This Thursday (November 17) is Liberty Media’s annual investor day.

Long time readers will know that I’m an avid Liberty watcher; in fact, last year I hosted a post Liberty day meet up for a bunch of investors.

In last year’s post leading up to Liberty Day I noted that basically every Liberty related stock had underperformed the index over the past few years. Because of that continued underperformance and some questionable capital allocation decisions, Liberty’s stocks were starting to get assigned pretty large “Maffei discounts” (i.e. their stocks were trading at large discounts to fair value because the market was putting a capital allocation discount on them). At the time, I suspected Liberty would want to do something to change the narrative and reverse those discounts.

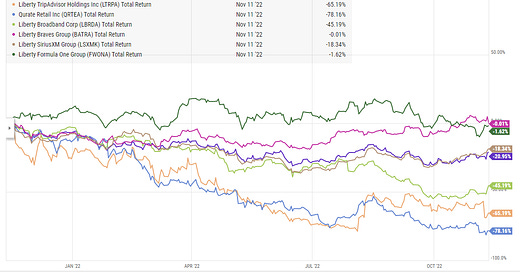

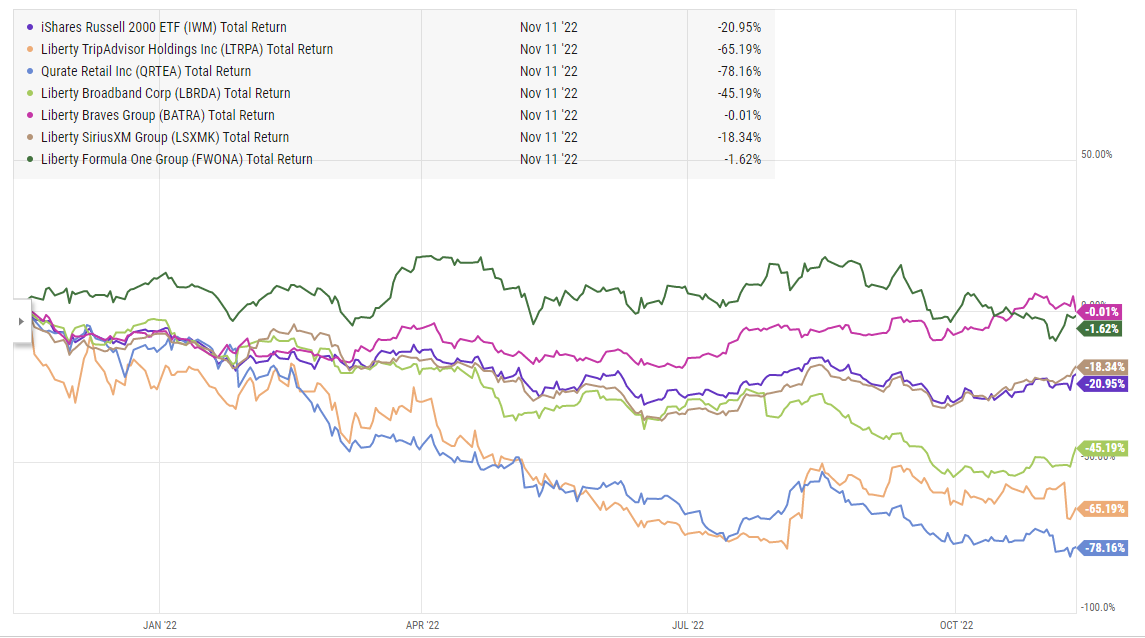

I could not have been more wrong. The last year has been an absolute disaster for Liberty stocks. Every single Liberty stock is less valuable than it was at this time last year. Obviously the market is down over that time period, but the majority of Liberty’s stocks have underperformed the index over the past year, with three of the stocks (Broadband, QRTEA, and LTRPA) dramatically underperforming.

And this isn’t just cherry picking a bad year; it’s now hard to find a single stock in Liberty’s portfolio that outperforms the index on a five year basis, and most dramatically underperform.

