Michael Liu on why he thinks Cogstate $COGZF is a great business wrapped in a special situation play (Episode #160)

Michael Liu, Analyst at Intelligent Fanatics Capital Management, discusses Cogstate (ASX: CGS) / (OTCQX: COGZF). Cogstate provides computerized cognitive tests for Alzheimer's clinical trials. Michael came on to discuss his thesis on Cogstate and how a failed takeover attempt could create an interesting special situation.

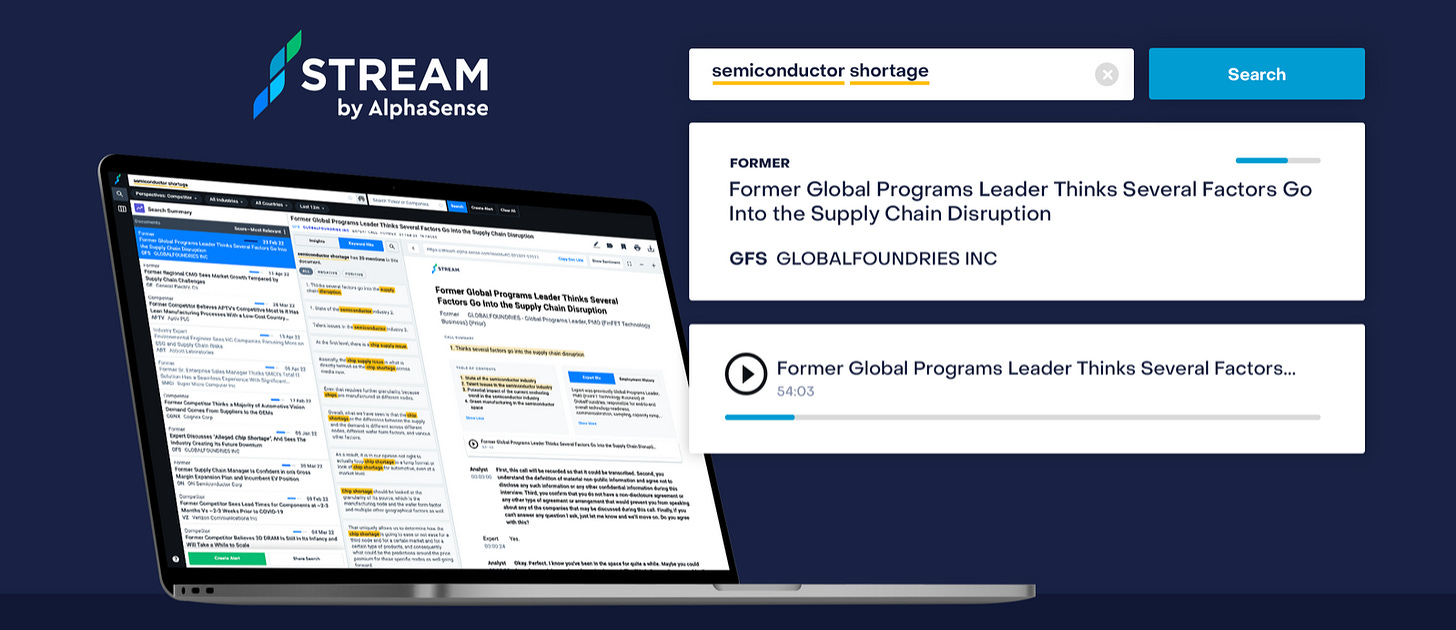

***This podcast is brought to you by Stream by AlphaSense.***

Expert calls just got easier.

With Stream, you have instant access to a library of 26,000+ transcripts and one-on-one calls with former executives, customers, competitors, and channel participants. Speed up your research process with AI technology that understands your intent and sentiment to give you deeper insights. Readers and listeners can get a free trial here.

Please follow the podcast on Spotify, iTunes, or most other podcast players, as well as on YouTube if you prefer video! And please be sure to rate / review the podcast if you enjoy it, or share it with someone else who would enjoy it (more listeners is a critical part of the flywheel that keeps this Substack and podcast going!).

Disclaimer: Nothing on this podcast or on this blog is investing or financial advice; please see our full disclaimer here. The transcript below is from a third party transcription service; it’s entirely possible there are some errors in the transcript

Transcript

Andrew: All right. Hello and welcome to the Another Value podcast. I'm your host, Andrew Walker, and if you'd like this podcast, it would mean a lot if you could follow, rate, subscribe, review it wherever you're watching or listening to it with me today, I'm happy to have Michael Lou. Michael is an analyst at IFCM. Michael, how's it going?

Michael: Good, how are you?

Andrew: I'm doing good. Hey, thanks so much for coming on the podcast. Let me start this podcast with just a quick disclaimer. The way I start every podcast, remind everyone nothing on this podcast is investing advice. That's always true. But we're going to be talking about a microcap Australian stock. So it's international, it's small, if that doesn't scream extra due diligence, extra risk, please do your own work. I don't know, what does, I'll also throw out, just because this is super small, I know Michael has mentioned that IFCM has a position, so I'll disclose that. I even have I think people would call a tracking position. So it would basically ground zero, but I own a couple shares here or there, so I'll throw that out as well. All that out the way Michael, the company want to talk about today is CogState. The ticker is I believe in the US it's COGZF is the kind of domestic ticker I think people are going to be familiar with. But yes, a small company. Really interesting. I mentioned, I have told, because you kind of walked me through a little bit of the story I was doing research was like insider buying, fail transaction, growthy company open market purchases. It's just got everything I've rambled a lot. I'll flip it over to you. What is CogState and why are they so interesting?

