Premium Post: Buying some insurance

This insurance company could easily be worth double today's share price.

A quick tease / investment overview: the company I want to talk about today is an insurer. They’ll report earnings soon, and based on peer results I suspect the earnings will be extremely strong. Despite that, they’re trading for well under than book value. I think they are worth ~2x their current price, and that could prove conservative: the closest peers for their most valuable segment are trading for a much higher multiple; as the company cleans up its other lower return business, the value of that segment should shine through. With a recently reconstituted board and an activist holding a major position, I expect the clean up to happen sooner than later.

Anyway, the company I want to discuss? ARGO Group (ARGO).

Before I dive in, a quick note: ARGO reports earnings after market close today (Monday, August 3rd). In general, I don’t care much about quarterly earnings; I find the market is too focused on whether earnings are $9.99 or $1.01 and not focused enough on how the actually business is performing and what strategic / capital allocation steps management is making. However, in COVID times, quarterly earnings are quite meaningful as they provide a lot of insight / data into how the company is performing in an environment unlike any we’ve seen before. So I’m a little hesitant to post this before earnings, as the stock could easily be up or down 20% on some unexpected results and this whole thesis will look silly with the benefit of just a few hours of hindsight. Still, I think the thesis is super interesting and actionable, and I’d rather focus on process over results, so I figured I’d take the risk of this post becoming rapidly stale after earnings. To the extent there’s any new and relevant data in earnings, I’ll put an update in this month’s general update (and, of course, feel free to reach out to me via email if there’s anything you want to discuss in the meantime!).

Ok, back to the company. ARGO is an international insurance company. At the end of Q1’20, book value was ~$47/share versus today’s share price of <$35/share. So, on a statistical basis alone, ARGO is kind of interesting.

But I think that simple statistical basis misses something. ARGO’s U.S. business is an absolute gem and would likely be worth more than today’s share price as a standalone company. ARGO’s international business is a mixed bag of goods; on the whole, most of them aren’t great, but some pieces of them are good and there’s certainly some value there as well. Put the two together, and you get a share price way higher than today’s.

That’s the basics of the investment thesis. However, there are two particular twists to the thesis that I think make ARGO particularly interesting.

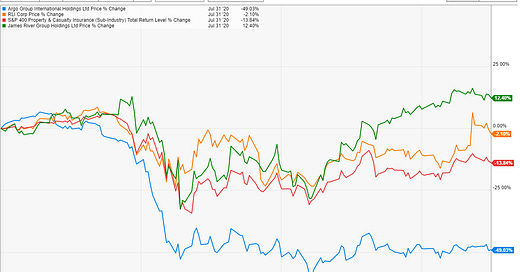

The first twist is ARGO’s share price has substantially under-performed peers since the March bottom. As I’ll discuss further in a bit, I see no reason why ARGO should be underperforming peers like this. Insurance markets are currently hardening (experiencing rising prices / profits), and that should be good for all insurers but particularly insurers like ARGO that trade for a fraction of peer values.

The second twist is ARGO seems ripe for some type of corporate event. I’m not sure if that’s a full sale of the company or simply a split up of some type, but I suspect the status quo at ARGO cannot hold for long and any corporate event would send shares significantly higher.

Why do I think that?

ARGO engaged in a bruising activist battle with activist Voce last year (which included this fantastic 130 page deck blasting the company and highlighting its potential value). The company eventually settled the battle after their CEO resigned in the midst of an SEC investigation into compensation practices.

Voce owns ~9% of ARGO, and at this point their investment in ARGO is basically their only meaningful investment (making up 70% of their fund per their last 13-F). Voce is going to be very, very motivated for the company to unlock value here. And I suspect the board will be motivated as well: with much of the board reconstituted on the heels of the Sec investigation / settlement, a stock price down ~30% over the past five years (and ~50% over the past year!), and a major shareholder doubling as an activist substantially underwater on their investment (Voce’s cost basis is somewhere in the mid-50s versus today’s price of <$35), ARGO knows that they’re on a short leash and will need to quickly maximize shareholder value if they want save any face; otherwise, shareholders will quickly replace them and bring in someone who will.

