A few weeks back, I posted “the quality bubble,” which discussed how a lot of traditional quality “GARP-y” (Growth At A Reasonable Price) style stocks have traded to levels that seem difficult to justify (IMO).

That piece attracted a lot of feedback and quality discussion (pun unintentional) on all sorts of different lines, but it was the very last point in the article that probably got the most inbounds. That point mentioned a strategy of trying to find stocks that are value stocks currently but could catch a quality multiple if things went right. I used BJ’s Wholesale (BJ) as an example; it trades for <20x EPS. Costco trades for ~50x; the two have the exact same business model. Obviously Costco is a better brand / business, but I see no reason why BJ couldn’t close some of that multiple gap if they execute well. So a purchase in BJ right now could be a combination value play with a multiple expansion kicker.

Anyway, I was reading Pershing Square’s annual letter this week, and something struck me: I’m kind of surprised I haven’t heard anyone talking about Restaurant Brands (QSR). It’s a ~13% position for PSH, it fits literally every bucket for getting a ”quality multiple” that I mentioned in my quality post, it trades for a reasonable valuation, and it’s run by highly incentivized management that have created restaurant rocket ships before. That’s a pretty crazy combo…. yet I don’t think I’ve had one person mention the stock as an opportunity. And I don’t just mean no one mentioned it as an opportunity in response to my post; I mean I haven’t seen or heard of anyone (outside of Ackman) talking about QSR as a long.

So I figured I’d do a quick write up on QSR just to throw something out there / see if I’m missing anything.

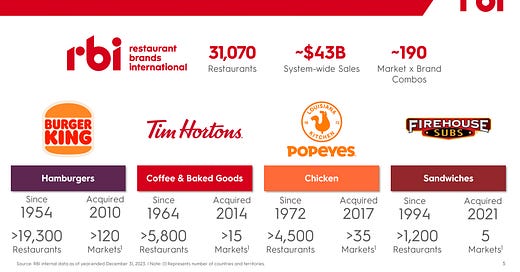

QSR owns four “iconic” brands: Burger King, Tim Hortons, Popeyes, and Firehouse Subs.

QSR is almost exclusively a franchising business (they do own/operate a few restaurants, and they’ll own a few more after the Carrols deal… but they plan on eventually refranchising those units). When done right, the franchising business is an awesome business: completely capital light, inflation proof, etc. The market generally recognizes this; QSR is trading for just under 25x this year’s EPS. Sure, that’s not a cheap multiple…. but it’s also not crazy expensive in the context of franchising businesses. I mentioned WING in my first write up; it’s currently trading for over 100x EPS for growth that honestly isn’t that much better than QSR (WING is forecasted to grow in the high teens for the next two years; QSR is forecasted to grow revenue in the low double digits for the next two years).

Honestly, you could stop there and QSR would be interesting in a GARP-y basket.

But what interests me more about QSR is the people and incentives behind it.

