Is $RSO too discounted?

Note: I wrote this over the weekend and meant to post before earnings came out, but I got distracted by the tragedy that is AMC. RSO reported earnings last night and filed an 8-K with a bit more info on their LCC sale on Tuesday, so some of the numbers here are slightly stale, but directionally everything is completely consistent so I’m fine posting it now (though I haven't listened to the earnings call yet). Enjoy!

Between questions on share dilution, Franklin Covey’s growth prospects, and AMC’s awful earnings, the blog has been a pretty dark / dim place for the last week. With America basking in the glow of being great again, a dim and dark blog simply won’t cut it, so I thought I’d try to get back on track with an idea I like: Resource Capital (RSO; disclosure: long).

RSO is an externally managed REIT focused on originating commercial real estate (CRE) loans. The basic thesis here is pretty simple: RSO’s NAV at the end of March was $14.16 versus today’s share price of ~$10.20, and I’m betting that 1) NAV is solid / understated and 2) the discount will close over time.

Let’s start with a quick background, because it’s helpful in understanding why the opportunity exists.

Resource Capital launched in early 2006 as an externally managed REIT with a focus on real estate assets. The fun thing about externally managed REITs (and externally managed companies in general) is that it’s pretty easy for the external manager to make money. In fact, bad externally managed REITs have a pretty simple game plan for maximizing the manager’s earnings in good times and bad, and RSO ran that game plan to near perfection. The game plan looks something like this:

Since management fees are based on equity under management, constantly grow equity

In order to grow equity, constantly issue shares

In order to issue shares, pay out a crazy high dividend to attract dividend investors to buy the stock

Repeat steps two and three until something forces you to stop

There’s one more important part of the playbook: never write anything down until you’re basically forced to (generally because the company has defaulted / filed for bankruptcy). External managers charge a fee based on % of equity, and when something is written down equity (and thus fees) comes down. So just mark everything at the highest price feasible until someone or something literally forces you to cut the valuation.

