Liberty’s investor day was yesterday, and I wanted to provide some follow up thoughts on it. I’ve ended up breaking my thoughts into three points:

Thanking everyone for coming to the meet up

Overall Liberty Day thoughts

QRTEA, FWONA, and Charter thoughts

Without further adieu:

Point #1: Thank you!

I wanted to thank everyone who came to our post event meet up. It was an absolute blast; I tried to say hey to everyone who was there, but I know I didn’t get around to everyone. If I didn’t manage to see you, my DMs are always open! I’m hoping to turn this into a yearly thing (and hopefully the Liberty IR-ettes, as I believe the video called them, will continue to show up!), so if you couldn’t make it in town for this one I hope to see you next year. (PS- there were lots of college aged investors who were at the Liberty day. Good for them; I definitely wasn’t going to investor days at their age (though, to be fair, I was reading 10-Ks during most of my classes!). I talked to a lot college students, but just want to explicitly note that if you’re in college and looking for a sounding board or something I’m always available! Again, DMs open).

Point #2: Overall Liberty Day thoughts

Honestly, I was a little disappointed by this year’s Liberty day. As I mentioned last week, I thought the recent moves across the liberty complex had set them up to announce something (or several somethings!) at Liberty day. I’m disappointed we didn’t get that; swapping BRK’s SIRI shares for LSXMK shares (which trade at a big discount to NAV) was awfully expensive; for them to do it now and then not have any announcement begs the question of why now.

Even outside the lack of big announcements, I thought the day was a bit of a yawn / a little weird. Maffei’s key note speech was odd; normally, he’d dive into some big trend that affected Liberty, but yesterday’s speech was more in line with what I’d expect a market strategist at a bank to give to some high net worth clients or something. It was just a little strange coming out of Liberty.

I was also a little bummed by the Q&A. If memory serves, they used to have two Q&A sessions, and they used to be exclusively for questions aimed at Malone / Maffei. This year, they only had one session, with no questions from the audience and about half the questions going to the business CEOs. I can see why Liberty went to the new format: having IR ask questions ensures quality questions get asked, and it guarantees each CEO gets a question (if they had done audience only, I doubt Tripadvisor would be fielding many questions other than “why are you so damn awful?). Anyway, audience questions can be hit or miss; sometimes you’ll get the “do you believe in God?” questions that no one really wants to hear, and sometimes you’ll get a question that catches management off guard and can be really insightful. So I can understand why they took the audience Q&A away, but I kind of wish they hadn’t.

If Liberty was asking for my main feedback, it’d be increase the Q&A time. Go back to two Q&A sessions, with one coming from the audience and exclusively for Malone / Maffei, and one coming in the same format as this year’s with questions for each CEO. If you’re time constrained, maybe limit the audience Q&A to 15 mins and do the more buttoned up IR Q&A for 30 mins. I think that would be a nice blend (though I’d also tilt a little further towards the Malone / Maffei questions; give the people what they want!).

Point #3: QRTEA, Charter, and FWONA

I wanted to wrap this up with three points on companies that stood out to me at the investor day.

First, on FWONA. I follow them, but I can’t say I’ve seriously looked at them in ~18 months (I love buying sports teams on the public market, but I think a gating factor for me with FWONA is I’ve just never really been passionate about the sport). I was really impressed by how well the business is doing and the vision management laid out (also, the funniest part of the day was definitely the IR bit on how investors ask about the 2023 race schedule in lots of different ways). As a business, FWONA is in a very good place, and given the strength of sports rights (look at what NBC is paying for EPL!), I need to spend a lot more time there. Even after a pretty big run YTD, I think the company has a lot of optionality and I could paint a lot of ways the stock is still cheap.

Second, QRTEA. I’ve been very skeptical of QRTEA; there are clear terminal value issues there, and that they’ve switched from a massive share cannibal to a hybrid share cannibal / special dividend payer has been a big red flag for me. So I was a little surprised when Malone said QRTEA was the cheapest company in his universe (and, yes, the QRTEA bulls were out in force at the meet up after). QRTEA’s investor day is November 19th (today, literally as I’m writing this); I’m going to try to approach the company with fresh eyes and review them because I know a lot of sharp investors in QRTEA and Malone just said it’s the cheapest thing in his universe. If that’s not worth checking out, what is?