Either way, I suspect a value unlocking event will take place at ARGO sooner than later. The goal of the value unlocking event will be to highlight their gem of a U.S. business. This could be accomplished in a number of ways: they could sell the whole company, they could sell or wind-down the international operations, or they could sell the company in parts. But something will almost certainly happen, and when it does it will help the market to see through clearly to the value of the U.S. operations. Given the U.S. operations are likely worth significantly more than today’s share price, any move to unlock value should drive shares significantly higher.

Ok, that’s the situation overview. Let’s spend time diving into ARGO’s parts and discussing why I think value is higher.

The key piece of value here is the U.S. business, so I’m going to focus the vast majority of time there. The U.S. business is a leading Excess and Surplus (E&S) specialty insurance business. E&S insurance writes hard to place risk that fall outside of the standard insurance market, often because of unique risks characteristics. A perfect example of E&S is here: standard insurance would underwrite a normal pest control business, but E&S would underwrite a pest control business focused on trapping feral animals. A more fun example? The time Berkshire insured Pepsi’s “Play for a billion” game; it was a unique event with a huge potential payoff (Berkshire’s annual $1B march madness bracket would fit here too). The Pepsi article notes that Berkshire may have been the only company who could underwrite that risk.

E&S can be a very good business. Offering insurance is generally a commodity game where everyone competes on price; however, if you’re underwriting something unique (which E&S does!), there should be less competition which should result in better pricing and potentially stronger profits. Many of value investors favorite companies have some type of E&S business: Berkshire, Markel, Fairfax, and a variety of others have an E&S arm, and many of them post consistently strong profits / returns on equity. Of course, the flip side is you can blow up writing unique risks if you don’t know what you’re doing (think AIG writing CDO insurance pre-financial crisis).

ARGO’s U.S. / E&S business is very good; however, the strength of its results are buried within the the consolidated results of the whole company.

In general, how good an insurance company is can be judged by their combined ratio. The combined ratio ratio tells you how much a company spends for every dollar of insurance they underwrite. A lower combined ratio is better; for example, a combined ratio of 95 means that for every dollar of insurance the company writes they spend 95 cents in expenses, meaning there’s 5 cents of profits left over.A combined ratio of 100 would mean the company has no profit left over; 90 would means there’s 10 cents left over.

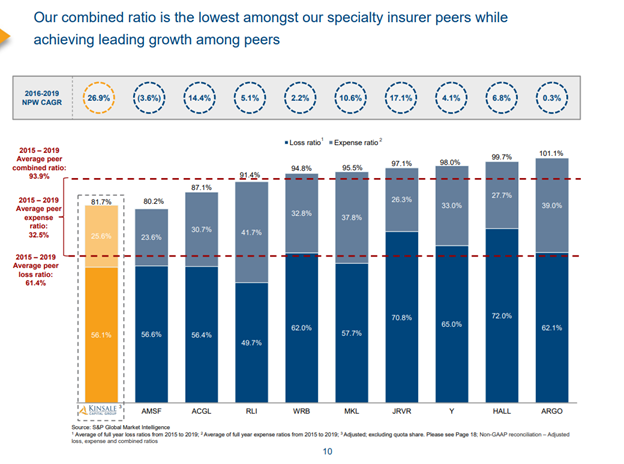

A combined ratio is the absolute most important metric when it comes to judging an insurance company. Why? Because other things can be pretty quickly changed; for example, a lot of insurance company’s profit comes from investing the “float” they get between writing a dollar of insurance and paying out their expenses (a big reason Berkshire grew so large; they combined float with the world’s best capital allocator). Your float investment can be pretty quickly changed: if your current investment manager sucks, you can quickly switch to a new one (or a buyer with a good investment manager could underwrite your current economics with their investment manager!). But the combined ratio shows the underlying profitably of the core insurance business. And on that metric, ARGO’s U.S. is really good. I pulled the slide below from KNSL’s investor presentation; note that it has ARGO’s consolidated business as the worst business among all peers.

However, if we isolated ARGO to just its U.S. business, the results would be very different; their U.S. business’s combined ratio over the past five years is ~90% (which would put them in third place on the chart above), with an expense ratio roughly in line with peers and a loss ratio well below peers.

Given ARGO’s U.S. business is towards the top of peers, it should likely be valued roughly in line with peers. That would call for a premium valuation; I’ve got all of the peers’ price to book and price to tangible book value below. Outside of HALL (which is a bit distressed), none of the peers trade for below book value. Many actually trade for a multiple of book value (see odds and ends for a bit more on this). I suspect that if ARGO’s U.S. business traded standalone or was shopped, it would trade for a similar premium.

