[Premium] Potential for more than generic returns

Collaborative Write-Up with Mike from Nongaap

Note: This section was written by written by Andrew from YAVB

On the whole, 2020 has been a bummer. But, for me personally, one of the bright spots for the year has been virtually meeting a ton of sharp new people. Some of them I’ve met through the podcast, and many of them I’ve met through this subscription service. Honestly, if I had known that I could launch a service where I would get paid and meet really smart / interesting people at the same time, I would have done this years ago!

Of all the new people I’ve met this year, I’d have to say my favorite is Mike from Nongaap. If you’ve listened to any of my podcasts (including the one I did with him!) or posts, you know that I frequently mention him as my favorite premium subscription / thinker on the internet. I can’t recommend him highly enough; no one has done more this year to expand my investing tool kit. Charlie Munger famously said “show me the incentive and I will show you the outcome”; Mike’s taught me a whole new way of thinking about management incentives and using them to generate interesting stock ideas.

A couple of months ago, I was looking at the Mylan / Pfizer RMT merger to create Viartis (VTRS). I thought it looked cheap, but I couldn’t get a handle on the management incentives. I thought there was the potential for some shenanigans, but I wasn’t positive. So I reached out to Mike, and he showed me a whole bunch of ways the RMT set management to profit from a cheap stock. Both of us agreed the set up was interesting, and he offered to do a collab post with me. The results are below; I’ve taken the lead in walking through the Viatris story and thesis, while Mike took the lead on the management incentive / bullish signals.

I hope you enjoy the collab, and I look forward to working with Mike more in the future!

Thesis summary

The thesis for Viatris rests on six points

Improved Corporate Governance (written by Andrew from YAVB)

Index / ETF flows as the financials normalize (written by Andrew from YAVB)

Valuation (it’s cheap) (written by Andrew from YAVB)

Finding signals in management incentives (written by Mike from Nongaap Newsletter.)

Bullish Incentive Signals at Viatris (written by Mike from Nongaap Newsletter.)

Historical precedent that these moves create value (written by Andrew from YAVB)

Let’s start with point #1:

Point #1: Improved Corporate Governance

Note: This section was written by written by Andrew from YAVB

Viatris was formed from a merger of Mylan and Pfizer’s Upjohn division. The focus here is Mylan, as the company had perhaps the worst corporate governance of any publicly traded U.S. company over the past ~five years.

The story here starts in the middle of the 2010s. Mylan asked shareholders to approve a deal to buy the non-U.S. drug business of Abbott. Buried inside that approval were some lines that gave Mylan the right to create a “stitching”. Mylan would then use the stitching to unilaterally reject future acquisition offers (notably, the company rejected an initial $82/share bid from Teva) and disenfranchise shareholders (who would constantly pushback on Mylan’s outrageous exec comp and other perks).

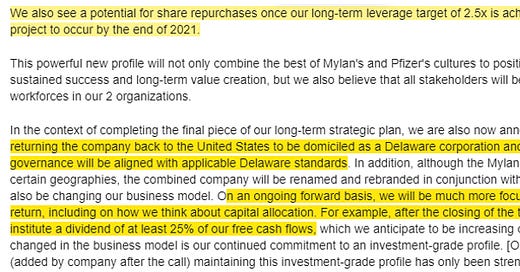

The merger with Upjohn solves (almost) all of those issues. While Robert Coury (Mylan’s chairman who orchestrated most of the outrageous moves) remains Executive Chairman of the new company, most of the management team will come from Pfizer. In addition, the new company will be incorporated in Delaware and “be aligned with applicable standards,” which removes the ability for the board to insulate themselves from shareholders through the stitching.

The quote above brings us nicely to the next point: the company is likely to see some tailwinds as their financials normalize.

Point #2: Index / ETF flows as the financials normalize

Note: This section was written by written by Andrew from YAVB

Viatris was formed through the merger of Pfizer’s Upjohn and Mylan. Upjohn was the larger business, with Pfizer shareholders receiving ~57% of the company in a dividend.

I’d argue that dividend created a lot of forced selling. Pfizer gave shareholders ~0.124 shares of VTRS stock for every share of Pfizer they owned; that’s <$2 of VTRS value for every Pfizer share (worth >$35/share). The record date for the spin was November 13th. Pfizer announced successful results for their COVID vaccine on November 9th. Consider that set up: a few days after announcing the first successful COVID vaccine, Pfizer, a dividend champion, gave shareholders a stock that had nothing to do with COVID and that didn’t pay a dividend whose value rounded to zero versus their core Pfizer holding. If that’s not the recipe for indiscriminate selling, I’m not sure what is.