That’s a lot of underperformance over a pretty long time period, and I haven’t even included the “Liberty adjacent” stocks that don’t include Maffei like LBTYA, LILAK, and WBD (all of which have been just abject disasters).

Liberty stans (and Liberty itself) might counter with a few points like:

“Five years isn’t THAT long!”

“The stocks are undervalued!”

“Liberty takes a long time horizon approach, and they’ll buyback shares to take advantage of the discount.”

Look, I get those arguments. I was in that camp for a long time, much to my portfolio’s detriment. And, given I still own LBRDA, perhaps you could say I’m still somewhat in that camp.

But let me propose an alternative thesis here: John Malone was one of the greatest capital allocators / businessmen of all time, but he has done a terrible job in choosing successors. All of his successors sound smart and they know how to talk about creating long term wealth…. but they don’t know how to make money (well, they don’t know how to make money for shareholders; they’ve done just fine making money for themselves with their enormous pay packages!), and Malone’s too rich and too old to admit his mistake and fire his friends / successors, plus he’s maybe a little stuck in the legacy media world and doesn’t see the ball as clearly on how media is evolving. That’s a dangerous combination, and it leaves shareholders really out in the lurch.

There are three things I can think of that show this “Malone out of touch with poor successors” point really well. And, to be fair to Liberty, I’m not going to use the stock charts of LILAK / LBTYA / WBD to make my point; again, those are complete disasters and it would almost be too easy to make the point with them.

Instead, let me point to four particular places to show how out of touch Liberty is currently:

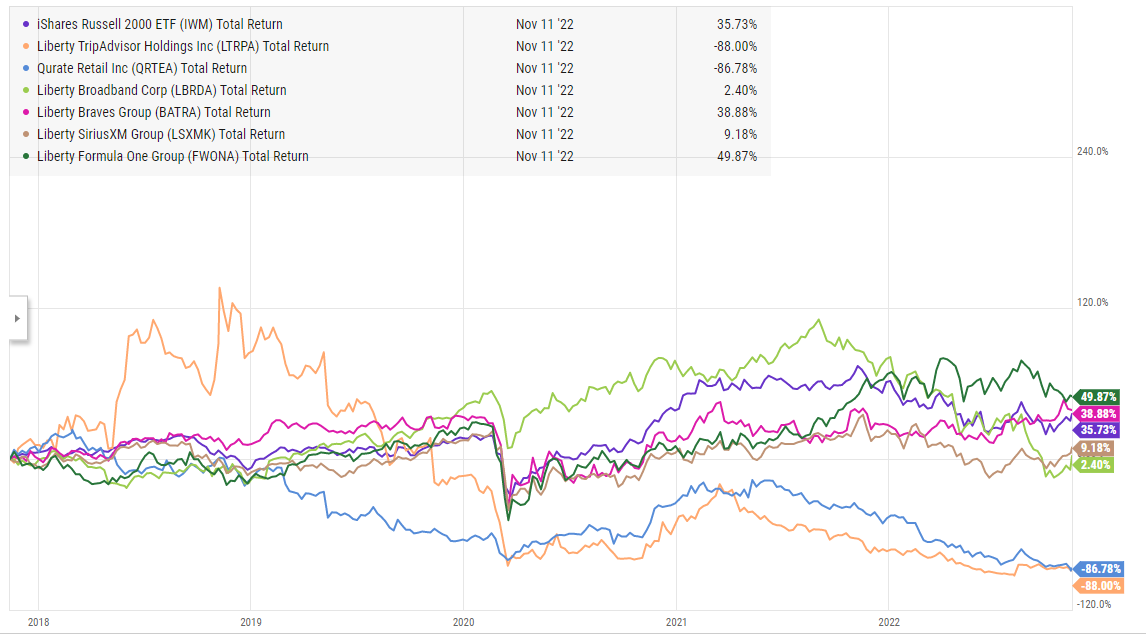

Continued issues estimating terminal value / buying value traps: The highlight here has to be QRTEA. At last year’s investor day, Malone (and, if I recall correctly, Maffei) said that QRTEA was the cheapest piece of his empire. I was pretty surprised by that; QRTEA had clear terminal value risk and the company had made moves (big dividend payouts) that suggested they had internal doubts about their terminal value. QRTEA’s stock is down ~80% over the past year:

Malone’s love of QRTEA reminds me a little of his love of Discovery. In 2017, he touted how cheap it was in the heels of their merger with Scripps. The combined company would be a cash flow machine and a dominant force in the legacy cable bundle. Malone was touting that story back in 2017 when Discovery was trading for ~$17.50/share; today, the company has merged with Warner Brothers and the stock is currently trading for <$12/share.

