J. Alexander's could be a tasty takeover target $JAX

Last month, J. Alexander’s (JAX; disclosure: long) received an unsolicited buyout offer at $11.75/share from their third largest shareholder, Ancora. I think the buyout offer is the first step to JAX selling themselves for a large premium to today’s price of $10.35, though I think it’s an open question whether the sale process will be orchestrated by the current board or a new, more shareholder friendly board. Either way, I think JAX is undervalued as a standalone company and likely to be sold at a nice premium in the near future. A quick overview: JAX is a tiny restaurant group. They operate 46 restaurants, mainly under the J. Alexander, Stoney River, and Redlands Grill names and mainly on the East Coast. All of their brands are relatively upscale restaurants: Stoney River is a steakhouse with an average check size of >$40, and J. Alexander and Redlands are upscale “contemporary American” restaurants with average check sizes >$30. Just to give you an idea of where that check size puts them in the quality / cost bucket compared to some more well-known restaurants, both Outback and Cheesecake Factory have average check sizes in the low $20s, while Ruth’s Chris Steakhouse average check size is ~$85/person. That’s probably enough of an overview. It’s a restaurant company; I’m sure most of you are familiar with the general concept! So let’s move on to more interesting waters. My goal is for you to walk away from this post with three key takeaways:

JAX is cheap as a standalone company

Activists have a very credible case to build that JAX’s management team is subpar and should be replaced

JAX’s history suggests it will be sold and the bidding will be decently competitive

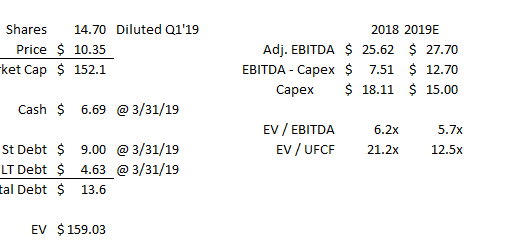

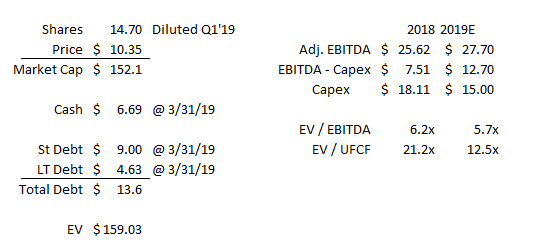

Let’s start with the first takeaway: JAX is cheap as a standalone company. With shares at $10.35, the company has a market cap of ~$150m, an EV of ~$160m, and trades for ~6.0x EBITDA.

Some notes on the valuation above.

JAX is spending $15-20m/year in capex, which makes the EV / unlevered free cash flow (UFCF, defined as EBITDA less capex) multiple look pretty high. At least half of their capex is growth capex; it costs ~$5m to open a new JAX and the company plans on opening one in 2019 with another to come in early 2020. On their Q4'18 call, management noted ongoing maintenance capex was under $5m a year; that seems a touch on the low side but within the realm of possibilities. If you adjust the capex number to a steady state number (say, $5m on the low end up to ~$7.5m on the high end), the company would show much stronger FCF (call it ~$20m/year, so the company would be trading at around 9x unlevered, untaxed cash flow).

I've excluded the operating lease component from the company's EV. New accounting rules make all companies throw their operating leases on their balance sheet; this doesn't have a huge impact for many companies but it's generally pretty impactful on consumer facing companies with lots of leases. Feel free to throw the operating leases into the EV if you'd like to (I think most financial websites are doing so), but make sure you add back the operating lease expense if you do so since you're now treating leases as a financing expense, not an operating expense. I don't think the answer changes materially either way to make spending too much brain power on the different account worth it.