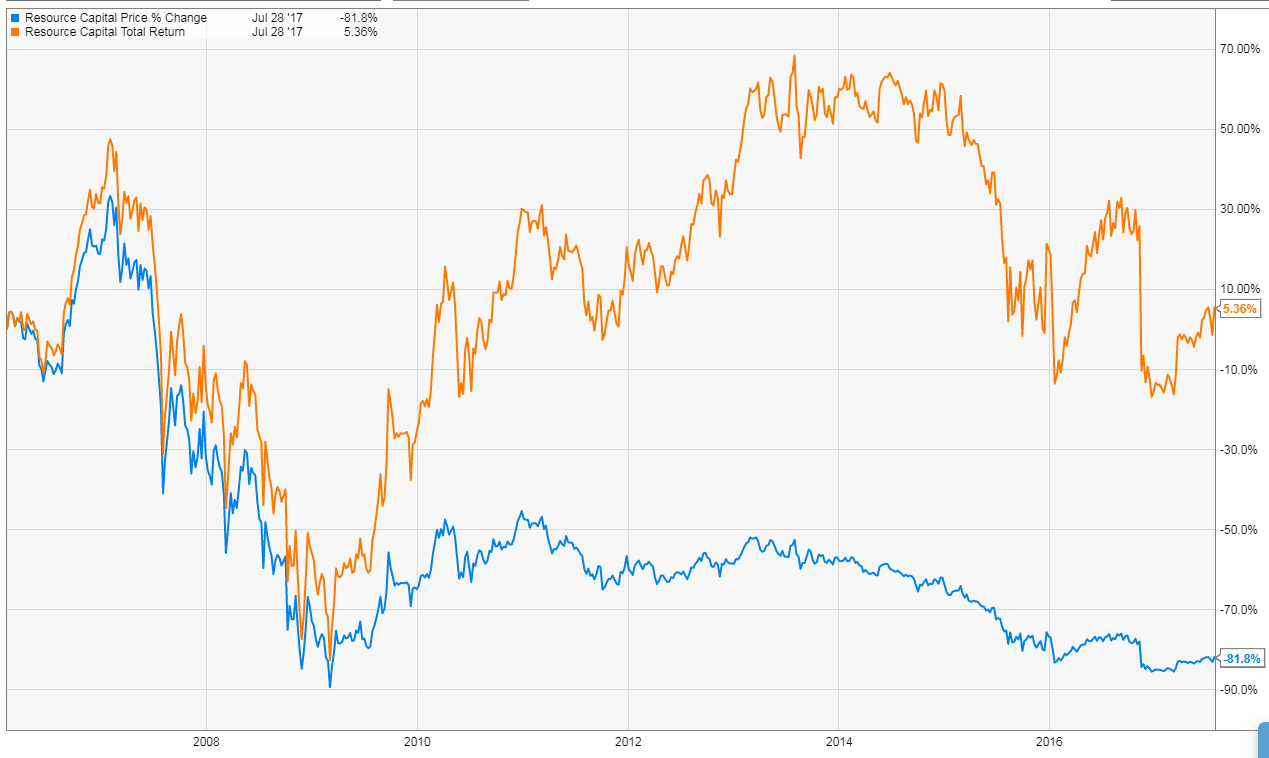

Anyway, RSO followed that playbook to perfection. From 2011-2013, the company paid out $240m in dividends while issuing $210m in stock. In 2015, the company paid out $2.34/share in dividends despite only taking in $2.08 in Adjusted Funds from Operations (AFFO). The end result was RSO’s external manager collected tens of millions in fees while RSOs shareholders saw basically no return on their investment over a long period of time. And remember- dividends are taxable, so the whole process of raising equity to fund dividends ends up being even more inefficient than it seems on the surface.

