Nexmo could make Vonage shareholders go "Woo-Hoo" $VG

Vonage (VG) is helmed by a fantastic CEO who has done a masterful job of capital allocation over the last three years

The company has three segments with wildly different outlooks and financials, and that disparity plus the legacy overhand of people thinking of VG as a dying consumer phone company could mask the underlying value of the company

My biggest issue with VG is valuing their Nexmo acquisition: it swings a huge piece of VG’s value, but can it really be worth twice as much as VG paid for it last summer?

In this blog’s first post, I wrote up Shoretel (SHOR; disclosure, I’m long). I’d encourage you to check out that post for a bunch of background on the unified communications (UC) space, but the basics are the whole space is undergoing a secular shift from having phones run internally / putting equipment in your closet to having phones run over the web through a monthly subscription (unified communications as a service, or UCaaS). At the forefront of that shift are players like RingCentral (RNG) and 8x8 (EGHT).

Probably right behind RNG and EGHT in the small business UCaaS race is Vonage (VG; disclosure, I’m long but much less than SHOR), the company I’ll be talking about today. Vonage represents the type of company I have found myself struggling the most with: a company with a fantastic management team that doesn’t trade at a material discount its quantitative value. When you find one, what do you do? Do you just hold it and trust in the management team? Do you sell when it hits fair value? I don’t know the answer, but we’ll get to all that after an overview (I hinted at it in my post on Tucows (TCX) Monday, but I’ll probably have a post coming in the near future discussing the topic more).

Many of you may know Vonage from its legacy consumer product (the CEO frequently mentions how people remember them from their “Woo-Hoo” commercials). That’s where Vonage got its start: providing a traditional landline phone product using the internet to deliver the phone instead of paying for a separate line from your phone company (i.e. AT&T). This segment is slowly dying as more and more people shift to only paying for a cell phone and traditional cable / phone companies just bundle the phone into their “triple play” packages; however, the segment throws off gobs of cash while it dwindles into nothingness.

Vonage saw the writing on the wall (consumer phone segment would eventually decline to nothing) and acquired a company (Vocalcity) that expanded them into the Business segment, and that segment is now where all of Vonage’s growth is coming from. Vonage accelerated their shift to business in late 2014, when they hired their current CEO (Alan Masarek) from Google with a clear mandate to continue to grow the business / UCaaS side. Masarek has dramatically cut costs on the consumer side, which now throws off gobs of cash that he has used to fund acquisitions to grow the business side.

Until the middle of last year, the business segment was 100% UCaaS focused (providing business telephone over the cloud, similar to RNG and EGHT). But last year, Vonage acquired Nexmo, the second leading player in the communications platform as a service (CPaaS) space (basically, the space allows messaging and phone calls in apps; like when you can send a text message to your uber driver through the uber app) for $230m, so now their business segment is a combination of a play on the CPaaS and UCaaS segments.

The “use cash to grow the UCaaS” strategy has been quite successful. The segment is now growing at 20%+ organic growth rates, and they’ve found strong synergies in acquiring smaller players and bolting them on to their platform. Vonage has also noted that they spent over $2B in advertising to build the Vonage brand when they were focused on the consumer side, and that advertising created a strong brand awareness that they think gives them an edge when selling against other small business focused UCaaS players.

If VG was just a typical UCaaS player attached to the consumer product, they would be interesting today given the brand awareness edge and the potential for a “sum of the parts” disconnect given the wildly different multiples the two segments should trade at. However, what makes VG really interesting is the Nexmo acquisition.

Nexmo is a CPaaS provider. They are the number two player in the space behind Twilio (TWLO), which IPO’d in June a ~$15/share, saw a 90% pop on their share price the day of their IPO, and currently trades for ~7x next year’s revenue. In general, CPaaS helps businesses communicate with consumers. A few examples are the best way to show this: say you’re using uber and want to call or text your driver; Twilio or Nexmo provide the technology that would allow you to do that through the app instead of needing to copy the driver’s number, exit the app, and then put the number in to call on your phone (they also have tech that enables driver / passenger communications through private / randomized numbers instead of giving access to each other’s actual contact info; big for privacy and security!). Or say you’re using an airline’s app and are trying to book a ticket and need to contact customer service; CPaaS allows you to press a customer service button in the app, call the customer center, and have all of the info in your profile delivered to that customer service rep (i.e. no having to repeat all in the info you’ve already typed in).

