I’ve written a bunch on PSTH / UMG over the past few weeks (you can see my most recent thoughts here). I mentioned this on Twitter, but I’m planning one more post for next week to address some lingering questions, add some more thoughts on UMG, and discuss anything else that’s on my mind with PSTH / UMG. If you have any questions / thoughts on the deal, feel free to reach out and I’ll try to incorporate / address them.

Anyway, while I’m planning that post for early next week (likely Monday), I’ve spent a lot of time researching the music industry this week. I’ve been saving a bunch of highlights / clips from that (mainly clips from expert calls, earnings calls, and WMG’s conference appearances), and I wanted a place to put them all so I could easily link to them in the upcoming post without turning the post into a fifty page long behemoth that is just overwhelmed by screenshots. Instead, this post will be overloaded with screenshots!

Before I get to the clips, I just want to highlight one thing: in my last post on UMG, I said I thought people would get excited about UMG once it was a standalone company and Ackman presented his full thesis on it. Nothing I’ve seen reading up on the industry has changed that view; Ackman / PSTH are buying into UMG at a low 20x EBITDA multiple; given the moat, visibility, and growth that UMG has, I think that ~20x multiple will prove much too cheap. I would say a multiple in the high 20s to low 30s would be more appropriate, but my work on the industry is still a work in progress I won’t specifically commit to any multiple yet. Still, I wouldn’t be surprised to look back 10 years from now and say, “yup, turns out UMG’s growth prospects and moat were so good 30x was actually too cheap.”

Anyway, below are the topics I found interesting music industry quotes on:

Overall investment thesis

Streaming Growth

Growth outside streaming

Labels versus Spotify

Artists versus Labels

LT outlook for major labels

On private capital competing for rights

On NFTs

On LT Margins

On UMG spin tax complications

And, in order, below are all of the quotes for those different categories along with the place the quote came from (if you’ve looking for the cliff notes, I already tweeted out my three favorite quotes…. update: due to some posting issues on your authors end, I had to delete some of those tweets and break the thread. Here’s the tweets that got deleted / resent).

Overall investment thesis

From WMG at MS TMT conference, March 2021 (I liked this one so much, I tweeted it out twice)

From WMG at GS Communacopia, October 2020

From WMG Q2’21 call

From WMG’s Q1’21 call

Streaming Growth

From WMG’s Q2’21 call

From a Tegus expert call

From WMG’s Q2’21 call

From WMG at GS Communacopia, October 2020

Growth outside streaming

Peloton on how important music is

From WMG’s Q2’21 call

Another from WMG’s Q2’21 call

From WMG at MS TMT conference, March 2021

From WMG at GS Communacopia, October 2020

From WMG’s Q1’21 call

From WMG’s Q4’20 call

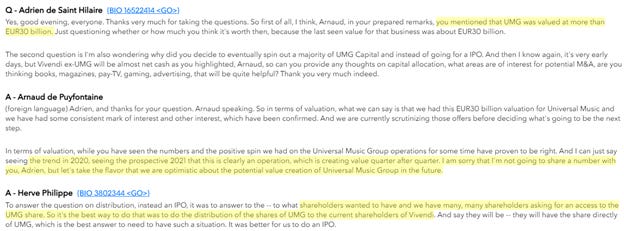

From VIV Q4’20 call

Labels vs. Spotify

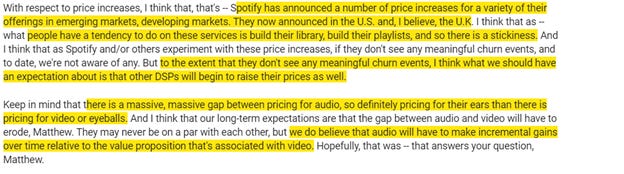

From a Tegus expert call

From a Tegus expert call

From a Tegus expert call

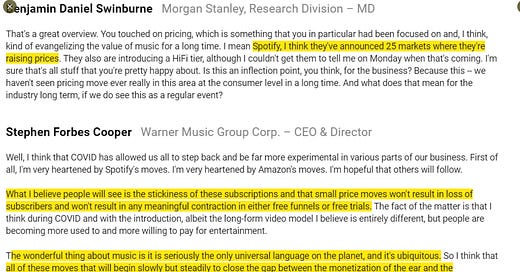

From WMG’s Q2’21 call

From WMG at MS TMT conference, March 2021

From WMG at MS TMT conference, March 2021

From WMG at GS Communacopia, October 2020

Artists versus labels

From a Tegus expert call

From WMG’s Q4’20 call

From VIV Q3’20 call

LT outlook for major labels

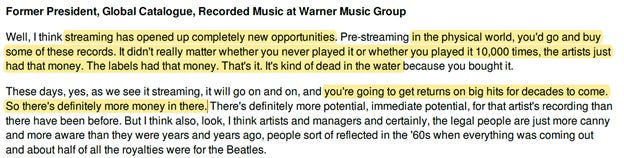

From a Tegus expert call

On private capital competing for rights

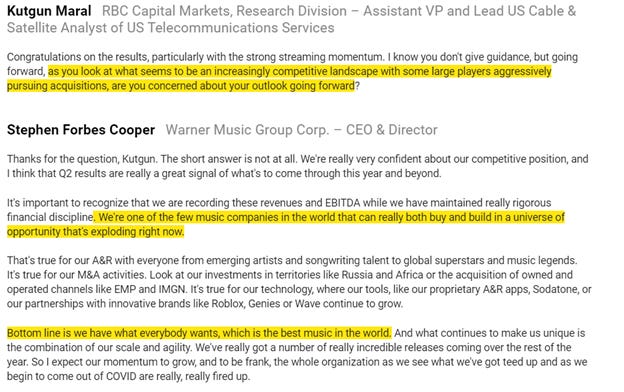

From WMG’s Q2’21 call

From WMG at MS TMT conference, March 2021

On NFTs

From WMG’s Q2’21 call

On LT Margins

From WMG’s Q2’21 call

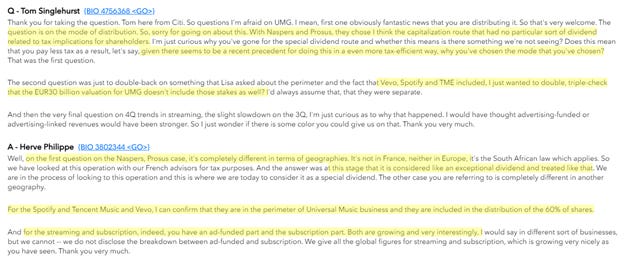

On UMG spin tax complications

From VIV FY20 call

From VIV FY20 call

From VIV FY20 call

From VIV FY’20 call

thank you for sharing and pulling the research - would like to do my own as well. Any advice on pulling transcripts for non-earnings calls? For example, I couldn't find the GS Communacopia transcript anywhere online. Would appreciate some advice on where I can find these types of sources