One thing I’m going to start doing monthly is a simple tweet asking for people’s favorite event driven idea. I’ll likely look at all of the ideas; I’ll take the idea that seems the most popular or most interesting and do a quick write up on it (perhaps after I buy it if I particularly like the idea!).

Anyway, for the inaugural post in this series, there was really only one stock / situation I could pick: the Liberty Sirius (LSXMK) “arb” with SiriusXM (SIRI). It was, by far, the most popular response to that tweet, and it’s also probably the arb I get the most inbounds on currently.

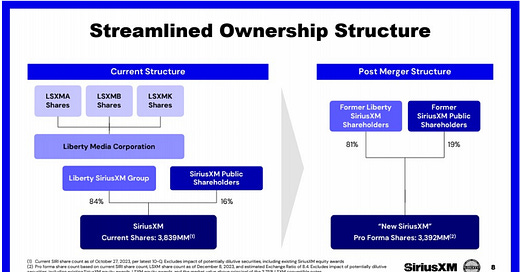

The situation and set up is simple. LSXMK owns ~84% of SIRI. For years, LSXMK has traded at a discount to the publicly traded share price of SIRI. In December, LSXMK and SIRI announced a merger where LSXMK will “collapse” into SIRI.

The deal is structured at NAV, so effectively LSXMK shareholders will get one SIRI share for each share of SIRI LSXMK owns (net of LSXMK liabilities). This works out to ~8.4 SIRI shares for every LSXMK share outstanding.

SIRI is a publicly traded stock, and the stock price currently hovers just below $5/share. That would come out to ~$41/LSXMK share, yet LSXMK is currently trading for ~$30/share.

So the most frequent question I get about LSXMK is “what gives? Isn’t this an opportunity? And not just an opportunity, but a 34% spread that will close inside of six months seems like the opportunity of a lifetime!”

It might be an opportunity…. but I don’t think it’s an arbitrage opportunity, and I certainly don’t think it’s the opportunity of a lifetime.

If you think SIRI is fundamentally cheap at the price you’re buying it through LSXMK, then yes… the current price is an opportunity. And you’d be in good company if you believed that; Berkshire Hathaway has been aggressively buying LSXMK stock (almost $300m so far this year).

So, on a fundamental basis, the LSXMK “discount” might be an opportunity. But I do not think this is an arbitrage opportunity.

An LSXMK / SIRI arb is simple in theory: go long LSXMK, short SIRI, and wait for the deal to close and the discount to collapse, thus collecting the ~40% spread “risk free” (arbitrage, shorting, and hedging are risky, please remember that and consult our legal disclaimer!).

I think ten years ago I would have looked at that spread and thought “opportunity.” It takes a certain combination of arrogance and naivety (which I definitely had ten years ago, and maybe still do today despite having a decent bit beat out of me!) to look at something so obvious and liquid and think “o yeah, the market is missing this easy near perfect super liquid arb. Definite alpha!”

When you’ve been doing this long enough, you realize markets are never that easy. Particularly large cap near perfect arbitrages (which a SIRI / LSXMK trade with a definitive merger / exchange agreement is; there’s no regulatory risk, no financing risk, the assets match each other perfectly, etc.) are never going to be that simple for that large a return.

So what’s the catch?

SIRI has very little publicly traded float, and what is floating is largely short as people play the arb. Given the high short interest, the borrow costs on the stock are wild, and the stock is prone for short squeezes. SIRI has already had one big short squeeze (and several mini-ones) in the past year. Bloomberg has a squeeze estimator (the “S3 Squeeze” in the chart below) that rates stocks on likelyhood of squeeze potential on a scale of 1-100 (with 100 being the most likely to get squeezed); I’ll give you one guess to where SIRI currently scores (spoiler alert: it’s 100).

The huge spread between SIRI and LSXMK reflects the simple fact that the cost of carrying this trade is going to be huge given the large borrowing costs, and there’s every chance SIRI stock gets squeezed between now and closing (which would increase your borrowing costs and could result in margin issues).

If you think SIRI is a fundamental value, then buying LSXMK is an obvious choice over SIRI. But, IMO, there’s no (actionable) arbitrage to be had here.

One last bonus note while I’m here: I don’t think there’s an arb between SIRI and LSXMK….. but I mentioned there might be fundamental value in LSXMK / SIRI, so I guess that begs the question: do I think there’s a fundamental opportunity? Personally, my answer is no. While admitting I don’t follow the company quite as closely as I used to, I’d point you to two different things:

The bear case on SIRI, for years, has been “won’t people just listen to music on their phones.” And, for years, the ease of use of SIRI (plus the exclusives) has proved the haters wrong. My suspicion (and, again, I am not an industry expert!) is that is starting to change; the integration between phone and cars is getting really seamless (whenever I rent a car, I’m impressed by how easy Apple/Spotify connect), and at some point I think the explosion of podcasts (which cuts into SIRI’s exclusives value) plus that ease of integration starts to finally chip away at SIRI. We may be seeing some of that currently: self-pay subs had a minor decrease in 2023, and I believe this is the first time they’ve ever reported a decline in paying subs.

Maybe you’ll say “one year of sub losses doesn’t make a trend.” And it’s true there’s a lot of noise in SIRI’s recent numbers (in particular, SIRI adds subs through new cars, and remember we’ve had big new car shortages since COVID), so perhaps you could excuse those numbers. Perhaps. But as recently as 2021 SIRI was bragging about consistently growing subs by ~1m/year (“2021 was an outstanding year across the board. We added more than one million net new SiriusXM self-pay subscribers for the tenth time in the past 11 years; this growth continues to be sustained by a fifth straight year of improving churn.”), and I’d love to point you to the cable stocks for what happens to businesses that go from consistent growth in a monopoly market to ex-growth in an increasingly competitive market (even if you can argue for noise or some type of unique environment limiting growth).

