Hi subs,

First, thank you so much for subscribing to the premium site!

Second, a quick housekeeping. You can always reach me at awalker@rangeleycapital.com with any questions / concerns etc. And, as the premium site is still a work in progress, feedback is very much appreciated. In particular, feedback on what you’d like to see in the monthly updates is welcome, but feedback / pushback on anything is always welcome. My current general thought for the monthly posts is to cover a general market thought, an overview into a sector I’m finding interesting, and then some more “odds and ends” of market things I’m finding interesting, but I’d love to be iterative based on where you’re getting / not getting value.

Finally, just wanted to make sure that everyone saw the ideas that have already been posted since some of you joined after they were posted. Those ideas were the Taubman preferred arb and the Macerich equity (summary here).

Anyway, on to the monthly update: three things on my mind.

General market thought: Dislocation opportunities

Tanker Stocks: rates exploding; what am I missing?

Other interesting things

General market thought: Dislocation opportunities

Markets have obviously been rather volatile over the past few months, and they’re up strongly over the past few weeks. I know a lot of investors are perplexed by that strength in the face of what will be an economic disaster over the next few months, and I certainly am too.

I think it’s important to remember one thing: the market is a discounting mechanism, but we’re two months into what is likely the single greatest economic dislocation of our lifetime. If there was ever a time for the market’s discounting mechanism to be off, this is it. I don’t mean this in a “the fed is propping the whole market up” or “buy stocks hand over fist” sense; I mean that there are likely to be companies that come out of this environment transformed as massive winners or enormous losers, and I suspect it will take a serious amount of time for the market’s discounting mechanism to reflect those outcomes.

There were three points in that paragraph I want to dive into: dislocation, broken discounting, and opportunity.

Let me break that point down: first, dislocation. Corona is likely to be the single biggest economic dislocation of our life times. I think it’s easily the biggest dislocation in America since WWII, and it’s hard to imagine something dislocating our life / economy more outside of WWIII or an alien invasion (even potential future pandemics are likely to dislocate our lives less than Corona; a lot of Asian countries handled Corona significantly better than the West because of lessons they learned from past pandemics (particularly SARS), and I would expect the West will learn lessons from the current pandemic that will improve our response to future pandemics; in addition, the infrastructure we build today will improve responses to potential future pandemics).

Second, the market’s discounting mechanism being broken. I think an example here might be best: The basics of most financial analysis involves looking at historical financials and using them as a basis for the future. “This company earned $10/share last year, and I expect them to earn $15/share this year. I’d pay 10x next year’s earnings for this company, so it’s worth $150/share.” Computer / quant funds in particular make use of this; a typical value quant fund will buy hundreds of companies that trade at really low P/E and short hundreds of companies that trade at high P/E and, over time, hope to capture some “value alpha” as those multiples mean revert. But Corona is likely to completely demolish those models. An example might show this best; consider a high end steakhouse that earned $10/share last year. All of their stores are currently closed, and there’s no telling when they will open. How do you value that company? Do you assume they’ll go back to making $10/share once the economy normalizes? How do you predict when we can “open” the country back up?

All of that is scary…. but it brings me to my third point: opportunity. It’s impossible for me to imagine that we’re six weeks into the greatest dislocation of our lifetimes, and we’re in an environment where many pieces of the market’s discounting mechanism are likely broken or nonfunctional, but there’s no opportunity for alpha generation. I actually suspect that current market is going to be the greatest environment for alpha generation we’ll ever see. The potential range of outcomes for a variety of stocks is huge; if you can successfully predict a bullish or bearish outcome, the payoffs can be enormous.

Anyway, I’ve got nothing crazy actionable for this particular section. I just wanted to highlight how I’m thinking about markets right now: the range of outcomes for a variety of thoughts and sectors is mammoth, and there’s likely more alpha to be had from having deep insight / conviction into an outcome than ever before. (If interested, I dove a little deeper on the opportunity side on the public blog; in general, I’m going to try not to have thought overlaps between the premium and public blog, but given how unique Corona is I figured an exception for this topic was ok!).

On to something actionable: tanker stocks

Tanker stocks

I’ve seen a lot of people pitching tanker stocks recently, and I’m very intrigued by them. The theory and math behind them are pretty simple: right now, oil is in mammoth contango (today’s prices cheaper than future prices) because demand is getting slaughtered so supply way outpaces demand. With contango, an oil trader can make a profit by buying oil today, storing it, and selling a future. It’s a riskless profit (this Reuters article covers it).