Hopefully, at this point, I’ve established that ARGO’s E&S business is a good one (at the higher end of peer businesses) and that it should likely trade for in excess of book value.

At the end of Q1’20, ARGO’s U.S. business had a book value of $1,099m and a tangible book value of $976m (see 10-Q p. 31). ARGO has ~34.5m shares outstanding, so if the U.S. business is simply worth book value the U.S. business alone would be worth almost $32/share, or roughly today’s share price.

There are some simplifications there. For example, there are some small corporate liabilities we’re ignoring (I’ll get to those in a second), and we’re of course zero’ing out the International business. Combined, the corporate liabilities and international business have a book value for $538m, or ~$8/share, so it’s not like we’re ignoring some huge liabilities (these should be a source of value!).

We’re also assuming Argo’s U.S. business is worth book. As a standalone business, I’d be surprised if the U.S. business wasn’t worth at least 2x book; with a 90% combined ratio, its ROE should be at least in the high teens, so both the fundamentals and peer multiples would suggest 2x book value is probably conservative. If I’m right, the U.S. business alone would be worth >$56/share. Throw in some value for the international business, and I think Argo’s easily worth more than $60/share.

Given ARGO is currently trading just over $30/share, maybe that valuation seems aggressive. I think the logic is pretty clear, but let me point out some more supporting facts:

Acquisitions in the space tend to happen at nice premiums. Markel bought State National a few years ago for almost 3x book value. Hartford bought Navigators for approaching 2x book value towards the end of 2018 (I mention because ARGO is listed as a peer in the proxy).

ARGO’s shares traded towards roughly my fair valuation as recently as February. Obviously, share prices can trade at any valuation and aren’t really a support, but I’ve seen nothing since February and now that suggests ARGO’s intrinsic value should be lower.

Let me dive in on that last point a little more: while ARGO’s share price has collapsed since COVID, there’s nothing I see that suggests their shares should be so hard hit.

In fact, I think E&S players are actually benefiting from COVID. The quote below is from ARGO’s Q1’20 call; note that it mentions continued pricing tail winds and discussed positive momentum into April.

This is not an ARGO exclusive thing; we’ve seen that momentum playing out across the board from all of their peers into their Q2 earnings calls. Some highlights:

Rli Q2’20 call: “Rate momentum has continued with double-digit increases on our property and casualty portfolio on both a quarter and year-to-date basis. We're still seeing pockets in the P&C space and certainly in surety that remain quite competitive. But our results for the quarter speak to our resiliency as a company.”

JRVR Q2’20 call: “current market conditions throughout our three segments are very attractive. Core E&S renewal pricing improved by 20%. This was our 14th consecutive quarter of rate increases and the highest quarterly increase in our history. We wrote $180 million of Core E&S premium this quarter, more than double the amount in the same quarter two years ago, and an increase of 18% as compared to the second quarter of last year.

More from JRVR “I think the momentum of the first half of the year is shaping up to continue. And our plan is to stick to our plan to continue to write business we understand at prices we expect to produce material underwriting margin”

More from JRVR “In general, as I mentioned, 20-plus percent decline in claims frequency in both our Core E&S book and our Specialty Admitted book, and I think that is clearly the result of kind of suppressed activity in the -- people are at home more and restaurants are having takeout, and all of those things that we all know about that are slowing activity are slowing claims. And yet that is happening at a time when rates are rising because of a lack of capacity in the market and because of inadequate pricing by large parts of the market for many, many years and the withdrawal of the largest E&S writer from much of the E&S business and admitted companies leaving the E&S market.So we're having depressed claims, increasing rates and yet, we're holding very high. I don't want to say overly high, but we're not holding conservative reserve positions. So I think it's a vortex, and it's a very positive one for us right now. The winds are blowing in our favor.

