Yesterday, basically anything that touched AI got smoked on the heels of the DeepSeek news. NVDA was down ~17% (the largest one day market cap drop in history!), power providers like CEG were down 20% (remember: a huge piece of the recent power boom has been driven by AI demand, so anything that hits AI is awful for them), and companies that had huge data centers that had the potential to convert to AI were smashed as well (for example, APLD and IREN, two bitcoin miners hoping to convert to AI data centers, were each down ~25%).

I’m absolutely no AI expert, but I did want to throw down some quick thoughts on the huge moves.

First, and most importantly, I think it’s a nice reminder that investing can be simple, but it’s never easy. I can’t tell you how many times I’ve had someone pitch me one of those names (or a name similar) over the past few months on the thesis “this is easy; the market still hasn’t caught up to how aggressive AI demand and operating leverage is going to be over the next few years”…. and those “this is easy” calls started accelerating after the $500B project stargate announcement just a few days ago! The sudden drop is a nice (if painful!) reminder that the market is never that easy, and, when you’re dealing with the tech driven cyclical industries, left tail events can come fast and literally out of no where.

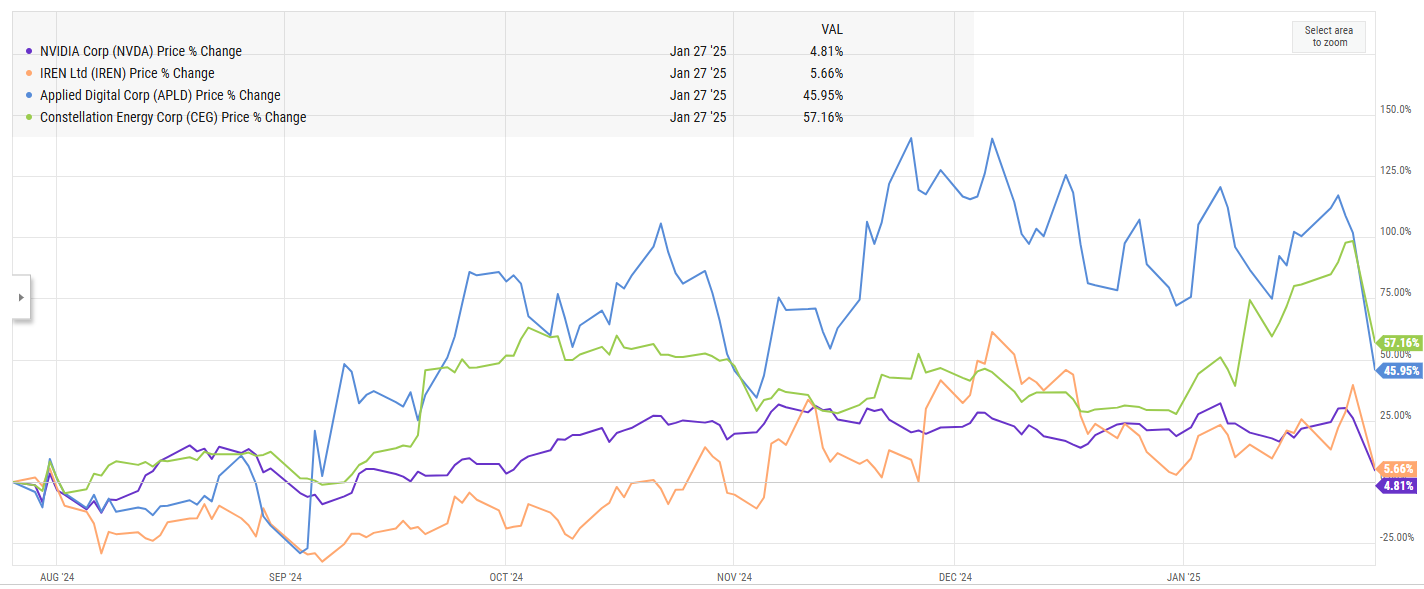

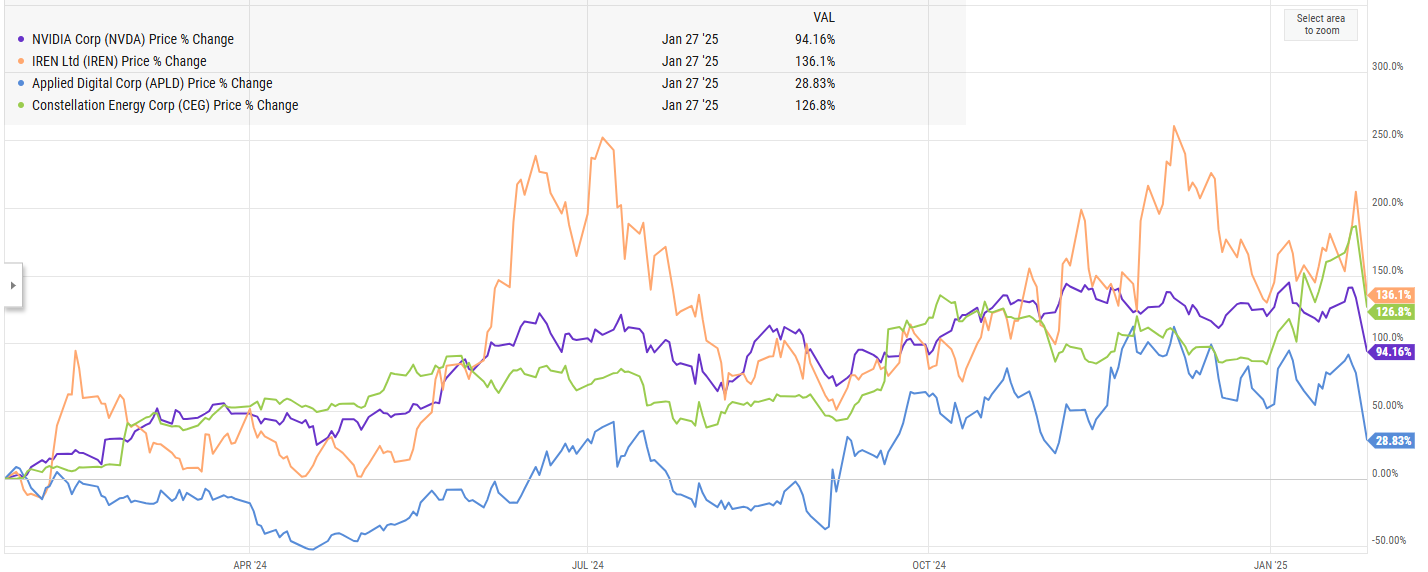

Second, I’d note that all of the names I mentioned upfront (NVDA, CEG, etc.) had huge one day moves…. but if you zoom out, they’re still up (often up quite a bit!) over any reasonably medium term time frame (I’ve got 6 months and 1 year charts posted below).

If this post Deepseek world is really a new paradigm in the AI cycle / the current boom is coming to an end, than yesterday’s move is a massive under-reaction. These stocks are some combination of very cyclical and very asset / operating leverage heavy; if the AI boom is about to stall out or, even worse, bust, then the stocks are going down a heck of a lot more. Just consider NVDA: after yesterday’s move, it’s trading for ~30x next years EPS. That’s cheap for a company growing 50-100% every year…. but it’s insanely expensive for a cyclical that’s about to turn (in prior turns, it wasn’t uncommon for NVDA revenue to drop ~10% year over year…. but prior turns saw NVDA decelerating from 