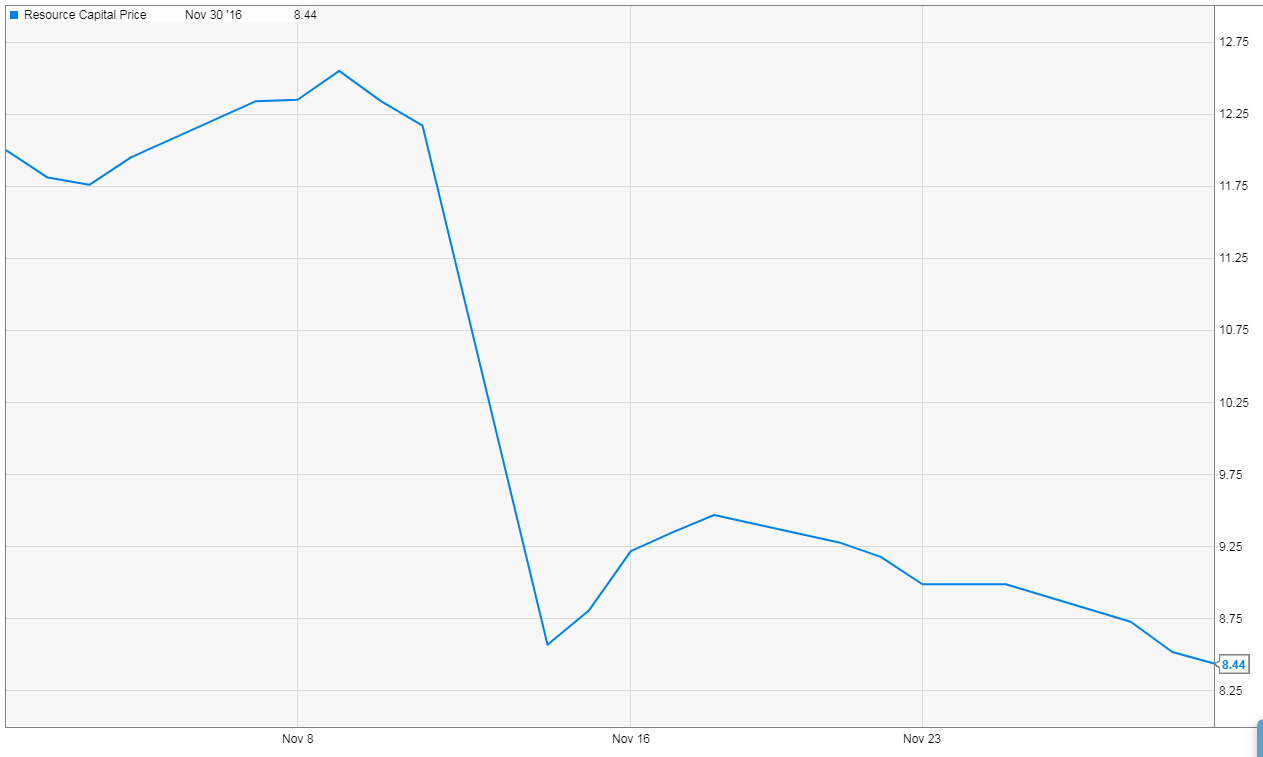

Anyway, things changed in 2016, when RSO’s external manager was acquired by C-III Capital Partners. After taking over, C-III almost immediately approved a new strategic plan that refocused the company on making commercial real estate debt investments, cut the dividend to a sustainable level, and wrote off a bunch of legacy investments. The stock price did not respond well to the moves, dropping from mid-$12s before the announcement to the low $8s.

Ok, that basically brings us to today. Management has been doing exactly what they said they would since establishing the new strategic plan in November: slowly disposing of legacy investments, reinvesting the proceeds into commercial real estate loans, and paying out a small dividend ($0.05/share/quarter) until the reinvestments have been fully ramped up into earnings.

So, at today’s price of ~$10.20, I find RSO pretty attractive. Let me quickly go through my bullet points of what I like about RSO

NAV is probably solid: RSO’s NAV at 3/31/17 was $14.16. C-III’s had 3 earnings report to adjust their NAV and it’s been consistent around that level. I feel decently that the marks on the book are solid / the NAV is real given the bloodbath they took in the first quarter they reported and the consistent NAV since then.

Filing indicates NAV is going up: RSO recently (and quietly) filed an 8-k that indicated they sold their LCC investment for $84m. LCC was on their books at $43.1m at March 31, so the sale will add >$1/share in book value given ~31.4m shares outstanding. The stock price did rise a bit on the move, but I’m surprised it wasn’t up more.

RSO does have deferred tax assets ($60.9m in total; $32.6m with an allowance against it) that should shield most, if not all, the gain.

I feel like selling LCC is important for two reasons. Obviously it increases book value, but it also gives more confidence that the rest of the book is marked properly. Based on LCC’s history (just from the 10-q and 10-k description), I would’ve guessed another write down was more likely than not when they sold it. Instead, they sold it for nearly double the value. Lends confidence that the market are solid / undervalued.

Discount to NAV is unusually wide for a REIT: Let’s ignore the LCC gain for a second. At today’s share price of $10.20, RSO trades for ~72% of March 31st NAV of $14.16 (I have NAV approaching $15.30 after adjusting for the sale, the most recent dividend, and a small anticipated loss in Q2). I looked at several similar CRE REITs recently, and RSO’s discount stands out as unusually wide.

ACRE is an almost perfect peer. ACRE is an externally managed REIT with a management contract almost identical to RSO and a focus on CRE investments. They trade for $12.81, or ~87% of NAV/book value of $14.67 (as of 3/31/17).

You could argue that ACRE deserves to trade tighter to book than RSO because ACRE’s is basically completely ramped up / generating earnings while RSO is around breakeven / posting a slight lose currently given the repositioning they’re doing. I can understand that argument, but I still think the gap’s too wide. I played around with a few different simple models that had RSO ramping to a normalized earnings rate by mid to late 2018; they suggested RSO should trade for a ~MSD discount to ACRE’s (so if ACRE was worth 85% of NAV, these were saying RSO should be worth 80%-ish). Again, these were simple models, but it kind of makes sense that two companies with similar asset and expense bases shouldn’t trade for too wide a gap provided you trust book in both cases.