Contango has gotten so big (because demand so low) that the world is literally running out of storage. I believe all physical storage has been filled or is close to it. So now people are starting to rent tankers for six months, park them in the ocean filled with fuel, and use them to do this arb. One or two tankers do that, no big deal. But there are only so many tankers you can do that with until the whole fleet is offline. The more tankers you do this with, the more rates explode for the remaining tanks.

Now, people aren’t going to pay exploding rates if the arb isn’t there. But they can pay a lot at today’s contango and still make a pretty sweet profit.

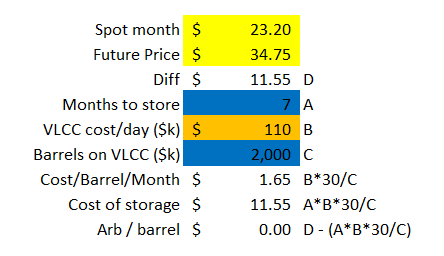

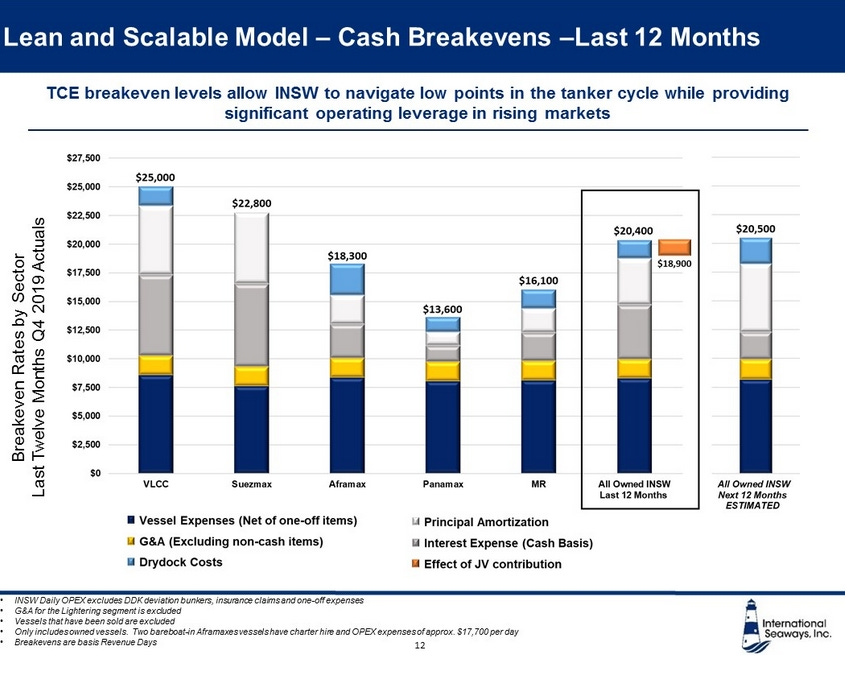

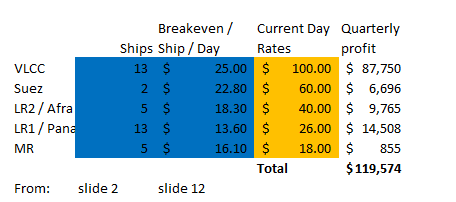

Here’s the math: I’m just pulling data from CME’s oil future. Near month is ~$23/barrle. December is ~$35.To make that trade, you take deliver of oil in May, store for 7 months, and sell in December. You capture $11.55/barrel before storage costs. A VLCC can store 2m+ barrels of oil. So at current contango, you could rent out a VLCC for $110k/day and you’d breakeven on that trade. Any less, and you’re making a riskless profit. (I’ve got the math on all this below).

It’s actually possible that you might pay over that arb price for VLCC’s at some point. It seems supply will continue to outpace demand in the near term. If you’ve got oil you need to take delivery of and no use for it, you have to get storage (you can’t just light it on fire or something). Imagine a scenario where all of the world’s storage is taken and you need to take delivery of some oil…. you’re going to be absolutely desperate. You will literally pay anything for storage because you’re not in it for financial reasons; you’re just trying to take delivery of the oil without breaking any laws (we’re not at that point yet; this article estimates global storage at 60% of capacity…. but it doesn’t take too many more months of anemic demand and oil build up to fill up that storage and drive prices through the roof.)

