Premium post: Shopping for value

COVID has introduced an unbelievable step change in retailing. 10 years of “offline to online” sales share shift happened overnight. The results can be seen in the stock market: anything exposed to physical retail has been slaughtered, while online retailers have soared.

I suspect there’s opportunity in that divergence. Once things normalize (i.e. we have a full COVID vaccine), there should be a little shift of online sales returning to the “offline” world. And the retailers that have made it through to the other side could be outsized beneficiaries; so many stores will have gone bankrupt by the time things normalize that the survivors could vacuum up enormous shares. For example, department stores Lord & Taylor, JC Penny, Stein Mart, and Neiman Marcus all went bankrupt during the crisis and will either close dozens of stores and reopen with a much smaller footprint or just liquidate entirely. When things normalize, in total those bankruptcies represent hundreds of stores that were doing tens of millions in sales. Those sale dollars need to go somewhere; a lot of them will go online but a significant portion will return to the physical world and be distributed through the surviving retailers. In addition, the surviving retailers should be in an incredible space when it comes to their cost structure: all of these bankruptcies mean lease renewals should come with a lot of negotiating leverage.

So, while today’s environment is awful, I think for companies that can make it through to tomorrow, the prospect of short term super normal profits exist.

I’ve spent a lot of time over the past few months looking for the perfect physical retailer to play that potential “semi-return to normalcy.” And I think Nordstrom (JWN) is the perfect play. If things begin to return to close to “normalcy”, I think Nordstrom is at least a 3x. The returns could be even higher if you get a period of super profits due to the flattened competitive land scape. Or, even if things remain closed / not normal for years, I still think JWN is undervalued and expect the stock to do well from here.

Most of you are probably somewhat familiar with Nordstrom, but I think that familiarity can serve as a gating factor for investors taking a look at Nordstrom (why would anyone ever invest in a department store?). So let me give a brief overview as a reintroduction.

Nordstrom is a luxury department store. It was founded in 1901 and has a reputation for incredible customer service. Today, the company operates 110 Nordstrom stores as well as 242 off-price Nordstrom Rack stores. In addition, they own trunkclub.com and Hautelook.

As you might imagine, the pandemic has been an absolute disaster for Nordstrom. ~70% of Nordstrom’s business (pre-Covid) happened in person; with basically all physical locations shut down, Nordstrom’s sales have been cut in half year over year. The company lost more than a billion dollars (pre-tax) in the first half of the year as the sudden shut down and operating leverage destroyed them.

So, to buy JWN, you need to have a view that things somewhat normalize. The good news is that, if we get there, the stock is screamingly cheap. In Fy19, JWN had EPS of $3.18/share and reported free cash flow of $309m. At today’s price of ~$14/share, JWN trades for just 4x of 2019 EPS (i.e. Pre-COVID) and 4x of 2019 FCF.

However, I think that valuation undersells just how cheap JWN is for three reasons. I’m going to spend the rest of the article discussing those three reasons, and in the the course of doing so I think you’ll see why I like JWN so much and why I think it’s the perfect way to play a retail recovery.

The first reason I think the valuation undersells is that Nordstrom was making mammoth investments into their business. Nordstrom called these “generational investments”, and the losses from these were consistently upwards of $100m/year (see slide below from their Q4’19 earnings).

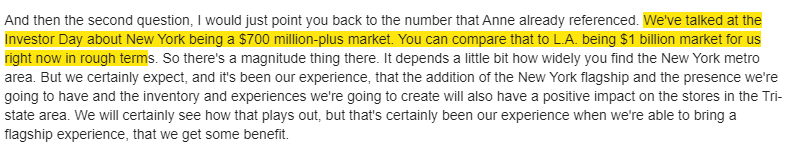

Those are huge numbers for a company Nordstrom’s size (as I write this, their EV is ~$5B). The headliner here is really JWN’s NYC investment; Nordstrom invested hundreds of millions to open a Manhattan flagship store that they thought could do $700m/year in sales after it matured.

The good news is those generational investments are now behind JWN. While the investments probably will not deliver the return JWN was projecting when JWN initially made them, at a minimum they will represent a tailwind to earnings if and when the environment starts to normalize. Remember, that NYC store that JWN sunk hundreds of millions into was supposed to do >$700m/year in sales; it opened in October 2019. JWN has literally never reported a year that included a full run rate earnings number from perhaps the largest investment the company will ever make!