Perhaps it seems simple to make that connection. But it turns out the process is actually super complicated: in order to make a connection, the company needs to have a relationship with whoever is delivering the signal / service to the person’s phone (i.e. in the U.S., they may need a relationship w/ AT&T if that’s who provides the network. But if the person is in Mexico, the provider would need a relationship w/ the Mexican network). That means if an app wants to have worldwide coverage, they need a provider who have relationships with thousands of carriers worldwide. There are also economies of scale here: the more calls / minutes you are using, the more you can negotiate with the networks for lower pricing.

Vonage has been saying the combination of Nexmo with Vonage could be a game changer for the company and accelerate Nexmo’s growth, which is saying something for a business that is already growing 30-40%/year and is the number two player in a nascent space. And I tend to agree w/ what VG’s CEO is saying- Nexmo seems to be a natural fit with VG’s capabilities, and it puts them in an interesting strategic space (all of their peers seem to be trying to get involved in CPaaS in some form, but given Nexmo and Twilio are pretty much the two biggest players in the field it’s hard to see how any of the UCaaS players will really break into the space). I believe Vonage brings three important things to Nexmo that can accelerate Nexmo’s growth:

Cost advantage: Vonage is already handling a significant amount of telephone calls and messages through their UCaaS / consumer side. They can use their corporate size to strike discounts when working with Nexmo providers.

Vonage mentioned ~$5m in cost synergies when they merged with Nexmo.

Sales force: Vonage can use their UCaaS business sales force to cross sell Nexmo. They can also offer smoother integration between Nexmo and their UCaaS clients. The combo could give them a leg up when selling against TWLO.

The company already has some examples of doing this- on the Q3’16 call, they gave an example of cross selling into a customer (Securities Training Corp (STC)), who had a 250 seat UCaaS deal w/ VG that they used to switch STC from another CPaaS provider onto the Nexmo platform.

Cash flow: Twilio and Nexmo are both rapidly growing but not profitable. That means they have huge cash needs: need to fund overhead / losses, working capital, etc. Twilio, as a standalone company, will need to worry about doing through the public markets for the most part. That means management needs to be meeting with shareholders, analysts, etc. They also need to make sure the story is always “on track”, i.e. they need to be hitting growth metrics and showing operating leverage at some point. Nexmo, in contrast, can just tap Vonage’s cash flow, so the management team can just focus on the business. Already, management has talked about accelerating investments they were going to make in 2017 into 2016 because VG is so supportive of them investing for growth. This could allow VG to make significant inroads against Twilio / create value in the long run. (I generally hate the argument "O, these guys have more cash so they'll win." If your business is creating value, in all likelihood someone will help fund it. What I am trying to drive here is that Nexmo doesn't need to constantly prove they are creating value- VG's management can let them worry about creating long term value instead of hitting short term metrics)

So let’s take a look at how to think about valuing VG’s different parts.

First, let’s start with consumer. As mentioned above, this is a declining business that throws of a ton of cash flow. The company hasn’t provided an explicit breakout of how much the consumer business is earning; however, management has suggested the business is doing close to 30% EBITDA margins and that the business account for more than 100% of their total OIBDA given the UCaaS and CPaaS sides are operating at a loss. Putting those two pieces of info together, we can infer the consumer side is doing ~$165m in EBITDA currently. At a 5x multiple, the consumer side is worth ~$825m. To support this valuation, I’ll point out that management has already guided for the business to generate $600m in total FCF from now through the end of 2020 with a substantial tail of cash flows after 2020. Management has compared the long tail of cash flows for this side to the tail of cash flows at AOL, which makes total sense to me.