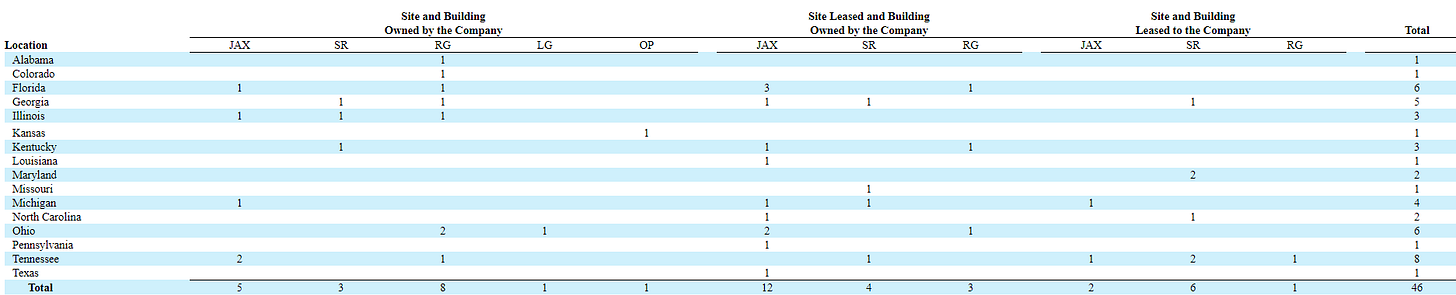

JAX owns a decent amount of real estate: they own the land and building for 18 of their sites, lease the land but own the building for 19 sites, and lease everything (the building and land) for the other 9 sites. That real estate is likely worth a decent bit; it's tough to say exactly how much, but it currently costs $5-6m to build out a new restaurant (excluding the land cost, per p. 9 of their 10-k), so it's likely just the buildings they own are worth millions. In addition, their 10-k lists land on their balance sheet at $20.2m; given some of that land has been held for decades, I'd guess that's a conservative appraisal. Coming up with a precise figure for what all of the buildings JAX owns are worth is tough, but there's certainly significant value here.

My personal guesstimate would be $50m in value; you can do some math on the Ancora offer and some multiples they give out and see that Ancora is valuing JAX's real estate at $40m.

Of course, the real estate value needs to be separated from the JAX business value. Because JAX owns so much of their real estate, they don't need to pay any rent on it, which boosts EBITDA. If this real estate were separated from JAX, EBITDA would go down as the restaurants had to start paying rent. I'm not going to attempt to adjust for that here but just something to keep in mind.

