Playa-ing around with SPACs (Part 2) $PLYA $PACE

Pace Holdings (PACE), a SPAC, is buying Playa Resorts in a deal scheduled to close this month.

Despite the history of SPACs, I find the deal and company attractive

Due to post size, I split my overview into two pieces: part 1 (see here) covers why I'm so negative on SPACs, and part 2 (below) covers why I like Playa.

Part 1 of this post was a long winded introduction to the SPAC space. This post (part 2) will focus on Pace / Playa specifically.

Anyway, Pace Holdings is an SPAC raised in September 2015 by TPG Capital. In December, they entered an agreement to merge w/ Playa Holdings; the merger was approved on March 1 and should close by mid-March.

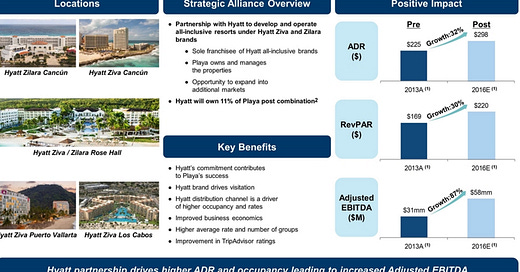

Playa operates all-inclusive resorts, mainly in Mexico (~63.2% of revenue is from Mexico). They think they have several significant competitive advantages, including their locations (they argue prime beach front properties are rare and preclude new entrants) and their model (they think all-inclusive gives better economics, higher occupancy, better visibility). Playa was formed in 2013, and one of the most interesting things about them is their relationship with the Hyatt brand. Hyatt and Playa worked together to create Hyatt’s all-inclusive brands (Ziva and Zilara), and Playa is currently those brands only franchisee.

I’d encourage you to both read the definitive proxy and flip through their IR presentation for a full overview, but I think there’s a lot to like about the deal.