Now let’s turn to the UCaaS side. Pure play comps (8x8; RNG) are trading for over 4x sales. I would guess VG isn’t quite worth their multiple; while VG’s organic growth has been roughly in line with the pure plays, they license their enterprise business product from Broadsoft which I assume would make them worth a bit less than those peers. 3x LQA sales feels relatively conservative, which would value UCaaS at just under $1B.

Finally, there’s the CPaaS / Nexmo side. This is where I really struggle w/ Vonage. They literally just bought Nexmo for $230m. That means the people who owned Nexmo, who ostensibly should know the most about Nexmo’s value, looked at the company and said “nope, not worth that much by itself” and sold to Vonage. Now, as mentioned above, I think Vonage got a good deal for Nexmo and has created a significant amount of value by putting the Nexmo platforms on their systems, but how much of a premium can you really give to something that was just sold for $230m? For example, peer TWLO is trading at 6-7x next year’s revenue; that valuation is probably insane (particularly given Nexmo’s lower margin profile due to heavier SMS weighting / international weighting) but if we valued Nexmo at 5x it would be worth $480m, or more than twice what VG bought it for. Is Nexmo really worth twice what VG paid for it last year? Even if we value it at just 3x annualized sales (less than half of TWLO’s multiple!), it’s worth $288m and still implies VG picked it up much too cheap.

That’s ultimately where I’ve decided to value Nexmo. I think it’s probably too cheap, but I can’t get that $230m sale number out of my head and I feel like value at $288m gives VG some credit for the synergies between the two platforms while not giving them any benefit of a bargain purchase. That makes sense to me from a conservatism standpoint.

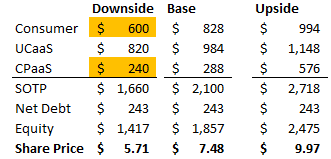

If we put all of those assumptions together, the company as a whole would be worth ~$2.1B. Net of ~$243m in net debt, the equity would be worth $1.86B, or just under $7.50/share.

Admittedly, we have made a lot of assumptions in valuing the company. Let’s call those assumptions our base case and see how flexing them up and down a bit changes our overall valuation.

To start, let’s look at bear cases. We could assume the consumer side is worth $600m, or what they are saying the business will generate in after tax cash flow over the next ~4 years, say UCaaS is worth a 2.5x multiple instead of 3x, and say that Nexmo / CPaaS is worth cost. If we did all that, the company would be worth ~$5.70/share. Maybe you think UCaaS so worth even less than that (you’re just bearish on the whole space and don't think they'll ever hit profitability), but it’s tough to reasonably look at the information presented above and valuations we see for peers in the market place today and come up w/ a value much lower than that, so I feel good w/ that downside.

Alternatively, we can look at the upside cases. If consumer is worth 6x EBITDA, it’d be worth ~$1B instead of $828m. If UCaaS achieved a still below peer sales multiples of 3.5x, it’d be worth $1.15B. And if Nexmo were valuated at 6x sales, it’d be worth $576m. Put it all together and you get just under $10/share.

The table below shows the different ranges mentioned above.

That valuation does miss one key thing here: management. I think management here is fantastic and has created a strategic platform that can deliver a lot of shareholder value for a long period of time by continuing to do bolt an acquisitions (management has been very clear at recent conferences that they see a lot of opportunity for acquisitions and consolidation in 2017) and using the platform they've created to take market share (from the combo of UCaaS / CPaaS sales force) and potentially expand into adjacent markets. I base that thought on several things:

In 2012/2013, the consumer business was doing mid-teen EBITDA margins. Management recognized the business needed to be run as a cash cow and cut massive amounts of costs. Today, the business runs with nearly 30% margins. Despite the cost cutting, the customer experience seems to have improved, as customer churn is at all-time lows. The combo has increased the consumer business side’s value by hundreds of millions of dollars and delivered massive amounts of cash flow that management has used to further the UCaaS strategy / buy Nexmo.

The company has done a fantastic job of capital allocation

They’ve bought back shares when share prices were low, and they increase share repurchases when prices are low.

In the first half of the year, the share price sold off as the market failed to understand the Nexmo acquisition. VG responded by repurchasing 7.4m shares at <$4.50/share; obviously very attractive given today’s share price of $7+

The company has been a habitual share repurchaser in the face of lower stock prices.

