Every month, I’ll put out a tweet asking for people’s favorite special situations (here’s October’s). There are always some interesting situations in there…. but my current favorite situation started brewing intra-month, meaning it wasn’t mentioned at all on that thread. It’s a pretty fascinating situation IMO…. and I hadn’t (publicly) written up a special sit in a while. Put it all together, and I figured I’d put some pen to paper and write it up in advance of next month’s tweet!

Anyway, the special sit is Verizon’s (VZ) acquisition of Frontier (FYBR; disclosure: long… and I’ll admit to some bias here as I’m a long time cable / fiber bull and have been involved in another cable special situation (disclosure: long WOW as well)).

The basics of the situation are pretty simple: in early September, Verizon announced a deal to by Frontier for $38.50/share. Frontier’s stock had been trading just below $29 before the deal, so the acquisition represented a ~35% premium (the press release used 90-day VWAP to call it a ~44% premium).

Where things get interesting is in the past month several major shareholders have come out against the deal. The largest to come out against the deal is Glendon, which owns almost 10% of FYBR stock. In addition, Carronade (owns just shy of 1%) and Cooper (~0.3%) have come out against the deal, and FYBR’s largest shareholder, Ares (owns ~15% of the company) has reportedly hired an advisor to study whether it supports the deal or not.

The shareholder vote on the VZ / FYBR deal is scheduled for mid-November. To go through, Frontier needs a simple majority of shares outstanding to vote for the deal. The event / special situation angle is simple: if you’re buying FYBR stock today, you’re betting enough shareholders will come out against the FYBR deal to put the vote at risk, and that Verizon will then bump their bid to get it over the finish line.

Now, Verizon is not just going to give a bump out of the goodness of their heart. Verizon is only going to bump their offer if the vote is going to fail and Verizon believes they can increase the price of their offer and still create value (i.e. they believe FYBR is worth $50/share in their hands, so yeah it sucks to have to bump the price from $38.50 to hypothetically $42, but it’s worth it because they still buy it for less than fair value).

That’s the basics of the situation. Here’s what’s so fascinating about it to me: there are two reasons a Frontier shareholder would vote down the Verizon offer:

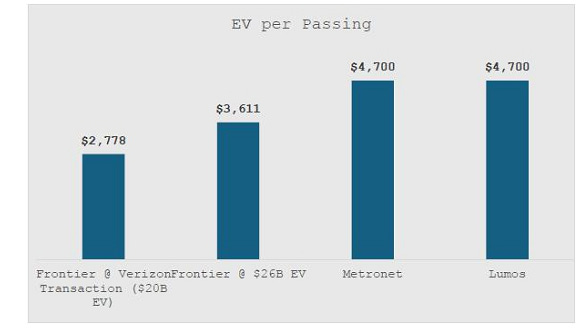

Belief that Frontier as a standalone is worth way more than the Verizon bid: This is the angle that most of the disgruntled shareholders seem to be taking. For example, Glendon’s letter includes the chart below arguing that Frontier is getting taken out way cheaper than precedent fiber transactions; Frontier would be worth >$50/share as a standalone if you believe the low end of that passing math.

Belief the VZ bid is worth more than Frontier’s standalone value….. but the synergies between combining Frontier and Verizon are huge and Verizon is capturing too much of that synergy value for themselves: Verizon is projecting enormous synergies from buying Frontier. In this scenario, a shareholder thinks Verizon is capturing too much of that synergy value for themselves. So a shareholder might believe Frontier is worth $30/share as a standalone, but $60/share in the hands of Verizon, and the shareholder threatens to vote the deal down to get Verizon to bump their offer and give more of that synergy value to FYBR shareholders. MoffettNathanson called this “a game of chicken” (both sides know a deal makes sense, but both sides try to convince the other they are willing to break the deal in order to get better economics), and I think it’s a really apt description for this scenario.

I think both situations are really interesting; let’s break them down a little bit more.

Situation 1 (belief that Frontier as a standalone is worth way more than the Verizon bid) is the angle I see most of the dissenting shareholders publicly advocating. Now, if you read Frontier’s proxy, it’s clear that Frontier was very well shopped, and Verizon made by far the best offer for the company. So the fascinating thing about this situation is it suggests that both company insiders (i.e. the management and the board) and knowledgeable company outsiders (the financial and strategic parties who bid on Frontier during their strategic process) did not understand the true value of Frontier, and that the minority outside shareholders know Frontier’s value better than all of those sophisticated parties who had access to top notch advisors, non-public information, management projections, etc.

