Premium Post: Cutting into a microcap (paywall)

Note: this stock is absolutely on the smaller side. I know this is below the investable market cap for some subscribers, but this is probably the most interesting idea / situation I’m looking at right now, so I wanted to write it up because I want the premium service to focus on my best /most actionable ideas regardless of size. Market cap here is just under $100m, with a free float of ~$55m given significant insider ownership. So please use limit orders and be careful. I’m working on two other ideas that are much larger, so if this is too small for you there should be plenty of other ideas in the near future!

Prodex (PDEX) is a tiny, reasonably unknown microcap. Activist Nick Swenson got involved in 2011, and the stock has been a multi-multi-bagger in the years (going from ~$2/share then to >$20/share today) since as the company sold off a noncore division and successfully focused on growing their medical products business.

I think that business has a bright future, and the stock could be another multi-multi-bagger as new product wins and growth drive results. However, a near term dislocation and some insider signaling suggests to me the potential for significant alpha in the near term.

There are two parts to this investment thesis. The first part is the shorter term and sexier part of the thesis: the event / insider signaling.

The second part is the less sexy but more important foundational work of the fundamental thesis.

Let’s start off by digging into the sexier part: the insider signaling.

My friend Mike from Nongaap came up with the term “corporate dark arts” for insiders altering their comp ahead of good or bad earnings (i.e. granting themselves options before a blow out quarter). A key piece of the dark arts is that once you’ve seen someone pull off a dark arts maneuver before, it’s a huge tell going forward. Companies might move around options grants and comp for a variety of reasons, but if you’ve seen them do a spring load before there’s a good chance they’ll look to do a spring load in the future.

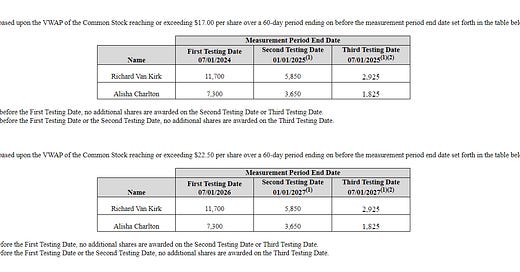

So, with that in mind, I’ll refer you all the way back to December 2017. PDEX’s stock was trading for ~$7/share, and the company put out an 8-k that had some very interesting performance targets for their CEO and CFO (what I will call “the first grant”). Each exec was granted stock that vested if the share price achieved a certain price by a certain time. For example, the screenshot below includes the fourth and fifth performance target. If you look at the fourth performance target, the CEO would be given 11.7k shares if the stock’s VWAP was $17/share before July 1, 2024. If he missed that target but did it by January 1, 2025, he’d be given 5,850 shares instead. If he missed that, he could get ~2.9k shares by hitting the target by July 1, 2025. After that, the target failed and he got nothing.

At the time of that 8-k, PDEX was trading for ~$7/share. To hit the max payout of the fourth performance target, the stock would need to do ~15%/year through July 2024, and the minimum payout called for a 12% CAGR through 2025. That’s not the most aggressive bonus package I’ve ever seen, but it is up there. Think about that fourth performance target. The stock could CAGR at 10% for the next five years and the CEO would get nothing from it. The stock had to CAGR at 12% just for him to pick up $50k.

A company isn’t going to give a CEO a bonus package that aggressive without feeling reasonably good that he can hit those targets. Sure enough, by late 2020, PDEX’s stock was trading over $30/share, and the CEO and CFO had hit all five of their performance targets. Given the fifth target called for the stock to be at $22.50/share by 2026, that’s a pretty impressive performance and a very early cash in!

So let’s fast forward to December 2020. The stock is at $40/share (an incredible 80% IRR from the $7/price at the time of the 2017 grant), and the CEO and CFO have achieved all of their stock targets from the 2017 grant. Naturally, the company decides to award them another similar grant package in December (what I’ll call “the second grant”), though this time the package is a little different. Instead of giving the execs stock that vests at certain levels, the company gives the execs options that vest when they hit certain share prices. For example, the fifth target (see below) vests if the VWAP of the stock is $50/share over the 60 days preceding 07/01/2030. With the stock at $40/share when these were granted, that’s not a lot of price movement for those options to vest. If the stock merely compounds at ~2%/year, these options would vest, though they wouldn’t be worth much.