My bottom line here: pre-Covid, Nordstrom had invested hundreds of millions into various initiatives. Maybe those pay off. Maybe they don’t. But, at minimum, as things approach normalization, those investments will no longer be a drag on Nordstrom’s income statement. If you think 2022/2023/2024 looks something like 2019 (Pre-COVID), Nordstrom’s earnings should be significantly higher simply because that huge drag on their income statement is gone (and that’s ignoring any return from those investments or from competitors going bankrupt!).

What if Nordstrom gets some type of returns from those investments? Well, if you go back to Nordstrom’s 2018 investor day, they gave all sorts of detail on what they thought their business model would look like as all of the investments started to pay off. The headliner here was probably the “$1B in free cash flow number” with excess cash returned to shareholders through dividends and share repurchase. Pre-COVID, they appeared on pace to meet or exceed those targets.

JWN currently has a ~$2.2B market cap. They shut down their dividend / share repurchase in response to Corona, but they’ve been pretty consistent that their capital allocation / return policy hasn’t changed for the long term (i.e. they still plan on returning the bulk of cash to shareholders once COVID passes). If JWN ever comes close to the level of earnings they were forecasting pre-Covid and doesn’t change their capital allocation policy, the stock will be a home run.

Ok, that’s point #1 (valuation looking through their investments). Let’s go to point #2: Sum of the parts (SOTP) math.

While most people look at Nordstrom and think of the department store, I think there are some potentially valuable assets that are missed by that view. Consider:

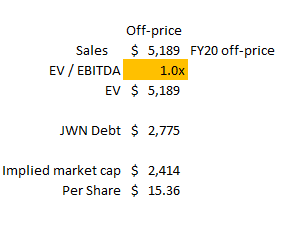

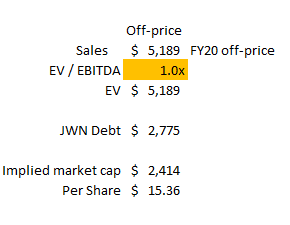

Off-Price: JWN’s off-price business, Nordstrom Rack, is a really nice business that plays to a lot of trends currently. An off-price business was originally meant to sell excess inventory or inventory with slight defects; however, as the chains have grown, off-price businesses have become mammoth sales channels in their own rights(it used to be a brand like Nike would only sell irregular / overproduction merchandise to an off-price retailer, but increasingly brands will work with the off-price stores directly). Off-price has also proved somewhat resilient to the rise of online shopping, as the “treasure hunt” nature of off-price (as well as the need to keep costs low and for brands not to dilute their brand by selling low price merchandise next to their full price stuff) makes an in person experience critical. The largest off-price company is clearly TJ Maxx / Marshalls (TJX), but Rack is a player in their own right. Rack is significantly smaller than TJX (only ~250 Rack stores in the U.S. versus almost 2.5k combined TJX / Marshalls), targets a slightly higher end business (you can see a nice comparison here), and is honestly not as well run as TJX (SSS for TJX have run mid-single digits versus very low single digits for Rack). Still, the similarities are enough that a comparison makes sense. TJX and ROST (another major off-price retailer) trade for 1.7x and 2x last year’s sales, respectively, and 14-15x last year’s EBITDA (I use last year’s sales / EBITDA to ignore the near term impact of COVID; clearly, with those multiples, the market is!).

JWN doesn’t give a ton of detail on their off-price business, and it’s clearly not as good a business as TJX / ROST. Still, it’s a good business, and a growing one. If it was just worth ~1x sales (a huge discount to ROST / TJX), the off-price business alone would be worth more than today’s JWN share price.

Real estate: Nordstrom owns a lot of real estate; they own the building + land for 18% of their stores and own just the building for 35% of their stores. This owned real estate is almost exclusively focused on their full price / traditional stores. That’s very good news for investors, as the vast majority of Nordstrom’s full price stores are located in Class A malls. Obviously, malls are weak / hated right now, but Class A malls tend to be located in absolute prime locations that should retain some value no matter what happens to physical retail. The history of investing in department stores for their land value is fraught (hello, Sears / JCP / Macy’s), but given how heavily concentrated Nordstrom’s real estate is in high quality malls, I would be surprised if there wasn’t a good deal of value buried inside Nordstrom’s real estate holdings.

