This is part 2 of my three part thesis on SharkNinja (SN) and why it could be interesting on the heels of their spinoff. If you missed part 1 yesterday, you can find it here. Today’s post is going to provide an overview of what SN is and the bull thesis.

I’ll start with the overview. SharkNinja owns the Shark and Ninja brands (shocking, I know). You probably know the Shark brand from their vacuums or hair dyers, and you’d know the Ninja from their blenders or their ice cream maker (the ninja Creami, which went quite viral on TikTok and which my wife refuses to let me get for a combination of “not having enough counter space” and “don’t you already eat enough ice cream?”). If you’re old enough to remember the cable bundle, you might remember the Shark and Ninja infomercials, which is how the brands started really taking off in ~2009.

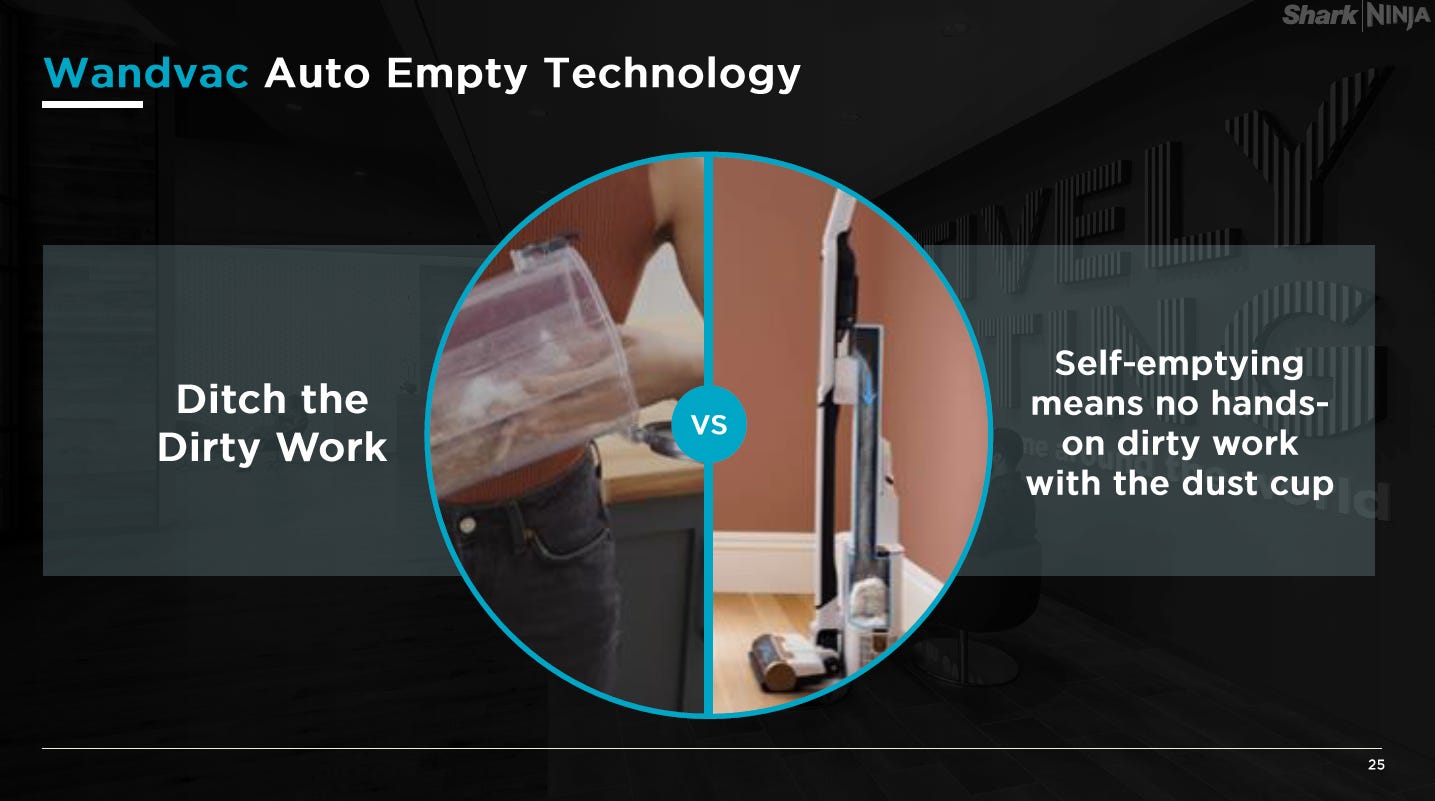

The company’s pitch is simple: they move into categories with better products at lower price points than peers, and that combo lets them take huge share. In particular, the company points to how much better they understand consumers in their research and how the products they release have consumer friendly features that other products don’t have. For example, in their investor deck, the company points out that competitor vacuums require manual emptying, while Shark’s are self-emptying. Another example: in a call with IR, they mentioned to me how their researchers followed consumers as they vacuumed their house, and how they noticed the consumers were taking scissors to cut hair out of the vacuum. When the researchers asked consumers how the vacuuming went, they’d say great and sheepishly apologize when asked about cutting the hair out of the vacuum. That research led Shark to launch a vacuum that wouldn’t clog with hair.