Anyway, the structure is a little different and certainly much less “YOLO” than the first grants, but the second grant had enough similarities to the first one (that the company granted right before the stock went on an epic run) that it was worth paying attention too.

However, that second grant is not the event that’s so interesting.

What’s so interesting here is what happens after the company grants those options. The stock plummets, getting almost cut in half. Some of the move lower may have been driven by this small insider sale, some might be driven by the company establishing an ATM program (which they haven’t used yet), and a decent bit might be from their “earnings miss” (though I’m not sure what analysts are covering it to set those estimates!), but the stock drops a decent bit and suddenly just getting in the money on the December 2020 options grant starts to look difficult. Just hitting the vesting level of the fifth target ($50/share by July 2030) will now require the stock to do ~9% annualized. And remember- hitting the vesting level doesn’t make the execs money; to really do well, they need to stock to be substantially above the vesting level! So, post-drop, the stock needs to go on another truly epic run just for those December grants to have any real value for insiders.

Now comes the interesting part. On February 23, the company responds to the drop by giving the execs a new stock option plan (“the third grant”) with some very interesting targets. The third grant has one vesting target: a $27.50/share price with a first test date of July 1, 2021 (just over four months after the grant date).

That is a wild, wild grant. In order to vest, the stock has to appreciate ~20% in ~4 months. With such a tight time frame, the IRR to hit the max grant is almost triple digits, and the IRR the stock needs to do to hit the minimum target ($27/share by July 2022) is >15%.

So the appreciation and returns for this to vest are juicy…. but I think there’s more to this grant than just pure upside. I don’t know if I’ve ever seen a company give an executive an option that required that stock to appreciate within five months in order to fully vest. It seems hopelessly short sighted, like telling the CEO, “hey, just stare at yahoo finance and go pitch the stock on WSB all day in order to get paid.”

Anyway, if any company granted a team an option package with that payoff / vesting structure in that tight of a time frame, I’d be pretty interested. But the fact that PDEX is the company granting the options here makes it all the more interesting because we know from the first grant that PDEX is willing to engage in the “corporate dark arts” and grant execs stock with price hurdles that seem aggressive but that are achievable. My guess is that PDEX granted these options knowing full well that business is doing very well, and the market is likely to be pleasantly surprised with the near term news flow out of PDEX. Maybe that “pleasant surprise” is revenue / earnings for their next report coming in better than expected, or maybe the company is about to announce a few new product wins.

Either way, I can’t imagine that PDEX is given those options with a four month vest without a very clear idea of how to get to that stock price target…. in particular, I can’t imagine that PDEX’s board is giving execs those options without a clear path to hitting max payout because PDEX’s board granted themselves those exact same options. That’s right, check out the footnotes on the directors’ recent form 4s; they granted themselves the same options package that requires the stock to appreciate 20% within ~4 months in order to hit the max vest. This is particularly notable because the directors did not grant themselves similar options / RSU packages alongside the first and second packages.

It’s one thing for a board to grant an executive team an aggressive options package. It’s quite another for the board to grant themselves the same package. And it’s still a third thing for the board to give execs aggressive options packages three times, but decide to include themselves in the third package after skipping the first two. There’s only one reason for that fact pattern / for the directors to do that: if they were absolutely positive the stock was going to be much higher in the very near term (and they were a little greedy).

I think the grant is made even sexier by the fact the activist (Nick Swenson) owns >25% of the company and serves as the chair of the compensation committee. Look at his history with Pro-Dex and AIRT; both are multi-multi baggers since he got involved. The fact that he’s this deeply involved and is giving management short term options with this type of upside (and taking some for himself!) screams that the stock is too cheap and going higher in the near term.

So that’s the sexy event: company insiders are clearly signaling they think this is going a lot higher very quickly. The question is: why are they so bullish? And I think we can find some of the answers to that if we go into the non-sexy, more fundamental side of the thesis!