I’ll happily admit that I got the WBD story just as wrong as Malone did and it was a massive loser for me. But I will also say that all of the recent insider buys at WBD (including Malone selling a ton of puts) are a lot less interesting once you remember how wrong Malone has been on the name in the recent past (including making some weird options trades on the stock in 2019).

Continued trend of buying high / selling low: Liberty’s one skill is supposed to be rational capital allocation. Given that, their continued trend of maxing out share buybacks when times are good and then pausing when the stock market drops is not just infuriating but points to real issues inside the group. Consider:

Last year QRTEA was aggressively repurchasing stock with their shares in the low double digits. Today, the stock is down ~80%, and QRTEA isn’t buying back shares because they’re trying to avert bankruptcy. Let he who has not bought a stock that’s gotten hammered over the past year cast the first stone…. but buying back a ton of stock with questionable terminal value right before a massive drawdown is becoming the norm at Liberty.

LSXMK bought back ~2m shares in Q3’21 at ~$48/share. They did just 276k in Q3’22 despite the shares trading for ~$40/share (to be fair, they did buy back some of their convert notes).

Constantly bungling the cap structure: This somewhat ties into number two, but Liberty is just constantly bungling their cap structure these days. A lot of Liberty’s companies (like LSXMK, LTRPA, and effectively LBRDA) are financial creations; they’re simply tracking the value of another asset. Given that, capital allocation should be relatively simple…. yet somehow Liberty constantly manages to bungle it. Consider:

The headliner here has to be the inexplicable LSXMK rights offering right at the COVID lows that they needed to bail out the FWONA cap structure. But we can find plenty of others!

How about last year’s deal to swap Berkshire’s SIRI shares into LSXMK? That was an absolute travesty of capital allocation; LSXMK traded for a massive discount to NAV (which consists largely of SIRI), but they swapped their shares for Berkshire’s full priced SIRI shares. At the time, I thought they would only do that if they had an immediate reason to do so…. here we are one year later and it looks like LSXMK decided to issue stock at a discount for no real reason except to speed up their tax consolidation (something that would have happened this year anyway!).

The most recent example of this is Liberty Broadband. In their Q1 earnings call, LBRDA noted they had drawn down on their margin loan to fund share repurchases at LBRDA; on top of that, LBRDA had declined to participate in Charter’s buyback in February in order to increase their stake in Charter (LBRDA has to participate prorata in CHTR’s buyback; doing so is generally how they get their cash to fund their own buyback). Talk about bullish! LBRDA was doing everything they could to hold on to as many CHTR shares as possible plus they were drawing down a margin loan to continue their own buybacks. At the time, CHTR was trading over $500/share, and LBRDA proudly noted they were buying back their own shares at a “look-through” CHTR price of $451/share.

Fast forward to Q3’22, and LBRDA sounds a lot difference. With CHTR trading <$400, LBRDA is pulling back on their repurchases in order to prepare to paydown some liabilities (from the conference call, “towards the end of the quarter, we did pull back on some of our LBRD buyback. We did this with an intent to retain some portion of the cash flow from our Charter sales to address some of our near-term liabilities”). It’s not like these liabilities sprung up out of no where! LBRDA got too aggressive with repurchases and leverage early this year, and now they’re scared and can’t buyback stock at even more attractive prices.

Inability to execute successfully: This is a tougher one to pinpoint, and to be fair to Liberty some of their companies are executing really well (FWONA). But we’re seeing multiple Liberty companies repeatedly fail to execute or evolve their business models as the world develops. For example, consider QRTEA. They took a big write down on their Zulily acquisition, and the company’s been in continually turn around for the past several years while revenue (and the stock) plummet.