A side note for a true story to give you a little idea of the shark brand power: I just moved into a new apartment and we need a new vacuum. I was zooming with some of the SN team, and when my wife heard who the team was from she texted me “I LOVE their vacuums; please see if they have an investor discount for their products because I was literally about to buy one for the new apartment.”

I know all of that pitch probably sounds corny, but I think you can see the difference between SN and their competitors in their financials. SN invested ~$160m into R&D in 2022, or just under 6% of their sales. That’s a much larger investment than, say, YETI (~$15m, or <1% of sales) or HELE ($48m, or ~2.5% of sales). Obviously there is a little category difference here (maintenance R&D for Shark vacuums is probably higher than YETI coolers), but it’s not a stretch to look at those stats and say SN is investing / leaning into new product innovation.

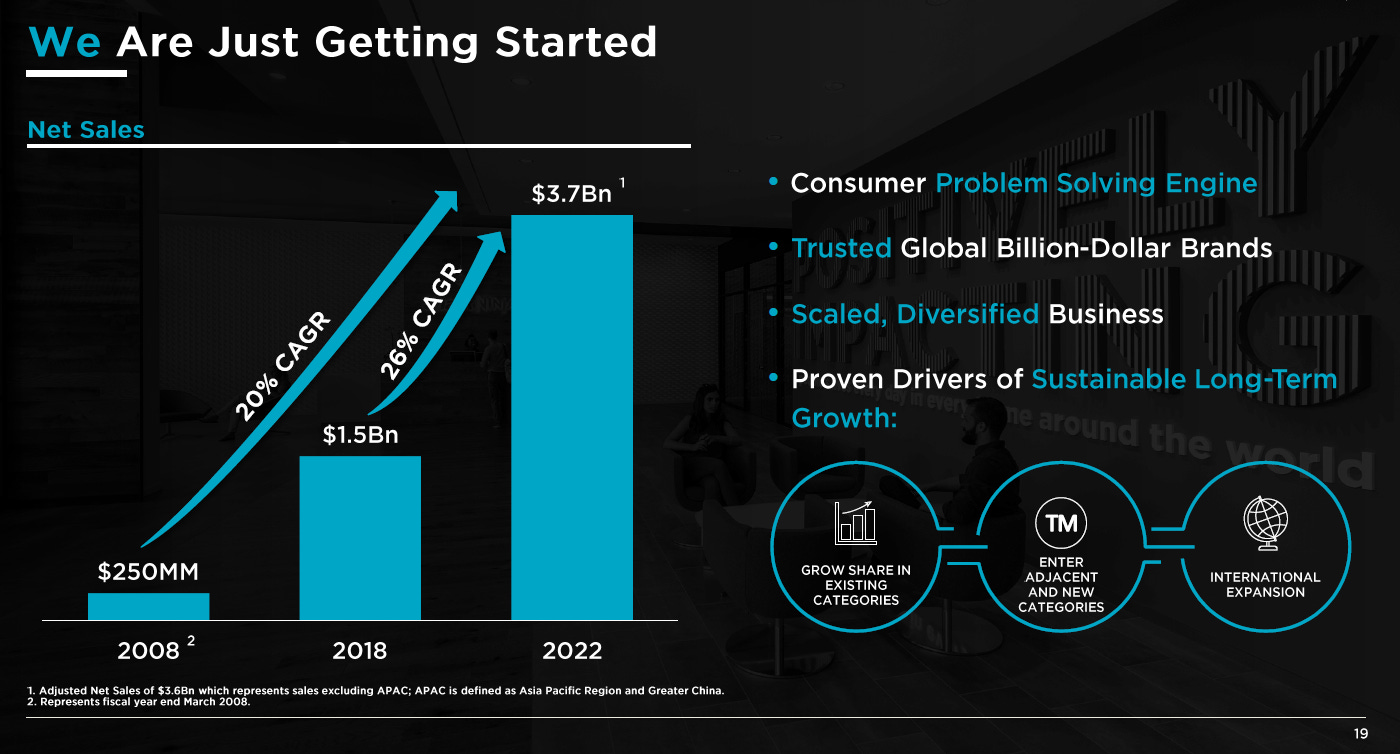

And SN has leaned into new product innovation to great results. Revenue has CAGR’d at ~20% for the past ~15 years…..