However, while the forced selling created headwinds short term, I think it creates long term tailwinds. Viatris has committed to paying out “at least” 25% of their cash flows as dividends in the near term, with the potential for share repurchases on top of those dividends once the pay down some merger debt (likely starting 2021). Once the company declares their initial dividend (likely early next year), there’s the potential for dividend funds to start buying VTRS and push shares higher. I suspect the initial dividend payment will be ~$0.80/share/year, with the potential to quickly get raised to ~$1/share/year as the company realizes some merger synergies and pays down debt. At today’s share price of ~$17/share, that initial dividend yield would approach 5%, which should drive significant demand from dividend / income funds.

It might not be “just” dividend funds that are attracted to VTRS; VTRS is downright cheap post merger. Which brings us to section 3.

Point #3: Valuation (it’s cheap)

Note: This section was written by written by Andrew from YAVB

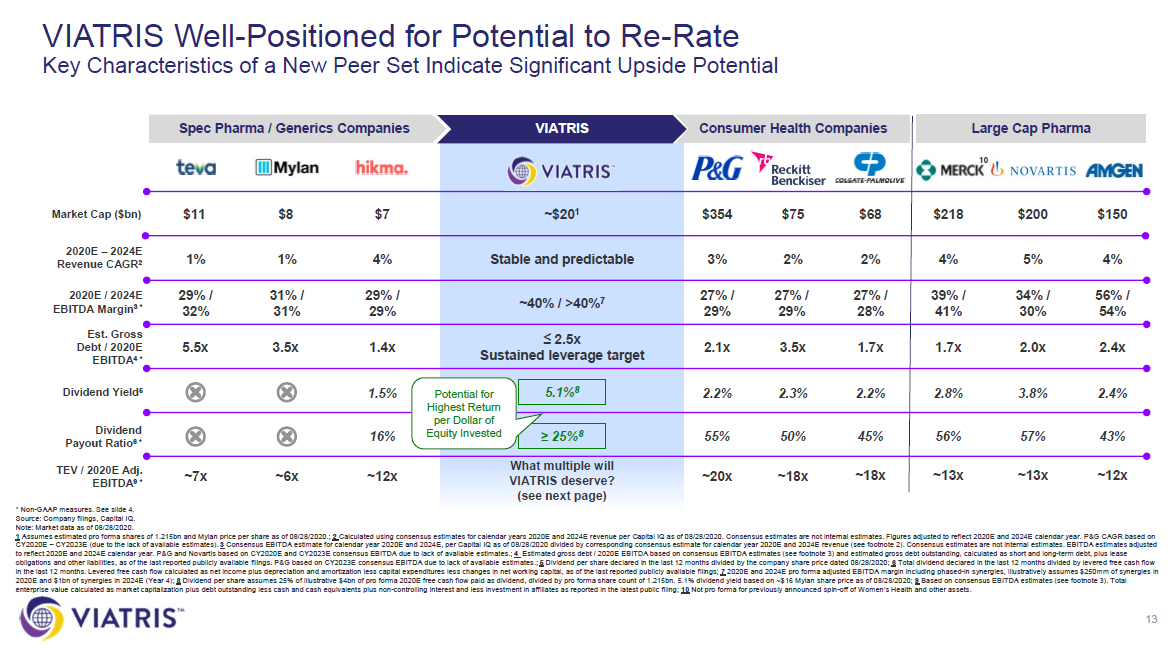

The combined company was projecting ~$8B in EBITDA before synergies for 2021; today’s share price of ~$17/share values the combined company at <6x their projected EBITDA.

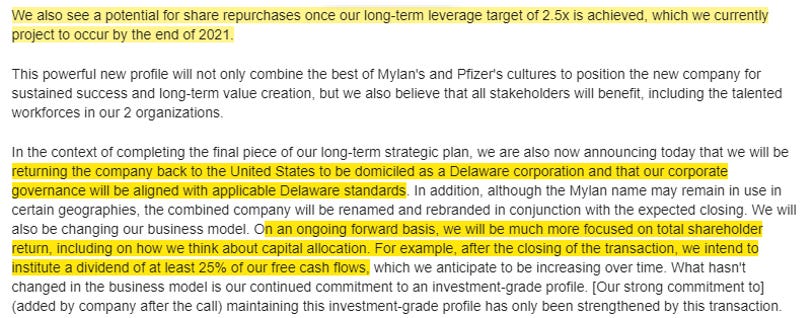

Now, there is the question of what multiple to slap on the company’s EBITDA. Viatris has argued that their assets sit somewhere between spec pharma / generic companies (like TEVA) and consumer health companies (like P&G); the market clearly isn’t buying that argument.