Fundamental Thesis

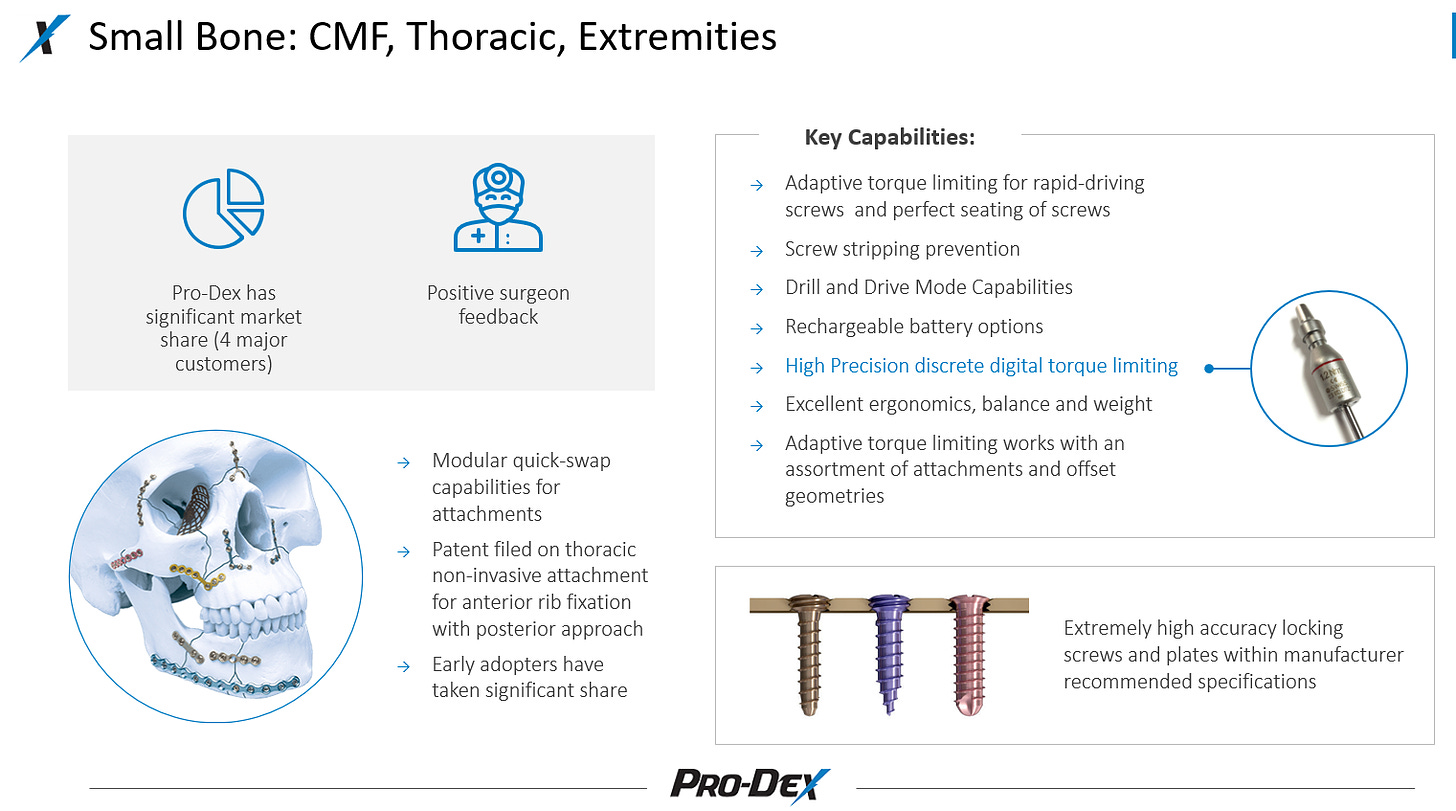

Pro-Dex designs and manufactures surgical drivers and shavers.

Just at a high level, it’s pretty easy to see the potential for this to be a good or very good business. Pro-Dex is manufacturing FDA regulated devices (which reduces competition), and the all-in cost of their devices is a small part of the overall cost of a surgery but a large part of the surgeon’s experience when performing a surgery (i.e. many of Pro-Dex’s products are the actual thing a surgeon is holding in their hand when performing surgery). Roll that all together (the combination of a regulated product, a product whose cost is a very small component of the overall cost of an operation, and a product that makes a material difference in surgeon’s comfort), and you have the potential for a very good business. If you’re in charge of purchasing for a hospital and you’ve been buying a PDEX product, are you really going to switch away from them to a competitor’s product to save, say, $100, and risk having a surgeon lodge a complaint that they’re less comfortable during surgery because you’re trying to pitch pennies by switching to a new brand?