Now, that whole paragraph may seem outlandish / make minority investors seem more than a little arrogant. Who are they to know a company’s value better than insiders and corporate buyers? And, I will admit, I’m a little skeptical of this argument; Frontier appears to have run a full and fair process to me….

But I don’t think it’s fair to dismiss this logic completely out of hand. Active investing is all about seeing something the market is missing; saying “I know the value of this company better than the market” seems equally silly in a vacuum as saying “I know the value of this company better than insiders.” And insiders are often wrong; I can’t tell you how many times I’ve seen a company turn down a bid as undervaluing it only to see their stock drop 90% in the next few years, or take a bid at a premium only for it to become clear the company was way, way undervalued at the time.

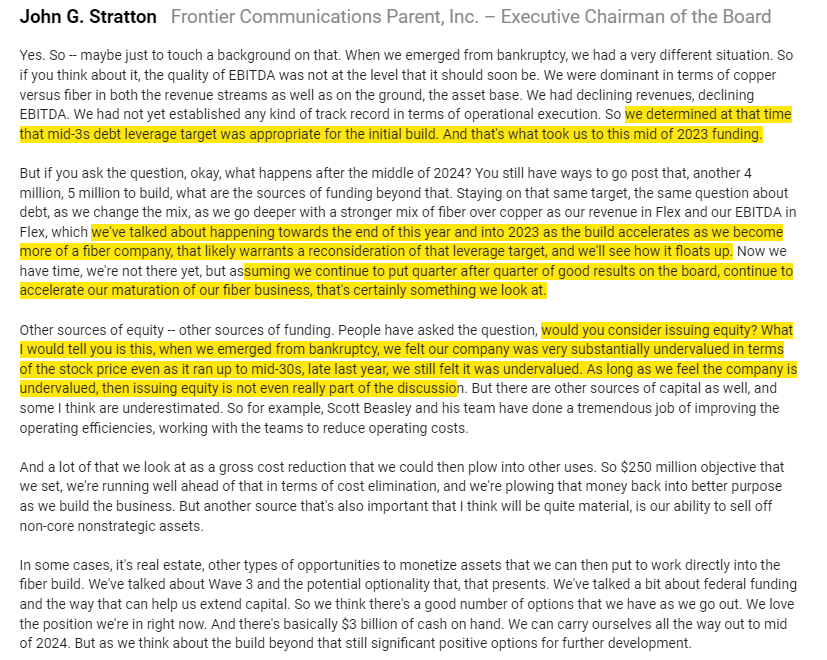

And we have recent history of Frontier being very wrong about their own value! Here’s their executive chairman in mid-2022 discussing how they thought their stock was undervalued “even as it ran up to” the mid-30s in 2021.

If you asked the executive chairman to explain why mid-30s was undervalued a few years ago but a slightly higher $30s deal was acceptable today, he’d probably say the environment was very different back then. Lower inflation, better sub growth, lower interest rates, etc. He’d be absolutely right….. but I think he’d also be proving the dissenting shareholders point! The environment can change rapidly; if you really believe fiber is a premium asset, its value should continue to increase. Why sell now when most of those trends have gone against you when you could continue executing on your plan, building value, and waiting until a more opportune time to sell yourself?

So that’s situation 1. Situation 2 (Belief the VZ bid is worth more than Frontier’s standalone value….. but the synergies between combining Frontier and Verizon are huge and Verizon is capturing too much of that synergy value for themselves) is actually a little more interesting to me, because the game theory and negotiating dynamics are really fascinating.

For simplicity’s sake, let’s say Frontier was fairly valued at ~$28.50 (where it was trading right before the Verizon deal was announced). The Verizon deal is priced at a $10/share premium to that standalone value, and Frontier has ~250m shares out, so Verizon is paying a ~$2.5B control premium for Frontier. Why would Verizon pay that premium? Because they think Frontier is worth way more under their control due to synergies from putting the two assets together.