The nice thing about VTRS at ~$17/share is you don’t need to buy that argument either! At <6x PF EBITDA, VTRS is probably the cheapest spec pharma / generic company out there (that isn’t currently filing for bankruptcy because of legacy opiod liabilities). And remember: that EBITDA number gets even cheaper once you start giving them credit for the $1B in synergies the companies think they can achieve!

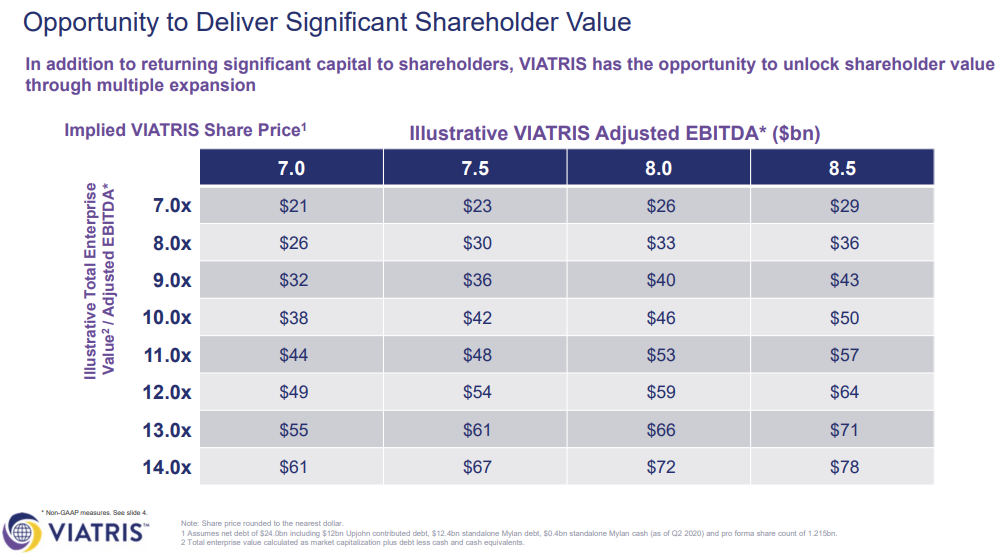

Viatris is not blind to this discount; they’ve been publishing the slide below in their recent decks to highlight just how cheap the company is.

As the synergies start to flow through and the dividend funds start to pile in, I see no reason that VTRS can’t achieve at least something towards the low end of this chart.

Point #4: Finding Signal in Management Incentives

Note: This section was written by Mike from Nongaap Newsletter.

Whenever a company is described as really cheap, I always ask myself, “Are insiders signaling the stock is really cheap as well?”.

After all, insiders will have much better visibility into the business, and it’s comforting (or confirmation bias?) when I see insiders signal they also believe the stock is cheap.

That comfort makes way for screaming (buy) sirens if the signal “trembles with greed”, although too much greed can creep into “dark arts” territory and be problematic for shareholders long-term. It’s still potentially a good short-term trade, but I digress.

Also, just so we’re on the same page, insiders signaling the stock is cheap is much different from insiders saying the stock is cheap. Management teams say their stock is cheap all the time, but their actions and behaviors will often not align with their words (especially in value traps).

It is the actions and behaviors I care most about. That’s where I look for signals.

There are many places to look for signal, but I believe the most important place to investigate is management incentives.

Emphasis on investigate, because many investors simply skim the incentives and end up missing the signals. I always tell people don’t underestimate the value-add you can generate understanding management incentives. In my experience, some of the best ROI in my research process comes from investigating the incentives, understanding them, and finding the signals that connect everything (i.e. strategy, capital allocation, management priorities, etc.) together.

There’s a long list of potential signals to consider, but the most notable for me are:

Changes in equity mix (i.e. shifting from RSUs to options after stock cratered)

Adjustments to incentive hurdles (i.e. introducing price-based vesting)

Unique or unusual vesting terms (i.e. accelerated vesting provisions)

Moving grant dates (i.e. off-cycle grant from typical timing)

A big caveat to all of this is, while insiders can signal they think the stock is cheap, their judgement (and the timing) can be off (if not outright wrong). Management still needs to execute in an uncertain business environment and things can change quickly. So keep that in mind when you’re investigating management incentives.

