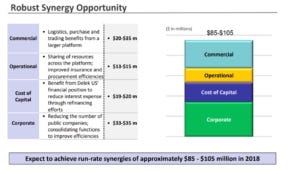

Delek bought Alon in early 2017 and was forecasting ~$95m in synergies (the slides below are from their merger deck here). Alon’s refining segment was actually smaller than CVRR’s, but Alon had some other businesses (namely retail gas stations) that may have added some synergies in there. All in, it’s tough to say exactly how much of those synergies were coming from just the refining combination, but I believe it was the majority and I’d note the Delek / Alon proxy emphasizes the synergies were a key reason for combining the company.

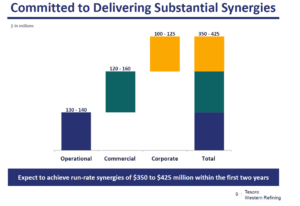

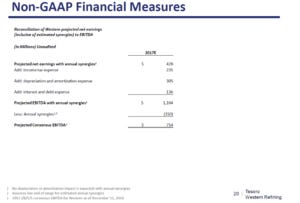

Tessoro saw $350-425m in annual synergies from their deal with Western. Again, not apples to apples versus CVRR given the size of the two combined companies and some other businesses each company owned, but given Western was forecasting just ~$754m in EBITDA as a standalone company the synergy value from combing the two companies was clearly huge.

Bottom line: it’s tough to say exactly how much in synergies there are from combining CVRR with another refiner, but based on recent deal history the synergies would likely be substantial and a strategic could likely pay substantially more than standalone value to realize those synergies. I would guess there’s at least $100m in synergies for an acquirer (though it’s well within the realm of reasonableness there are substantially more for the right strategic acquirer); at an ~8x multiple those synergies would be worth >$5/CVRR share. Assuming CVRR’s standalone value was ~$25, adding a $5 merger premium would work out to takeout price of ~$30/share for CVRR. FWIW, recent deals in the industry have generally come with a ~25% takeout premium associated with them, in line with the $5 merger premium on a $25 fair value discussed here. At a $30 CVRR share price, CVI would be worth over $45/share.

The last thing I’ll mention is that M&A spirits in the refining sector are clearly running high. In April, Marathon bought Andeavor in the biggest-ever deal for an oil refiner. Major deals like that tend to spark a wave of industry consolidation, and if you review the recent calls from some of the smaller independent refiners (PBF, HFC, DK), it’s clear that they see a wave of consolidation on the horizon. In CVRR, you have a smaller player controlled by a financially sophisticated owner in a consolidating industry with large potential synergies from a deal with a strategic buyer; that combination normally ends with an auction involving a bunch of strategic players and a sale at a nice premium to the highest bidder. That’s the outcome I see happening with CVI in the near future.

Odds and ends

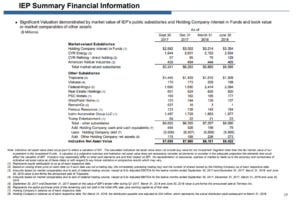

Investing in activist controlled companies can be hit or miss, and there are certainly unique risks to investing in controlled companies. I understand those risks, but I’ll just note that CVR is, by far, the largest current investment for IEP. For better or worse, Icahn’s going to do whatever it is that he thinks will maximize CVI’s value. I’d also note that Icahn has been a mammoth seller of companies recently: in addition to selling Tropicana, he sold Federal-Mogul earlier this year. Combined, selling those two assets represents Icahn selling ~37.5% of his net exposure (~25% of his gross exposure) since the beginning of the year. That’s a huge cash raise! You can also track IEP’s net exposure on their hedge fund through their earnings calls and see Icahn has been relatively bearish for years (they were net long ~11% at the end of Q2’18 and were net short 77% as recently as Q3’17); based on that exposure, I would guess Icahn’s a willing seller of just about everything at the right price today in anticipation of better prices / a worse economy tomorrow. Between the CVRR / CVI tender / swap earlier this year, the Tropicana / Federal-Mogul sale, and the bearish net positioning, I would say all the stars are very aligned for Icahn wanting to sell CVR (it probably doesn’t hurt that refining is a cyclical business as well, and someone w/ a bearish outlook probably wants to get out of cyclical businesses!).