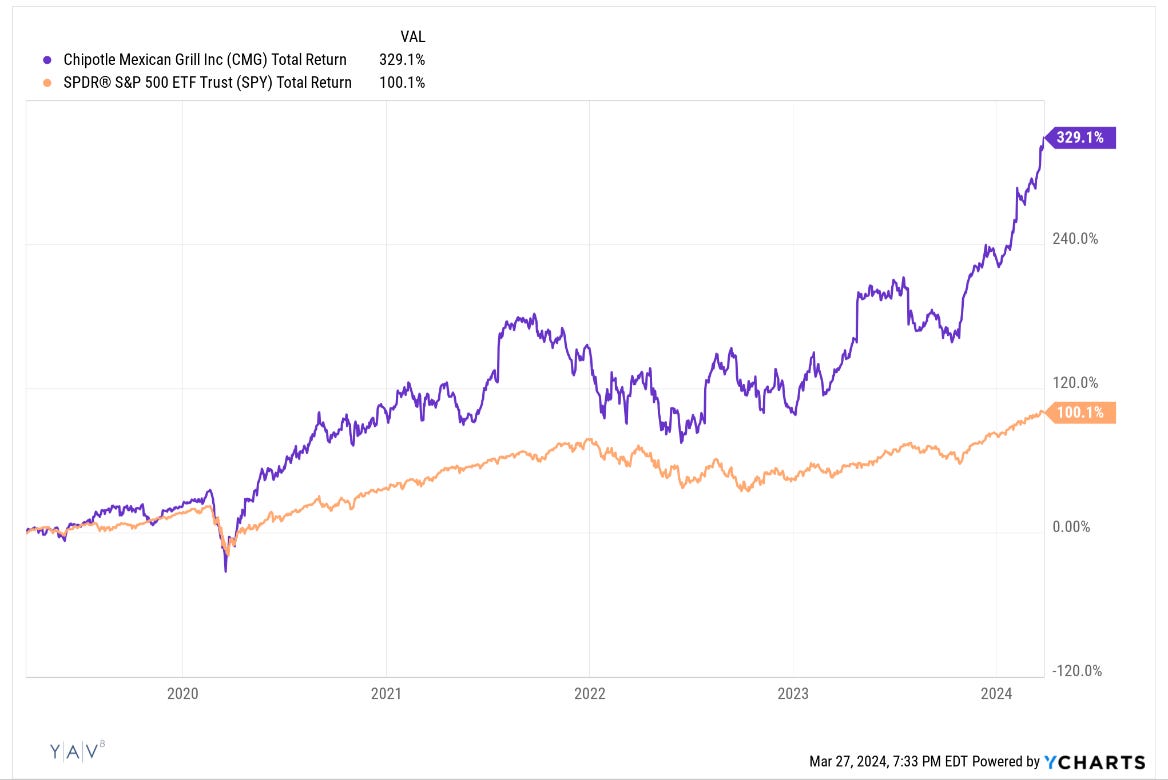

Let's start with what drew me to look at QSR: Pershing / Ackman. Love him or hate him, Ackman has had unbelievable success in the restaurant business. The headliner here is obviously Chipotle, but he’s had plenty of other successes in the sector (Starbucks, Wendy’s, McDonalds all come to mind). Ackman isn’t shy about letting you know how well he’s done in the restaurant industry; here he is on the Friedman podcast earlier this year: “The beauty of the restaurant business… Our best track record is in restaurants. We’ve never lost money. We’ve only made a fortune, interestingly, investing restaurants.” (And thanks to all the people who responded to my tweet asking where the quote came from!)

Then consider the management team. QSR’s executive chairman is Patrick Doyle; you may remember him from his insanely successful run as the CEO of Domino’s (where he famously admitted the pizza tasted like cardboard). He was the CEO of DPZ from early 2010 until the middle of 2018; the stock did alright under his leadership….

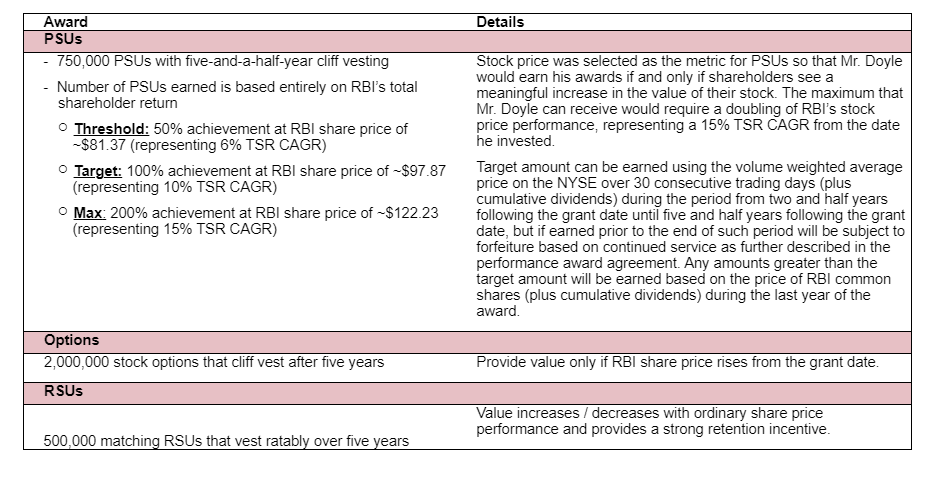

So QSR has an industry legend with a history of successfully creating value in franchising in charge, and he should be reasonably incentivized to create value: he was given an equity heavy package when he joined QSR; the headliner here is probably the PSU grant of 750k shares if he can get the stock to $97.87/share by November 2027, which balloons to 1.5m if the stock hits $122.23/share. That’s a solid ~$200m payoff for performance (on top of another 500k RSUs and 2m in options that he was given when he joined). The image below lays out Doyle’s incentives and payments very nicely (it’s from QSR’s proxy), but here’s the original 8-K if you want all the details.

That’s a very rich comp package; if Doyle hits the high end of the targets, that package is worth $400-500m (pre-tax, but what’s $100m of taxes between friends?).

The CEO has a similarly equity rich package; when he got promoted to CEO he was granted 300k PSUs that matched Doyle’s package:

I’d just note one other thing about the PSU package: yes, it’s generous and worth literally hundreds of millions if it’s hit. But corporate boards and executives aren’t in the habit of giving themselves high end goals that are impossible to hit. I’m not saying it will be a layup for QSR to hit the high end of the PSU goal, but I’d guess everyone involved at QSR was very aligned on a plan that made the highest end of the PSU goal achievable without some wild YOLO.