Overall, examining management incentives remains one of the best ways to elevate your research process without too much incremental effort. It’s a high ROI activity when done correctly!

Point #5: Bullish Incentive Signals at Viatris

Note: This section was written by Mike from Nongaap Newsletter.

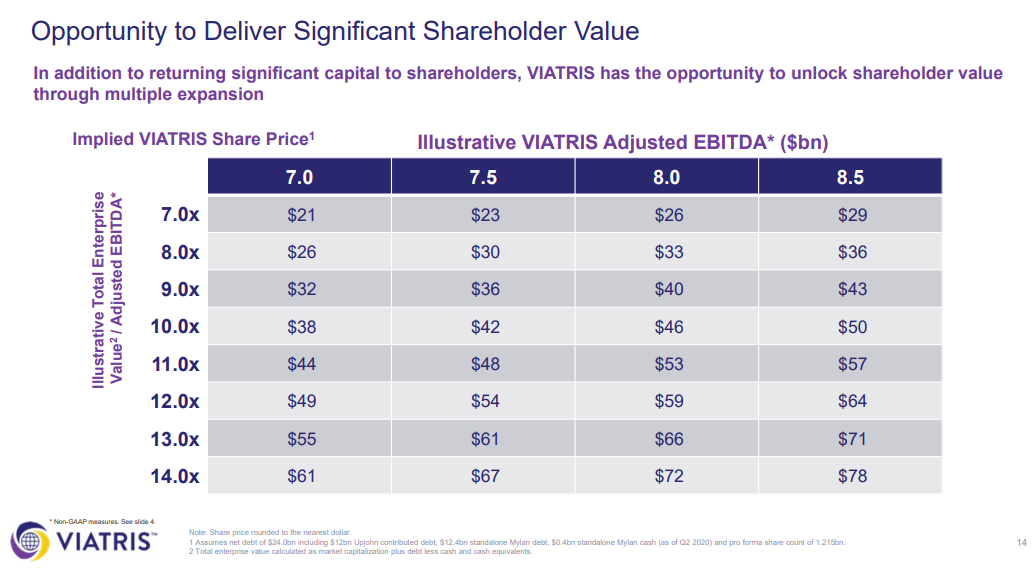

It’s no secret Viatris is communicating to investors they think the stock is cheap:

Investors are understandably cynical when they see slides like this, but it’s pretty easy (in my opinion) to determine whether or not management is being genuine.

If insiders genuinely believe their stock is really cheap, their incentives will typically signal a similar sentiment. In many cases, the equity compensation will be repurposed and/or restructured to ensure insiders properly participate in the upside.

In the case of Viatris, insiders appear to signal the stock is cheap and there’s significant upside opportunity.

Specifically, Executive Chairman Robert Coury’s post spin-off compensation structure includes 1.6 million performance RSUs with price-based vesting hurdles that really caught my attention:

Each performance restricted stock unit ("PRSU") represents the right to receive one share of common stock of Viatris Inc.

The PRSUs were granted on November 23, 2020 and are divided into five separate vesting tranches requiring share price appreciation and shareholder returns (including dividends and other distributions) of 25%, 50%, 75%, 100% and 150% from the date of grant through December 30, 2025.

In the case of the first three tranches, the PRSUs are subject to a retention requirement through the first anniversary of achieving the shareholder return goal, and in the case of the final two tranches, the PRSUs are subject to a retention requirement through the term of the award.

The PRSUs would vest in full upon termination of employment without cause, resignation for good reason, disability or death.

The most notable elements of Robert Coury’s performance RSU include:

Viatris stock needs to compound ~20% y/y the next 5-years for full payout

Based on a grant date price of $16.77, Robert Coury’s price-based hurdles are: $20.96 (25%), $25.16 (50%), $29.35 (75%), $33.54 (100%), and $41.93 (150%)

There is also a time-based retention requirement to the grant

While these terms are solid, what makes it a bullish signal for me is when and how the terms were set.

Robert Coury essentially “negotiated” (i.e. this is what he wanted) the shareholder return targets (25% to 150%) months ago:

Under the potential employment agreement, Mr. Coury would also receive a one-time grant of 1.6 million performance-based restricted stock units, which would be divided into five separate vesting tranches requiring 25%, 50%, 75%, 100% and 150% shareholder returns from the date of grant, subject to accelerated vesting in the event of certain terminations of employment.