Michael: Yes, sure. So yes, thanks for having me. And CogState's a really interesting company, especially now because I think we've been investors in CogState, like you said, for many years, and CogState is and has always been a great company, but right now in particular, they're down about 40% from highs earlier this year because of sort of a failed takeover that you alluded to that we can talk about more. Just, a variety of technical, non fundamental related events that have causes stock to go down a lot. So you're left with sort of this great business at the lowest evaluation that it's been in several years. So I think it's a really interesting opportunity here, sort of a great business wrapped up in a special situation play. So sort of going to both of those elements, the reason it's a great business is like CogState business is making computerized cognitive tests for Alzheimer's. So these are the tests that pharmaceuticals give patients in clinical trials to see if the drug is successful or not in improving the patient's cognition or flowing the worsening of their cognition to measure the cognitive effects of their drugs.

CogState is a very dominant player in that market. They're about in the computerized cognitive test space. They're about five times larger than the next biggest competitor. So they're by far the market leader for all intensive and purposes, the only player in the market. And they have a very strong foothold in the market because they have very close relationships with almost all of the big pharmaceuticals that play in Alzheimer's. So, the biggest pharmaceutical in Alzheimer's are Eisai and Lilly right now, and they're also the two companies that are going to have the first approved drugs in Alzheimer's that we can talk about later. But Eli Lilly use with CogState, they have an agreement to uses CogState on all of their clinical trials. So that's a lot of work that CogState does through Eli Lilly. A couple years ago Eisai bought 10% of CogState, and they also use them for several trials. And Eisai also has a 50-million-dollar license agreement to take CogState test and bring it to the direct to consumer screening market that we can also talk about later.

So CogState has really good foothold in this industry that is about to see a lot of growth going forward because of some recent successes in the space that have come from companies like Biogen, Eisai and Eli Lilly. Sort of, they've found for the first time in 20 years, they've had successful drug readouts in Alzheimer's. And this has sort of catalyzed of the opening of the floodgates for a lot more Alzheimer's R&D going forward. So you can see companies that have previously exited the industry coming back in, like Merck and GSK, have used to be big in Alzheimer's. They sort of took a hiatus over the last couple of years, and now they're coming back in after seeing the successes from these other big pharma.

And then companies like Eli Lilly and Eisai that have always been involved are now aggressively ramping their R&D efforts. And because CogState is the dominant player in this industry, basically all increases in Alzheimer's R&D, eventually benefit CogState and slow down to CogState's bottom line.

So historically, CogState has been a 20% grower on the top line bookings for the last five to 10 years. I think there's room for that to accelerate to 30% plus meaningfully over the next couple of years as these increases in R&D come through and the company is profitable. And like I said, it trades at very low valuation today. On that note, the flip side of what happened to create the special situation right now that makes the company so compelling, there's [inaudible] compelling today.

Andrew: Why don't we pause there, because the special situation I think is the sexy kicker, but I do think it's important for people to understand like kind of the fundamentals more. I'd love to. You know I love it a special situation, but I do think the fundamentals in understanding that is really important for understanding like it dropped 40% on, I don't want to say kind of failed, like a weird special situation. I think people are going to want to know that there's the fundamental value in understanding the business first. So do you mind if we just kind of pause here and then we'll come back to the special situation?

Michael: Yes, absolutely.

Andrew: Okay. Great. So let's just start. So CogState makes these development tests, and tell me if I'm wrong, but the way basically people can think of it is, Biogen has that new Alzheimer drug, and what they do is they're literally giving older people, right? An iPad app, if I'm correct, and they are clicking through it and it's CogState test, and they're clicking through it and saying, "Hey, no sign of mental degradation versus last last month or last year, or some signs of mental degradation." Is that kind of what people should be thinking about this product?

Michael: Yes, so for the 90% of the business today is using the testing clinical trials and just you can go to cogstate.com to get a sense of what their tests are, but it's really simple technology. For example, it'll have a card that flips over, and once it flips over, you click on the iPad or you click on K on your keyboard, and then it tests your reaction time down to the millisecond. It'll say, "Have you seen this nine of cards before? It'll show you a sequence of cards. Have you seen this card before? Yes or no?" And then they'll test your reaction time, and obviously, if you get the answer correct or not that you've seen the card before, that's short-term and long-term memory. And they can test all these things to a very minute scale and get, you know, millisecond level data on.

And they have a huge database of patients that have already taken these tests, obviously, so they know what is mental decline and what isn't and how to assess all of that. So in clinical trials, they give these tests to patients I think it's every three months-ish or something like that. And then they measure half of the arm is taking the drug, half of the arm is taking placebo, and they see which side is getting their cognition benefited or working quickly when they compare the two sides means, and CogState test, that's the primary use of the technology.

Andrew: So I think the first question that pops up is why you're dealing with Biogen, you're dealing with Merck, these are literally hundred billion dollars the richest companies in the world, they can develop anything they want. They're the ones interacting with the patients. I do think there is something to scale and have in the database, but why doesn't Biogen just go out and develop this a as you said, I looked at it and I think that, if I remember correctly, they've gotten a big ace of spades is the front of their website and their annual report because, it's an [inaudible] why can't Biogen just go and develop this on their own? And kind of, I mean, it's not like they're paying tons for this, but just kind of cut CogState out, get something proprietary maybe that pulls into their models and their data a little bit more.

Michael: Yes. So it developing the test would take no time. You could code it, anybody could code a test like this to run, but...

Andrew: I seen some click the websites that have similar, like, see how quick your reaction time is. Like, it's pretty simple.

