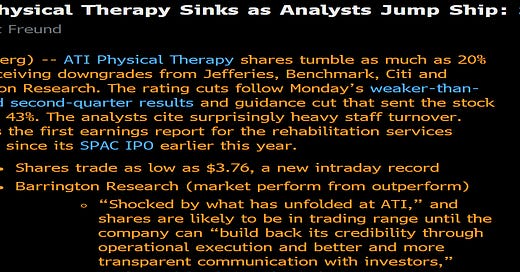

Yesterday morning, ATIP shareholders woke up to some very unwelcome news. Driven by staffing issues and competition for labor, ATIP was slashing their full year guidance. Revenue was cut by ~10% (from $731m to ~$655m), while EBITDA was cut by ~45% (from $119m to ~$65m). As a result of the lower guidance, the company took a big goodwill write off. The stock was smashed in response to the weak earnings / guide; it closed last week at ~$8.34, and as I write this it is trading just a hair below $4/share. Despite the dramatic slide in the stock, analysts tripped over themselves to cut their price targets and recommendations, as they clearly believe there are more “shoes” (i.e. bad news) to drop here.

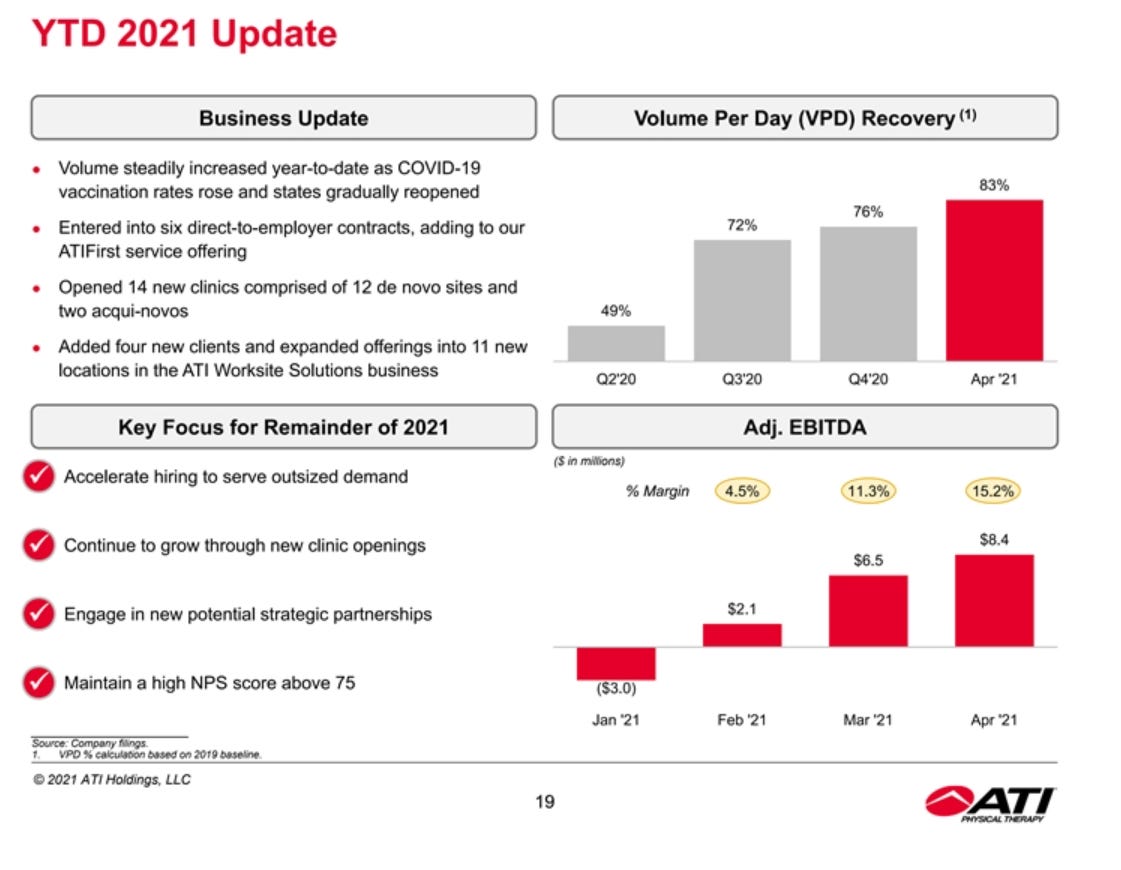

Normally, I wouldn’t write about a company getting cut in half on an awful earnings report. But ATIP is unique; they were a SPAC (FAII) and completed their deSPACing in mid-June. They completed that deSPAC’ing in part on the basis of their prior projections; clearly, they knew that they would miss their numbers miserably when the deSPAC went through, but they chose not to tell shareholders because they knew it would increase redemptions / put the deal at risk. In fact, not only did the company not update shareholders on the projections, as recently as their May investor deck they were painting rosy pictures about their 2021 outlook.