An example might show this best: JNJ’s DePuy Synthesis division sells the MatrixPRO Driver for drilling CMF screws. The “Pro” in “MatrixPRO” stands for Pro-Dex (you can see them listed as the manufacturer on the instruction manual). That product is used for drilling extremely small screws (3-4 mm) into someone’s face. That’s a reasonably delicate and pricy surgery; if you’re an administrator and JNJ raises the price of that product by $50, are you really going to switch to a competitor’s product? And, if you’re JNJ and Pro-Dex tries to take a small amount of pricing on that product, what are you going to do? Pro-Dex holds the tech and is the manufacturer of record at the FDA; it would take years to switch to a competitor (and a small amount of pricing can go a long way; you can see the price of one of PDEX’s products on the second page here)!

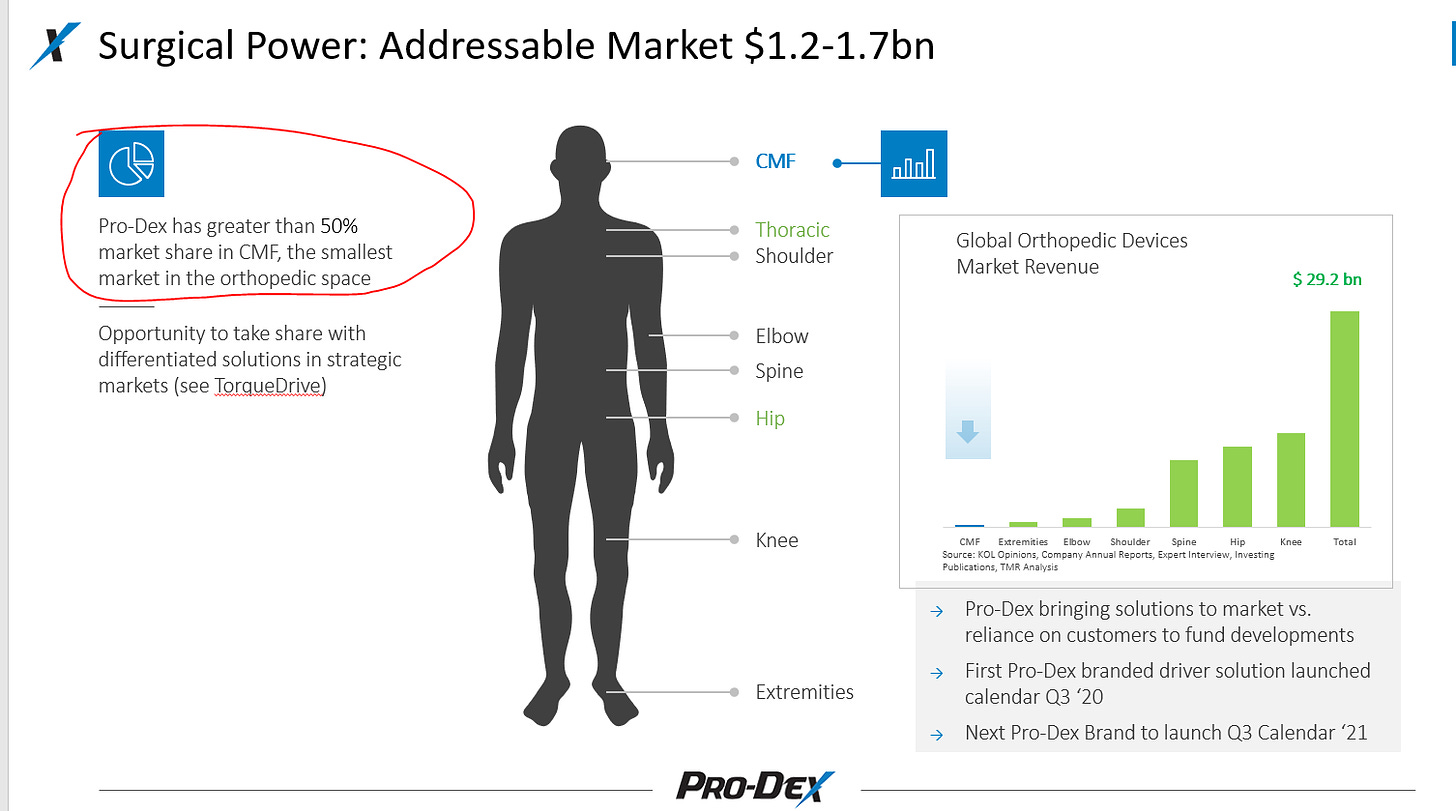

So, if done right, Pro-Dex has the potential to be a very good business. Medical devices should be reasonably economically resilient, and Pro-Dex should have some pricing power over time. Somewhat surprisingly for their size, Pro-Dex should even have some scale benefits; the company suggests they have more than 50% market share in the CMF space.

So, bottom line, I think PDEX has all the makings of a potentially very good business. Barriers to entry, sticky product, high market share in their niche, limited economic sensitivity, etc. And, at today’s prices, you’re paying a pretty reasonable multiple (~15x LTM EBIT) for PDEX.

But where things get really exciting, and where the fundamental piece merges with the sexy insider signaling above, is in PDEX’s growth potential.