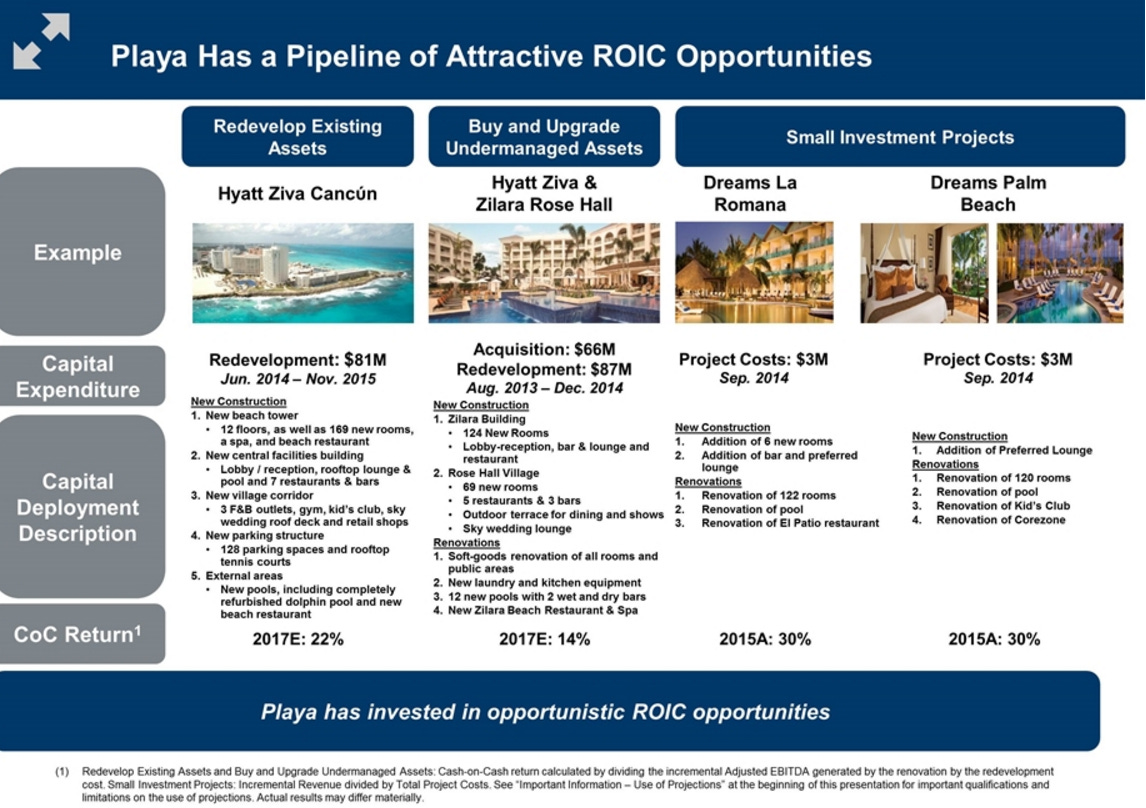

Hyatt rebrand: Playa has shown an ability to renovate / rebrand hotels under the Hyatt brand and greatly improve their economics. Having the Hyatt partnership gives them opportunities to accretively acquire more resorts and rebrand them, as well as potential upside from rebranding more of their hotels to the Hyatt name.

Why is having the Hyatt name helpful? Having a relationship with a big brand is incredibly helpful. Yes, you need to pay them some % of revenues as a royalty for the use of a brand, but the brand drives instant trust for your properties. It also greatly increases chances of direct booking someone versus having someone book on a third party like Expedia, which take a cut of any bookings, as well as giving you easy marketing opportunities by appealing to the brand’s loyalty program. I’ve spent a lot of time looking at the Time Share operators (ILG, who owns the Hyatt brand time shares, HGV, VAC, etc.), and I don’t think it’s any coincidence that as the industry consolidates it tends more and more to the players that have branded relationships.

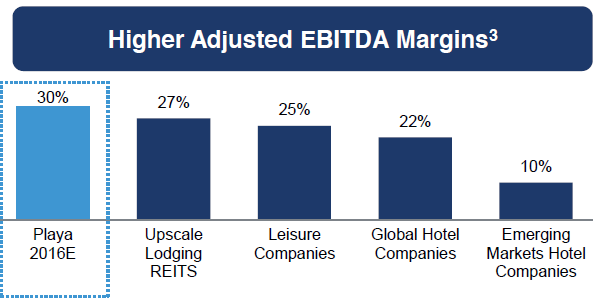

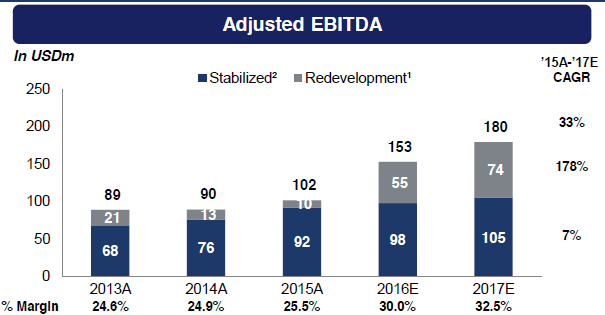

Significant margin expansion opportunity: Playa is currently doing ~30% EBITDA margins, and they think they can improve it to ~35% for four reasons.

First, they built a platform that can support significant growth, so any incremental hotel growth (new starts or acquisitions) should show some operating leverage.

Second, five of their hotels are currently externally managed. Bringing that management in house will cut out the external manager’s margins.