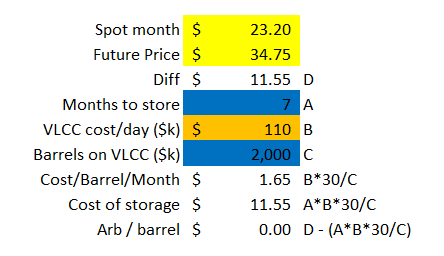

Anyway, ignoring the “panicked storage” trade, right now contango is driving exploding rates for tankers. The slide below is from INSW’s April investor deck and shows average rates for Q4’19 and Q1’20; currently, rates appear to be substantially higher than the Q1’20 rates (here’s reuters noting that VLCCs peaked at $235k/day and were trading at ~$125k/day yesterday).

Ignoring that rates are likely significantly higher than the slide above currently (which is a lot to ignore!), the tankers absolutely mint money at those levels. INSW provided the slide below that shows them making $441m annual EBITDA at “2015 peak rates”; those rates are a bit above what they averaged in Q1’20 but appear substantially below current tanker rates.

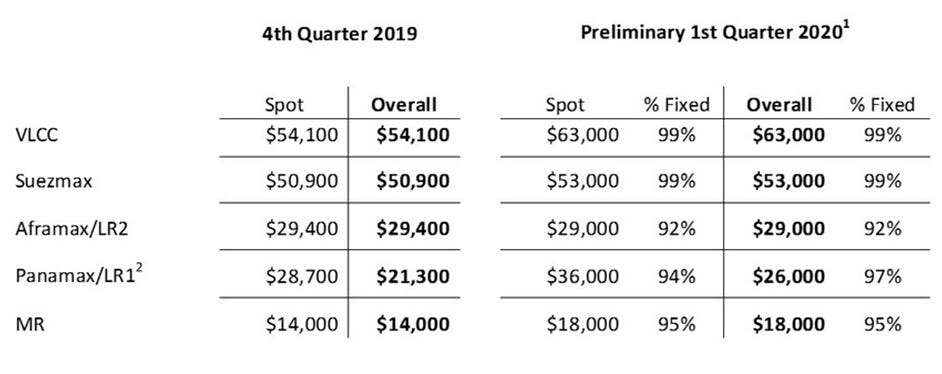

INSW’s entire EV is ~$1.35B, so at the rates / earnings profile presented above the whole company is trading for <4x EBITDA. Given a decent bit of leverage, the cash flow to equity is even more attractive. INSW actually gives their breakeven costs by vehicles, so you can plug in your own rate estimates and figure you how much cash flows through to the equity.

Ok, putting it all together, I estimate that at Q1’20’s rates they did ~$70m in cash flow to equity (and note this is real cash flow to equity, as the breakeven rates INSW presents includes interest expenses and principal amortization; they’ll pay down ~$20m in debt in the first half of the year), and that at current rates INSW should do significantly in excess of $100m in cash flow in Q2’20. INSW’s market cap is <$700m; we’re talking about them earning over $170m in half of the year so they’re earning ~25% of their market cap in the first half of the year. And INSW is probably the most conservatively levered of the tanker companies; a few of the more levered tankers could potentially earn the entire market cap (or more) in the first half of the year if rates hold up around these levels. I’ve posted a quick screenshot of the math for INSW’s equity cash flow this quarter below; it’s rough but I think it helps illustrate (note also that INSW has a JV stake in two FSO’s that should distribute another $11m in cash flow to them this year; see p. 7 of their 10-k).

It seems pretty simple… but I have three main questions.

My main concern is: what am I missing? The fact that tanker rates are exploding isn’t exactly a secret: I intentionally linked multiple articles from reputable international news sources showing tanker rates are exploding to show that main stream news sites are covering this. There are plenty of people on twitter covering every daily move in tanker rates, and while I don’t normally look at sell-side research, I glanced at a few and every tanker analyst I saw is both very bullish on tanker stocks and is frequently covering the rate explosion. I’m worried this is a “if you’re at a poker table and you don’t know who the patsy is, you’re the patsy” situation. If the arb isn’t a secret, why hasn’t the market already adjusted?

I tweeted this question out; some of the responses are interesting but nothing groundbreaking. This was by far the best response.