FSFR / FSC have been two popular stocks in the value / event drive community because Oaktree recently bought out their management contracts and they trade well below NAV. I have FSC trading at ~74% of NAV while FSFR trades at ~77% of NAV. Now, these aren’t perfect comps because they are BDCs focused on lending to companies instead of REITs specializing in CRE loans like RSO; however, the overall goal (collect income from leveraged lending and pay it out as a dividend) is basically the same, so they make for nice comps. They also have substantially worse management contracts than RSO (both charge management fees on total assets instead of equity), and I would guess they’re looking at an “RSO back in November” type cleansing once Oaktree takes full control of their contract; for them to trade tighter than RSO despite RSO already have gone through the “cleansing” process is pretty surprising.

There’s a whole host of reasons why I suspect FSC and FSFR are due for some write downs (not the least of which is the incentive for poor managers to never write anything down discussed above), but here’s one: RSO currently has 3% of CRE whole loans underperforming expectation (see 10-Q p. 26) versus FSC at ~10% (if you consider investments rated 3 or 4) and FSFR at ~5% (using investment 3 ranked assets).

BXMT probably isn’t the best comp as it’s focused on a bit safer loans than RSO, but it has a similar management contract and the underlying economic exposure of the loans is similar. It trades for >1.15x NAV.

The other thing I find interesting about RSO is their new manager, C-III, because there’s a chance these guys are good enough investors that this deserves to trade around NAV. C-III is controlled by Island Capital, and the whole group is run by billionaire Andrew Farkas (who is now Chairman of RSO). Farkas has made a fortune investing in real estate, and the thesis here is he’s good enough that this deserves to trade up to NAV.

Now, I see a lot of investment thesis that center around “hey, a billionaire is buying this, so it must be good” and quite honestly one of the most frustrating things I see people say / write. If Buffett’s buying something, do I care? Sure! If some guy who got rich as a levered oil driller is buying a tech company, do I care? Not so much. Also, getting rich in real estate is often more a function of taking on a ton of risk (through leverage) and having a rising economy / good cycle make you look good, not a function of true alpha generation / intelligence, so even though Farkas made a fortune in real estate it’s worth wondering if that means he’s worth paying huge fees for (which RSO effectively does through the management contract, and it’s worth remembering he almost went bust when he was starting).That warning aside, it does seem Farkas is a pretty good guy to bet on. To start, Farkas made his money in commercial real estate, and RSO is involved in commercial real estate lending, so there’s an expertise match between RSO / C-III / Farkas at the most basic level. The WSJ also notes that he’s “built several empires in brokerage and real-estate services over the years,” which lends some confidence that he’s a consistent money maker, not just someone who got lucky once, and in general the press around him just seems to suggest he’s the type of guy who knows how to make money.

Bottom line: I think RSO is too cheap at this wide a discount. Comps with worse management contracts / asset quality / managers trade tighter to book than RSO, and I think there’s an interesting case to be made that RSO’s manager is materially better than your average external manager / a group worth betting on.

Risks

Obvious economic risks (cycle turning, interest rates rising, asset prices dropping, etc) for something that is making levered debt investments.