Michael: Exactly. Yes. The test is everywhere. What's different about CogState is they have 20 years of validation of using, using their tests in clinical trials and about a thousand academic papers studying their tests. Big Pharma is very picky about what they put into a clinical trial. Like the last thing you want to do is to spend a billion dollars running through phase 1, 2, 3 trials getting a really successful result in Alzheimer's, which is already extremely difficult to do. And then go into the FDA. And then once you have your drug approved, when you have the successful data, the FDA goes, wait, what endpoint did you use to test that drug? We've never heard of that before. Can you go back and redo those trials? That would be horrible. So CogState is the only computerized test that has been used thus far to my knowledge in large phase three sort of pivotal Alzheimer's trials.

And that's a big level of validation that no other company has. And that's because they've spent so many years sort of slogging through the effort of giving the test away for free to academics, for them to study the test and make sure there's no practice effects, it actually tracks cognition. They've compared it to every single other paper in pencil test out there. So the whole industry is very averse to change. And so it's taken a really, really long time for CogState to get their plays in the industry. And big pharma is not going to save a couple of million dollars just by speculating on another startup's test and run the risk of something failing with their end point. That's why Eisai has given CogState 50 million to license their test for clinical trials. That's why CogState does a hun 50 to a hundred million a year of bookings selling this test to big pharma.

Andrew: I was about to make that point. Again, it seems like, Oh, yes, we'll bring it in-house to save money. It's like CogState's revenue for managing, and we'll talk a little bit more about all the other options. Managing all the Alzheimer research through this is 50 million per year. Like that's a fraction of what you're going to spend in one drug on research trials. It's a very small part of it, but as you said, if you went with something else and there was any issues with it, cool, that's a billion dollars that you just spent in R&D out the window. You're losing patent protection time, you have to go back and redo everything. You take a huge hit, there's going to be scandalous stories saying that you're not tracking the data well, like, it's a very small cost, but it's a critical component. Go ahead.

Michael: Yes, I was just going to say, the other thing you can think about this way is there is precedent as to how much money and time it would take to create a new computerized test and bring it to market. And that's the CogState started in the early 2000, the IPOs in 2004 at 50 cents a share, and they've been for the last like 20 years, they've been unprofitable for maybe 15 or 16 of those years constantly raising money. They've had to raise a lot of money to do this. It's taken about 15 years for them to finally get ingrained in major late stage clinical trials. And stock today is at a buck 50 when it iPod at 50 cents back in 2004, which is not a great, IRR if you calculate it. So the financial and time incentive to do this really doesn't exist for competitors or for big pharma, anybody.

Andrew: And now the data, if I'm Biogen and I'm using CogState's app, does CogState's app. Does CogState control the data? So like they control it and then when Merck runs it, they get the data from Merck too, so they can start adding in all these different things. And I don't know if that's really a network effect, but they get all the kind of results to continue to improve their algorithms and everything.

Michael: Yes, absolutely. So that's a big part of, it's like a, it's a positive feedback loop, like you said. They get more data from the more trials that they're used in, and that allows them to get a better, smarter test per se. And it's the same thing with the more trials they're used in, that validates their test too. The more trials, clinical trials they're used in, the more academic studies they're used in, the more validation they get. If it's the same feedback loop that makes them more ingrained in the industry.

Andrew: And if I'm Biogen, Merck, whoever, and I'm running an Alzheimer's test, and I for some reason choose not to use CogState, I don't believe there's any other kind of computer app trials that have the FDA seal approval. So the alternative is kind of just pen and paper. Am I thinking about that correctly?

Michael: Yes, exactly. So when I say CogState, the market leader in computerized tests, computerized tests are only about 10% of the total market. The rest of the market is paper and pencil tests. Now, these paper and pencil tests are not great when you look at them. So you can, you can Google how to do them. So the biggest ones are like the MMSE and the CDR sum of boxes. These are tests that, I mentioned before, how you do CogState tests and they take your data down to the millisecond, they know every right answer, wrong answer, all of that, and they put it together. These tests are more rote based. They were developed in the 1970s and '80s through sort of just academic papers and ideas. So there, there would be tests like, you know, it's a checkbox like how severe is your memory loss?

Is it mildly severe, moderately severe, or severely severe? And then you check that and then you do all these boxes. And then it's actually kind of amazing to think that multi-billion dollar Alzheimer's drugs are being approved based on these very rote brute force paper and pencil tests that you would think there's much more sensitive tests that can be used like CogState today instead of these brute force ones. But again, it's just reflective of the nature of this industry that it's very averse to change. So these tests have been used for many decades, and they're going to continue to be used for many decades. But like I said before, there are many problems with these tests. One is they're not standardized. Every single one has to be administered.

So if you're administering a test to me and then I go in to the facility the next month and somebody else is administrator the test, and then there's other people administering the same test to my placebo comp in China or something like that's a source of that's a source of difference of potential error. And then there's also a lot of practice effects for those tests. Cox test was specifically made so that you can't get better at it over time. Whereas a lot of these other tests, like some of them, you'll have, you draw the same shape every single time and you draw the same shape twice in a row, you get better at it over time. So there's a whole host of benefit or of issues with paper I pencil tests that cognate solves.

And maybe the biggest benefit of CogState's test now that's become relevant since Covid, is that their tests are able to be administered remotely with basically no difference versus in-person administration because again, their tests aren't really administered. You're just doing it on the computer. Whereas for a paper and pencil test, administering those tests remotely are very difficult. And right now there's a big growth being seen in what's called decentralized clinical trials, which are clinical trials that are done remotely with, sort of like over a zoom call. You do these cognitive tests instead of going in person. I think actually the head of R&D for Takeda on a Twitter space is recently said that you expect that all clinical trials in the next year will have some form of decentralization element. Whereas this was not really heard of pre COVID. So CogState is a really big beneficiary of that tailwind as well. So they're just so much better than the paper and pencil competition. But again, it just takes time to overcome the precedent. That's the precedent in the medical space.

