Every month, I’ve started putting out a tweet asking what everyone’s favorite special situation is (here’s this month’s).

I can’t claim that’s a unique tweet; plenty of accounts do it. It’s pretty good engagement bait!

And I don’t want you to think that this blog (or my twitter account!) are all about engagement bait, so here’s the two point tl;dr if you don’t want to read this (very long) article in its entirety:

Check our disclaimers and remember nothing on here is investing advice / do your own work

ADTH is currently running a go-shop, and I think ADTH has a very good chance of attracting an overbid. With the stock trading right around deal terms, the market is giving you a “free roll” at current prices (but, again, check our disclaimers; investing is risky, and I use the term free roll in its poker terminology)

Anyway, monthly tweets asking for special sits can quickly become engagement bait, but where I like to think I add value is I actually read and look at every response to those tweets, and if I see one that’s particularly interesting I’ll do write ups / provide feedback. So, for example, in February, the most popular response was the LSXMK / SIRI arb, and I wrote up my thoughts on it (spoiler: I wasn’t a big fan). That spread has played out about as I thought: it’s closed as SIRI has massively collapsed towards the LSXMK price. If you had that spread on, you probably made a little money…. but a lot less that you’d guess from looking at that chart given the small float and huge borrow costs at SIRI.

Honestly, the LSXMK / SIRI trade today might be more interesting as a fundamental long. Berkshire has scooped up almost $1B of LSXMK on the open market since the beginning of the year; SIRI’s market cap is <$15B, and it’s going to get added to a ton of indices once this deal goes through and the full company is free floating. The shares are going to be a little tight given Berkshire’s ownership…. put the two together, and I’d guess you get a little buying tailwind through the rest of the year. And, while I have serious questions about the sustainability of the business, it is optically quite cheap at these levels.

Look into past write ups over, I wanted to do a (not-so) quick post on the idea that I thought was most interesting from this month’s tweets, because it doubles as perhaps the best merger arb situation I’ve seen this year: AdTheorent (ADTH).

The basics

A quick overview: on April 1, ADTH announced a merger to be acquired for $3.21/share. The merger PR noted the price represented “a 17% premium to the 60-day volume weighted average stock price as of March 28, 2024 and a 27% premium to the 90-day volume weighted average stock price as of March 28, 2024.”