Although the Compensation Committee and independent directors of the Mylan Board were supportive of the potential employment agreement, following discussions with Pfizer, the Mylan Board determined not to adopt any new arrangements for Mr. Coury at the time. The Mylan Board determined that it would be up to the Compensation Committee and independent directors of the Newco Board to determine the compensation arrangements of the Newco executive officers, including Mr. Coury, though members of the Mylan Board remained supportive of the employment agreement…

It is expected that many of the members of the Mylan Board, which was supportive of the employment agreement described above for Mr. Coury, will become members of the Newco Board, so it is possible that the Compensation

Committee and independent directors of the Newco Board will approve and adopt such compensation arrangement for Mr. Coury following the closing…

Instead of waiting for the Newco Board (and the arrival of directors from the Pfizer side of the deal who may have different views) to establish the terms and targets of his performance RSU grant, he set his preferred terms beforehand and the Newco Board signed-off.

Yes, the Pfizer side was aware of Robert Coury’s terms beforehand and likely agreed to facilitate the transaction, but the whole arrangement has a slight corporate governance “dark arts” smell to it.

The Executive Chairman’s compensation setting process being separate from management’s compensation setting process is peculiar, but not a total surprise since the Executive Chairman’s compensation seems to be a key consideration in getting a deal done.

This dual track process also means Robert Coury’s compensation is set, while Viatris’ CEO, who comes from the Pfizer side of the transaction, is still waiting on the incentive metrics and targets for his equity grants.

Luckily for us, this dual track dynamic also means we can draft off of Robert Coury’s compensation to extract signal. If Mylan had adopted Pfizer’s more measured approach to setting compensation, I probably wouldn’t be doing this write-up.

The reason we can extract signal from the performance RSU grant is due to Mylan’s egregious corporate governance track record and compensation practices. Old habits die hard and it shouldn’t surprise anyone the person who orchestrated most of the outrageous moves at Mylan would make one last deal for himself as Executive Chairman before handing over more control/oversight to the Pfizer side.

Basically, greedy people are reliably predictable and we can lean into that predictability to extract signals. By the way, I’m not saying greedy people are “bad” (or “good” for that matter). All I’m saying is you can make some reliable deductions when you know someone 1) has a strong propensity for greed and 2) has the power/influence to fully express their greed. The performance hurdles carry much different meaning when you look at the grant from this lens.

The fact that Robert Coury was willing to accept these price-based vesting hurdles (25% to 150%) months in advance without knowing the post-spin stock price (he certainly contemplated a range of prices) is a big signal to me. Robert Coury wouldn’t agree to these terms if he didn’t think there was a margin-of-safety to hit the stock price targets. This means there’s a lot of confidence being signaled by him that these hurdles are easy to achieve and there’s a path to substantial upside.

To reinforce this view, the performance RSUs also include a time-based retention requirement to prevent Robert Coury from quickly hitting his stock price targets and simply leaving the company with 1.6 million in vested shares. You wouldn’t include time-based retention unless there is concern the price targets can be quickly achieved.

This time-based retention requirement also isn’t mentioned in the February 2020 Mylan Proxy nor the August 2020 Final Information Statement when discussing the initial framework of Robert Coury’s compensation which makes me think it was introduced later and likely influenced by directors on the Pfizer side.

I certainly don’t think Robert Coury would be advocating for time-based retention requirements and I don’t think Mylan directors would suggest it. It’s such a specific and unique term that I would have expected Mylan to disclose the time-based retention requirement in their February 2020 proxy if it was indeed part of the original terms of the performance RSU.

I actually hope Pfizer directors played a role introducing time-based retention. Part of the long-term bull case for Viatris is better corporate governance, and if Pfizer directors pushed for time-based retention to Robert Coury’s “trembling with greed” performance RSU grant, that is very a good sign for the company’s corporate governance going forward.

Put it all together and I believe Robert Coury’s performance RSU grant offers a bullish signal that there is meaningful stock upside at Viatris.

Point #6: Precedent deals suggests move can create value

Note: This section was written by written by Andrew from YAVB

One last bonus thing before we log off; while there aren’t a lot of recent precedents for this type of deal, history suggests they do generate alpha over the medium term.