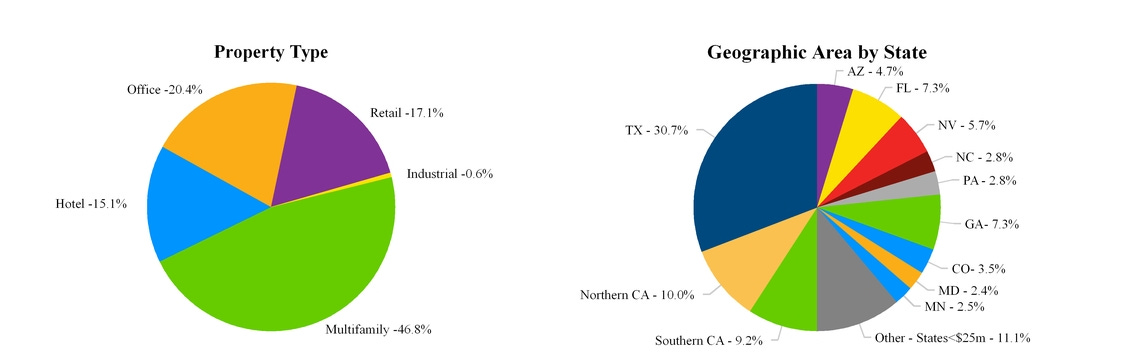

A lot of their exposure is in Texas, which has ongoing economic exposure to oil risk, but tough to separate out how much that would impact RSO.

One nice thing about RSO: their loans are generally 3-5 years and floating, so they generally reset fast enough / rise with interest rate increases so you’re not too exposed there.

Also, most of their exposure is to multi-family apartments, which is a segment I personally really like.

Aside from the obvious economic risks above, your biggest risk is external manager / conflict of interest risk. While C-III keeps talking up their share ownership, they own <1m shares, so their annual management fee (even before incentives) is worth more than their share ownership.

Some quotes that worry you about your external manager from this (admittedly old) WSJ article

“But some critics complain that Mr. Farkas is more interested in making money for Insignia's shareholders than for investors in the partnership”

“Insignia recently settled a lawsuit brought in federal district court in South Carolina by a group of limited partners, which alleged that the company artificially depressed secondary, or resale, market prices to create a favorable environment for tender offers”

“Virtually every deal I did went bad. Every penny I made, I lost. And I had a lot of angry investor”

“But for a general partner to be trying to buy out investors, the conflicts of interest are phenomenal.”

Also, I know a lot of people who invest in hedge funds follow the “pull your money if the manager is getting married or divorced” strategy, so personal life is a risk as well.

End game risk: This is somewhat related to the external manager risk above, but one thing I worry about with closed end type vehicles trading at a discount that get taken over by big asset managers is the end game. C-III didn’t acquire RSO’s management contract to shrink the company’s asset base or liquidate the company to close the NAV gap; they clearly want to grow the equity base (and associated management fees) long term. To do that, they probably need to get this trading up towards NAV and to start issuing equity there. But what if they run this for a year and the stock trades at a stubborn discount to NAV? Would they compromise and just start issuing shares at a discount to increase fees? Would they ramp up leverage / aggression to try to juice profits in the short term? I don’t know, but the thing I struggle with the most in these situations is if a multi-billion dollar manager is really going to be laser focused on maximizing shareholder returns in a company they control where management fees value outweighs their skin in the game.

Odds and ends

Farkas used to employ Andrew Cuomo (New York’s Governor and a potential Democratic 2020 Presidential Candidate) and is clearly still good friends / very involved with him. If you google around, you can find a few other connections between Farkas and pretty powerful people. A lot of commercial real estate is having connections to get zoning and other things done, so those connections literally cannot hurt.

There was a solid slate of insider buying late last year right after the shares sold off on the dividend announcement, which gives you a bit more confidence that insiders see the value here / are incentivized to realize it, though in the grand scheme of things the buying was pretty small.

There could be incremental earnings from refinancing some higher cost debt in the cap structure.

Converts- RSO has $215m in convertible notes ($115m of 6% due late 2018; $100m of 8% due early 2020). It would be a happy problem to have to worry about the notes converting given their strike, so I’m not worried about the dilution here. I wouldn’t be surprised if these could be refinanced a bit cheaper once they’re due.

Preferreds: RSO has ~$270m of pref stock outstanding carrying an interest rate of ~8.5%. ~$160m is callable beginning this year; the rest (the series C) isn’t callable until 2024. I don’t think there’s a refinancing opportunity here given the Series C trades for basically par currently, but the option to figure something out to lower that interest payment is there and would result in incremental FCF to the common.