I’ve focused this article on CVRR while talking about CVI. Why? CVI can call CVRR at market price, so if you want a premium CVI is the way to go. Yes, CVI is a little messy with the UAN stake, but given how much the value of the CVRR stake overwhelms the value of the UAN stake, CVI is going to maximize the value of the CVRR stake and worry about everything else later. This is where it’s really nice to have Icahn on your side in CVI: he’s going to maximize the value he receives, and the way he does that is to maximize the price of CVI. Most likely, he’ll announce a sale of CVI and then spin off UAN stake if the buyer doesn’t want that stake.

I liked this article’s blurb on Lamp getting named CEO of CVI / CVRR, “Perhaps the most exciting thing to follow in the coming quarters is any change in direction under the incoming CEO. It should be noted that Lamp has been in executive leadership at three refining companies that either merged or were acquired. The industry has recently gone through a massive wave of consolidation, and it has left CVR as one of the smallest fish in the pond. While it's no guarantee, one has to wonder if this is the first sign that CVR Energy might be for sale”

Lamp was president of Holly Corp (the predecessor to HollyFrontier (HFC)) from 2007 to 2011 and then COO of HollyFrontier for a while. I’m not sure what terms he left under, but familiarity between companies / management teams is generally a good thing when it comes to potential M&A.

In September, CVRR announced they were looking to sell their Cushing Tank Farm Assets. This is a small deal but it could make sense as a prelude to selling the whole company (if the Tank Assets are non-core, sell them now to present a potential buyer with a cleaner company that only comes with the assets they want to buy).

CVRR’s refineries are higher complexity than most independent peers (from CVRR’s 10-k, “Complexity is a measure of a refinery's ability to process lower quality crude oil and feedstocks in an economic manner”; higher complexity = better). The weighted average of CVRR’s refineries is 13, which I believe makes them the most complex publicly traded refiner (PBF is second with an average complexity of ~12.2). Compare CVRR’s complexity to Delek: Delek has 4 refineries, two of which are rated ~10 and two are rated ~8.5. Probably doesn’t mean anything in the grand scheme of things (the higher complexity should already be reflected in CVRR’s financials), but it’s possible a buyer puts just a little more premium on CVRR just because they want more complex assets.

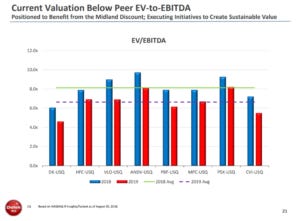

Industry multiples are very sensitive to spread assumptions, but FWIW CVI/CVRR trade at the low end of peers on a forward basis.

Both HFC and DK are aggressively repurchasing shares currently. I know some people who look at aggressive, industry wide share repurchases in cyclical industries as a sign of an industry top. There’s some logic to that, but it’s also a sign of executive / insider bullishness on the industry. Insider bullishness is generally a good thing for potential M&A; I wouldn’t be surprised if either HFC or DK were the ultimate buyer of CVRR for many reasons but it certainly helps that they both appear bullish on the industry! Delek in particular would make sense as a buyer; rumor is Icahn considered buying them with CVRR a few years ago, so if Icahn is looking to sell Delek + CVRR would make plenty of sense.

Just to give you an idea on what some peers are thinking about the overall macro and M&A environment for refiners, here’s some quotes from HFC’s Q2’18 call (DK’s had plenty of focus on M&A as well, but I thought HFC’s were too good to leave out):

“we expect the macro environment to remain very positive.”

“With IMO 2020 on the horizon we believe our business is well positioned to benefit from both crude differentials and crack spreads for the next few years”

“we’ve been very open that we want to grow our company…. We’ve been pleased with the deal flow we’re seeing, both for our refining and lubricants business.”

2015/2016 were not good years for refiners. Could another bad year or two come along in the near future? Of course! But I’d guess it’s just as likely we have a really strong cycle coming as another downturn given how recently we had a soft market.