Andrew: Not only does it take time, but if you're in the middle of an Alzheimer's trial that's running for, call it four years, right? And you started two years ago using paper and pencil, even if CogState's stuff is way better, you can't just switch over to CogState stuff today, right? You'd ha then it would invalidate the whole trial. Like you can't do it until either the drug's approved or disapproved and you have to go back and do a new trial or after the drug's approved and you need to continue monitoring. You could probably do design to switch, but that is, and you said you think of the hundred of the industry for Alzheimer's research, you think 90% of it is pen and paper right now and 10% of it is CogState and then grounds to zero is some other solution?

Michael: Yes, I would say so. I mean, yes, 90% is pen and paper probably. I think CogState said that their market share right now is something like 13%. So maybe we say like 20% is computerized, and then CogState is the majority of that computerized. But again, we're talking about like a total amount in terms of like pivotal trials. So phase two and phase three Alzheimer's trials, there's maybe only like 20 to 40 of them in the works right now. So, 1% is not even single trial.

Andrew: Next question. So right now, all of the revenue is really coming from something related to Alzheimer's trials, that type of stuff, right? So I do think there's a question, Hey, Alzheimer's research is booming right now, but if I reground, let's use Covid. If I rebound four years, covid research, two years, I guess Covid research would've been booming and now Covid research has come way down, right? Or if I went back 20 years, I'm sure there's some disease I'm not thinking about. That was people were really hot ne into doing research and then five drugs came out, and now maybe there's one or two trials, but like, it's pretty much gone. Alzheimer's quote unquote nice thing is, which is a dark way to look at it, but it's a huge market. It's going to going to take years to solve. Maybe not solve, we're going to have lots of things, but you know, I do worry, Hey, if we got two blockbuster drugs approved, three blockbuster drugs approved in the next five years, in the next five years, CogState going to have really nice revenue. But after that you just see this huge dry out? So can you kind of talk to CogState what their revenues look like outside of big phase two and phase three drugs for trials for these Alzheimer's drugs?

Michael: About 80% of CogState's business is Alzheimer's. And I don't expect that to change going forward. In fact, I would expect the Alzheimer's side to continue to grow. I think it is a risk that Alzheimer's R&D goes down in the long term. And that has happened in the past before when there were a lot of failures that stringed along in Alzheimer's. And that's when, like I said before a couple of those big pharma exited the industry and R&D sort of dried up. You can see that reflected in the stock chart in the 2017, 2018 timeframe when it went down maybe 75% from highs. But right now Alzheimer's is in a very, very positive place for R&D. So these are blockbuster drugs that are going to come out, but they're blockbuster because they're the first treatments, the first disease modifying treatments ever for Alzheimer's.

That's why they're Blockbuster because they're the only things on the market in terms of their effectiveness. They're really not that effective. The effectiveness is like, is is very marginal at best. And it's something that you may or may not even notice in daily life. That opens but again, the fact that they have found stuff that can be successful opens up the door to additional treatments here. Alzheimer's is, before these recent approvals happened, Alzheimer's was the largest untreatable killer in the world. And today it's still a top five disease state or something like that, that's now just suddenly been understood to the slightest bit that big pharma can now justify investing in additional R&D for that. If you look at companies like Eli Lilly and Merck, like 300, 200, 300 billion market cap companies, there's only a couple of disease states that can move the needle for them and Alzheimer's is one of them. And Alzheimer's now been figured out, which I think could open up the room for a lot of R&D growth. I don't think that R&D stops after this. If you look at large cap analysts are saying that Alzheimer's R&D is going to two to three x over the coming years after these approvals and the FDA pathway has opened to approve these drugs. And Alzheimer scientists have said, all of the stuff that has recently happened is going to quote, open the floodgates to additional R&D going forward. So I think if anything, this is the start of the tail end rather than the end of it for Alzheimer's.

Andrew: No that's one of the two points I was trying to drive there. A, like this is the first line and you know, it's generally not the first drugs. Like you're going to have so many improvements. There's going to be so many follow on trials. Like I don't think it's like, "Hey, we get two big blockbusters over the next five years and then research done." Like I think you're going to get that. But then the other point I was trying to maybe get at, and you can correct me if I'm wrong, but I think even once these drugs are approved, because it's Alzheimer's, because it's such a big market, I think there's lots of post-trial research that gets done and CogState will still be having as they continue to check up on the people are on there every month, every quarter, every six months to see how their mental acuity is doing. CogState still benefits from the, that type of post-trial research check up, all of that.

Michael: Yes, absolutely. So there's two points. So one thing just on the previous point of additional R&D that I mention. You're totally right on thereal world studies and the post-approval studies that are going to go down. But the other thing with Alzheimer's R&D is that these drugs that were recently approved were just based on the same mechanism of action, which was clearing these amyloid plaques in the brain that build up when you get Alzheimer's. There are dozens of other potential mechanisms as action to treat or potentially even cure or prevent Alzheimer's. And that stuff is all in the works as well. So just because this one mechanism of action has had some success, it doesn't mean that suddenly there's no way for a small cap pharma to budget their way into the market.

There are dozens of other things that they could do to create better versions of this one mechanism of action to clear the plaques. So to clear them better or to get rid of or to benefit a whole host of other things in the brain better are associated with Alzheimer's. And what you said about, the real world studies is absolutely correct. So I mentioned before that Eisai has given CogState a 50 million license to license their test and push it out direct to consumer to screen patients for Alzheimer's. That's sort of Eisai just wanting to have something out there. So right now, Alzheimer's is really underdiagnosed and obviously Eisai, who owns the leading Alzheimer's drug right now, Lecanemab really wants to push out CogState tests to increase diagnosis of Alzheimer's so that more patients go on their drug. It's like they pay $10 for a test, they get $20,000 for by selling their drug. It's a great deal for them.

