Hi subs,

First, thank you so much for subscribing to the premium site!

Second, a quick housekeeping. You can always reach me at awalker@rangeleycapital.com with any questions / concerns etc. And, as the premium site is still a work in progress, feedback is very much appreciated. In particular, feedback on what you’d like to see in the monthly updates is welcome, but feedback / pushback on anything is always welcome.

Anyway, on to the monthly update: four things on my mind. One new idea / situation I’m still mulling over / thinking through, and three updates on my favorite companies.

Lionsgate / Loral

MAC Update

WWE Update

IWG Update

Lionsgate / Loral

Loral has been a perennial “event” stock. A review of the full situation is a bit beyond the scope of this update, but the basics are Loral had two assets: a bunch of cash on their balance sheet, and a ~63% stake in Candian satellite company Telesat. The endgame for Loral has been obvious for years: merge with Telesat and distribute the cash to shareholders (and the cash distribution would have some tax advantages if done as part of a merger).

However, waiting on that merger has proved something of a “waiting for godot” situation. Loral and Telesat were on the one yard line for a merger that would have valued Loral at >$80/share back in 2014, but that deal fell apart and it’s been roughly crickets since…. until last month, when Loral announced they were paying out the majority of their cash to shareholders and they were in “advanced discussions” to merge with Telesat.

Loral’s stock is mildly interesting to me on the heels of the deal: if you look through the dividend, buying Loral’s stock today creates Telesat for a mid-single digit EBITDA multiple. Telesat is probably the best of the large satellite businesses (I, ETL, etc.); however, that’s the best house in a bad neighborhood. Their peers are in serious distress and don’t trade for much better multiples, and there are long term questions about the business.

So why mention them? Well, Loral’s controlling shareholder is MHR. MHR runs a very concentrated book; basically three stocks (LORL, NAV, and LGF) make up their entire book. Of those three, MHR is firmly in control of LORL and LGF (through super voting shares), and I can’t help but wonder if the cash out at LORL is designed so MHR can do something at LGF. (As a reminder, LGF is Lionsgate. It owns the Lionsgate TV / movie production and the Starz premium channel)

There are three reasons I think that MHR might be looking to do something with LGF:

It’s strange that, after all these years, LORL would dividend out their cash while talks were in “advanced stages.” It’s been over a decade; why not wait till the deal is completed to send out the cash? I think the obvious reason is MHR urgently needed cash to do something with LGF.

MHR has been buying shares of LGF on the open market (here’s their March buys, and here’s some May buys). Perhaps they see LGF as so undervalued that they are willing to take a slightly suboptimal LORL sales price just to get more cash to buy more shares of LGF?

Starz has been talking about raising money to fuel their international expansion for a year or so. MHR is about to get ~$50m in cash from the LORL dividend, and if they can liquidate the rest of their stake after a Telesat merger they’d have another ~$200m or so. Could MHR be looking to fund that expansion themselves? LGF has long argued that their international operations are quite valuable but they get negative value for them (international is growing quickly and losing money, so a SOTP based on Starz earning’s gives them negative value for it). I would guess the market would respond very positively to Starz getting some outside cash to fuel their international expansion.

Again, this is a work in progress (I may do a full write up at some point). But it’s an interesting one. Like most premium / streaming services, Starz is seeing a mini-boom thanks to Corona. CBS offered to buy just Starz for ~$5B last year. LGF’s entire enterprise value is just over $4B today. So, at today’s prices, investors are paying less than CBS offered for Starz last year and getting the rest of Lionsgate (which includes a very profitable TV segment that makes shows like Orange is the New Black and the movie studio that has the rights to franchises like Hunger Games, Twilight, and Knives Out) for free. The media sector overall remains primed for consolidation, and LGF is one of the few assets out there that is available and digestible by a variety of strategic players, and I suspect its strategic value in a takeout would be multiples of today’s share price.

Lionsgate reports earnings later this month, roughly around the time the LORL dividend will be hitting MHR’s account. It’s possible we see some type of deal announced concurrently with earnings.

MAC Update (overall take: bullish)

I wrote up Macerich here (and a summary here). They reported earnings yesterday, and I tweeted out some highlights from their conference call here.

Overall (and similar to Simon’s call, which I mentioned in yesterday’s Taubman update), my largest takeaway from their earnings was how positive “cautiously optimistic” both companies were. Both seemed reasonably confident they’d be paying dividends in the back half of the year, which was shocking to me given they’re collecting ~20% of rents and most of their properties are currently closed.

