My wife is off this week, so we did a little weekend trip away to visit some family. I flew back Sunday night with an eye towards working Monday (she’s staying for a few extra days)…. and Monday morning I discovered it was a federal holiday and markets were closed!

Now, as an investor, markets being closed doesn’t mean you can’t work! As the Peter Cundill book said, there’s always something to do (another 10-K to read, another stock to research, another filing to dig through)…. but I find working on days the markets are closed (whether it’s weekends or federal holidays) are a little more laid back. There’s no “new news” breaking to look at or respond to, there are no new SEC filings to catch up on, most people are off their desks so there’s no one to call to distract, etc. I find it a lot easier to catch up on emails (partially cause there are no new ones pouring in!) or dive into some stocks or situations that have been on my “to research” radar but I never quite get around to looking at because there’s always something a little more pressing or sexy to look at during the week (I’m attracted to event-y stuff like a moth to a flame, and during the week there’s always new events popping up to distract me from “sleepier” value companies!).

Anyway, due to my misreading the federal holiday calendar, Monday turned into a “lazier” work day. I was researching a company that would probably fall into a “GARP-y company at a value multiple” bucket, but the company had some pretty clear tail type risks (to simplify a bit, they have a SaaS type product, but I worry larger tech companies could turn the product into an add-on / commodity and displace them over time).

Honestly, the risk of a larger company moving into the space / turning the product into a commodity / free feature add on is so obvious that I’m not even sure it’s a tail risk, but saying “tail risk” is kind of the only way I know of describing that type of existential “my product was turned into a free add-on” business risk.

Thinking about tail risk and how much I overuse the term got me thinking about tail risks in general. In particular, it got me thinking about “tail” type trades that might be underrated by the market.

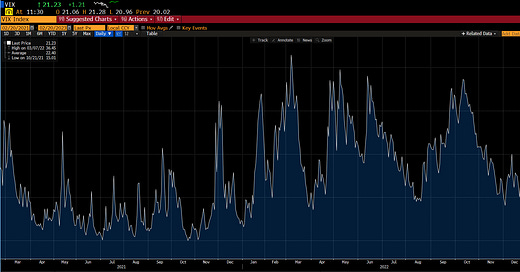

The obvious tail trade is “nuclear war.” There’s no doubt it’s a correct answer as a tail risk…. but I’m going to disqualify it because it’s almost too obvious and because we’re all probably dead if the nukes start flying so you really can’t collect on that tail risk trade (it’s cheesy, but the “if you hear the missiles are flying you buy” story is an absolute classic) . Also, I’d note that the VIX has traded >20 basically nonstop since Russia invaded Ukraine last year, so you could argue the market is building in a little additional “tail risk” charge for elevated nuclear war risks.

My personal favorite tail trade currently is the “AI taking over the world” trade. It’s inspired by this post from The Diff (I’m a huge fan): if AI is about to take over the world, you buy all of the NVDA stock you can while shorting basically everything else. The theory here is that an AI takeover drives the risk free rate screaming higher, and the computational intensity of AI hitting self improvement means hardware makers become insanely profitable.

What else is out there?

One dark-ish one I’ve had over the years: what would it take for U.S. equity premiums to rise because we start getting concerned about rule of law in the U.S.? This thought mainly came to me during the Musk / Twitter trial (it was so clear Musk was trying to get out on buyer’s remorse that if he was successful basically no contract would matter anymore), but some of the regulatory decisions of both the Trump and Biden administrations have me concerned that the government is increasingly willing to ignore rule of law and company / contract rights to score political points. So far, we haven’t seen that really effect the capital markets (at least to my knowledge it hasn’t), but I wonder if at some point we see equity premiums start to rise in a developed market “I’m not sure the government will let me keep my profits” type fashion.

On the brighter side, there are lots of health / longevity breakthroughs that we appear on the verge of achieving. I’m particularly thinking of weight loss drugs, but there are plenty of others. I suspect that if we had a sudden breakthrough that dropped BMI across all of the U.S. or that took life expectancy up a few years, there would be all sorts of winners and losers that aren’t priced into the market. Off the top of my head, if weight loss drugs were successful in reducing huge swaths of obesity with no massive side effects, I’d have to imagine health insurers are in for a few years of windfall profits as obesity related diseases they had budgeted for became way less prevalent. In contrast, maybe hospital utilization goes way down, and you see a wave of hospital bankruptcies?

There could be interesting knock-on effects of those drugs. Would gym membership go way down because a now thinner population doesn’t have the motivation to go? Or would it go way up because a thinner population finds it easier to exercise and maybe gets a little more vain about seeing definition on their now slimmer bodies? Would sales of snacks go down because people have less of an appetite? Or would a thinner population have even less self control when it came to their diets?

Anyway, those are just two tail risks that popped into my mind. I’ve got a few other half formed ones that I may share in the near future, but I figured I’d share those and open it up to see if anyone else had good / interesting ones.

Another great post!

Here's an idea. I don't see this ever happening, but I guess that's why it's a "tail" risk. If China was to invade Taiwan, then TSMC would go offline and the only way to manufacture high end logic chips will be via Intel since they are the only Western based manufacturer of any real scale.

I personally have a pair trade on where Intel and TSMC are equal weighted in my portfolio (I view them as a tax/royalty on technology growth and the digital transition). If TSMC goes to zero then Intel will >2X (probably a lot more than that) because they will be the only game in town (Samsung still exists, but they aren't a pure play like Intel and TSMC).

Did you see the tweet from RepMGT over the weekend about national divorce? That is another tail risk for sure. Pretty shocking to be coming from a sitting member of Congress.