Speaking of plan, QSR has already tipped their hand a little bit on their outlook; last month QSR provided their 5 year plan. It calls for growing the whole system at ~8%/year and driving “at least low double digit annual total shareholder returns.” That math shouldn’t be too hard; QSR trades for just under 25x EPS (or a >4% earnings yield), they’re forecasting 8% annualized growth. Franchising is a very capital light business, so 8% annual growth should translate well into at least 8% annual cash flow growth (in a very capital heavy business, 8% growth is nice but consumes a ton of capital; the beauty of franchising is someone else pays for your growth so revenue growth should translate really well to the bottom line; in fact, they appear to have been a bit conservative as you should get some operating leverage in this business and they don’t appear to have forecasted any). Entering at a ~4% earnings yield and growing 8% would generate ~12% annualized returns before any changes in multiples are factored in (and I’d argue if interest rates stay where they are and QSR successfully operates this plan, multiple expansion is much more likely than contraction!). The company would probably agree that outlook is conservative; their outlook included the line “the outlook we are sharing for growth is really the lowest average performance that we expect over the next five-years, with real upside potential from there,” and at their investor day in February Doyle suggested the plan should be viewed as “the lowest” annual performance with upside potential.

There’s also the possibility of accretive M&A. I’m generally skeptical of M&A creating value, but there are multiple verticals QSR isn’t in and given their scale and franchisee relationships there’s a decent chance there’s an M&A transaction or two in the next five years that creates some value; just look at the returns from the Popeyes acquisition:

Popeyes isn’t unique in terms of successful M&A for QSR; both Tim Horton’s and Firehouse have seen huge earnings growth post acquisition:

It shouldn’t be lost on anyone that QSR doesn’t have a pizza vertical, so there’s at least one clear category where M&A could make some sense…. though, to be fair, given QSR’s size it would be pretty difficult for M&A to be a real needle mover here.

Do I think QSR is the edgiest / most alpha rich stock on the market? No, definitely not….. but I also would have said the same thing about CMG ~5 years ago, and the stock is up >4x over that time (for a casual ~34% IRR).

It’s probably worth noting that CMG started that period with a much higher multiple than QSR has now (at FY19 year end, they had a market cap of ~$23B against trailing Net Income of ~$400m for a casual 50x+ P/E). Now, CMG has a much different business than QSR (on top of the obvious differences in price point / quality, CMG owns their restaurants while QSR franchises), so we’re comparing apples to oranges a bit here, but that is worth noting simply because CMG started with a much higher multiple than QSR has today and still managed to deliver unbelievable shareholder returns (in part because the multiple stayed elevated / expanded a bit further, but it’s hard to nitpick returns and operational execution as strong as CMG has had!).

So, no, I don’t think QSR offers the most alpha on the market…. but I’ve been wrong before (too many times to count!), and the set up here is incredible: put it all together, and you’ve got a quality company backed by a famous investor in an industry where he’s “never lost money” and run by a highly incentivized management team with a history of creating enormous value who has literally just laid out their path to double digit annualized returns (or better)!

My guess is QSR roughly hits their plan and the stock does ~15% annualized over the next five years. That’s pretty damn good, and the nice thing is given the quality of the business and the reasonable entry price it’s tough to see how you do really poorly on an investment from here (and you do have the optionality of this catching a quality multiple and really getting bid up; why couldn’t QSR trade for 40x EPS if WING is way over 100x?)

Anyway, I don’t have much more to add here. I can’t claim to be a QSR expert (well, maybe that’s not true; I’m certainly an expert on fast food…. it’s just I’m an expert on eating, not analyzing!), but the set up is wild and I’m kind of surprised I haven’t heard more people talk about it.

PS- one of the interesting things about QSR is that their brands generally are much smaller than the largest player in their markets (i.e. Burger King has about half the store count of MCD in North America).

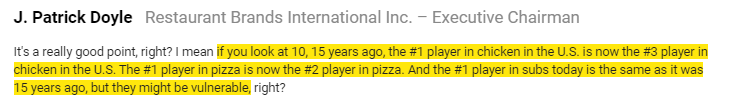

You could look at that two ways: on the positive side, it shows plenty of room for expansion / upside, and it’s not completely unheard of for the challenger brand to eventually overtake the largest brand. On the negative, there are clear scale benefits to being the largest player in a market, and something like Burger King has been #2 to MCD for so long that it’s kind of hard to imagine that changing…. but market share shifts do happen! If I was long QSR, I’d be thinking about this almost throw away line from the investor day and dreaming about what happened if Burger King or Firehouse caught absolutely fire and took the #1 spot in their category over the next ~20 years.