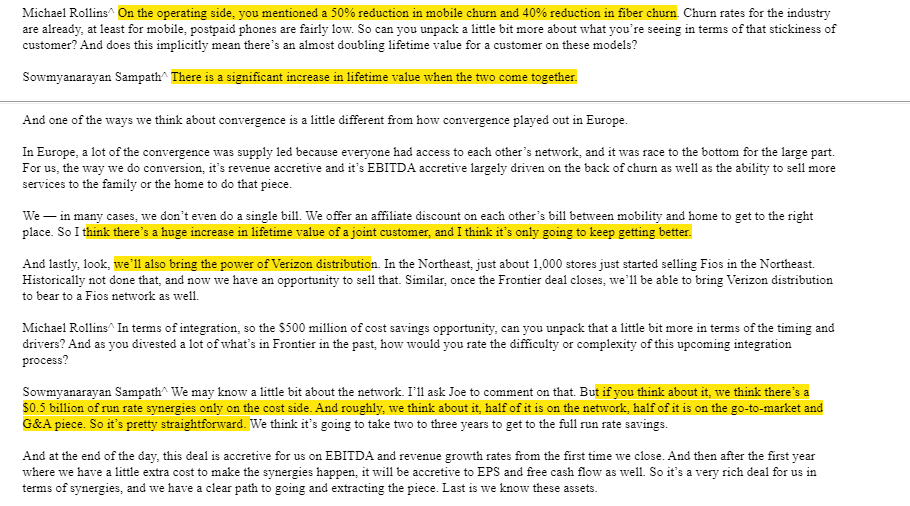

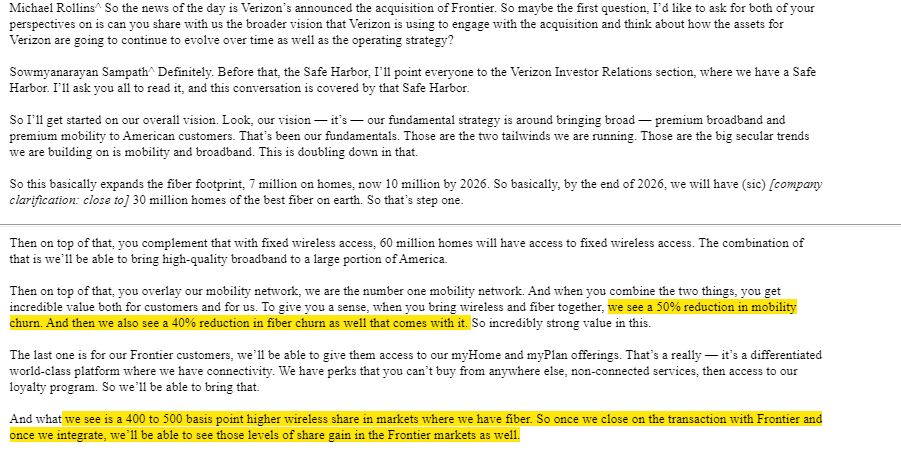

And you can see that in Verizon’s communication around the deal; I’ll include a few extra notes in a second, but I think the clip below really sums it up best. The headliner here is that Verizon is forecasting $500m in cost savings from buying Frontier. However, on top of those cost saving, Verizon notes some other big opportunities. In particular, buying Frontier lets Verizon offer a converged (i.e. home fiber + wireless) offering in more of the country, and Verizon notes a “significant” increase in lifetime value when they pair fiber with wireless. On top of that, Verizon notes they expect the power of Verizon distribution to improve Frontier’s sales (i.e. some revenue synergies).

Verizon has also noted they have a 400-500 basis point higher wireless share in markets they have fiber (likely in large part because of that churn improvement!).

Verizon currently trades for a ~7x EBITDA multiple. If we simply slapped 7x on the $500m in cost savings VZ is projecting, buying Frontier creates $3.5B in synergy value. On top of that synergy value, Verizon should enjoy benefits in their core wireless business (thanks to that 50% reduction in mobile churn for people who take fiber), and they should improve Frontier’s fiber business (thanks to that 40% reduction in churn). It’s really hard to quantify the value of either of those churn reductions since they’re thrown out in a vacuum, but I’ll note Verizon is a ~$350B enterprise value company and Frontier’s fiber footprint will be ~5% of the national market. Again, it’s tough to estimate the values given the lack of inputs, but I don’t think it’s crazy to say “hey, if buying Frontier improves VZ’s core wireless share by ~5% in ~5% of the markets while reducing churn, that could be worth another $2-3B”.