One thing I did not address on the synergy side is RINs. Icahn and CVR have a whole history with RINs that I won’t go into here (these New Yorker and Bloomberg articles provide plenty of background), but it appears CVRR has been the hardest hit by RINs (on their Q2’18 call, they called themselves “the poster child for exposure to RINs). Helping with CVR’s RIN problem could present additional synergies for an acquirer, but it’s really tough to tell what happens here (how much upside there is for an acquirer, what benefits CVRR’s current efforts to improve RIN access will have (see Q2’18 call), or even if RINs will be a piece of the regulatory infrastructure going forward). CVR will spend ~$60m in 2018 on RINs (see p. 17), but their cost has run well over $200m/year several times over the past few years, so the upside from some relief here is obviously huge.

Speaking of regulation, IMO 2020 is on the horizon. IMO 2020 is an International Marine Organization rule (thus, IMO) that limits sulfur in all marine fuels. The rule will clearly have an impact on the refining sector overall, though what exactly the impact will be is a bit up in the air. I think the impact on CVRR will likely be small (they mentioned being well positioned on their Q2’18 call), and I wouldn’t be surprised if in the end it was actually a slight positive for CVRR simply because it hurts other refiners more than it hurts CVRR: CVRR’s plants are high complexity, and it seems like high complexity plants should be the least hit from the ruling. Here’s what PBF said on their Q2’18 call about IMO 2020 (I believe CVRR is the “one independent refiner” they mention): “Looking ahead, we believe our high complexity refining system is well prepared for the upcoming marine diesel fuel standard shift with IMO 2020. As we have said in the past, PBF has more coking capacity on a percentage of throughput basis than all, but one independent refiner. That being said PBF does have the opportunity to optimize its system even more.”

Icahn owns a majority of CVI, so shares are somewhat illiquid and the company is excluded from most indices. I tend to view illiquidity and index exclusion as an opportunity, particularly since it means Icahn will likely need to sell the company when he’s ready to exit, but it’s obviously worth keeping in mind when buying / building a position.

Bonus: some more on CVRR’s standalone value

In the write up above, I didn’t really dive into CVRR’s numbers or standalone value; I more leaned on the “Icahn took it out at ~$25, which probably means it’s worth at least that.” Honestly, that’s a big crux of the thesis here, but if you’re interested in diving a bit deeper here’s a bit more fundamental work on CVRR.

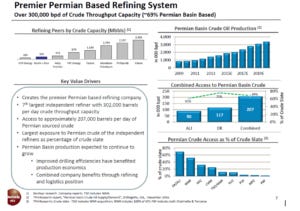

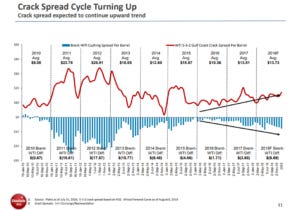

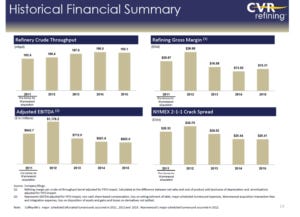

CVRR owns two refiners. Refiners make money by taking crude oil and turning it into more valuable things (mainly gasoline and jet fuel, but some other byproducts as well). In essence, the company is taking a commodity and turning it into more valuable commodities. The refiner makes the difference (the spread) between the cost of the oil it buys (plus the opex to refine it) and the price it can sell its outputs. So refining can be very cyclical: what really matters for them is a wide spread between the inputs and outputs, and last year’s earnings numbers have little bearing on the current year’s earnings because the spread can swing widely quickly. The best way to see that variation in earnings is really by looking CVRR’s historical earnings; for example, take the slide below (from their 2017 investor presentation). EBITDA fell from almost $1.2B in 2012 to ~$600m in 2015 (and just $222m in 2016!) despite crude throughput increasing from ~170 mbpd to ~193 mbpd over that time period because the crack spread dropped significantly.

So what’s most important for valuing CVRR is not necessarily last year’s earnings, but more a view to what the company can earn on a normalized basis. So what can CVRR do on a normalized earnings basis?