Make no mistake: I’m not suggesting trading ARGO on earnings for a pop or anything. I’m just highlighting that shares have been hammered since COVID, and I see no reason why. It shouldn’t be from incremental investment losses (most of these were taken Q1’20; there is some lag from alternatives getting marked a quarter behind but those are small) or COVID losses; they’ve already disclosed the Q2 results from both of those (it comes out to <$2/share in negative Q2’20 marks). Those marks should be mainly offset by a variety of things (gains from the rest of the investment book, a small gain from the sale of Trident closing in Q2’20). So I don’t think there are any ARGO specific things here that suggest they’ve been unusually impacted by COVID or anything in Q2. In fact, I think it’s more likely ARGO has just been ignored by the market, and that their earnings tonight and for the next few quarters will surprise the market with how strong they are.

Bottom line: ARGO is currently a more complicated story than peers, and the market hasn’t seen through that complication yet. But, at least in the U.S. (where the vast majority of value is), Q2 should be strong, and I’d guess that pricing momentum continues for some time. The new board should be motivated to clean the company up, and as they do the market should rerate ARGO higher / closer to their peers.

Risks

There are absolutely risks here. Insurance companies are prone to all sorts of disaster risks, and sometimes it can be unfair. If you underwrite insurance on a building on one corner and I underwrite the exact same building on the other, I would show huge losses if my building burns down while you’ll show moderate profits even though we took the same risks. So obviously you have some general insurance risk here. But there are two specific, unique, and somewhat connected ARGO risks here.

The first is just general cockroach risk. Again, the old CEO “resigned” because of an SEC investigation into improper exec comp. Cockroach theory would suggest a company and a CEO that were willing to skirt the numbers when it came to exec comp would also be fine with toying around with the numbers in other areas. That’s a disaster when it comes to insurance; insurance companies are very accounting / assumption driven and insurance companies that are a little aggressive with numbers can report big profits in the short term while guaranteeing implosion in the medium / longer term (note that the SEC investigation itself is no longer a risk here; ARGO settled in June).

That blends into the bigger risk here: assumptions. ARGO could be reporting higher than normal earnings because they’ve been underreserving or doing some other type of improper risk. There is some small evidence that’s the case here: ARGO has a “run-off” division that consists exclusively of decades old liabilities from old insurance lines that they no longer write (primarily asbestos liabilities). ARGO has consistently proven to be under-reserved here, posting a total of ~$36m in losses over the past three years as they needed to increase their run-off reserves. Given run-off had <$300m in reserves in 2017, that’s a pretty big reserve miss! Similarly, international has consistently posted unfavorable prior year loss developments, including a mammoth $110m write off in 2019 (an enormous amount given they write ~$600m in business/year!).

So there is some risk here. However, the good news is that the core U.S. business has not seen the same unfavorable developments that the rest of the business has; in addition, it appears that the U.S. book tilts a little more heavily towards “short tail” insurance (things like property insurance, where you’re only exposed to any damage that happens within a year so you should know pretty quickly if you missed on your reserves) versus longer tail insurance (something like promising to pay for someone’s healthcare for the next 50 years, which is very sensitive to a whole host of assumptions!) than the rest of the company, though I’d generally be a little more comfortable with more short tail exposure!

Odds and ends

A little follow up on the U.S. E&S peers multiple: it’s tough to compare any because many of them have other business lines. The below is from KNSL’s investor deck; ARGO’S U.S. business is nearly exclusively E&S, so as a standalone unit it would be at the top of the chart (and insurers towards the top of the chart are trading for very high multiples!).

I mentioned earlier that acquisition multiples in the space have generally been high. I obviously think ARGO is an acquisition candidate in some form (either the whole company, or with pieces broken up). I’d be remiss if I didn’t mention that private equity players have proved desperate to get involved with insurers. Doing so makes sense; insurers control a ton of float so they have a huge amount to invest, and private equity is ostensibly good at investing. The market has loved private equity / insurance deals; for example, KKR was up 10% on an announcement they bought an insurer last month. I’m not sure ARGO is a perfect fit for a private equity firm, but private equity’s love for the space provides ARGO a lot of extra options. If a bidder loves a specific ARGO division (i.e. the U.S. segment), it should be pretty easy to find a way to realize value for the rest of the company from a private equity player. Or there should be plenty of options to reinsure / get out off longer term risks at a nice price from all of the private equity players desperate for long term assets.