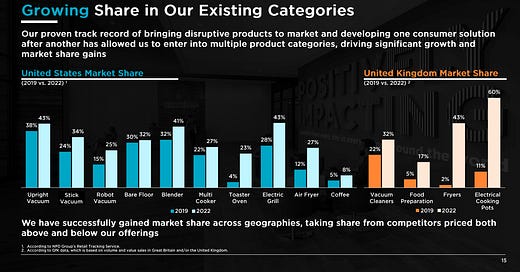

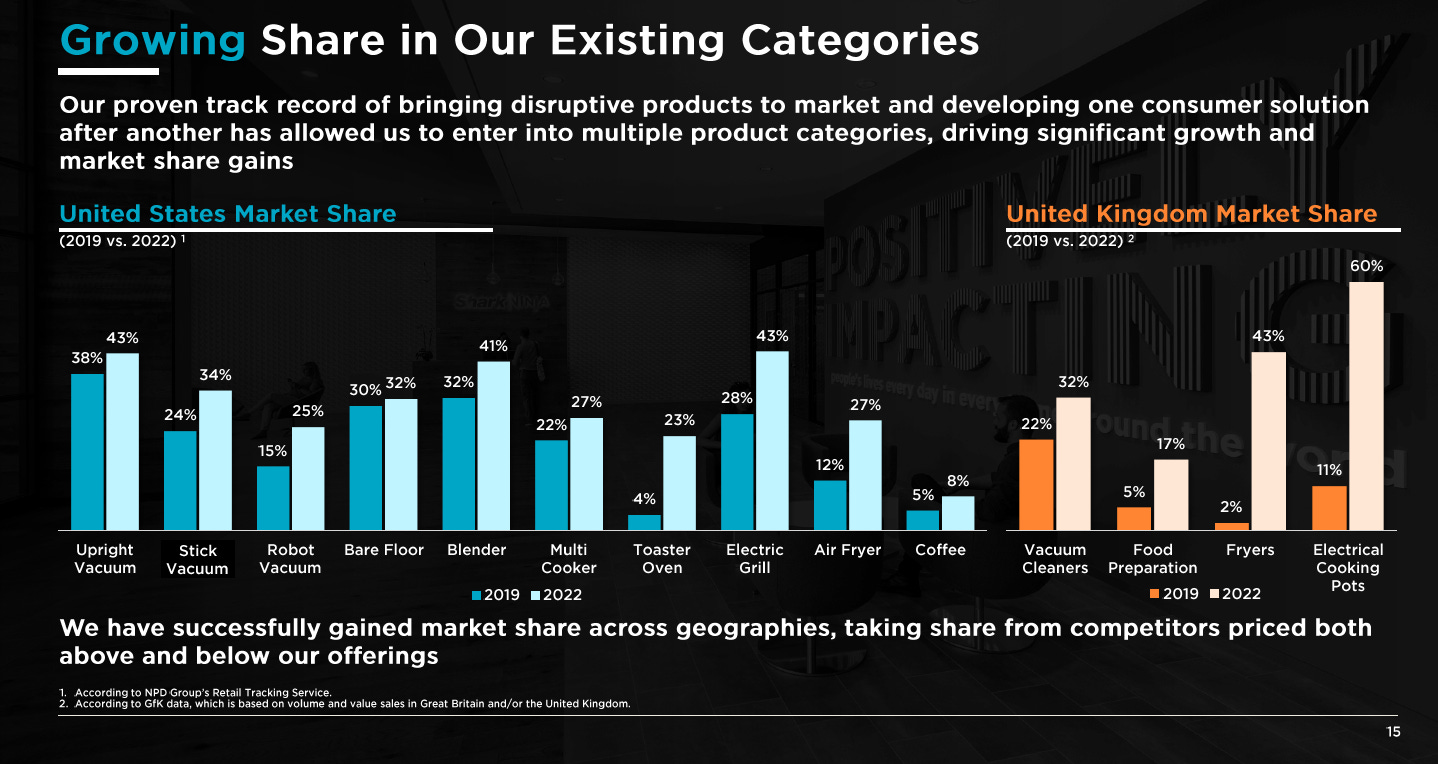

….and the company has come to dominate just about every category they’ve launched into.