PPS- This was obviously a pretty bullish post. I laid out the math for mid-teens annualized returns, showed the back up for it from the company’s management team and how they think those returns are the low end of what they’re capable of, etc. I guess one natural question is: “cool, sounds great; how big’s your position (or, if you don’t have one, why not?)?” For me, the answer is pretty simple: investing is really hard. I see the bull case here and think it’s interesting….. but this post took me maybe half a day to of research to put together. It’s hard for me to look at anything in this post and say “yeah, that’s a really differentiated insight there.” I generally only try to invest in things when I can point to some view I have that’s differentiated / different. I don’t think I have that here; I more have a “parroting back the bull case and some simple math.” I’d guess QSR works out really well (I’m now psychologically long I suppose), but until I had some differentiated insight / viewpoint (for example, if I had real conviction that Firehouse was gaining steam and set to 5x units in the next 5 years, or conviction that something had shifted and Burger King would overtake MCD over the next 10), QSR’s not for me.

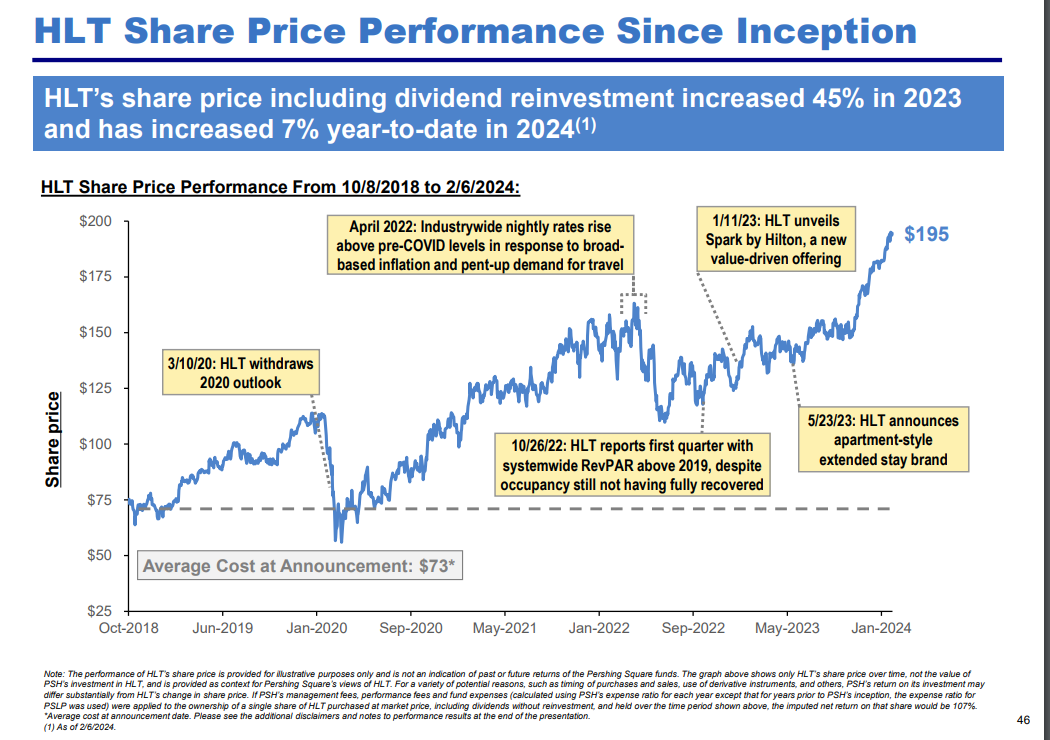

PPPS- You could have written the paragraph above (it’s a good business, but it’s a full multiple and I don’t have any differentiated insight) about a lot of Ackman’s recent investments…. and you would have eaten your words / regretted not investing in most of them. For example, consider HLT: I thought the multiple was full and there wasn’t a ton of differentiation there, and the stock is approaching a casual triple in less than six years despite having a freaking pandemic in the middle of it. Ackman’s pretty darn good at quality consumer investing; if your whole thesis was “I’ve seen this before and I ride with Ackman on quality consumer names”…. well, there are worse theses and I wouldn’t be surprised if you’re following up on this post from a beach in five years.

Interesting article, thanks for taking the time to research QSR. They do seem to have a lot of debt on the balance sheet though.

What Ackman's QSR cost basis?

I think you need to do a QSR business breakdown podcast ? How about you invite Ackman or somebody from his team? :)