There are plenty of other examples of each and every issue I listed above. Honestly, if you wanted to, you could probably find each issue at just Liberty Tripadvisor. On the financial side, LTRPA got margin called at the COVID depths, and on the operational side, the business has failed to perform at every turn and every new initiative (tripadvisor plus, instant bookings) has flamed out despite Liberty’s continued promises of a brighter tomorrow.

Anyway, I’m probably rambling a little here. But I’ve been a long time Liberty fan and this is the year I just kind of stopped believing. This isn’t the Liberty of old; Malone has either lost several steps or just isn't as involved with Liberty (likely some combination of the two), and his successors are absolutely as skilled in destroying shareholder value as peak Malone was at creating it. And the successors are getting multi-generational wealth while they’re at it: Maffei made $21.5m from LSXMK / FWONA / BATRA in 2021 (down from over $47m the year before) as well as $18m from LBRDA (down from just under $21m the year before). Go look at the 5 year stock performance of all of those stocks above; should Maffei really be making >$50m a year to effectively oversee a bunch of tracking stocks when all of his companies keep winding up in distress or his holding companies are constantly on the verge of margin calls?

Malone used to point to his controlling stake in Liberty as a key benefit for long term shareholders. He could give managers the cover they needed to make long term investments that more short term focused investors wouldn’t like, or he could shield them from “opportunistic” buyout offers when a company or industry was out of favor.

That might have been how it worked in the old days. But today, the only thing Malone’s controlling stake is doing is entrenching managers with massive pay packages who continue to underperform their peers and the indices. Honestly, all parties involved would be better off if Malone would drop his controlling stake and let an activist come after each and every one of these companies and hold his successor’s feet to the fire on the years of value destruction.

Look, I’m a Liberty fan. I hope they come out and announce a series of deals this week that unlock and create a ton of value. I will be very, very happy to have egg on my face if that’s the case. But at this point, hoping for a value unlock at Liberty is like Charlie hoping Lucy doesn’t pull the football away from him…. except every year that football gets a little bit smaller as Liberty’s mismanaged capital allocation and huge compensation packages eats into the underlying value.

PS- Speaking of activism, my friend Chris Colvin has published a letter to Liberty about unlocking the value of the Liberty Braves. I have absolutely no disagreement with Chris that the value for the Braves is there; the fact that Liberty has just let the Braves stock continue to languish so far below net asset value without doing anything to take advantage of it is yet another reminder that the company does not care about creating shareholder value anymore.

PPS- speaking of the Braves, I don’t think it’s a coincidence that the only things in Liberty’s portfolio that have really worked are BATRA and FWONA. Why? These are scarcity / trophy assets that can make or break media networks, and Liberty clearly saw the ball clearly on them (and the execution at both has been fantastic, with FWONA being particularly incredible). In almost every other Liberty stock, Liberty has clearly been running a mid-2000s playbook on relatively tired assets that have not evolved with the time, and the results speak to how poorly that has gone.

Every time it's this time of year and I see that email subject line in my inbox, for a second I think "oh no, what did I do this time?" and then realize it's about Malone... haha

LBRD after tax "look through" CHTR earnings:

2017 $0.96/LBRD share (with $2.74 LBRD debt/share)

2021 $8.82/LBRD share (with $19.67 LBRD debt,preferred,indemnification/share)

As far as the stock performance - should Mr. Market's actions be used to judge management? For a long term investor in a company buying back a lot of stock, the lower the stock price goes and the longer it stays there, the better, no?

As far as your point 3.c.

- it's easy to look back and say "They bought at a high price and pulled back at a low price", but who knew in January that the price then wasn't the low point?

- addressing some liabilities at the end of 22q3 could spring up out of nowhere. Maybe thanks to low CHTR price QRTE indemnification or exchangeable debt became attractive or perhaps GCI FCC fine/settlement? Or something else? We should find out soon.