Post spin, SN has ~$660m of net debt and ~139m shares outstanding, so at their current share price (~$36/share), they’ve got a ~$5B market cap and a ~$5.7B EV. They’re guiding for ~$665m in EBITDA in 2023 (up >25% YoY, driven by ~10% organic sales growth and a heck of a lot of operating leverage) and ~$3/share in EPS, so at current prices you’re paying around 8x EBITDA and 12x EPS. That’s in line with or cheaper than a lot of peers that are growing much slower; for example, HELE’s growth has roughly stalled out (depending on your source, they’re either slightly shrinking or slightly growing), and they trade at double digit EBITDA and EPS multiples (and that’s adjusted earnings; there’s a very active debate over if those adjustments are truly one time / HELE’s earnings quality). It’s hard for me to look at HELE and SN without thinking SN should trade for a pretty nice premium.

That’s the crux of the bull thesis: you’ve got a company with a ~15 year long track record of >20% growth that dominates (and maintains domination) just about every category they launch into that currently trades for a low double digit multiple.

But I think that math doesn’t give SN quite enough credit. I mentioned in part 1 that I had some differentiated thoughts on SN, and my biggest differentiating thought is this: SN is actually cheaper than it appears on headline numbers.

Remember: SN is investing significantly more into R&D than competitors. They’re also launching into multiple new categories (outdoor grills, a sparkling water system, etc.). Launching new categories is expensive (in particular, it requires an investment in G&A and sales and marketing), and a lot of their R&D is growth oriented. Most of the loose peers I see are not making growth investments anywhere close to the level SN is making, and it shows in the numbers (SN is still growing double digits while peers are showing flat or negative growth as they continue to lap inflation issues and inventory builds).

So if you’re looking at SN and valuing them on trailing earnings, you’re probably doing them a disservice. You should probably add back all of that growth investment if you’re just using their trailing numbers, as you’re giving them no credit for their growth.

For example, SN’s sales and marketing expense (S&M) in Q2’23 ran at ~22% of sales versus ~19% in Q2’23, and G&A ran 7.6% versus 7.0%. If you rolled S&M and G&A together, I’d guess you could cut out costs equivalent to roughly 4-5% of sales if you were going to stop investing in SN’s growth. Along the same vein, I mentioned above how SN invests ~7% of sales into R&D versus peers at ~1%; if SN was going to go ex-growth, I’d guess there’s another ~5% of margins to be added back as they slashed R&D spending.

Combined, that’s ~10% of sales that could be saved if SN was really going ex-growth. SN is guiding to ~$4.2B of sales this year and ~$665m in EBITDA, so those potential “growth savings” represent really meaningful amount. EBITDA adjusted for those costs would be over $1B, and at current prices the company would be trading under 6x EBITDA.

Now, if they cut all of those costs, the company would rapidly go ex-growth. And I’d guess they’d lose some market share in the near to medium term if they dialed back marketing / didn’t keep innovating. So the right answer to a “what do earnings look like ex-growth investment” is probably a bit less rosy than the math I just walked through. But I think the directional point I’m making is very correct: SN is investing a lot into growth, and valuing them on trailing numbers gives them no credit for that. Either they continue their long track record of growth, or eventually the SG&A and R&D will be brought down to a more steady state level and margins will jump / earnings will increase by hundreds of millions as the growth costs fall away. Either way, SN is probably cheaper than it looks on just trailing numbers.