Obviously I’m a big fan of the Nexmo acquisition- but I think the other acquisitions they’ve done have been fantastic. Management has said they try to target acquisitions where 1+1 = 11, and to date it seems like that’s exactly what they have done.

The company built their UCaaS business up through acquisitions, but they’ve done so in a smart way. All of their acquisitions are on the same platform (BSFT software), which allows for better synergies and quicker / simpler integrations, and they have managed to purchase companies at impressive multiples well below where peers are trading.

The Vocalcity acquisition in 2013 was done just before the current management took over, but analysts on the call were constantly congratuilating them on the price and pushing Vocalcity for why they would sell so cheaply.

Other odds and ends

The UCaaS / business segment, like all of its peers (RNG, EGHT, etc.), is currently operating at about breakeven. The company is projecting profitability from this segment and 20% EBITDA margins by 2020. These numbers are in line with what peers are forecasting. If correct, it will probably serve as a catalyst for the company as the overall strength of the business begins to shine through.

Risks

Consumer

Business falls off faster than expected

UCaaS

Business disrupted- Microsoft, Amazon, Slack, Cisco are all either already competing in the space (though at the larger scale level) or have been rumored to be looking at the space.

The profitability ramp all of these companies think they can get to never happens (i.e. the “20 by 20” operating margin projections are way, way off)

I feel pretty confident that they can hit 20% margins are close to them. It’s an SaaS model. Once you cut out the upfront marketing costs to get new customers / fund growth, it’s pretty tough to see how these don’t hit some mid-teen type margin.

Nexmo / CPaaS

Valuation:

Discussed above, but Vonage bought this for $240m earlier this year (<2x next year’s sales), a few months before Twilio would IPO at $1B+ valuation (at least 4x next year’s sales, would trade up to over 8x). How could a sophisticated financial buyer sell at that level if Nexmo was really worth much more?

A couple of things make me feel comfortable here

I really believe in both the cost and revenue synergies here. In other words, Nexmo within Vonage is much more valuable than Nexmo outside of Vonage, so I think you can justify valuing it at a higher price

The sponsors probably got a terrific return for taking cash, and the IPO process is incredibly difficult and risky. Perhaps they saw they were getting a really nice multiple and didn’t want to risk having a failed IPO in a rapidly evolving space.

Threats

Can this be insourced: yes, it could. In the old days, if you wanted something like this you could build out your own data center, internally develop the software and purchase the hardware to run it, and then deploy a team of engineers to create the code that would allow your programmers to offer calling features. In addition, you’d need to negotiate contracts w/ thousands of carriers globally. So yes, it can be done, but I’ve heard a lot of feedback that suggests it’s much easier and cheaper to just outsource it.

Just thinking out loud here- but if Uber is outsourcing to Twilio and Nexmo, does it really make sense for any app company to have this insourced? Probably not, which suggests to me there is some form of scale advantage here that protects from both new competitors and insourcing risk.

Push notifications: push notifications are done by the app itself and could absolutely be used to replace all of the messaging features.

Push notifications can be easily turned off (or accidentally turned off) or ignored, and I doubt people want mission critical notifications dependent on someone having push notifications turned on and noticing it. For example, uber sends a push notification when your car is close by. They could rely entirely on that… but what would happen if the person didn’t notice it? Without CPaaS, how would the driver and messenger communicate with each other if the notification didn’t go through for some reason?

A lot of Nexmo / Twilio revenue is going to come from customer service type functions (having trouble with your checkout cart? Press a button and call a help line). I don’t see how you replace that w/ a push notification function.

Wifi calling- Could a lot of Nexmo’s volume be replaced by calling within apps over wifi? That seems like a real long term threat here; it probably doesn’t kill Nexmo but it would certainly reduce volumes if apps could build in functionality that completes sidesteps using phones systems.

To be honest, this threat makes theoretical sense in my head, but I’m not sure if it’s actually possible. It seems a bit of a stretch that companies are going to baseline potential mission critical systems on all parties having constant access to wifi in order to shave off a few fractions of a penny.