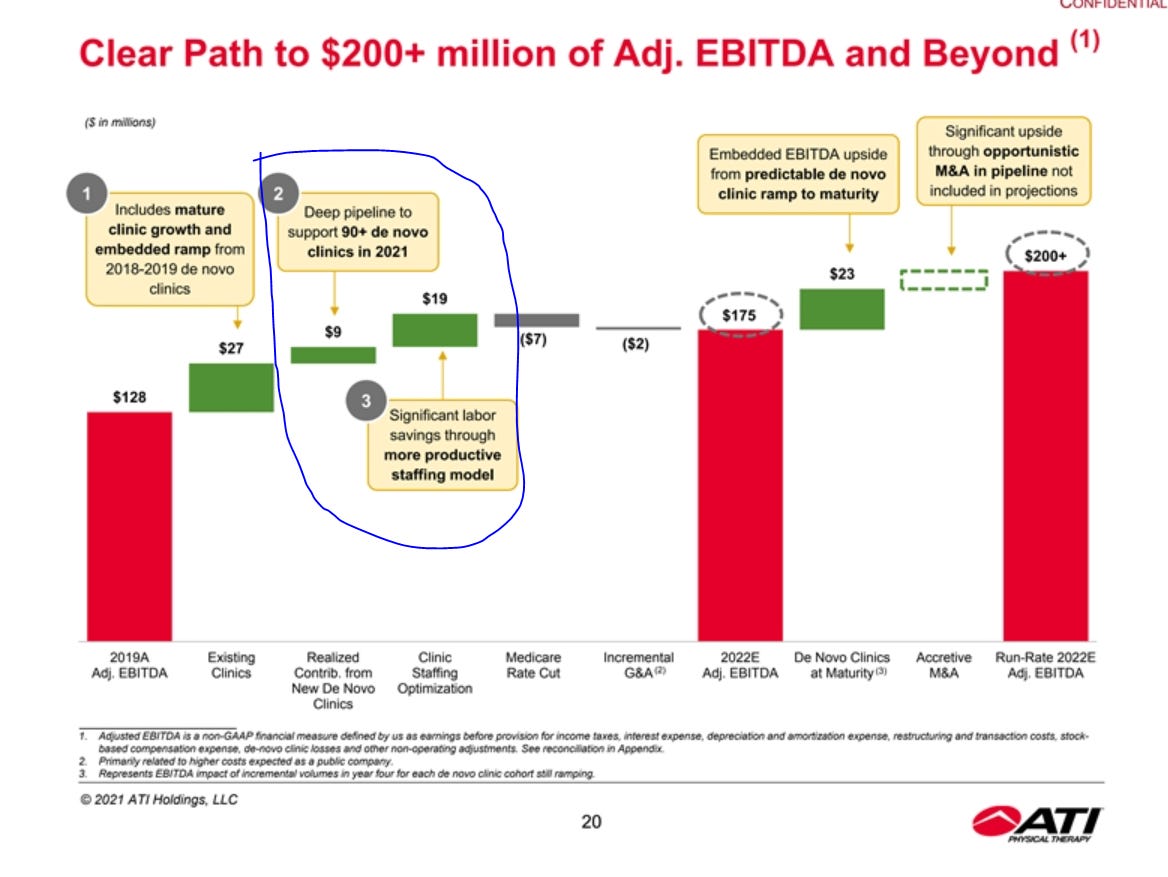

Or check out the slide below (from the same deck); bullets #2 and #3 are particularly interesting because they directly contradict the company’s stated reason for missing their 2021 forecast. This slide reiterates their “deep pipeline” for de novo clinics in 2021, while also suggesting that their “more productive staffing model” will improve earnings (in fact, they will drastically miss de novo clinics for 2021 because they are having trouble with staffing. The irony!).

(PS- I’d encourage you to listen to / read the ATIP earnings call. Listening to management and analysts try to dance around the “how could you miss numbers this badly a month after deSPACing” question was pretty funny; it got even funnier when their “peer” USPT subtly dunked on them in this 8-k by making clear the issues were ATIP specific, not industry wide).

As far as SPAC shenanigans go, ATIP’s are pretty vanilla. They really just missed their guidance and didn’t disclose that; those issues pail in comparison to something like CLOV failing to disclose a DOJ investigation. And they obviously don’t compare to NKLA, GOEV, and RIDE…. well, I’ll wait on the results of the DOJ investigation before stating what I think they did to investors.

So, yes, ATIP pulled some shenanigans, but they were vanilla by SPAC standards. Why then am I writing about it?

It’s because I can’t understand why the heck the sponsors pulled these shenanigans.