So that is something that really benefits from more drugs on the market because then there's more demand for a screening test for Alzheimer's. And that would be CogState, is really, I think, the only player that has a large financial backer pushing them out into the market. And there's also potentially a lot more phase four and late stage trials with these drugs that are getting approved. So the two latest stage drugs in Alzheimer's right now are Lecanemab, which is owned by Eisai, which is owned by Eli Lilly. And once these drugs are approved, there's a lot of stuff that you can do with them. First of all, there's a lot of stuff that you have to study about them. Like, what's the main maintenance dosing regimen that you have to do? Can you give them in different delivery formats so that, you know, everybody's trying to work to get their drugs into a subcutaneous delivery format, which is so that the patients can inject themselves instead of having to go to the facility multiple times over a year. So there's all all these different tests that they can run. They have to run confirmatory studies to sort of prove out that their test works in the real world. Right now one thing that's driving that is that CMS has not fully reimbursed these drugs right now. The CMS has so like Medicare has a ruling in place that says that once these drugs get traditional approval, they get it's what's called coverage under evidence development. And what the evidence development right now is that they have to enroll.

Everybody that takes the drug has to enrol in a registry to monitor their cognition and to monitor safety changes as they're taking the drug. So Eisai is sort of incentivized to get rid of that thing. So that it just makes it a lot easier for patients to get the drug. And in order to do that, they'll probably have to run a confirmatory TR trial and Lilly will probably have to run a confirmatory trial as well to just prove out once and for all that their drug actually works. Cuz right now there's still a lot of suspicion in the industry. Like it's not consensus that these drugs actually work that great or that this mechanism of action works. So there's a lot of stuff that they still have to do just to prove the validity of these existing drugs and let alone doing additional R&D to find new drugs and new indications and all that there new mechanisms action and all that.

Andrew: Perfect. So at this point, hopefully people understand what the company is, I'd say kind of mode, why it's pretty modey very nice growth trajectory in the near medium and long term. Let's quickly talk valuation and then we'll split flip over to that special situation that I think Scott, me excited you excited. A lot of people on Twitter are pretty excited based on my DMs. Let's just start valuation. So as we're talking, I'm looking at the US ticker again, that's COGZF trading for a dollar per share, right? Add a dollar per share. You can correct any of my numbers if they're wrong, but I've got the market cap around 175 million. The enterprise value just under 150 million. So I'll just flip it over to you disagree with any numbers if I threw them out incorrectly? Very possible I did. And then let's just talk EV to sales, EV to earnings, all that type of stuff.

Michael: Yes. So yes, I'd say, the EV is something like 141, 150 million US right now, the US symbol is currently trading at a premium to the Australian symbol. Cause I think there's demand in the US to buying the stock more than Australia, at least.

Andrew: if you want to buy in Australia, you've gotta wake up at some pretty weird hours. It's difficult. You've gotta find an Australian broker to go trade it for you. It's hard to buy stuff over in Australia.

Michael: Yes. So but going to valuation, I think looking at right now the company is in a weird state to be valued because they had a strong profitable year last year where they were trading at a reasonable earnings multiple. And this year there are some revenue and bookings delays that have occurred that have sort of pushed out certain revenue recognition of certain high margin revenue into the next fiscal year, which, you know, their fiscal year ends June. Cause half two of two of calendar 2023. So stuff is pushed out like six months right now. So I don't think it's appropriate to look at the company on an earnings multiple right now. I think it's better, there are better ways to look at this business. the first thing I would say is that they have about 40 to 45 million in the clinical trials revenue.

So they're at about three times sales in that sense. And they also report bookings. So that's by far the most leading indicator of this business. And they're trailing bookings as something like 60 million and I think they can do 80 million this year. So they're at about two to 2.5 times bookings. And these are by far on the low end of where the company has traded in the last few years, the company has historically always traded at around two to four times bookings. And right now, like I said, they're around two to 2.5 times bookings. So they're at the low end of a historical valuation even though they're at by far the high end of potential future prospects for growth.

There are a few comps out there. Like I said, the second largest computerized cognitive test player is actually public. It's called Cambridge Cognition listed in London and Cambridge currently trades out basically the same valuation as CogState, about 2.5 times sales and about 2.5 times bookings. And it's the same thing as CogState, even though Cambridge is one fifth of the size, far less at scale and with far less of exposure to Alzheimer's, which is the big sort of money maker in this industry is going to see over the next few years. So I don't think that stock is particularly expensive here. The company has sort of a demonstrated ability to get to 20 to 25% ebita margins at scale, which is what they did last year. And they filled their long-term guidance for bottom line margins. So three times sales for 20% ebita margins at scale is not that commanding of evaluation, especially for a business that could hopefully grow sales at 20 to 30 to 40% over the next couple of years per year. So I think the valuation is very cheap. It's on the low end of where the company has always historically traded. And this is a very funny contrast to the very high growth prospects that the company has over the next couple of years.

Andrew: So I don't disagree with any of that, but let, let me just push back on a few things cause I think it'll be helpful for people thinking through like, like you've been following this for years. I've been following it for a week but I read the H1 their most recent earnings call, which they did at the end of February or early March, and they come out and they say, look, you can't comp this year's results to last year. It's because we signed the largest contract in our history last year. So the results are all funky you can't comp that. What you can do is maybe comp this year to two years prior and they'll give you kind of an apples apple performance and they say, Hey, we're up 10% versus kind of the comparable period in 2021.