Liberty’s history with getting out of satellite businesses doesn’t suggest SIRI has a rosy future. Liberty split out their DirecTV stake back in 2009. A few years later, AT&T bought DirecTV…. right before the business completely fell off a cliff.

If you’re going long SIRI today (either on its own or through LSXMK), I’d be looking at Liberty getting out of DirecTV just before it collapsed and wondering “man, Liberty has held this SIRI stake for a loooooong time; they could have collapsed the tracker and exited years ago. Why are they doing it now? Is there something on horizon that’s making them want to get out now?”

Now, the counter to this would be that DirecTV stock actually did quite well between Liberty exiting and T completing the acquisition, so perhaps they don’t have a perfect crystal ball or there’s lots of value to be unlocked in SIRI as the street comes to appreciate the standalone story as a fully free float company.

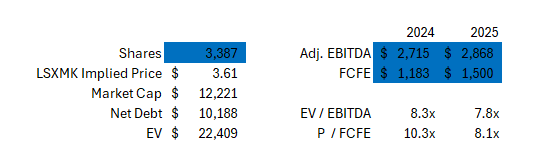

Again, I’ll note I’m no expert. Any discussion of SIRI’s fundamental value has to include something about their spectrum value (which will likely get unlocked eventually and seems primed for today’s wireless world), and the business as a whole has been proving the doubters wrong for years. Plus, it’s pretty cheap. LSXMK filed the SIRI proxy at the end of January; they included the projections for the business below.

With SIRI trading for ~$3.61/share through LSXMK, the stock is currently trading at ~8x EBITDA and maybe a 10x FCF yield (dropping to 8x in 2025, and perhaps further beyond that if you believe their current capex cycle is over…. though I’d suggest there’s always another capex cycle on the horizon when it comes to telecom in general and particularly anything that touches satellites!). Note that I’m just using their 2024E shares outstanding and debt below to properly account for the transaction (so I do give them credit for this years FCF if you’re a stickler!).

That’s pretty cheap; you could easily paint a story of “unique scaled business on the back end of a bunch of capex that’s a free cash flow monster with Berkshire buying” to talk yourself into a bull thesis here…. but I just feel like this is a terminal asset where the competitive forces have finally caught up to them, and that Liberty finally decided to exit seems to indicate to me that they see the end coming and are positioning themselves accordingly. Plus, as I’m fond of saying, you need to way the opportunity cost of anything you purchase, and while SIRI at ~8-10x free cash flow look cheap-ish, I’d suggest there are plenty of other businesses with much less terminal value risk that are trading for a similar multiple.

So LSXMK is a pass for me…. but that’s just me! If you’ve got a differentiated view of the business (like Berkshire seems to), LSXMK could very well be a screaming opportunity!

That wraps up this month’s (inaugural) special situations run down. Have an idea for next month’s? I’d love to hear it; feel free to drop a comment, hit me up on twitter, or send me an email.

PS- one interesting thing I did not mention because I don’t think it’s really part of the fundamental case but it could great some near term tailwinds: SIRI is currently ~84% owned by LSXMK. After this deal goes through, they’ll sudden be a ~$12B market cap company with 100% free float…. I would not be surprised to see them get added to a bunch of indices soon after this deal closes, which could put a little bit of a tailwind into the stock.

My 2 cents: As you mention car sales have been at historical lows and same with inventory (check FRED auto sales and Inventory/Sales ratio).

It is logical they will return to the mean. Historically, conversion rate from promotional subs was at 40% and is now at mid 30s.

If car sales increase 10% (which is what most big brand companies are estimated to grow; GM, Ford, Toyota, Hyundai, Tesla and a couple others when I did the maths with next years estimates) then 30% conversion will lead to an increase of 3% of sales (just to add context).

There will be no price increase this year and 1$/month increase next. Assuming the increase gets offset by higher streaming only subs (which would increase volume on the other hand but let’s assume only 3% increase as per the example above) then ARPU stays constant 2024 & 2025.

So sales constant or +3%. On the satellite CAPEX front it should get to 0 by 2028 so 300M run rate CAPEX (I agree on increase CAPEX later on but we should have 3-4 years of lower sat CAPEX from 2028 onwards)

2024 should be slightly less than 1200 because of transaction costs + interest expense.

With Car sales + lower CAPEX, should be at 1300M-1500M FCF for 2025-2028.

So buying Siri at around 8-9.5x FCF doesn’t seem insane, even for a 0 growth business, specially when churn is very low at 1.6-1.7%.

BTW share of ear report by Edison Research shows more modern cars (ie better phone connectivity, car play etc) have Siri increasing market share (at the same rate as Spotify) at the expense of traditional radio. So that’s a nice plus too.

Heads merger goes through and you get a nice ~40% upside to current prices. Tails merger goes through but Siri tanks to 3.6$/shr at 8-10x FCF or lowest valuation in its history and you break even, can it drop further? Sure 🤷🏻♂️ but historically it’s lowest has been x11, can it stop growing suddenly finally? Yes, guess that’s the bear thesis of the last decade.

Risks I see:

-Royalty Costs going higher (Spotify would have the same problem as far as I know so both of them would need to increase pricing)

-They start to lose subs rapidly and somehow the thesis everyone has been arguing for a decade actually starts playing out 🤷🏻♂️.

I like the bet but that’s just my two cents. Sorry for the rant!

is liberty really exiting? or are they just optimizing their ownership of siri and closing the discount? can you really argue that this optimization transaction is a signal that they believe siri is starting to melt? for the last several years the structure has been a huge impediment to creating value on the liberty side. the structure was holding back siri too, so there was likely big push back from that side of the table to get this done now.