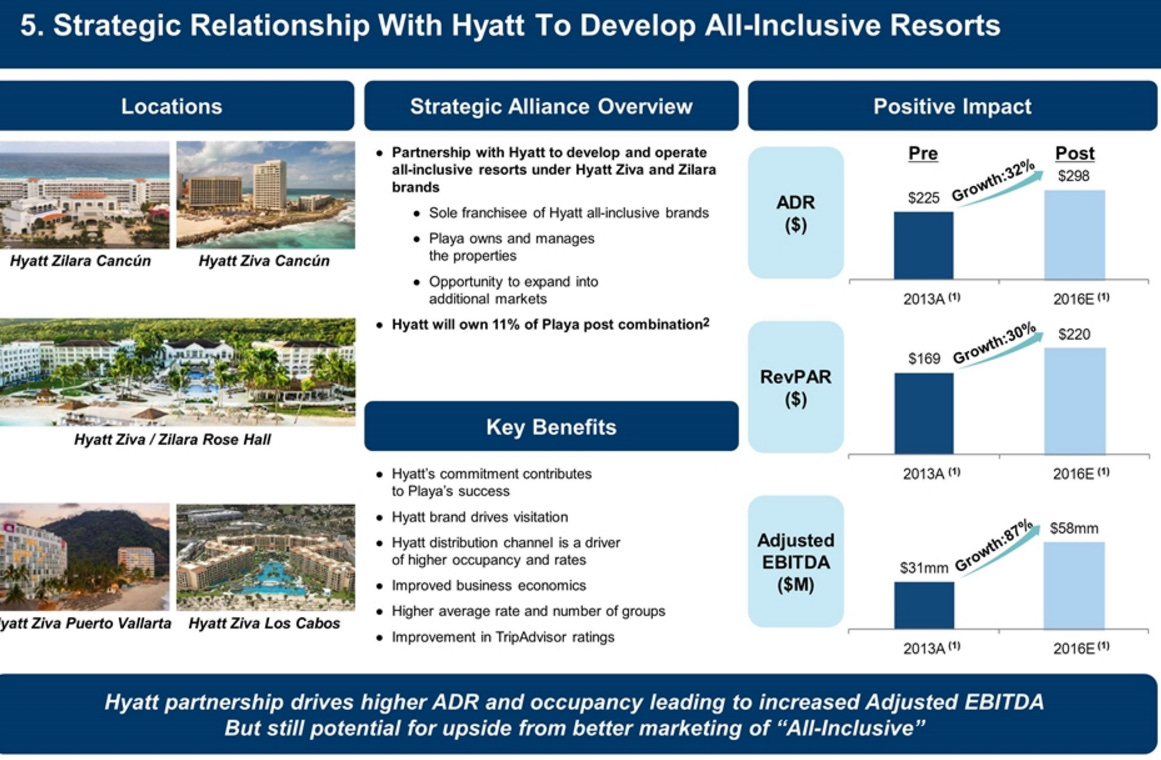

Third, some of their hotels were just refurbished and are still ramping up.