Remember, the whole sexy part of the insiders signaling was they appeared to be positioning for a dramatic near term increase in share price. And the thing most likely to drive that dramatic increase is a big near term boost in revenue that catches the market off guard. With some digging, I think we can see where that boost could come from.

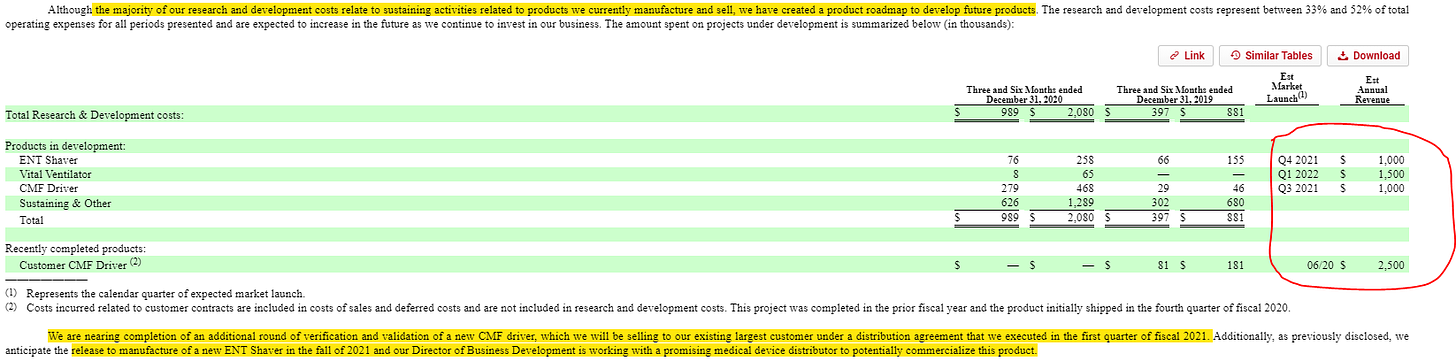

The first place to look is in PDEX’s 10-Q. I’ve pasted a table describing their R&D below.

Notice the numbers I’ve circled; Pro-Dex is launching four products within ~18 months that will do ~$6m in projected revenue. That is not a small number for a company PDEX’s size; remember, LTM revenue is ~$36m (to be fair, that LTM includes a little bit of the $2.5m CMF launch from June 2020).

So I think there’s a pretty easy story that could be told here: in December, management got real bulled up on the near term revenue schedule and granted themselves a boatload of options before all of these growth products kicked in. Then the stock crashed, everyone associated with the company (management, the board, etc.) saw the growth drivers starting to deliver as the stock fell, and they all got even more greedy and double dipped on the options.

I’m not saying that’s 100% what happened, but it does have a nice ring to it.

Things get even more interesting if you pay attention to what was asked at their annual meeting. I’ve included the most interesting quote from it below; you can find some more highlights here. I have a pdf transcript of the whole thing, but as it was shared with me I’m hesitant to just blast it out. If you’re interested, ping me and we can figure something out. I’d also encourage you to check out their most recent investor pres here.