Semi-related to the “what am I missing” question…. I don’t understand why oil producers would continue producing oil as all the world’s storage fills up. As the world’s oil storage continues to fill up, contango will need to get higher and higher in order to support continued storage increases. There is a marginal cost to producing oil; at some point wouldn’t oil producers just shut it all down to match demand and supply?

What happens on the back end of this cycle? It’s great that the tankers are set to earn a ton of money in the first half of the year…. but what happens after the contango trade dies down? World oil demand is likely to be anemic for a long time; as soon as the contango trade is gone, there will be a glut of ships and rates should crash. I think the counter to this argument is that the tankers are going to earn so much in the near term that any terminal value beyond this contango trade is likely to be gravy, and that the contango trade is likely to take many of these tankers off the markets for multiple months (the trade I showed above was a seven month trade, and it appears most of the boats getting charter for storage are for multiple moths), so you have enough cash flow visibility looked in to not be too concerned with what happens after.

Shipping management teams are not exactly known for being shareholder friendly. Most of them have long histories of either 1) robbing shareholders or 2) being super cyclical in how they invest (when rates are high, spending all of the company’s money on expansion, only to see the company in distress when rates inevitably crash).

Anyway, that’s an overview of the tanker trades. I’m extremely interested in them because of the divergence between their near term cash flows and stock prices are so extreme, but I’m worried I’m a patsy…..

Other things I’m finding interesting

EBIX / YTRA: Yatra is an Indian OTA. They went public via SPAC a few years back. Last year, EBIX launched a strange hostile offer to acquire them (I mentioned how strange it was at the time). That offer eventually lead to a friendly merger agreement in July. The deal was supposed to close in Q4’19, but here we are in Q2’20 and the deal is still outstanding. In September, both sides put out a press release saying they “remain committed” to the merger, and both sides mentioned they were still working on the merger in their Q4’19 earnings releases / calls at the end of Feb / beginning of March. I’ve been following because the merger process was so strange, mainly due to the merger proceeds (EBIX was acquiring YTRA for preferred stock convertible into EBIX shares or, at YTRA shareholder options, redeemable for $5.31/share in cash 24 motnhs after the merger closed). With YTRA stock trading for $1.06/share, the returns to the deal going through and EBIX eventually redeeming the preferred stock for cash would be bananas (400% gross; 100%+ annualized). Given the radio silence on both ends (in fact, YTRA has not put out a press release in all of 2020!), how hard Corona has likely hit YTRA’s business, and just the general strangeness of both companies, I would guess the deal is overwhelmingly likely to break, but I wanted to highlight it because it’s such a strange / quirky situation.