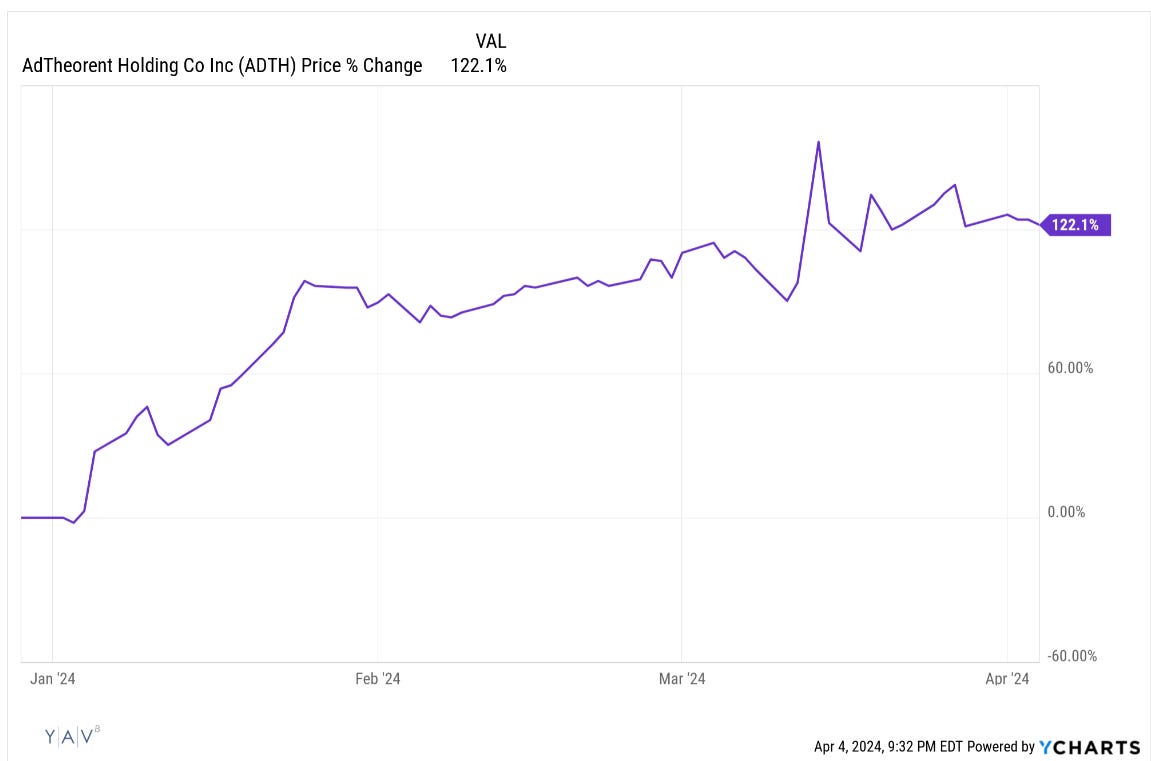

Despite that alleged premium, you could forgive ADTH shareholders for attributing the press release as some type of April Fools’ joke. You see, ADTH’s stock has been a rocket ship so far this year:

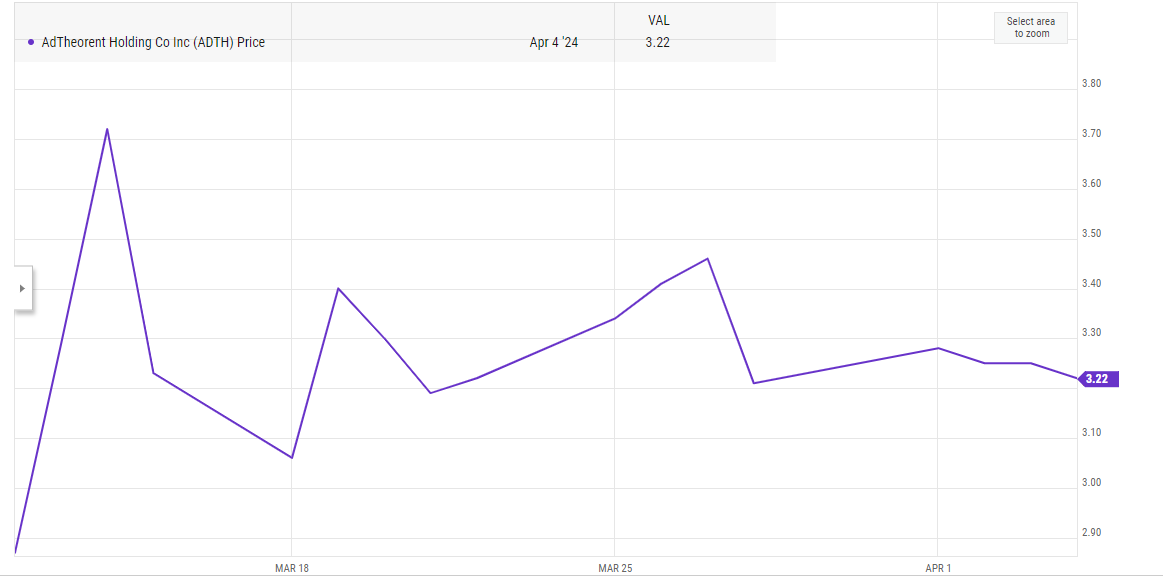

Given how much the stock is up, a big premium to the 90-day trading price results in a small premium to the most recent closing prices (there’s a reason ADTH mention 60 and 90 premium and not 30 day!). In fact, ADTH posted solid Q4 earnings and guidance on March 12, and since then ADTH had consistently traded for at or above the $3.21/share takeout price (see graph below). So while the company tried to paint this deal as at a solid premium, shareholders likely looked at this as a no-premium deal (or even a take under) given the recent share price.