Now that’s really interesting. That’s the company discussing two different potential large launches that will happen within their Fiscal Q3’21 (January-March 2021; the quarter we’re currently in). Again, that quote seems to neatly fit the narrative that the company is seeing great results in the current quarter, and that their growth has taken another leg up, and they gave themselves the third grant because they got a little greedy looking at the discrepancy between share price and value.

I don’t want to harp too much on the near term growth prospects; again, I think it’s an interesting hook, and I think it shows how bullish insiders are versus the current stock price. But there are plenty of other things to like about Pro-Dex. For example, the 10-k (see p. 20) mentions they are one of 8 companies chosen for NASA’s VITAL ventilator program. I doubt that’s a big needle mover in terms of revenue or anything, though I could be wrong, but I think the fact Pro-Dex was one of eight companies selected speaks to the technical expertise and capabilities here.

In November, Pro-Dex bought a property (the Franklin property) for ~$6.5m. That property is located “down the road” from their current portfolio and will be used to expand their capacity (the 10-Q notes that the property will go active in the summer). At the AGM, the executive team suggested that Pro-Dex could do $80-$100m in sales (or more) with their current asset base. To wrap this up, I think it’s useful to think about what Pro-Dex would look like at that level of sales, because it helps to frame exactly why insiders seem so bullish here.

In the LTM, PDEX has done ~$36m in sales. Margins have taken a slight step back in the LTM (mainly due to a big increase in R&D), but over time you can see PDEX has been getting operating leverage on both the gross margin and EBIT lines.

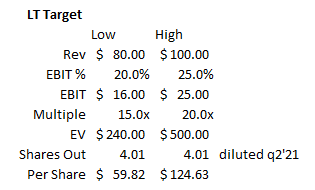

It’s tough to estimate how high margins could go if and when PDEX approaches their growth targets, as there’s no perfect comp for PDEX. Still, just triangulating a little bit based on their current trends, loose peers, and a little industry experience, I don’t see any reason why PDEX’s long term EBIT margins can’t approach 25%; I actually think they could go higher in the right scenarios but let’s just say PDEX could hit 20% margins (which they did in 2020) on the low end and 25% on the high end. If we applied those multiples to the $80-100m in sales capacity, PDEX could do $16m in EBIT on the low end and $25m on the high end. Slap a 15-20x EBIT multiple on those numbers (probably conservative; loose peers trade at 20-25x EBITDA), and we’re looking at a share price of $60/share on the low end and ~$125/share on the high end.

I’m not saying PDEX is going to get there tomorrow. In fact, I’m not saying PDEX is going to get there at all. I’m just trying to frame out what I think PDEX’s management team might be looking at / thinking when getting bullish on the company.

The other angle here to consider is that, at some point, I think PDEX is an acquisition target. I would guess that’s a long way off; again, the PDEX team seems to be in this for the long haul and wants to grow the business massively. But that’s probably the endgame, and if and when they do sell the multiple should be eyebrow raising. PDEX dominates their niche, which tends to be the type of thing larger players pay up for, and the synergies between PDEX and a larger company would be huge. For example, in the last twelve months, PDEX has spent ~$3.5m on G&A. Note that is pure G&A; selling and R&D costs are broken out separately. I would guess almost 100% of that G&A cost would be a synergy in a merger. PDEX’s LTM EBIT is ~$6m and their current EV is <$100m, so the potential synergy from G&A cuts alone is absolutely enormous!

Anyway, I’ll wrap it up here. PDEX’s enjoyed a massive run over the past few years, and I think if you just glanced at the financials you’d think it’s a nice microcap company that’s fairly valued. But I’m not sure I’ve ever seen an insider move signaling so much bullishness as the directors giving management and themselves the third grant, and if you dig through the filings and some other stuff I think you can see a massive growth opportunity and why insiders might be so bullish.

Q3’21 wraps up at the end of March, and the company generally reports Q3 earnings in early May. When they do, I expect we’ll get a lot more visibility into some of the company’s near term growth prospects.

I think the market will like what it sees, and I expect management will easily hit the vesting targets for the third grant. Most likely by the first date (this July), but almost certainly by the later date (July 2022) given all of the growth initiatives should be fully playing out on their income statement by then.