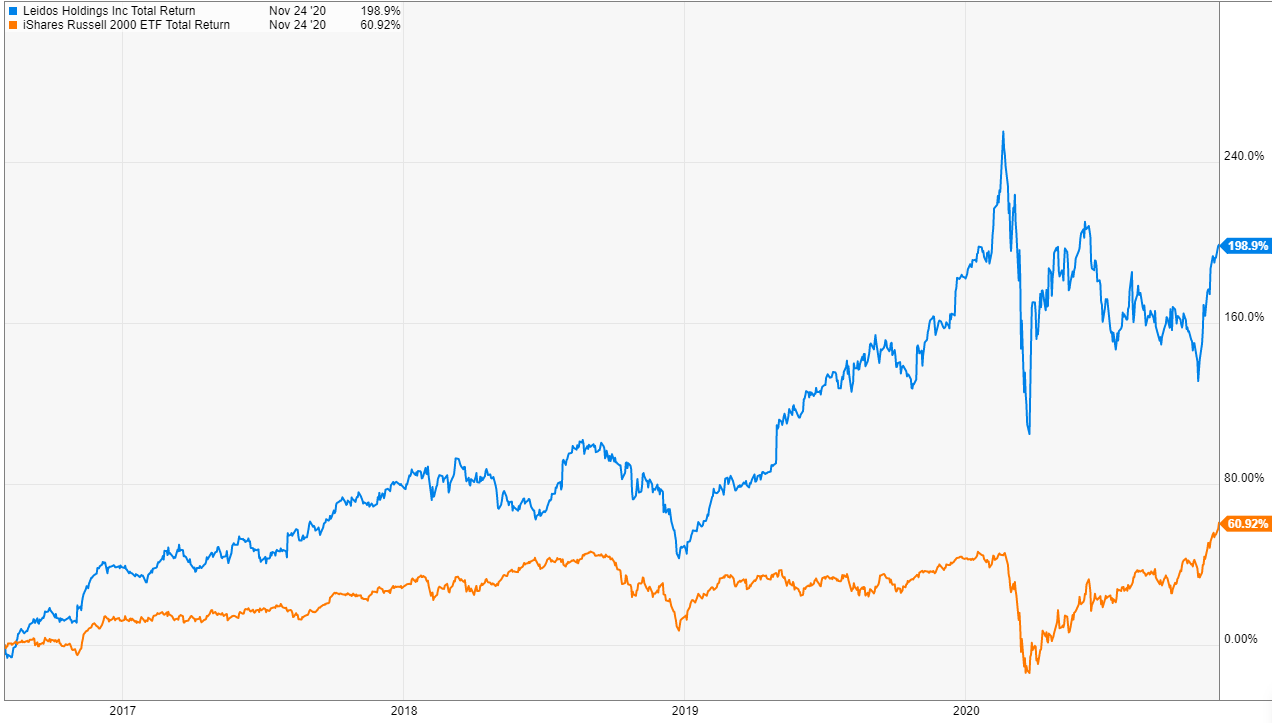

The Mylan / Upjohn deal was structured as a Reverse Morris Trust. The most recent Reverse Morris Trust I can remember was Leidos (LDOS) / LMT. That’s worked out pretty well for shareholders, with returns >3x the market.

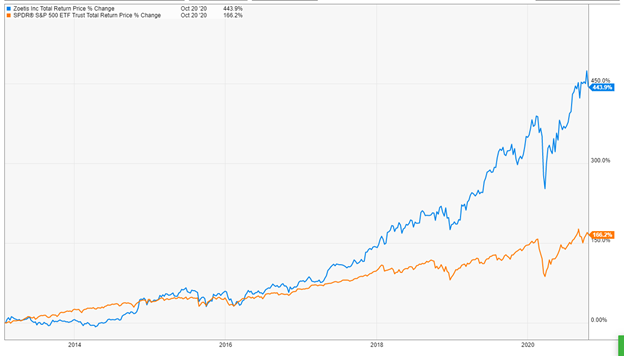

There’s also recent history to suggest Pfizer spins do well. The last Pfizer spin was Zoetis (ZTS); investors there have also been very happy as the returns have >3x’d the market.

Sendoff

Note: This section was written by written by Andrew from YAVB

There’s a lot swirling around Viatris. There will be a massive integration over the next few years. The company’s financials are messy, and healthcare policy changes will always loom over the company.

But, for the past five years, Mylan’s corporate governance has been hall of shame level bad. Management has shown no issues with lining their pockets at shareholders’ expense. The Viatris merger is absolutely a value creating merger, and, as Mike has shown, management took the opportunity to line their pockets one more time. Fortunately, this time the corporate governance at the company is getting upgraded, and management needs the stock price to increase in order to fully benefit from that last pocket lining. Buying shares today aligns you with management and their desire to enrich themselves; historically, that’s been a really good bet with Mylan.