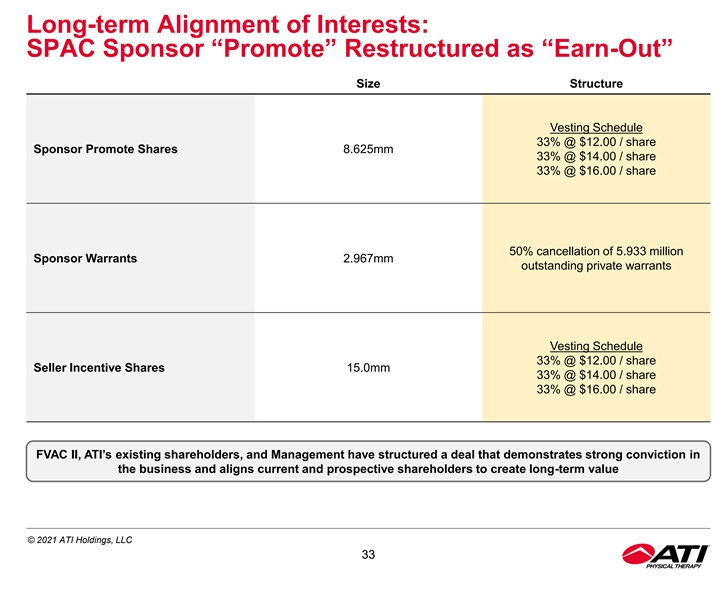

The ATIP / FAII deal wasn’t a “typical” SPAC deal for sponsors. Yes, it was announced right at the height of the SPAC bubble in late February, but it had a PIPE coming in from serious institutional investors (including a $75m check from its sponsor, Fortress) and the sponsor agreed to restrike all of their founder shares so that they only vested if ATIP did well (per the PR, “FVAC II has amended the terms of its founder equity to align with long-term value creation and performance of the Company. FVAC II’s sponsor will defer 100 percent of its founder shares in accordance with the following vesting schedule: 33 percent at $12.00 per share, 33 percent at $14.00 per share, and 33 percent at $16.00 per share. FVAC II’s sponsor will also cancel 50 percent of private warrants.”).

So here you had a sponsor who should be reasonably aligned with minority shareholders, as well as a group of serious institutional investors. Maybe I’m just naïve, but I don’t get why Fortress wouldn’t disclose an updated set of numbers before this deSPAC’d.

It would be one thing if Fortress was a typical SPAC sponsor. In that case, just jam the deal through without disclosing new numbers. If you’re a typical SPAC sponsor, the all in cost of your sponsor shares + founders warrants comes out to ~$2/share. So just jam every deal through and obfuscate because it’s almost impossible for shares to trade below your cost basis, so you’re really incentivized to push any deal through.

But, in this case, Fortress had restructured all of their equity to vest at prices much higher than trust, and they were investing a $75m check into the PIPE at trust value ($10/share). Now Fortress has pissed off a bunch of PIPE investors who bought into a deal on a faulty outlook, and they’ve pissed off a bunch of SPAC shareholders who held through a deal and instantly saw the outlook massively cut and lost a ton of money. So Fortress managed to do huge damage to their reputation for pretty much nothing given it will now take the equity 3x’ing just for Fortress to be close to having some of their shares vest (as well as Fortress being down ~$45m on their $75m PIPE check).

So I don’t get it. If you’re Fortress, why not disclose the new (worse) outlook? Sure, redemptions might go up, but it’ll help your reputation*, and if redemptions go up enough then you can use it as a stick to bring ATIP back to the table to recut the deal / valuation to account for the new (significantly worse) outlook and maybe make your PIPE investors happy (and save your PIPE money from a big haircut).

*On reputation: lots of people like to say “this company is sponsored by big private equity firm X; they wouldn’t do something shady because it will hurt the PE firm’s reputation.” I’ll disclose I used to work in PE; I have great respect for everyone I worked with there, and I think ~90% of the people I worked with there were truly good people who I enjoyed being around. That said…. I think the notion of “reputation” is pretty overblown. Firms will happily sacrifice their reputation when millions of dollars are on the line, knowing that the markets have very short memories. But, given the equity vesting here, Fortress hit their reputation for basically nothing. That’s not a very good trade.

Anyway, I wanted to highlight this example because it’s so stark and so silly that it was worth pointing out. Again, it pales to some of the worst SPAC offenses, but it’s pretty bad. This type of “rosy projection to deSPAC / cut once your public” is exactly the type of thing the SEC was worried about when they started pumping the brakes on SPACs, and probably with good reason. If a company had done these shenanigans with some type of debt deal (i.e. raised a debt deal on a set of projections in June, and then pulled the plug on those projections in July), I think there would be an investigation and I would guess the lenders would have a pretty good case in court that the loan was made under false pretenses.

I’m not sure why that should be materially different for companies deSPAC’ing with absolutely egregious projections.

the warrants are 80 cents! That I don't get

To me, these are temporary hiring and inflation issues. Huge growing market, aging population and highly profitable. Oppt to continue to open locations with FCF while paying down debt. It will be a $12/14/$16 5x in a year. Backing up the truck...