Leaving the call, I was much more bullish because two of the largest downside concerns I had for Macerich were not concerns for management at all. My two big near term concerns were the company breaching their revolver covenants and co-tenancy clauses causing their malls to self destruct if their anchors went bankrupt;

MAC had absolutely zero concerns about either on their call. They were asked ~3x on each, and each time they got more aggressive in saying “it’s not a concern.” By the end, MAC was effectively saying their malls could be closed due to radioactivity and they wouldn’t have a covenant issue. Their lack of concerns on co-tenancy made more sense; I had heard co-tenancy was extremely common in class C and B malls, but given they have a high proportion of A malls perhaps they really don’t have any worries there.

Overall, there was nothing crazy bullish in the quarterly results themselves. Malls are closed and it’s a struggle to collect rent. But between malls slowly starting to reopen, no co-tenancy issues, and no worries on the revolver, a lot of the most bearish downside cases for MAC seem to be getting taken off the table. Given MAC trades at a fraction of what a few of their top properties are worth in a stabilized scenario, taking those most negative scenarios off the table vastly improves the risk/reward (which I already thought was fantastic!) because it greatly increases the chances you can get to that stabilized level.

WWE update (Overall take: mixed)

I wrote up WWE in mid-Feb. Obviously, a lot has changed since then.

The crux of the thesis was the market was discounting the short term potential (and demand!) for WWE’s premium rights, and the market was ignoring the long term potential from the next round of rights negotiations.

The short term is a little frustrating; there’s been plenty of reporting that the WWE was on the verge of a blockbuster deal with ESPN that would put Wrestlemania on ESPN+. Unfortunately, that deal was destroyed by the current crisis. (And, of course, this ignores the massive revenue and earnings lost from the inability to do live shows!)

The longer term is a bit murkier. On the upside, interest in the WWE and their characters remains high; for example, the SI article behind the scenes of Wrestlemania notes “one thing is certain: ESPN is interested in being in the WWE business.” And WWE content remains in demand across platforms; for example, last month two shows in Netflix’s top 10 were WWE produced / themed.

The counter to that is that the core product itself has been absolutely devastated by the lack of fans. As American Idol has discovered, hosting a live product without a fan base losses a ton of the magic. It’s simply not as good of a product, and people at home tune out quickly. WWE ratings have been tanking in the Corona environment, and given they’ll likely be taping shows without fans for months, viewership seems likely to remain low.

That’s a huge concern. What if the WWE can’t do shows with fans for a year? Ratings will likely stay low…. does that lead to a bunch of lapsed fans and lower ratings on the other side simply because less people care about wrestling?

I continue to like the WWE. I think their next TV contract will be even larger than this one, and they continue to have a bunch of strategic assets and value that the market doesn’t give them credit for. But the WWE is the only live “sport” on television; at the beginning of the crisis, I’d hoped that being the only live sport would lead to increased ratings and new fans. Instead, interest continues to trend down as no one wants to watch wrestling without an audience. I worry about the longer term negative consequences from declining ratings that won’t easily be reversed even once fans can attend.

IWG update (overall take: incrementally more bullish, and I was already quite bullish)

I posted on IWG last month in sharing an office investment, and it remains a major position. I continue to think the stock is worth substantially more than the current price, and while the market is clearly waiting for some signs of clarity, I’m seeing some encouraging news.

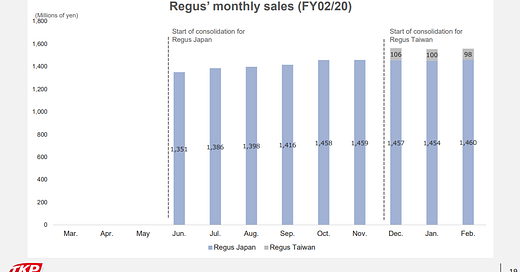

First, recall that I thought the edgiest piece of the IWG thesis was the work on their Japanese franchisee, TKP. TKP recently reported results, and they include lots of stuff on their Regus franchise. The results there are promising; the highlight is slide 19 (pasted below) saying “at this stage sales have been essentially unaffected.” It’s just one franchisee, so I’m hesitant to take too much from their report, but it’s a very promising sign.

Second, WeWork’s CEO gave an interview on CNBC. The whole thing is informative, but right towards the end he mentions 70% rent collection, which is a hugely bullish near term number. Again, don’t want to take too much stock in a competitor’s (non-audited) figures, but that would be a great number for IWG in the short term.

Third, most of the major office providers (VNO, SLG, BPY, etc.) have reported results, and all of them have been reasonably bullish on near term collections and leasing demand (see, for example, BPY here).

Individually, none of these significantly move the needle for IWG. But the market continues to imply some level of distress for IWG in the near term and is ignoring the long term potential here. I think that’s wrong. We should know more when IWG reports at the end of this month, but based on these early signs I think the report will be a lot more positive than the market expects.