Table below from p. 34 of their 10-K

Ancora’s offer to take JAX private lists a bunch of publicly traded peers; the average peer trades for ~10x EBTIDA and the lowest peer trades for 7x, so JAX is currently trading for a multiple below all of their peers even before capturing their real estate value. Bottom line: JAX is cheap on both a relative (given their multiple discount to peers) and absolute basis (9x unlevered free cash flow before factoring in their excess real estate value), and their real estate likely provides some hidden value / downside protection. Ok, so JAX is cheap. Time to turn to the second point: activists have a credible case that JAX's management team is subpar and should be replaced. There are lots of different angles to this case, but let me start with the simplest: JAX has been undermanaged and is investing in growth projects that don't come close to realizing their cost of capital (to say nothing of creating value). Consider this: at year end FY14, JAX had 41 restaurants in operation. At year end FY18, the company operated 46 restaurants. In those four years (FY15, 16, 17, and 18), JAX spent ~$64m in capex and an additional ~$4m in preopening expenses. Obviously some of that capex was maintenance, but I'd estimate about ~$40m of it was growth related. So, in total, JAX had ~$45m in growth spend (~$40m in growth capex and ~$4m in preopening costs). JAX's adjusted EBITDA went from $22.3m in FY14 to $25.6m in FY18. You can slice those numbers a bunch of different ways, and I'm sure management would protest that some of their growth spend needs more time to play out (they constantly talk about how their restaurants have a higher % of regulars / repeat customers than a typical restaurant, so it takes time for their new builds to fully season. They may be right about that, but it still suggests that this growth capital is being invested with awful IRRs). There's probably a kernel of truth to that, but however you cut it I think it's clear that the company's growth capital is realizing almost no returns. Investors should rightly question what type of returns management is underwriting when they are spending growth capex and why they are continuing to open new restaurants when they are clearly having issues with their current batch. JAX's EBITDA margins and restaurant level margins are also at the lower end of most publicly traded restaurants; I think there's an argument to be made that a better manager could boost margins here (particularly when you factor in the artificial margin boost JAX gets from owning so much of their real estate), but it's not 100% clear so I'll just rest that case here. The slightly more complex (but still pretty simple!) argument against JAX's management team is that they're horribly conflicted. Some background is helpful here. JAX was a publicly traded company until late 2012, when Fidelity National Financial (FNF) bought them out for $14.50/share. FNF then spun JAX out in late September 2015 (the "original" JAX consisted only of J. Alexander; FNF added Stoney River to them as part of the spin). FNF did not retain a stake in JAX; however, a bunch of FNF-related individuals and JAX's CEO (Lonnie Stout) controlled an entity (Black Knight) that had a lucrative external consulting contract with JAX at the time of the spin (see p. 61). I think the contract was egregious and lucrative; however, if the story ended there I would say it was probably fair-ish since the contract was disclosed at the time of the spin. The bigger issue I have is that JAX announced a deal to acquire 99 Restaurants in August 2017. The 99 deal was horribly conflicted: the majority of JAX's directors were associated with FNF (99's owner / seller) in some form, and the deal allowed FNF to effectively acquire control of JAX for no premium. There are plenty of other conflicts (which are well documented in Marathon's letter opposing the deal), but the summary is the deal was extremely conflicted and minority shareholders eventually voted the deal down. Thinking about the 99 transaction is interesting in light of Ancora's offer to buy JAX for $11.75/share. As part of the 99 deal, JAX and FNF agreed to value the shares JAX was issuing at $11/share. FNF would acquire control of JAX through the 99 deal; it's curious that JAX was ready to give up control at $11 for the 99 deal but is currently rejecting the Ancora offer (which is worth more than what JAX valued themselves in the 99 deal) out of hand as "dramatically undervaluing" the company. It's also curious that JAX is engaging in a "just say no" defense where they refuse to engage with Ancora. JAX has defended this by noting that their board includes a representative from their largest shareholder (Newport) as evidence that "just say no" is done to maximize value to all shareholders; however, Newport was ready to vote for a deal that valued JAX at $11/share when JAX was buying 99 restaurants. Could it be that Newport was willing to do so because they had an investment in 99 as well, so Newport's opposition to the Ancora deal isn't so much about protecting minority shareholder's value as it is making sure they can keep as much of JAX's value for themselves as they possibly can? Hopefully at this point I've shown that JAX is undervalued as a standalone company and that the management team and board are both subpar and conflicted. Let's now turn to the last point: JAX's history suggests an auction would be pretty competitive. It turns out that the 99 deal was not the first time that JAX had run a conflicted sales process. JAX was a public company before FNF bought them and eventually spun them back out. In their prior public form in 2012, JAX was facing pressure from an activist fund (Privet) who made many of the same points in this article (company under performing, new stores generating poor returns, etc.). Facing a proxy vote that would likely result in some tough questions being asked on management's performance and pay, JAX announced a deal to be acquired by FNF. The headline price of that deal was $12/share, but the actual value was probably materially lower to shareholders given a decent piece of the value was a "nominal, secondary class interest". You can read the background of that offer here (see ~p. 20) to get a full view of how the FNF bid played out, but a quick summary is that a mini-bidding war for JAX broke out with multiple parties submitting cash bids in excess of FNF's original deal. FNF ultimately "won", but to do so they had to bump their initial bid not once but twice (first to $13/share and then to $14.50) in addition to changing their bid to an all cash bid. With the benefit of hindsight, it's pretty clear that JAX's management was panicked by Privet's activism and grabbed the first lifeline that was thrown to them when FNF offered them a deal that would let them keep their job (the proxy background makes clear that FNF was planning to keep JAX's management team around post deal, and indeed JAX continues to be run by the same top execs) instead of looking to run a process that resulted in full value for all shareholders. For me, the key takeaway from that saga (aside from JAX's management being very willing to throw minority shareholders under the bus to entrench themselves) is that the bidding for JAX was relatively active / there were numerous parties who took a look at JAX and made a bid (again, look at the background of the proxy; I read lots of proxies and it's pretty rare to get up to "Party G" and "Party F", particularly when most of the parties have submitted bids). I think an active bidding market makes sense / one would almost certainly develop if JAX were put up for sale now: JAX is a relatively small bite size (~$200m), which makes them a perfect target for any number of smaller private equity firms or restaurant roll ups. In addition to being a perfect size for a large number of bidders, JAX's financials are reasonably stable (adjusted EBITDA has been between $20-30m every year since 2012) and the company should throw off significant cash given low maintenance capex needs. Combine all of that with the dream of growing the JAX brand (i.e. why can't this be a 75-100 store chain restaurant with good returns on new stores with the right management team / growth strategy?), improving / leveraging operating margins (as mentioned above, margins are a bit below peers and could probably come in line with peers from either cost cutting or growing into their cost structure), synergies (G&A synergies for a restaurant roll up buyer; taking out public company costs for any buyer), and financial engineering optionality (selling off the owned real estate), and you can see a lot of different areas where a potential buyer could get excited. So how do I think this all plays out? The board seems to be rejecting Ancora's $11.75/share offer out of hand. However, Ancora owns ~8.5% of JAX, and another major shareholder (Marathon, who owns ~6.5% of JAX) has come out in support of the board running a process. When two shareholders owning 15% (combined) want something to happen and state it publicly (as they both seem to have done with wanting JAX sold here), it generally happens one way or another (i.e. the board does it or they get booted and the new board does it). Of course, the current board includes a major shareholder, Newport, who owns ~11%, so perhaps the board has enough shares behind them to avoid running a process and maintain the status quo. It will come down to what other shareholders want, and I think there's strong evidence that they'll take Ancora / Marathon's point of view and think the company should be sold for two reasons. First, JAX's response to Ancora offered no vision or plan to improve performance or back up why they think they can get to a higher share price than Ancora's offer, and it's very difficult to beat something (Ancora's offer at a premium) with nothing (the status quo). Second, minority shareholders voted against the 99 transaction last year, which I think shows that minority shareholders are frustrated with the current board and very open to replacing them. If the JAX board continues to refuse to engage, I think the odds of Ancora or Marathon eventually running and winning a proxy contest against the current board would be pretty high. One way or the other, I think JAX's time in the public markets is running short, and I expect they'll be sold for a nice premium in the near future. Odds and ends