However, ADTH shareholders have one saving grace: the deal includes a “go-shop” where ADTH can solicit better offers until May 4.

So the thesis here is simple: ADTH is currently trading right around the deal price (as I write this, it’s trading a penny or two below $3.21/share). Buyers can “free roll” a look at a bumped bid; if you get a bump, then you’ll make a huge profit; if you don’t get a bump, then the deal closes on terms and you basically breakeven (I note that all investing involves risk; nothing is truly free. The inevitable heat death of the universe stalks us all. Check out our legal disclaimer for more).

But the “free roll” here could be even better than that. In merger arbitrage, you generally run your downside to where a deal would trade if the merger fell through for some reason. In the absence of other information, you generally assume that the stock would trade to where it was trading before the deal. Because this was a no premium merger, ADTH actually offers two different barriers / margins of safety on the downside: if we don’t get a bump, the deal almost certainly closes on terms…. and, even if it doesn’t, there’s probably not much fundamental downside to the company as a standalone stock given there’s no merger premium baked in here!!!… though I would caveat that deals generally, but not always, break because of some unexpected operational disaster at the target, so while in theory there should be no downside in a fundamental break, in practice a break probably comes alongside some awful fundamental news that changes the downside materially.

Adding a little spice to the set up

So we could stop there and ADTH would be pretty interesting. Most go-shops expire without an improved offer (here’s an article that suggests ~10% of go-shops result in an improved bid, which feels directionally correct to me. Here’s an Harvard Law study that suggests the success rate has declined a bit in the modern era to the high single digits), but most is not all, and an improved bid can carry a large premium. For example, earlier this year, Thoma Bravo increased their bid for EVBG by ~22% after the go-shop yielded a competitive process. A “free look” at ADTH’s go-shop certainly has some value to it.

I would argue that ADTH’s go-shop is much more likely than the average go-shop to result in an improved bid, and a potential improved bid could carry a large premium to the initial deal price. I’d point to several reasons why:

ADTH got taken over for no-premium. Many acquirers anchor on stock prices when deciding how much of a premium to pay for a company; in this case, an acquirer doesn’t need to say “if we beat the current deal by 10%, and that deal was at a 30% premium to the prior market price, we’re paying a premium on a premium!” The no-premium deal means topping bids can be made without that double premium.

ADTH is getting acquired cheaply. The press release calls this out as a $324m deal, and that is technically true as it’s ADTH’s market cap at the deal price. However, the screenshot below is ADTH’s balance sheet. Note that they have no debt (in fact, they barely have any liabilities!) and $70m in cash. In addition, notice that their accounts receivable has ballooned up by $15m YoY in 2023; if you listen to their earnings call, ADTH suggests that ballooning was related to timing issues and will unwind in Q1 (in fact, they’ve probably already unwound!). So, while ADTH’s market cap is ~$321m, I think it would be fair to knock off $70m (for their net cash) or $85m (net cash adjusted for excess receivables winding down) to get to the EV their acquirer is buying (let’s call it $250m for the rest of this article to make a nice, clean number).

So ADTH’s EV is ~$250m. In 2023, they did $111m in adjusted gross profit and $22m in Adjusted EBITDA. Their 2024 guidance called for $125m in adjusted gross profit and ~$28m in adjusted EBITDA. So the acquisition is happening at ~2x adjusted gross profit and 8-10x EBTIDA (depending on which number you want to use). This is a reasonably capital light business (capitalized software + capex runs ~$5m/year), so that EBITDA number tracks well to cash flow as well (there is some stock comp in there, but I’d think a lot of that comes out as synergy, as I’ll discuss in the next segment).

Getting spicier

But things get even more interesting as we keep pulling back the hood. Consider a few things that have to be going through any buyer’s head:

G&A at ADTH was ~$18m in 2023. A ton of that G&A will be an easy synergy for the buyer; for example, in 2022, the board made >$1m, the audit cost ~$870k, and the CEO made $3.6m while the CRO and CFO each made ~$1m (I used 2022 numbers because the 2023 proxy hasn’t been field yet). In addition, public company costs generally run $1-3m/year (directors insurance, shareholder resources, etc.). Add it up, and that’s ~$10m in costs that should all largely disappear once ADTH gets absorbed into a larger organization. Against a $250m EV, that’s a lot of cost synergy!