If you look forward, I think they were saying look at where our contracts for FY 24 are today versus where our contracts for this year were a year ago. And they said, "Hey, that's about 20% growth, right?" So I say, "Okay, you're kind of trading at 10 to 20% growth as you said, like two x sale, if you think they can get margins back up to around 20%, that's going to be around 10 to 12 times ebitda. Like yes, that sounds pretty attractive, but it doesn't sound like hit you over the head cheap. So I think that would just be, I look at it and say, Oh, 10% o for two years, like it just doesn't sound that growthy that cheap I think would be the pushback."

Michael: Yes, I don't think because revenue recognition is just like very lumpy and based on when certain contracts get recruited and all that. The leading indicator is definitely bookings. And you can see that bookings now are 60 to 80 million per year in any trailing month, 12 month period that you want to look at. And if you book 60 to 80 million in bookings every year for a couple of years, you're going to be recognizing 60 to 80 million in revenues per year in a couple of years. And I think that's where the company is headed in the long term trajectory. The near term is going to be lumpy based on how they get there, but no matter what those bookings are going to be recognized as revenues. And I think there you see a clear path to continued growth getting to 60 to 80 to a 100 million in bookings.

And the thing is like there's, there's a lot of delays hitting the company right now. They talk about the main trial getting delayed, but I think there is also another trial, two large, two other actually large trials that were supposed to be started by Eli Lilly late last year that has now been pushed to maybe a couple months out later this year. So that those two trials also are impacting the company. I think that's what when they talk about their maintaining staffing levels to service contracts that they have coming up in the pipeline, I think those trials are what they're talking about. So to clarify all this, there's Eli Lilly has this next generation drug called Remternetug that's just a better version of Donanemab that they're working on doing trials for. And those trials based on stuff on the internet we're supposed to hit in late calendar 2022. And now I think they're expected to be booked somewhere around mid calendar 2023.

So those trials were supposed to contribute to this year's results as well, but they got delayed. I think all of these delays are related to CogState has said Lilly's Tau testing Partner Tau is another thing in the brain that builds up when you get Alzheimer's. Lilly's Tau testing partner has had a couple of delays doing their one big trial, which is the big trial, 30 million contract that CogState had booked. And I think that's also affecting this next trial that's doing, Lilly just is doing this sort of innovative trial design where they try to stratify patients by tau loads. So they only enroll patients in the trial that have intermediate tau loads, which is just like a theory that they have that this will make them a better trial. But it also means that this is like a new approach and so I guess there are delays that are associated with that, but I think they'll be cleared up in the long run.

Andrew: Well, speaking of delay, I think we've covered what the business is. We've talked a little bit about valuation. I think a very simple way to look at it is, as you said, they should be run rating 60 to 80 million in bookings. Eventually that'll be revenue, 20% margins. That gets you to call it 15 million in ebitda. You're at under 150 million in EB. So less than 10 times kind of the run rate go forward ebitda that might take a year to get there, but that's that. And there should be growth.

Let's talk about in February, big news, right? The stock is trading over $2 per share. I think that's actually Australian line, not US line, but it's trading over $2 per share and all of a sudden the stock just plummets and then a couple days later they come out. I'll pause there, what happens? Cause stock to plummet. What's the big [inaudible]?

Michael: Yes, so before the stock plummeted, it ran from two to about 240 on record volume. The largest volume to the company has seen, I think in its lifetime of existence. And nobody really knew what was going on. And then suddenly on February 18th the stock goes down 10, 20%. Next day it goes down 10, 20% and it just keeps going down until one 60, until it's halted. And then once it's un halted, it opens at like 1.20 or 1.30 and the stock is now down 50% in a matter of days when nobody really knows what happened and the company puts out a release which says that, what was going on was earlier in the year they were in discussions to be acquired and on February 18th those discussions ceased.

They didn't give many details. Later in the call they said that the talks fell, fell apart due to price disagreements on price, the price that the acquisition would go through. But in any sense that information clearly leaked and not to the general public. So there was somebody buying the stock in anticipation of a buyout that didn't happen that then likely when the buyout didn't happen, they likely turned into a fort seller and now have tanked stock about, like I said, 40 to 50% from highs at the trough and now it's down maybe 30 to 40% from highs.

Andrew: Was there something too, I feel like they said, Hey, and I think it were made related to this Lilly deferrals that you talked about. They said, "Hey, one of the reasons the buyer might have boxed, it wasn't just price but we had these revenue deferrals and the buyer was like, I don't know, and just kind of walk." Do I remember that correctly or was I misreading that?

Michael: I don't think the company has officially said that. Those are the reasons. That's investors putting two and two together. Because at the same time that they said that the acquisition talks at the same time that they gave all this detail, they also pre-announced half one result and half two guidance, which talked about those delays. And that's what investors look at to say, "Oh, the stock's down 40%. Look at all this bad fundamental news that has happened." To be honest, the delays really don't impact anything at all because it's just like revenue. Like I said, it's because of particular things that, that are going on with these big trials that really is doing and it's only moving, revenue a little bit from one quarter to the next. So it's really not that big of a deal. But investors want to, I think see something of a fundamental justification for the move there.

Andrew: That's reassuring. Cuz there is a difference between if a buyer walks and if a buyer, like if you have revenue delays and a buyer walks, right? Because revenue delays and a buyer like, "Hey, what is that? Is the buyer just that hold footed or is there something else going on where buyer walk on price like that happens all the time." And I do think there's a quote from the H1 23 call, they said we'll be unapologetic about seeking to maximize returns for our shareholders. If that means selling the business at some point we'll consider that. Like I think they're pretty shareholder aligned and they were just like, "Hey, outlook for the business is bright, we're going to need top dollar if we're going to sell this company."