I wrote the vast majority of this write up in mid-April and simply updated some numbers. Since then, there were two updates the furthered the plot a bit but I didn't feel like necessitated a full out rewrite of the article.

First, Ancora responded to JAX's response on April 17th, reiterating their offer to buy out JAX and highlighting many of the conflicts mentioned above. The response was pretty boilerplate.

Second, this morning, Ancora filed a preliminary proxy suggesting shareholders withhold votes from JAX's director nominees. Many of the points in that filing mirror points in this post (which is why I decided to post now!).

Outside of retailers, restaurants are probably my least favorite place to look. There's generally zero moat and competition is crazy fierce. From an investors' standpoint, the dream for investing in a restaurant would probably be to buy into them at a low multiple and have a management team that will to return all excess cash flow to shareholders the moment their growth program started showing questionable returns. Unfortunately, most management teams are willing to grow at any cost (they'll plow their cash flow into new restaurants and acquisitions no matter what return they're looking at). So I was admittedly hesitant to look at / discuss JAX, but ultimately I thought the set up and valuation was too attractive to pass on. It seems like a process is on the verge of starting, and with Marathon and Ancora looking over the boards' shoulders I think capital allocation will be rationale / won't matter too much because this will get sold in the near to medium term.

As far as I can tell, this is Ancora's first time launching an offer to take a company private. I suspect they wouldn't offer to buy the company if they weren't reasonably to very confident they could get a deal done if JAX accepted their offer, but I also think the offer is more of a "let's put JAX in play by sending a lowball bid" tactic than it is an actual attempt to take JAX private. This article on Ancora mentions their JAX bid and seems to suggest that this is more a tactic to get JAX in play.

I don't think I explicitly stated it in the write up so I'll throw it down here: JAX's real estate value is a big piece of the attraction here. Counting on real estate value for restaurants / retailers has a very checkered history (hello, Sears!), but at today's prices we're buying JAX for ~$160m. The company has no debt, is cash flow positive, and the owned real estate is probably worth at least $40m, or ~25% of the EV. That combination creates significant protection on the downside.