30-40% growth on ~$5B in annual revenue. I would not be surprised if the eventual drop this cycle is a little more pronounced after multiple years of 100%+ revenue growth took NVDA to >$100B in revenue). Not saying the cycle is or isn’t turning…. just that yesterday’s stock move will either prove to be a massive underreaction if the cycle stops, or a huge overreaction if the cycle’s momentum continues. Hard to see an in between where yesterday’s move was the right amount (though, of course, on a probability weighted basis it could be the right amount, i.e. the world is uncertain, but yesterday’s news creates a 33% chance of a world where these stocks should have been down 75% and a 67% chance of a world where the stocks shouldn’t have moved, so the 25% move is exactly wrong in terms of the end game but it’s right in terms of the probabilities of the end game now).

Lastly, after every down day, you’ll hear a ton of people joking “hearing a pod is blowing” (though I suspect many people are joking much less than you think and are actually testing the waters to see if someone is hearing / seeing something they’re not). So it’s a very common joke…. but I suspect if you could design a day custom built to blow out a pod, something like yesterday would be the day. Every single stock that had been outperforming / working (and thus was likely a favorite of momentum driven strategies) getting slaughtered on an out of nowhere event, while more value driven stocks that are probably used as funding shorts are flat to up (WMT was up 3%, T was up 6%, etc.). That combination seems custom built to shut down a few pods running momentum heavy strategies with a lot of leverage (and the degree with which the selling picked up through the day may suggest that there was quite a bit of deleveraging going on….)

Anyway, nothing too crazy in any of the above… but yesterday was a really interesting day, and I just wanted to jot some thoughts down while they were still top of mind / any time a bunch of stocks are down ~25%, I always suspect there’s a chance for a baby or two to get thrown out with the bath water, so wanted to just put this out there and see if anyone had any thoughts / interesting situations they were looking at!

PS- I thought this was a really interesting read on the state of the AI market (and a lot of NVDA bearishness on it!)

Always good to read your insights !!