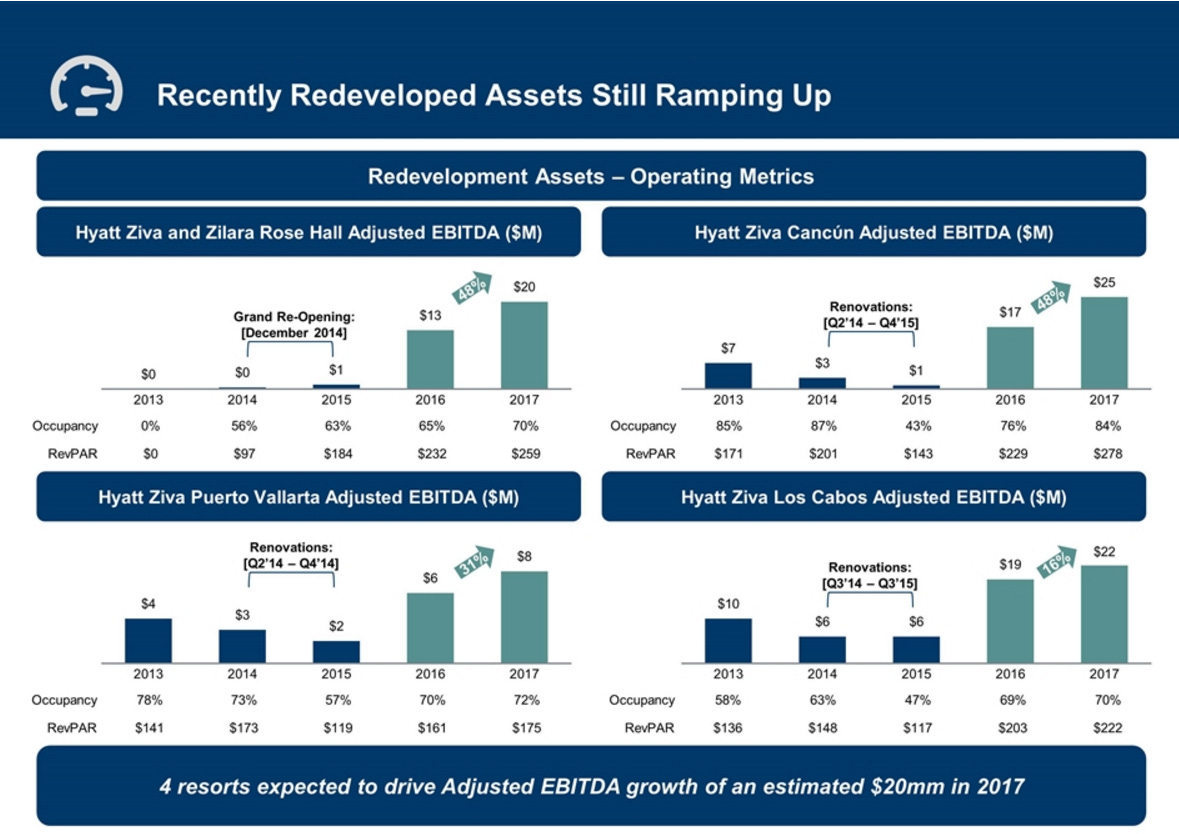

Fourth, the company currently does just 9% of their sales through higher margin “direct” sales, well below peers. Increasing that margin over time should significantly decrease costs

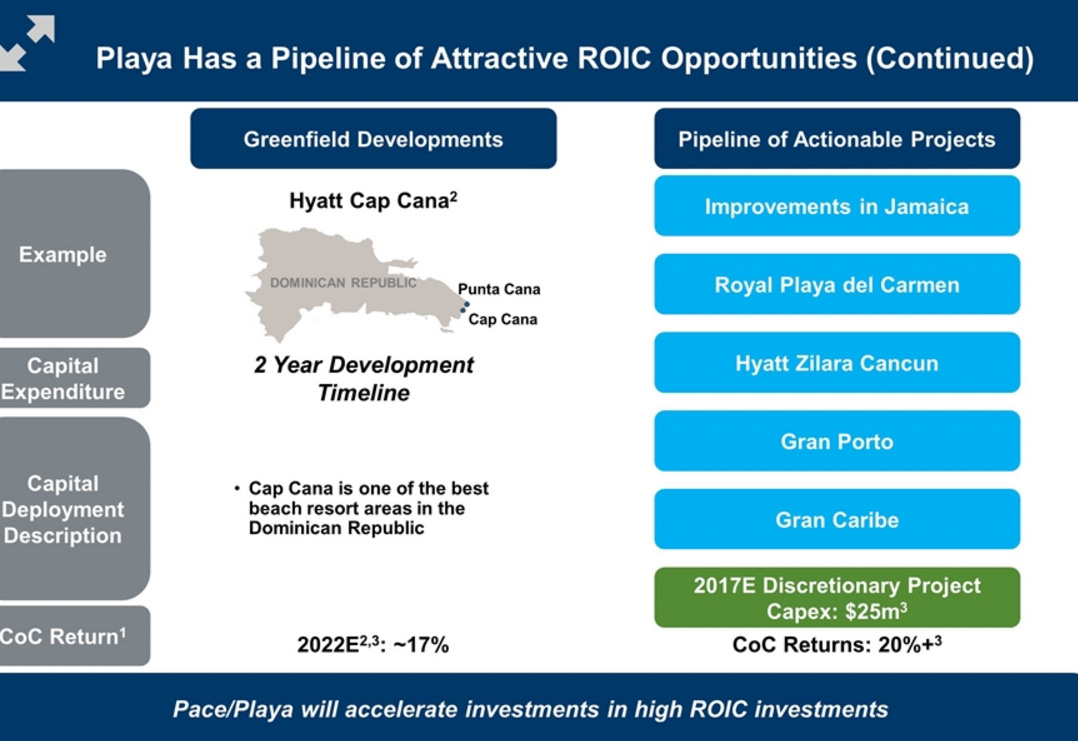

Growth opportunities: The company should have pretty attractive growth opportunities, both from new builds (the proxy reveals they have a plan to open two resorts in Cap Cana, Domincan Republic in 2019), acquiring other hotels (which should be accretive if they rebrand them or improve operations), and refurbishing their current hotels.

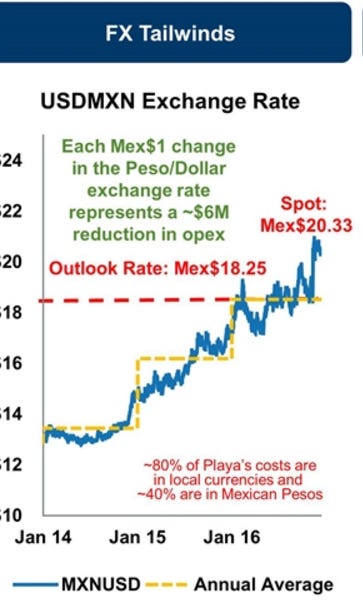

Peso benefit- The deal to buy Playa was struck right when America was starting to become great again. Now that we’re fully great, the dollar has appreciated significantly against the Peso. A lot of Playa’s costs are in Peso, but a lot of their revenue is in dollars or other currencies, so this natural Peso short should benefit them.