Michael: Yes, no management here is very good. They're rock solid. I mean, management has backstop. Every single fundraising that the company has done since it's inception in 2002, the chairman Martin Meyer owns I think 20% or something like that. Brad O'Connor, the CEO who I know well owns 5%. They also recently bought stock when the stock dipped after this, all this stuff was announced, Brad bought a 100,000 of stock, Martin bought 75,000 of stock, the company implemented a 13 million buyback. These are all things that have not happened in a long time. Brad and Martin haven't bought stock since the company's rights offering the last capital raise in 2019 at 26 cents. And that was the last time they bought stock. And that turned out to be a very fortuitous time by stock, as you can imagine. Cause now the stock is 1.50 and it went to a high of 2.40.

So they're, they're smart, they're conservative and I think they're, they're sort of rational in this game. They know that the longer they wait, the more business that they get in Alzheimer's, the more some of these approvals come through and people actually see what's going to happen in Alzheimer's R&D, the more they're going to be a desirable asset. And CogState right now is a very desirable asset for almost every single CRO or channel partner out there because everybody in the space knows what's coming to Alzheimer's R&D and the biggest channel part that they have, which is Clario which has done work on 75% of all FDA approved drugs over the last few years. Clario doesn't have a big CNS arm, so like central nervous system. So they've said publicly, they're very focused on getting into Alzheimer's and getting into getting into CNS diseases. And CogState is sort of, they have a partnership with CogState and that's their way of getting into this industry. And that's the case for a lot of companies. CogState has brought a lot of their channel partners, a lot of business in Alzheimer's, and so they're a very desirable asset to get a foothold into this industry.

Andrew: So I want to talk about the potential acquires in second, but as you just, you jumped me, I was going to say like, look, the share price came down, caught 50%, and then you had multiple insiders buy the stock of the open market and the company announced that they were doing I think their first share buyback ever. And that was set to start, I think they said on the call they announced it into February, but I think they said Australian approval said they couldn't start the buyback till March 20th, but stock down 50% insider buys plus repurchases. You'd love to see it, right? You'd love to see it. But I was talking to someone today about, there was a company that had a short report come out, right? And the short report came out, the stock was down, call it 20%, and the next day the CEO filed a form four that said he bought the stock when it was down 20% and he filed it during market hours and me and him were talking and he was like, don't you think that's weird?

Like the CEO filed it during market hours instead of waiting as long as possible to file the form for like was he actually buying stock or was because he saw value or was he just trying to like signal to the market that hey, this short report is wrong. And he was like doing more, I don't want to say market manipulation, but signaling then actually like trying to take advantage. And I hate to read too much into it, but you do wonder like yes, they, they bought some stock but it wasn't like a wild, wild amount of stock. Do you think there's anything to, Hey, this was more than signaling than actually like really taking advantage of the stock down because I'll just throw one more thing out while I'm rambling. Like yes, the stock came down a lot, but if you look, the stock is back to levels, it was maybe six months ago, right? And you didn't see the urgency for them to insider buy or buy stock six months ago. So what's the difference today versus just a few months ago?

Michael: So six months ago there was significant uncertainty because the the phase three readout for Lecanemab was coming out at the end of September. And most analysts were at a below 50% probability that that drug would be successful, which meant that that would sort of derail CogState's plans in their partnership with Eisai as well as sort of cast out from the rest of the industry and for the rest of big pharma on the fact that these drugs would be successful. So Lecanemab read out at the end of September very positively, and that sort of caused one of the spikes that you can see at the end of September in CogState stock. And that has sort of catalyzed all of these other like cascading effects that I had talked about in Alzheimer's R&D that have happened over the past couple of months to increase R&D going forward and to sort of of increase the long term growth trajectory of CogState in terms of the insider motivations, I really can't speak to it.

I know that Brad, we've talked to Brad for years. He's a very conservative player. He doesn't like to part with money very easily and I think that he bought the stock because he thinks it's cheap and he said he thinks the stock is cheap. I mean, they've all said that, so, it remains to be seat, I don't think they filed it immediately after they bought as well. I think they waited a couple of days too, so.

Andrew: No, no, I was just.

Michael: [crosstalk] in a rush.

Andrew: I was just relating that other anecdote to, it's so funny you see insider buying and suspicious investors, the first thing is like, is this a red flag over a green flag? You're like, no, it's probably pretty good. But that commentary in September is great because I saw the share price and I went and looked through the old news filings and they said, "Hey, we've had nothing. We don't, there's no like, inside information that's causing the spike." But I did kind of wonder in my head, "Oh, if there was clearly a leaky process this time where the stock went off and then went down before people knew about the buyout." I was wondering if there was like some type of leak in September. I didn't realize it was like, just fundamental news that impact, I didn't put two and two together was just fundamental news that impacted the whole industry that sent it up then. And that does make a value say should be higher than value six months ago because the industry is in a much better spot.

Michael: Yes, absolutely. I mean that approval really a lot of the company's value was contingent on that approval.

Andrew: Was, question and then we can kind of wrap it up or talk about anything else you want to I don't believe the company has disclosed who the buyer was, but as you said, CogState is in a unique position with a kind of unique asset. They bring a lot of business to their partners, do you think if they have hung up the first sale side, because in my experience, once a company engages in Sirius stocks with one company, even if that follows through, like other people kind of know, "Oh, they are for sale, they're open to the right price." Like who do you think the other buyers were? Who do you think might look to take this out?

Michael: So I think the company said that the buyer was a strategic player in the industry.

Andrew: Yes.