Again, it’s incredibly difficult to value JWN’s owned real estate in this environment. The company gives almost no breakdown on individual stores. I actually started going through the mall owner 10-Ks and finding / trying to value the individual JWN stores that way, but it quickly became a garbage in / garbage out exercise as you needed to make tons of assumptions about the underlying state of the mall / releasing spreads when the JWN stores closed / lost profits on the JWN stores. Still, just because it’s difficult to value doesn’t mean there’s not value in there. SRG is the publicly traded holding company for the majority of real estate Sears used to earn. That’s valued at ~$135/SQF of land. A similar valuation would imply JWN’s real estate is worth well in excess of $1B. Again, this is not a great apples to apples comparison; SRG is much farther along in redeveloping their real estate, though I suspect JWN’s real estate is in much more desirable locations. Still, versus a ~$5B EV currently, it suggests there’s significant real estate value here.

Other stuff: There are other assets in here as well. TrunkClub and HauteLook, two buzzy acquisitions that JWN subsequently wrote off, are worth well less than what JWN paid for them but certainly have some value. Nordstrom also has a slew of private label brands; separating the value of a private label brand from the retailer is always fraught but these are good brands that probably do have some value.

The overall takeaway I want you to have from this section is that JWN is valued like a legacy department store, but it’s more than that. In particular, the off-price / Nordstrom rack business is growing, profitable, and peer comps suggest it could be worth more than today’s share price on its own. JWN’s real estate is almost certainly good.

For the third point, I wanted to build a little on the SOTP math. Yes, I think the SOTP math suggests that JWN’s parts are worth significantly more than today’s share price…. but I also think the whole of the parts are worth more than their individual pieces. Consider: Rack benefits because it has access to Nordstrom’s sourcing / inventory, and Nordstrom’s benefits because they can use Rack to move excess inventory. The whole company benefits because using either to lure a customer into the Nordstrom’s loyalty program increases lifetime spend, and because they can start to leverage their stores for their online capabilities.

I don’t want to oversell this: obviously, physical retailing is a difficult business that faces a tough future. But Nordstrom brings an interesting collection of assets: a great brand, a growing off-price business, offline to online capabilities, and a strategy that uses their physical business to draw foot traffic. Consider alterations:

If you and I sat down today and tried to figure out how to run a department store in today’s world, the strategy we’d come up with would look a lot like Nordstrom’s. Have a great brand and customer service (check). Integrate online and offline seamlessly (check). Use your physical stores to offer things digital only competitors can’t like in-store pickup and alterations (check).

My bottom line here is that I think Nordstrom trades below its SOTP. If you could somehow hive off and spun out the off-price business, I think it would be worth more than today’s share price. But I think that would be taking a short term gain at the real expense of long term value creation. Nordstrom is worth more than the SOTP because the parts fit so well together.

The market is spooked by how bleak the retail environment is currently. But I think JWN is doing everything they can to be a winner on the other side. And, if they are, I think shares are massively undervalued at today’s share price.

Odds and ends

One thing I didn’t mention in the main write up? A fair value / price target. I tend to shy away from price targets; I prefer to just prove fair value is a lot higher than the current price. A specific price target for JWN is particularly difficult as there is such a wide range of outcomes: do you believe in a short “super profit” period when physical retail fully returns but a ton of competitors are bankrupt? Do you believe JWN return to 100% of pre-covid earnings or 50%? When do you think they resume share repurchases? And, given Rack / off-price would be worth ~2x JWN’s share price if it traded at a TJX / ROST multiple…. how big of a discount do you want to put on off-price versus competitors? All good questions, and all unknowable. So a price target is really tough here. That said, I think they hit >$3 EPS again (what they did in 2019) in the medium term, and I think the company trades for at least 10x EPS. Put the two together and I see a pretty clear path to >$30/share in the medium term, more than a double from today’s share price.

The Nordstrom family has a long history of trying to take Nordstrom private or increase their stake in the company. In 2018, a special committee rejected a $50/share go private offer from the family + Leonard Green. In 2019, the family talked about increasing their stake before deciding not to. I think the family viewed this deals as potentially opportunistic: buyout the minority shareholders before the generational investments start to pay off. I’m sure they’re happy they didn’t get to pull off the take privates, but I wouldn’t be surprised if they try again if the environment starts to stabilize and shares don’t respond.