I may not have driven this home enough in the main write up, but a nice thing I like about ARGO is I think they’re about to hit an inflection point where they go from “entrenched board focused on enriching management” to “board and management team that are really incentivized to deliver shareholder value.” Five legacy board members (out of 13) resigned and were replaced by 3 new board members at the most recent shareholder meeting, a new CEO is in place, and in response to the SEC investigation ARGO adopted a bunch of shareholder friendly incentive structures (increasing stock ownership guidelines, adding return on equity to their performance goals, measuring performance over longer time periods, etc. See p. 34 for more). You could boil down the thesis pretty simply to: old management had some nice assets and ran them like a piggy bank, new management is incentivized to highlight those asset’s value and will face a revolt if they don’t. In general, my experience has been that good assets in the hands of a management team incentivized to realize value have their value realized, and it works out for shareholders.

Just to spend a little more time on the former CEO, ARGO was basically run like his piggy bank. The clip below (from their proxy) shows all the side perks the investigation into his comp exposed. Those are easy synergies going forward, but they’re small in the grand scheme of an insurance company with >$1.5B in equity value. I think the real value comes from replacing a manager who viewed the company as a piggy bank (going so far as to use company funds to buy the CEO a Manhattan penthouse!) with a management team more focused on creating shareholder value.

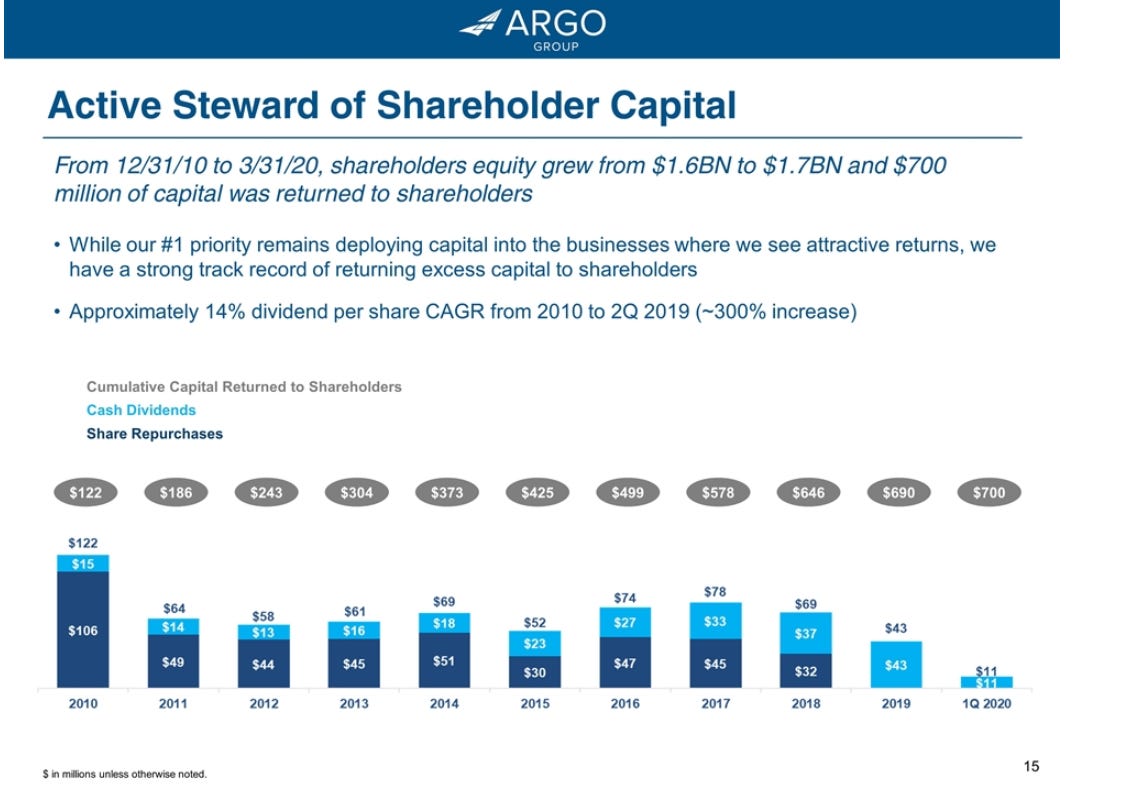

ARGO has a decent history of returning capital to shareholders; with shares languishing below book and management / the board feeling pressure from shareholders, I wouldn’t be surprised to see capital returns to shareholders increased (particularly if they did something like sell off the international operations).