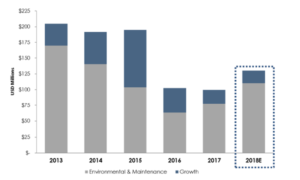

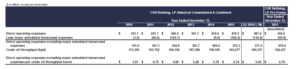

Probably the easiest way to come up with an earnings number is to average the past five years. From 2013-2017, CVRR averaged ~$506m in EBITDA/year. Of course, refining is a capital intensive business, so EBITDA doesn’t translate directly to cash flow. Over the same time period, CVRR has averaged ~$140m in capex/year, of which ~$100m is maintenance/environmental and the rest is growth capex (slide below from CVI’s September 2018 presentation).

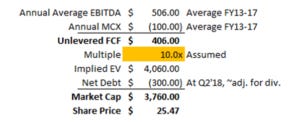

So with ~$506m in normalized EBITDA and annual maintenance capex of ~$100m, CVRR’s normalized unlevered free cash flow would come out to $406m. I’d guess CVRR standalone is worth at least 10x unlevered cash flow (CVRR is structured as a partnership and has no tax expense, so we’re effectively pricing the business at a 10% cash flow yield. Given where interest rates are, that seems like too low a multiple / too high a yield to me, so keep in mind this is probably conservative). At 10x unlevered cash flow, CVRR would have an EV of >$4B EV. CVRR’s relatively unlevered (net debt of ~$300m), so its market cap would come to ~$3.8B and CVRR shares would be worth ~$25.50/share (right around what Icahn offered for them in the tender!).

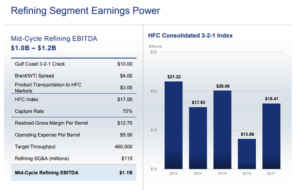

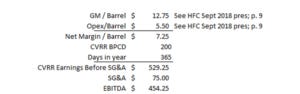

We can also try a bottom up analysis of the individual plant’s output to confirm our valuation and assumption makes sense. I stole the chart below from HFC’s September 2018 investor presentation. It helps show what their refineries can do on a normalized earnings basis.

There are some reasons to think this “HFC model” isn’t perfectly applicable to CVRR that I’ll address in a second, but as a first pass let’s use the numbers from that chart and input CVRR’s economics. CVRR’s facilities currently have a capacity of 206,500 barrels per calendar day (bpcd). HFCC’s slides above show a gross margin of $12.75/barrel and opex of $5.50/barrel; assume those number and CVRR should make $7.50/barrel in margin. Multiply that by 200k barrels/day (assuming utilization is a bit below the 206.5k max number) and 365 days in a year, and CVRR is making just under $530m/year before SG&A costs. SG&A has average $75m/year over the past five years; assume $75m/year and CVRR’s midcycle EBITDA is ~$450m/year. (Note that SG&A number could be high: the company is focused on bringing SG&A down and thinks their restructuring efforts will bear fruit in 2019)

That EBITDA number is a bit below the “average EBITDA” number of $500m we used earlier, but I think the difference can easily be explained by somewhat conservative assumptions in this model. That “HFC model” modelled CVRR’s refineries like they had economics similar to HFC’s, but in all likelihood CVRR’s refineries are better than HFC’s. We can see that in their operating performance; the slide below is from CVI’s September 2018 investor deck and shows CVRR operating with significantly lower costs and better distillate yields than HFC.

That’s obviously one point in time, but you can see CVR consistently operates with better refining margins and lower opex/barrel than we assumed in the “HFC model”.

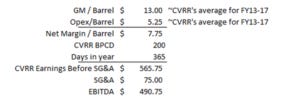

From 2013-2017, CVRR’s average refining margins of $13/barrel and opex/barrel of ~$5.25, so all in profit/barrel is ~$0.50 higher than what we originally estimated. Make those adjustments and we get an “HFC model” EBITDA number of $490m, roughly in line with what we estimated based on CVRR’s average earnings from 2013-2017.

Anyway, this was a very long modelling exercise in justifying a pretty basic assumption: Icahn took out CVRR minority shareholders at ~$25, so it’s reasonably likely CVRR is worth at least that much as a standalone business and significantly more to a strategic buyer.