Michael: And it's always sort of been suspected that the company's channel partners would eventually take them out. The CogState has a couple of big channel partners, Brad said on the last call, they have about three big ones. I think the known ones are Clario and Clinical Inc. Are their two major channel partners. So it was likely one of them. And to speak to your point, I think before, like just in terms of why the buyer potentially wants, both Clario and Clinical Inc are owned by private equity. So if they were to acquire CogState, it would be the private equity buying CogState. And I think private equity is more motivated than most for in terms of like bottom line and getting an IRR and all that instead of like, and just long-term strategic vision. So it's possible that also played into it when they saw the revenue deferrals and they saw the sort of lack of profit that would come in the next six to 12 months after they bought this thing.

They said, let's just hold off on it. Maybe the investment committees didn't agree to it or something like that. But I think it's most likely that it was Clario or Clinical Inc. And one of CogState's main channel partners that bought that offered to acquire them. And I think that going forward it's highly likely that one of their channel partners, not necessarily the same one, but one of the other ones, would go and acquire them as well. Because like I said, everybody wants to play in this industry. Clario and Clinical Inc have already made a couple of acquisitions themselves into the CMS and Alzheimer's space. So CogState is just the most logical addition to, for these companies to sort of step up to the next level and become a real player in the Alzheimer's industry in ahead of the upcoming tailwind.

Andrew: Perfect. Perfect. Let's see. Anything else I wanted to talk about? No, look, I think we've covered just about everything I wanted to cover on the call. Is there anything you think we didn't hit hard enough that we should have hit harder or maybe something we didn't talk about that you think investors should kind of be thinking about?

Michael: Yes. I'm looking through my notes as well. I don't think so. I think, okay, so one other thing on the buyout that I think might be relevant is that there were a couple of buyouts that didn't pan out in the last 12 to 24 months in the Australian space. So with EML Payments and Appin, both of those companies were in talks to be acquired that eventually fizzled out. And both of those stocks are now down about 75% plus from when those buyout talks happened. I think there is a lingering sort of just like bad taste in a lot of Australian investors mouths after seeing those deals happen. And that sort of might be contributing to the oversized reaction to the CogState stack here as well from this buyout talk not happening. But again, it's all speculation as to what can happen.

We're still pretty confident that CogState is a very high quality long-term business. That's why we're doing this. That's why I love to talk about this space. And if you have conviction is a very good time to buy into this company that's the most, I think for any medical company to play the Alzheimer's space in a sort of agnostic way where they benefit as long as there's any progress in the space whatsoever. And they're profitable, growing with strong management, good ownership, and everything you can ask for at a valuation that's really un demanding. And that I think could create very good returns going forward.

Andrew: Fantastic. And look, I kind of was addressing it as the red flag, but you'd love to see like the companies performing well, it seems to be on an inflection point. You talked about it, I think on their earnings call. The direct was we've seen a huge increase in opportunity over the medium to long term in the marketplace. Short term might be rocky, but huge increase in opportunity. And you love to see, right, when the stock gets weak, management buys the company goes to take advantage of the cash to buy back shares and increase shareholder value. They say, we're going to be unapologetic about seeking to maximize returns for shareholders. Like that's the type of stuff you love to see as an investor. Yes, I guess we'll wrap it up there. Michael, I think I'm going to see you end of April, Planet Microcap. I think we might be doing another podcast or a panel or something there. So I'm looking forward to that. People can catch us there, but aside from that, I'll tag you on Twitter. I'll remind everybody [inaudible] stock microcap.

Michael: It has.

Andrew: You guys have a position in it. I've got a little total position, but anything else we should talk about before we wrap up?

Michael: I don't think so. Yes, I think that was great conversation.

Andrew: Great. Hey, I really enjoyed it. I know you've done your work on it. I'm really impressed you managed to pull all the drugs and all the different companies off the top of your head because these drugs, I mean, once you get over four syllables, it's tough to remember all of these different drugs.

Michael: Yes, Alzheimer's is a fascinating space in general. There's just so much going on. It's fun to just track for the hell of it, but that's just me being weird.

Andrew: Michael, this has been great. Looking forward to talking to you soon.

Michael: Sounds good. You too. Thanks.

[END]

Interesting company. Top line growing at about 11% per annum on average over the past decade. Gross margins stable and strong at about 50% and operating margins have grown a great deal (not sure that they have much further to go). the combination of strong top line growth, margin growth and multiple expansion have driven shareholder returns over the past 5 years.

There are two problems.

First, the multiples have expanded too far. With adjusted economic earnings margins (free cash flow variant) in high single digits, this is a company that can't justify trading a much more than parity against sales. But it trades at 6.4x top line currently. Even if the top line doubles in the next year or two, the price is still too high and a 3.2x multiple still impossible to defend. The price has run too far ahead of the fundamentals. Multiple contraction is highly likely and that would bite hard.

Second, dilution is a problem. Over the past 5 years shareholders have been diluted 35% (9% CAGR) due to an expansion in equity outstanding. This isn't a new phenomenon. Over the past 11 years shareholders have been diluted 61.6% (9.1% annually).

This appears to be largely due to stock based compensation which was 1.73% of revenue in 2021, rising to 2.5% a year later and on a LTM basis has risen to 5.07%.

This appears to be a company run for the benefit of insiders at the expense of shareholders.

The stock buy-back that has recently been announced doesn't even offset the dilution of recent years. Shareholder equity is leaking out the back door and although the share price will be artificially driven higher, at least in the short term, by creating artificial market demand via a buy back program, the shareholders continue to be diluted by over 9% per year. For a shareholder it is like taking two steps backwards for every one step forward.

This is definitely not one for me. The risk skew is heavily weighted to the downside.

There are way better opportunities out there IMHO.