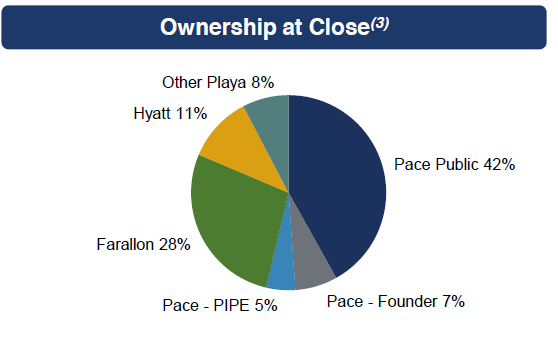

Not a cash out for Playa shareholders- My general rule of thumb for any acquisition is this: the more cash the seller takes for their asset, the more they want to get it off their hands. The more equity they take, the more they believe in the upside of the deal (or at least enough believe in the merit of deferring taxes by taking equity). In Playa / Pace’s case, it’s interesting that the common shareholders are rolling 100% of their shares into the new company. All of Pace’s cash is going to pay off preferred shareholders (mainly Hyatt, who will maintain a significant equity stake as well) or to the combined companies balance sheet, and Playa’s big shareholders will remain major shareholders in the combined company.

The merger background also makes me feel like Playa insiders are pretty bullish on the combo. Part of their valuation involved having TPG / Pace cancel some of their founder shares, and they also demanded some earn out warrants w/ a $13 strike price as part of the deal.

Pace insiders executed a private placement that let them buy more Pace shares through Playa at an effective price of $10/share as part of the deal, which suggests they’re pretty bullish too.