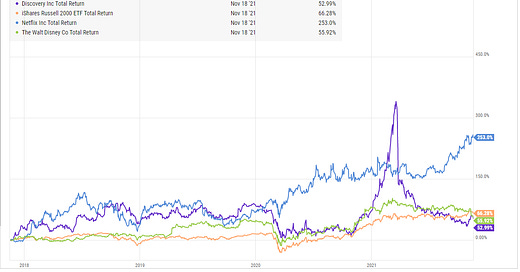

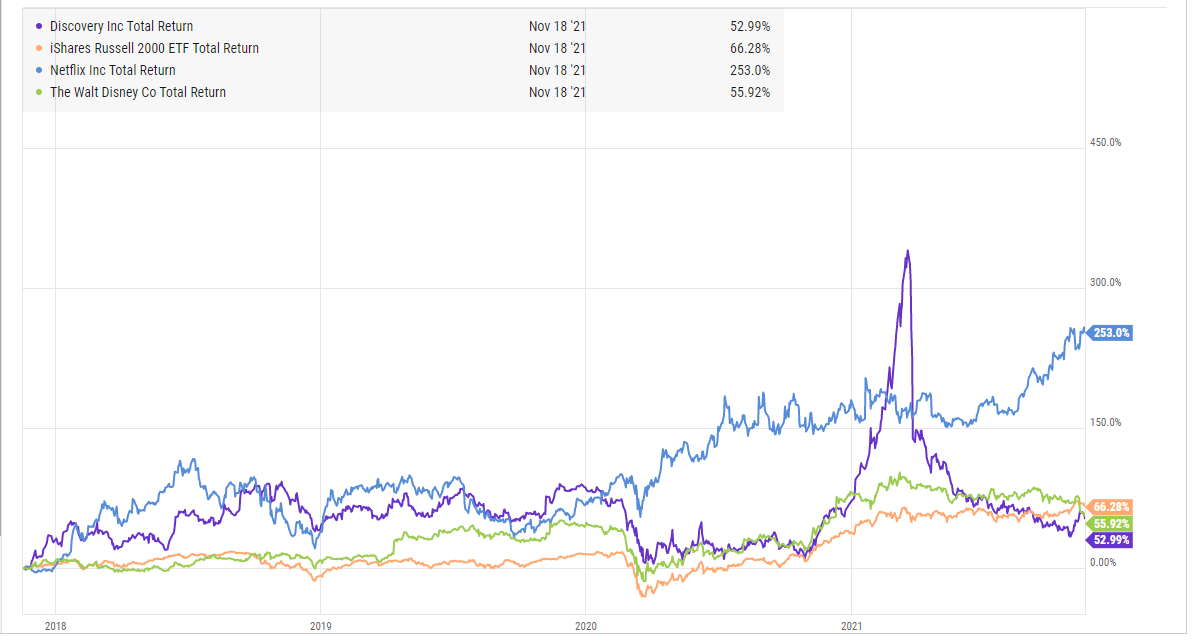

I will say one more thing to throw a little cold water on the QRTEA bulls: the way Malone talks about QRTEA now reminds me a little of how he talked about Discovery after the Scripps deal. DISCA’s stock has done fine since then, but it’s not exactly a screaming homerun (it’s trailed the index and relevant peers).

Every investor has blind spots; Malone in general is very bullish on cable nets trading at low valuations because he loves that cash flow. It’s possible that he’s underestimating the terminal value risk in there… but it’s also possible I have a blind spot to QRTEA and I just habitually underestimate it given my history there. (PS- Bill Brewster came on the podcast and talked QRTEA with me last year; he’s generously offered to come back on the podcast to talk QRTEA again; I think I might take him up on that!)

Lastly, Charter (CHTR). This section started out as a quick thought on Charter, but I got a little triggered (in a fun / friendly way!) by this tweet saying Charter wasn’t cheap, so I’ll be doing a more full write up on Charter in the near future. I’ll just give a little preview: I think Charter’s executing very well, and I remain impressed by how Tom talks about it and the path he lays out. Is it the cheapest stock in the world? No, absolutely not… but I think it’s a great company with good growth prospects at a very reasonable price. I think the stock will double in the next 3-5 years, with the possibility for a better return if they got a little more aggressive with capital allocation, if the mobile business plays out better than I expect (and honestly I’m starting to expect big things from it), or if they can pull an M&A rabbit out of their hat. Personally, I view Charter a little bit like the way Buffett used to view Wells Fargo: Charter is a stock that I view as underpriced and likely to outperform that market over a multi-year period with substantially less risk; anything else I want to buy needs to buy judged on the opportunity cost against that (Actually I kind of view the whole publicly traded cable sector ex-CABO in that way, though Charter is by far the cleanest / least hairy way to play).

So I’ll have more on Charter in the near future. Till then, just wanted to say thanks again to everyone who came out to Liberty day and I’m looking forward to seeing you all next year.

it was very underwhelming.

personally they stole all the good stuff earlier in the month.

after much thought i can see why they didn't announce anything regarding SIRI/Liberty - don't want to screw up tax stuff.

no plan or intent!

the exchangeable i bet they try to deal with first.