On top of those potential cost synergies, ADTH has a really rich customer roster (see below; from Q3’23 earnings). A buyer could envision some sales synergies from taking over ADTH’s client roster.

ADTH has ~300 employees (301, as of the 10-K). ADTH’s core business is using machine learning and AI to power their DSP, so a lot of their workforce is machine learning / AI engineers. That’s a very in demand workforce…. an acquirer might place some value just on grabbing ADTH’s workforce.

Toss it all together, and ADTH is selling themselves for a cheap headline multiple…. but I think once you consider all the other goodies, you could say ADTH’s value to a buyer is even cheaper than the headline number. For example, if you assume $10m of all-in synergies, then ADTH’s “buyer EBITDA” goes up to ~$38m and at the current deal price ADTH is selling for <7x buyer EBITDA.

That low-ish multiple would leave a lot of room for a topping bid, and perhaps one at a big premium. Slap a ~10x multiple on $38m in EBITDA, and you could justify a bid approaching $5/share. I realize that sounds crazy against a current deal priced at $3.21, but that’s the math… and, I’d note that this was a no-premium deal. A 30% premium to the closing share price would have gotten you in to the low $4s, so you could look at that math and say we’re just justifying / backing up what the company would have sold for with a normal premium.

And it’s worth noting: I haven’t really mentioned ADTH’s business, but they are a demand side platform (DSP) powered by machine-learning. DSPs are a very acquisitive group precisely because the synergy math I laid out above (on both the cost and revenue / customer side, as well as just the flywheel of getting bigger) work very well.

Turning the dial to “Shut-the-cluck up” spicy

At this point, I’m hoping to have relayed a few things: that ADTH is getting taken over on the cheap, that this is an acquisitive industry, that a buyer could see a lot of synergies in a merger, and that investors at current prices are free-rolling an improved or competitive bid.

But here’s the thing that really stuck out to me about this merger offer and that I think indicates how likely we are to see a competitive process / a successful bid:

ADTH’s go-shop runs for 33 days.

As soon as I saw that line, I knew something was strange…. but it gets even weirder. The go-shop ends at 11:59 ET on May 4. May 4 is a Saturday… now, I love Cinco de Mayo as much as the next guy, but you’ve got to have some real big Cinco de Mayo plans to end your go shop on a Saturday.

Maybe all of that doesn’t sound strange… but I’ve seen dozens of go-shops, and I’ve never seen one that didn’t end in a “0” or a “5” (i.e. a 25 day go-shop, or a 50 day go-shop) or end on a weekday. And it’s not just my memory; I searched Bloomberg and Bamsec and couldn’t find a single example of a go-shop that ended in a non-zero/five number (well, there was a vitamin shoppe deal in 2019 that appears to have technically been 29 days, but I’m willing to call it 30 if you are!). Nor could I find an example of a go-shop that ended on a weekend; it’s harder to search for these (merger contracts generally just say what day the go-shop ends on, not what day of the week it is!), but I spot checked 10 different go shops and all of them ended on weekdays. Note that I wouldn’t consider a go-shop that ended on a Sunday night particularly strange (though I don’t believe I saw any), but ending on a Saturday is bonkers to me, and I certainly can’t find an example of another deal with a go-shop ending on a Saturday (feel free to email me or add a comment if you can find one; again, none of these are explicitly laid out in merger contracts, so all of this involved a lot of me finding and going through old merger contracts and proxies by hand).

So that’s just a wild combo. You’ve got a go-shop set at a really strange number of das and set to end on a Saturday; both appear to be outside of industry norms and I just can’t think of any normal reason why you’d set them there instead of using normal times (i.e. why not do a 35 day go-shop that ends Monday night on May 6?)

My suspicion is that one of two things happened here:

Remember that ADTH’s stock had been rocket-shipping so far this year. It’s possible ADTH entered exclusive deal talks in early January (when the stock was ~$2/share) centered around a $3/share takeout price. With the stock running while they were negotiating, suddenly ADTH found themselves in a situation where they had negotiated a large premium deal a few weeks ago that’s become an effective take under.