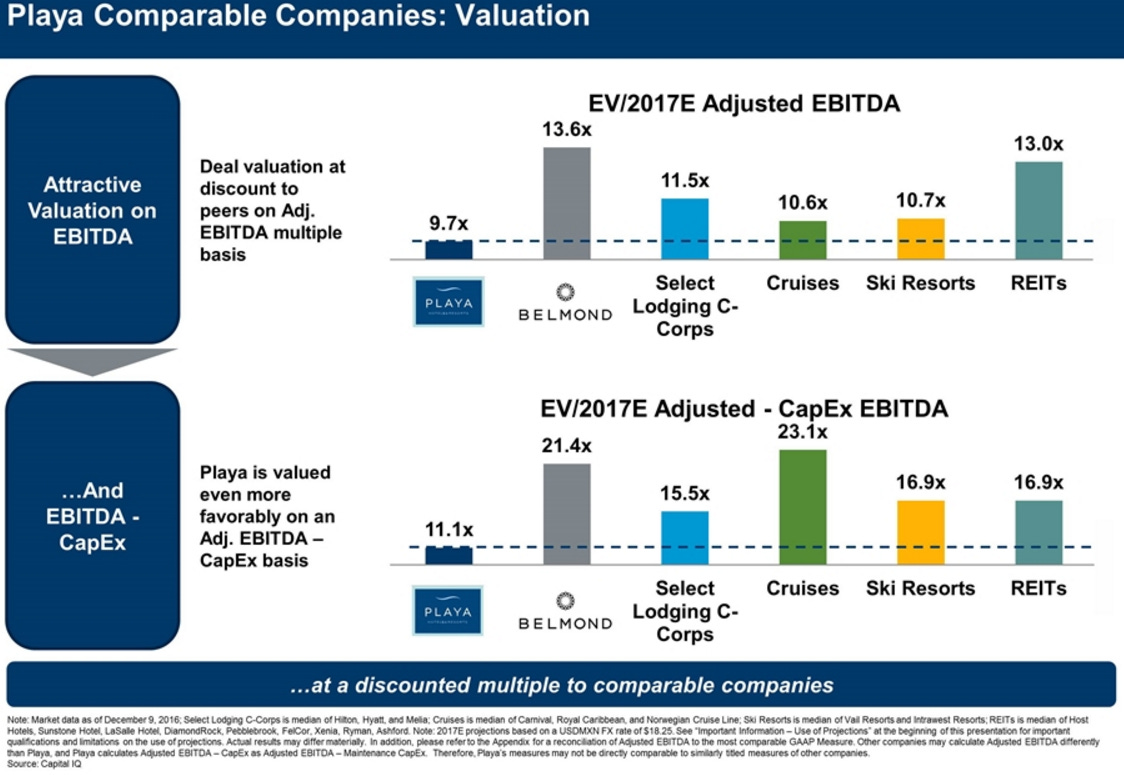

Decent valuation- At $10/share, this looks pretty attractive versus peer valuations and on 2017E.

Seems to be where trends are going: This is a bit subjective on my part, but I feel like all-inclusive is “where the puck is heading” in terms of vacation trends. Part of the reason cruises are so popular is all drinks / food are included, so you get price certainty. Why shouldn’t that be the case with beach vacations?

I plan vacations with friends a few times a year, and for the most part people would prefer to do all inclusive and not need to worry about splitting checks, searching for drinks, exchanging currencies, having spending mismatches (i.e. one group wants to go fancy while another wants to be frugal), etc.

It seems like other groups might be thinking similarly; this article is a bit of a puff piece but mentions Marriot dipping their toes into inclusive packages.

Ok, so clearly I’m seeing a lot of positives. So what’s holding me back on the company?

First and foremost, you have to come back to those old SPAC incentives. Pace clearly wanted to get a deal done; heck, their proxy even says they submitted a non-binding letter of intent to another target (see p. 114). It’s tough to think this deal is that fantastic when they were actively negotiating another deal around the same time they were looking at this one.

And then you have to wonder about incentives for Pace’s manager, TPG. TPG runs a massive private equity fund, which generally gets 2 and 20 on any deals they do. How do they decide to do a deal using the Pace SPAC shell versus in one of their funds? Is it possible that they save the juiciest, highest return opps for their private equity fund and use their “b” ideas for the SPAC, where they get paid more based on deal completion (through the founder’s shares) versus actually finding a good deal with a ton of upside?

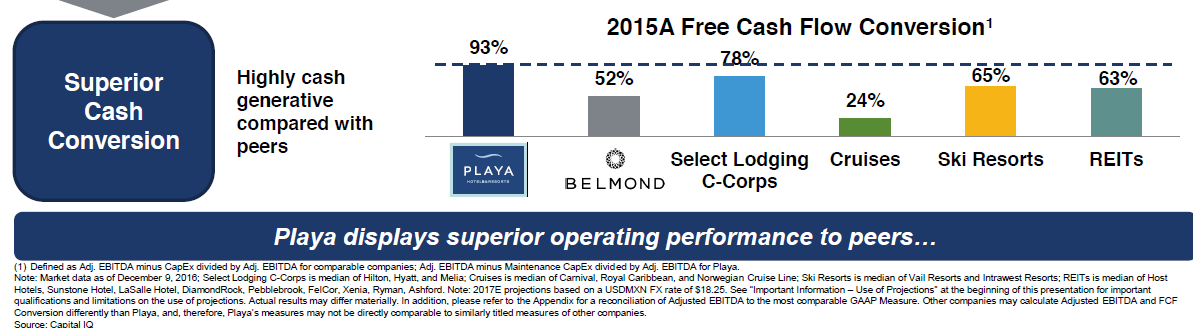

It’s also pretty clear that Playa was “dressing” itself up to be sold. Remember, Playa had filed an S-1 for an IPO before agreeing to merge with Pace. Their whole pitch, both as an IPO and in their Playa merger, is that they’ll be a growth company that can make high ROI investments in both improving their current properties and buying up other properties. That’s a great pitch, but the company completely shut off growth capex in 2016. Why would they defer high ROI investments in 2016? Is it possible they don’t have as much long term confidence in the business and wanted to reach a deal before the questionable returns of growth capex revealed itself? Or did they simply want to look the best on the chart below, where they compare they define their FCF conversion as EBITDA less maintenance capex and define it for everyone else as EBITDA less all capex. Since MCX = capex for 2016, they can claim w/ a straight face they aren’t really gaming these numbers.

There are plenty of other things to be concerned about here.