The Nordstrom family owns ~33% of the company. High insider ownership at a retailer can be a blessing and a curse; while it ensures they want to maximize shareholder value, high ownership also can prevent activists from coming in and can enable a management team wedded to a strategy from a different time (“this whole internet thing is a fad; let’s build more class C mall stores!). The good news is that the Nordstrom family seems very aware of the need to evolve the business, and at these prices the evolution doesn’t have to be entirely successful for an investment to work out well. You really just need JWN not to die.

Speaking of the Nordstrom family / insiders, there are signs that they think the stock is cheap. Specifically, in late August, the company cancelled a bunch of (underwater) PSUs granted before COVID and replaced them with stock options.

H/T to nongaap, who first pointed the PSU to option conversion out! FWIW, I did a whole conversation with him on identifying this type of management incentive change.

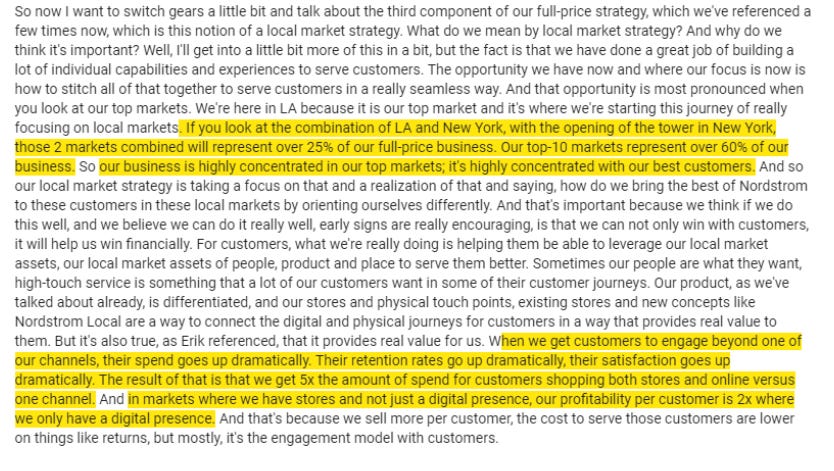

Nordstrom’s sales are highly concentrated in their top 10 markets, which double as the largest cities in the U.S. That means COVID probably hit JWN a bit harder than it hit most other retailers (which, given how hard it hit retailers, is saying something!), but also means JWN probably bounces back a little harder than peers as well.

I mentioned that JWN thought the NYC store could do $700m+ in sales. Pre-Covid, I think if you gave management truth serum, they would have told you that number was wildly conservative. Why couldn’t the NYC market outperform the LA market?

Building a little on the “the parts are worth less than the whole,” remember that the returns from the NYC store isn’t just about the returns from just the NYC store; having it open should benefit sales in the whole market.

A key piece of the thesis is JWN is cheap based on pre-COVID results / outlook. I know a lot of people are scared of physical retailers, so it’s worth noting that JWN was actually performing better than expected until COVID hit.

As I wrapped this up, Ted Weschler (of Berkshire fame) disclosed a ~6% stake in Dillard’s. I looked at Dillard’s as part of my research for JWN (I looked at just about every department store type retailer) and prefer JWN. Dillard’s could be looked at as a worse quality but more levered / higher beta bet on physical retail than JWN. DDS has been buying back shares quite aggressively, so if it works it’ll be a huge home run, and they own a ton of their real estate as well. However, Dillard’s is way further behind in their online retail efforts, their stores are much more concentrated in lower quality malls, and they don’t have anything like Nordstrom’s off-price business. All in, I much prefer JWN, but it’s nice to have other sharp eyes betting on a similar thesis.

JWN has a credit card deal with TD bank that expires in 2022. Who knows what department store credit card deals look like at that point in the future, but heading into COVID banks had been willing to shell out a pretty penny to lock down store cards. The headliner here was obviously Costco, and JWN is no where in that league. Still, pre-COVID, I would have guessed JWN would get a small tailwind from a new / renewed credit card deal, and I still wouldn’t be surprised if a new deal resulted in a little influx of cash for JWN.

A few more quotes highlighting how cheap JWN is on pre-COVID earnings and how big the potential NYC market could be. I didn’t want to fill the main article up with them but they’re interesting nonetheless.