ADTH was running a process, but the process was about to get derailed. Possibly because a competitor caught wind and was using the process to poach customers, possibly because a reporter caught wind and was about to publish an article. Either way, ADTH took a bird in hand and took the most complete deal rather than let the process potentially derail, and they included the go-shop so they could finish the original process.

Now, I absolutely understand that both of those probably make me sound like Charlie looks in the meme below:

A skeptic might say to me that Occam’s Razor is in effect here; ADTH wanted to sell themselves and the stock price mooned…. but ADTH looked at things rationally and still hit the highest bidder. However, the optics still look bad, so they threw in a go-shop so they can go to shareholders and say “yes, this was a no-premium deal, but it really was the highest possible price we could get.”

That’s entirely possible!

But let me propose something different.

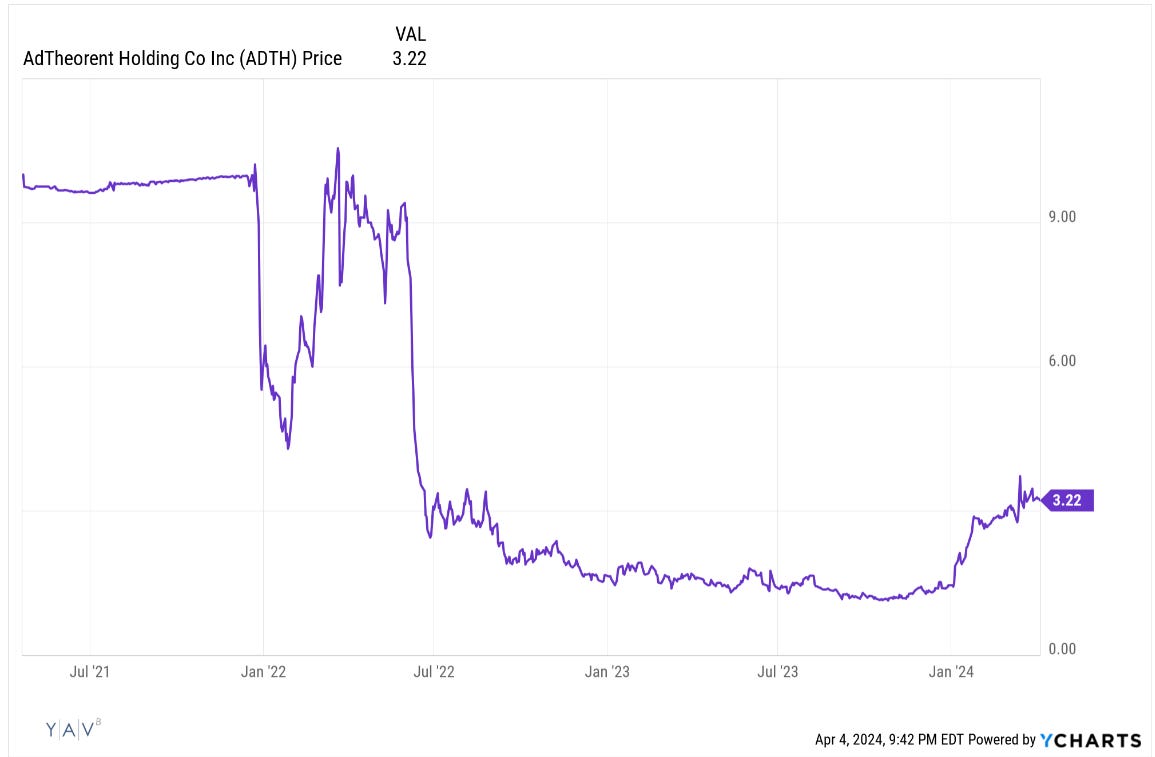

ADTH went public at the bank end of the SPAC bubble in late 2021 (you can see their merger deck here). They had dreams of world domination, including opportunistic M&A…. but the stock crashed almost immediately upon deSPAC’ing, leaving the company as a subscale player in a space where scale matters and with limited options.