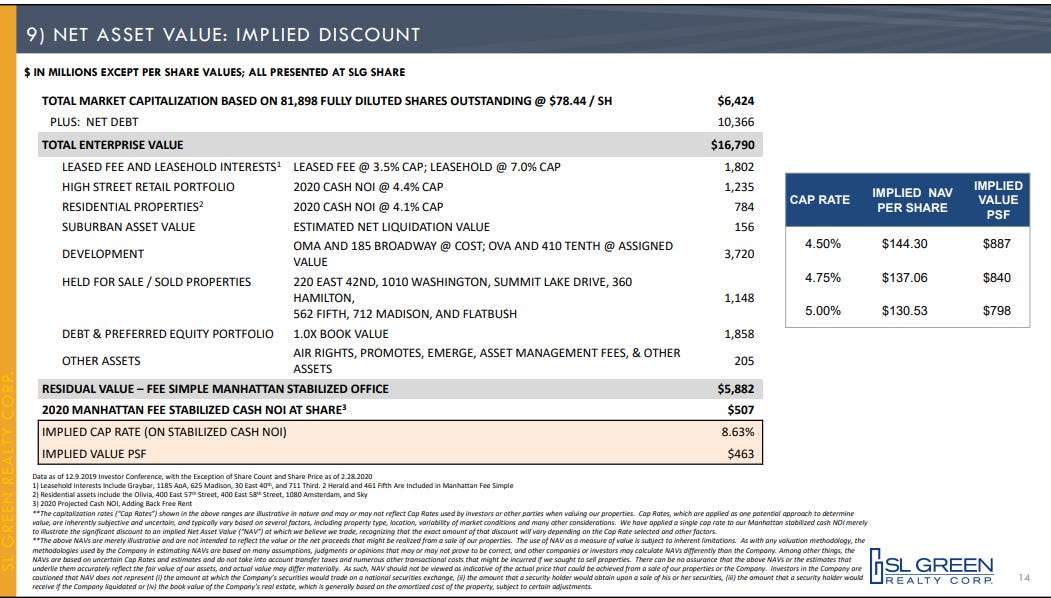

NYC office space: anything touching the NYC office space has been demolished. For example, SLG is trading for ~$54/share. I lifted the slide below from their March investor deck; at today’s share price, their deck would imply you’re buying their Manhattan office space for a ~13% cap rate. Now, I don’t agree with a lot of their assumptions, but you can haircut them in a bunch of different ways and you still get a high single digit / low double digit implied cap rate for their properties. Historically, NYC office space has traded at low to mid single digit cap rates, so the potential arb there is huge…. but the company has been making that argument for years, and the share price has done nothing but gone down. Going back to the dislocation theme, I do wonder how the NYC market space looks coming out of this: WeWork and the coworking players are likely going to look a lot different coming out of this, a bunch of retail concepts are going to be bankrupt, and companies may rethink their office footprint and how much they can work from home. My gut tells me there is some opportunity here: most of the office players are investment grade rated (so the Fed’s programs should guarantee them liquidity), and history suggests betting against big city office towers plays out poorly. Still, lots of questions in the air.

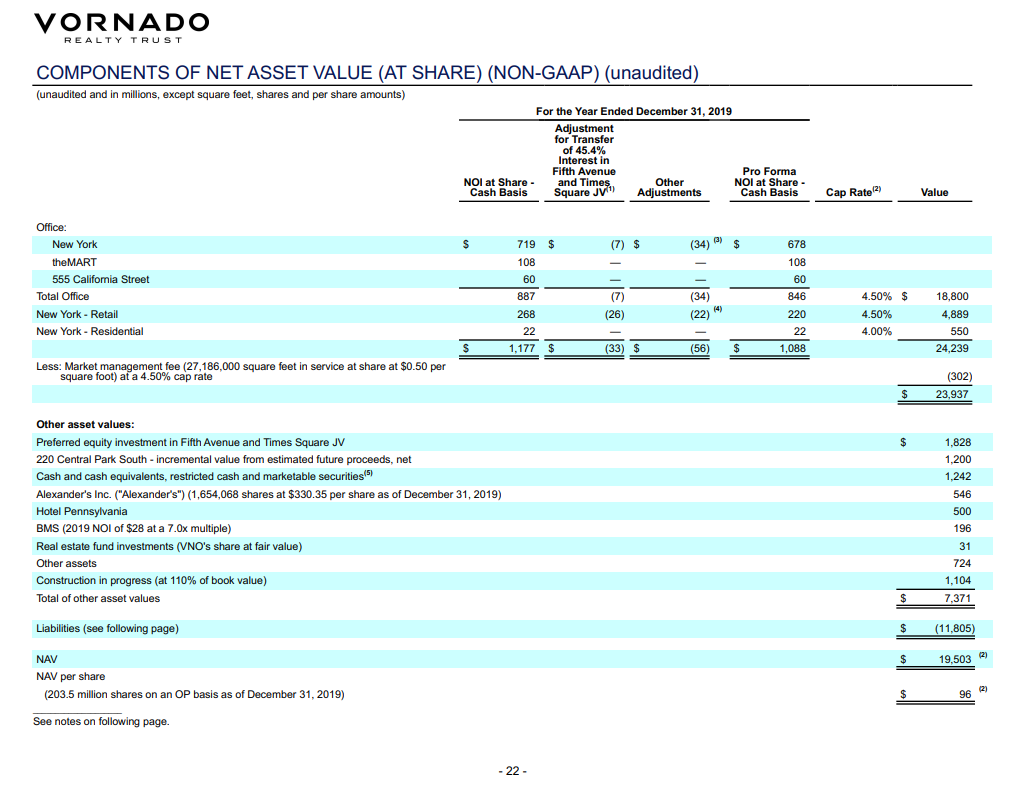

PS- I focused on SLG here, but VNO or any other loose peers are a similar story (based on SLG’s deck above, I would 37.5% of NAC and a 13% cap rate on their office buildings if you assume the rest of their marks are accurate. A similar assumption on VNO’s NAV puts them at 45% of NAV and a 10% cap rate). VNO’s shareholder letter is quite good and came out ~10 days ago, so it’s quite timely and worth a read. (VNO NAV assumption below)

That’s all for this month. Again, please feel free to reach out with questions / comments / concerns.