And there are other potential synergies! Verizon noted that they think they can get more than $500m in cost synergies, and that there are some capex synergies they aren’t incorporating into their projections.

Add it all together, and I think you could point to a world where Verizon is creating ~$7.5B of synergy value by buying Frontier, and Frontier shareholders are getting a premium of only ~$2.5B, so the “value split” between Frontier and Verizon is around 33% to FYBR and 67% to VZ. Perhaps Frontier shareholders believe a more equitable split is 50/50, so they should get another ~$1.25B of value. That’s not a small number; again, Frontier has ~250m shares outstanding, so Verizon would need a ~$5/share bump to go to a fully even split there.

So that’s the overall state of play. As I write this, FYBR is trading for ~$35.80/share. Before the dissenting shareholders came out, FYBR was trading for ~$35.30/share. If VZ doesn’t bump their offer and vote succeeds, FYBR probably trades back to ~$35.30/share, so you risk ~50 cents/share on the downside1. If shareholders can make it seem like the vote is going to fail, I think the synergies on VZ’s side are high enough that they’d bump by $2-4/share to get a deal overr the finish line. Let’s take the midpoint and call it $3/share; put those two numbers together ($0.50/share dwn, $3/share up), and the market is pricing in ~15% chance of a bump.

That feels low to me; you’ve already got three shareholders representing >10% of shares saying they’re against this deal. Momentum in event driven land can beget momentum; every shareholder who comes out against the deal is more likely to beget more shareholders to come against the deal, if only to try to play the game of chicken. Remember, Verizon is a very deep pocketed buyer; an extra $3/share is nothing to them, and they’ve been very aggressive in talking up the synergies from this transaction and how it’s the cornerstone of their strategy going forward (their Q3 earnings press release is titled “Verizon updates broadband strategy” and literally every bullet in their fiber strategy mentions the Frontier acquisition). When push comes to shove, I suspect Verizon would give FYBR shareholders a sweetener rather than risk losing this deal and having to scrap the strategy they’ve been laying out.

Now, there are obviously a lot of pushbacks here. For one, we don’t have critical mass of investors against the deal yet, and we also don’t know how the proxy firms are going to vote. All true…. but, again, the market is only putting a ~15% chance of a bump, and that feels low given how much Verizon has talked up the acquisition / that shareholders know Verizon management covets this asset and paying an extra $1B is not that much for VZ management versus needing to redo their entire strategic planning.

Another pushback: you could also note Verizon has said publicly their bid is their best and final:

But I’d push back on that pretty strongly; what is Verizon supposed to say? “Yeah, we think we’re stealing Frontier, if shareholders really push we’d give them $10/share more? $15/share if they push hard enough!”.

Anyway, this is getting long and rambling, so I’m going to wrap it up here. As someone playing for a bump, I’m keen to see if more shareholders come out against the deal (I’m surprised that, to my knowledge, none of the current agitators have included the quote from the exec chair I used above that described his stock as undervalued as a standalone in the mid-$30s!) and how the proxy firms recommend shareholders vote. I’d be shocked if the proxy firms rec’d against the deal, but if they did that’d be a huge feather in shareholders cap towards getting a bump.

PS- one last quote from the Verizon CEO that I think shows how bulled up they are on the acquisition

PPS- my downside scenario assumes that this deal gets through, one way or another. The risk in any game of chicken is that shareholders play their hand too far and Verizon says “whatever, enjoy being a standalone.” If you’re a true believer in scenario 1 (that FYBR’s value is ultimately higher than the VZ bid), that’s a great outcome! But if you’re actually here for the game of chicken and trying to capture more of the synergies, that outcome is bad for Verizon (it prevents an accretive deal from happening) and a disaster for you. So, while that is certainly a risk, I just honestly don’t see a way Verizon doesn’t at least come back to the table at least once with a small sweetener if the deal is at risk. The synergies are too large and VZ is too tied to the deal. I remember a few years ago some shareholders at Netsuite tried to play chicken with Oracle (T Rowe wanted a huge bump), and the stock tanked when people thought the deal wouldn’t go through…. but eventually the shareholders caved and Oracle got the company, so in a worst case where VZ doesn’t bump I’d expect eventually shareholders fold and VZ takes this over.

Again, none of this is financial advice! This is simple up/down analysis every event investor does in a trade. The world is often much, much crazier than simple up/down analysis; go see the legal disclaimer for more caveats!