In that world, as soon as the M&A window opened up, ADTH understandably locked down the first credible exit they could find, and they negotiated the go-shop as way to capture more value if someone else wanted to come along will guaranteeing themselves an exit if no one popped up.

That’s that world I think we’re living in. And, in that world, ADTH’s go-shop option has real value…. particularly given how cheap the sales price looks and how large the synergies to a buyer likely are.

And we’re currently buying that option for basically free. I’ll take that bet all day long, and I’m hoping to pays off when the go-shop ends in early May.

If so, it could make for a very happy Cinco de Mayo!

Odds and ends

It’s worth noting that ADTH isn’t alone in seeing their stock spike so far this year. If we go all the way back to ADTH’s deSPAC deck, they listed three publicly traded competitors (DSP, TTD, CRTO), and all three of them have seen their stock rip so far this year. That’s important backdrop: even if none of those peers are the best acquirers, it’s easier for any acquirer to justify an acquisition when peer stock prices are going up (it makes relative valuation multiples way easier, and it generally suggests an easier financing environment)

I spent a ton of time talking about the upside and the opportunity for a bump here…. but the major reason this deal is so interesting is because of the downside protection. On top of the no-premium deal cushioning the downside, this merger is very unlikely to break. It’s a tight merger contract with few conditions (basically just HSR and shareholder approval) and no real outs. While HSR is required, it’s really hard to imagine an anti-trust issue here (these are small players in a big market, and my understanding is they don’t directly compete with each other) and there’s no financing condition (debt is provided by RBC). And the timing should be reasonably tight: the press release calls for the deal to be completed by Q3’24, and the merger agreement sets the end date for July 30. I’d guess this closes in late June or early July.

Some background on the buyer is interesting. Cadent is the buyer, and they’re backed by Novacap, who bought them for ~$600m late last year. There are some really interesting quotes in that article on Novacap buying Cadent, including, “Whereas Lee was more focused on short-term growth that could produce liquidity, Troiano said, Novacap gives Cadent the resources to pursue a ‘long-term view for the next three to five years’” and a lot more discussion of Cadent’s M&A plans and how much they help grow Cadent’s value.

PS- between the debt from RBC and a real buyer (Cadent), that probably firms up the downside here just a little more. Sometimes when you see a strange process or deal outcome, you worry that there’s something going on and there’s some skeleton in the closet that caused a cheap price and you’re downside is way worse than assumed. Certainly possible here…. but a credible buyer and financing source suggest at least the big red flag tail risks are probably off the table.

It’s worth reading through ADTH’s Q4 earnings call. You’ll see things like “, we have meaningfully accelerated our growth trajectory” or “2 global holding companies completed platform evaluations and signed post evaluation platform agreements in the first quarter and a third holdco evaluation is in progress.” They also talk about how google eliminating cookies could be a “huge opportunity.” Maybe you believe that, maybe you don’t….. but ADTH is getting taken out for <10x EBITDA in an acquisitive industry with a lot of synergies, and given that cheap valuation all it takes is a buyer factoring in a little something for those tailwinds to get a bump.

The press release announcing the transaction includes a quote from the chairman: “The transaction and the upcoming “go shop” process underscores the Board’s commitment to maximizing value for shareholders.” That is a curious line; compare it to Everbridge’s deal which included an (ultimately successful) go-shop that is barely mentioned in the release. Perhaps nothing, but it could be an indication that the company truly sees some value potential in the go shop.

These are obviously different industries, but MTTR just got acquired for a mammoth premium (>200%). I just point that out because like ADTH, MTTR is a former deSPAC. DeSPACs have generally been left for dead, and we’ve seen a lot of them get acquired for large premiums. Again, apples to oranges, and ADTH is under contract…. but it’s worth considering that we’re consistently seeing deSPACs with strategic value much higher than their left for dead prices on the public markets.

When will the company share the out come of go shopping?

Andrew - do you think lack of post-earnings announcement puts higher bid to rest, or were you expecting a last second release this weekend/Monday?