Again, I just hate the sales-y air around getting an SPAC approved. Here’s their merger call transcript. It includes an argument that their business grows and thrives during economic expansion while outperforming in contractions. It’s tough to have it both ways like that.

Their strategy clearly involves growing, and I worry about any company that is deadest on growing.

Part of their growth plans involves their “Panama Jack” license. Their Hyatt hotels are higher end resorts, and Panama Jack will be a step below that. True, it gives them access to a new / larger market, but I also worry it gives them access to a more competitive market where they don’t have the same edge / managerial experience.

Part of their growth plans also include building new resorts. New resorts cost tens or even hundreds of millions of dollars, so that’s going to be a major cash drag and any issues at a new resort is going to be a big problem for the company (not lfie threatening, but certainly a disaster for shareholders).

You really need to believe the company has a nice growth story for the stock to make sense. Yes, they like to point out that peers are at 10-13x EBTIDA and at $10 you’re buying them for ~10x, but honestly 10x EBTIDA isn’t a super cheap multiple on an absolute basis.

The company argues that this merger gives them “growth capital” and that all of the proceeds will go towards the balance sheet or retiring high cost preferred shares. I view this as a double edge sword: it’s nice that the company is doing the deal not because they need the capital but because they want to grow, but why couldn’t they find a much less dilutive way to do it? It’s not like there’s a shortage of capital right now…

The company likes to taut their 30% adjusted EBITDA margins and the potential to expand to 35%. I certainly get how that’s a selling point, but at the same time I see a company earning higher margins than their peers and I worry about competition / margin contraction, not ability to further leverage costs. If margins regress to peers, this becomes an expensive company very quickly.

This is related to the deferring of capex question, but it’s tough not to look at how margins have expanded over the past few years + the deferral of growth capex and wonder if the company was “dressed up” for an IPO / merger and they pulled forward some earnings to do so. Again, there are reasons for margin to have expanded over the past few years, but it’s just a concern that pops up. Maybe I’m being to cynical.

The proxy reveals the company has four material weaknesses in internal controls. I can’t remember seeing a company point out that many issues before, but my memory could very easily be slipping.

Corporate governance here is awful, by design. The sponsors can maintain close to effective control even if they sell down major portions of their shares. This is going to be a Dutch company with assets held outside of the United States. If all goes well, none of this will matter, but if things go poorly shareholders might be surprised by how few rights they have in this structure. In general, shareholder governance doesn’t matter until it does.

But ultimately, to me the question comes down to the SPAC question: is this actually a good business with a real growth story, or was this prettied up to lure people in at a high valuation. I have bet that it’s the former, not the later, but it’s a small, nervous bet. I’m hoping to add to it if my conviction increases that this is real, or quickly sell out if there are early “growth hiccups”, as they could be a sign that this really was just dressed up to get a deal done.

Before wrapping up, a note on the warrants versus the stock. I noted in my SPAC overview that I thought there might be “forced sellers” of SPAC warrants after deal completion. I can’t help but wonder if I’m not the only one who noticed that and the pendulum has swung too far in the other direction, because PACE’s warrants are awfully expensive. PACE’s warrants are not normal warrants with a one for one expiration; it takes 3 pace warrants to buy one share of stock at $11.50. In addition, the warrants cap out at $18/share (the company can call them if the share price exceeds that level). So the warrants have a max payoff of ((18 – 11.50) / 3) = ~$2.17. There are a lot of different ways to cut it, but the bottom line to me is that the $18 call is a very real cost*, and at today’s price of ~$0.80/warrant the warrants seem to be pricing in a very rosy future or assuming this will be an incredibly volatile stock. I own a bit of both the stock and warrants, but at today’s prices I think the stock makes more sense than the warrants to be honest.

*I think using black scholes on a five year warrant implies a level of mathematical precision that doesn’t exist in the real world, but if I plug an $18 call w/ a 5 year strike (the warrants expire 5 years after the deal closes) and assume 40% volatility, the $18 call feature is worth ~$0.57/warrant (also adjusted for the 3 warrants for 1 share feature). It starts to become a little circular (i.e. higher vol = lower value for the $18.50 call = lower implied price for standalone warrant), but if you add that $0.57 price back to today’s warrant price of ~$0.80, the warrants would be trading for $1.37/share without the call, which implies roughly 47% volatility. That seems pretty high to me.