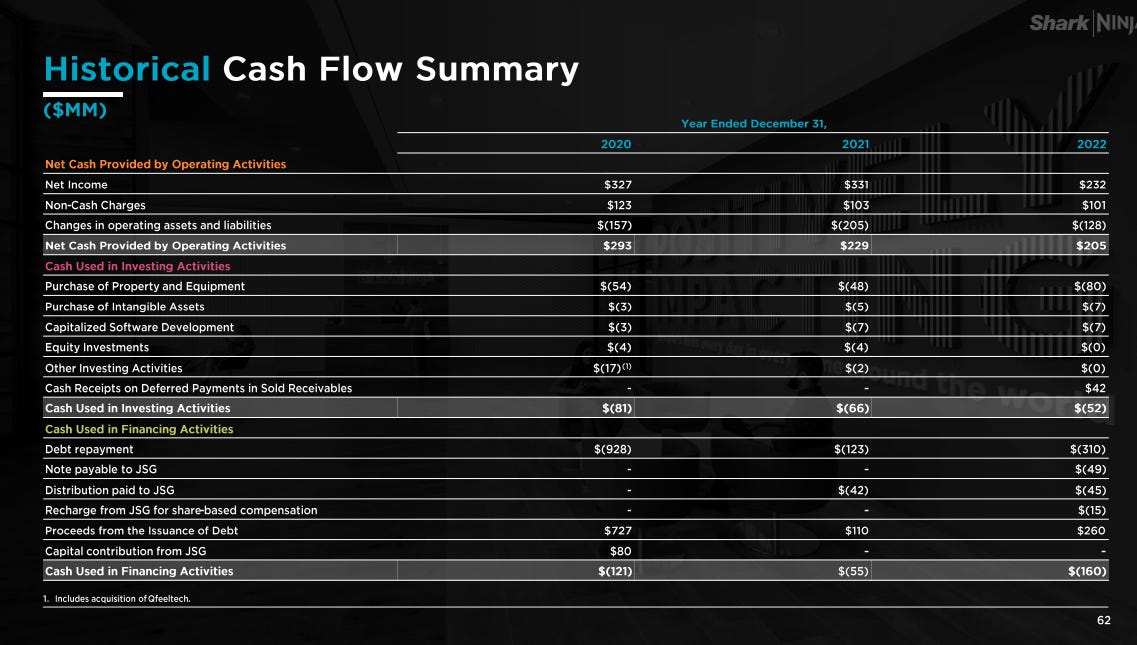

Speaking of growth, it’s worth noting that SN is guiding to ~$130m in capex this year. That’s up from ~$80m in 2022 and ~$50m in 2021 and 2020 (see p. ~104 or the chart below). That’s a big increase; the only thing I’ve seen the company say about it is in their Q2 call they said the capex was "to support investments in new product launches and technology.” Obviously a little speculative, but it’s possible the company is planning a massive new launch or multiple new product introductions and the capex is them getting in front of it.

There’s one other thing that I haven’t seen mentioned elsewhere that I think is worth noting: management is going to be very incentivized to realize value here, both because of some spin dynamics and because of their personal ownership.

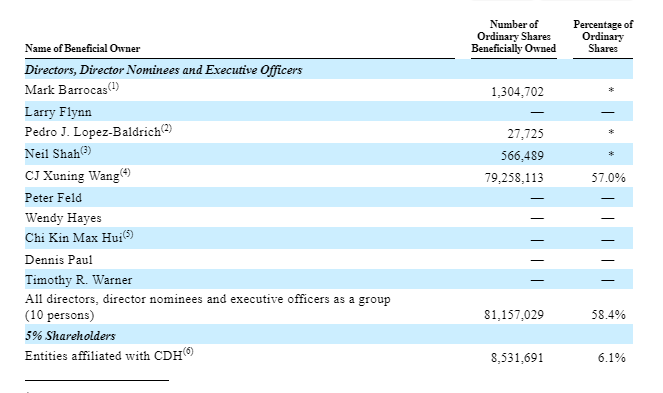

Let’s start with personal ownership. If you just look at the prospectus, you can see the CEO owns ~1.3m shares (and the majority shareholders continues to own almost 80m shares!). Obviously that’s a huge amount at current prices (approaching $50m for the CEO; approaching $3B for the majority shareholder).

However, if you think back to you can be a stock market genius, what really sets spins up for alpha generation is when management sets themselves up to get paid. And that could be the case here. Remember, SN was spun out of a Hong Kong company, and the Hong Kong company quietly put out the press release below on July 30.

That is a lot of RSUs (over $80m worth at today’s pricing), and as far as I can tell that grant wasn’t picked up in any SEC filings or anything because it was filed by the Hong Kong parent (and, without getting picked up by the SEC filings, I really haven’t seen anyone mention it anywhere).

So that’s leg one of the “management incentivized” stool. The other leg is from the spin dynamics. Go back to the insider ownership chart I pasted above. The chair of the board owns ~57% of SN. If you look through the prospectus, you can see that he negotiated the right to be the chair of the board as long as he owns 30% of the stock.

I don’t think that negotiation is included by accident; I am sure he wants to maintain a meaningful position in the company but he also wants to sell down the stock over time to realize liquidity.

Obviously that’s a lot of shares and a potential overhang on the stock…. but I think it could also work in SN shareholder’s favor. Management owns a huge amount of stock, and the chair clearly wants to sell some of his stock in the near to medium term. Management is going to be very incentivized to get the stock price up; they’ll be doing roadshows, pushing for coverage, etc.

None of that would matter if this was an awful business with awful economics…. but this is a growth-y consumer brand with a history of dominating niches. I think some marketing could attract investors / help the stock reach a “fuller” multiple. And, with >$2B in potential secondary offerings (plus maybe some margin loan potential) and a company that is probably a little more fun / well known than your average mid-cap (it’s always a little easier to pick up coverage of households names because there’s a little familiarity to them and researching / covering a consumer company is easier than your average company. It’s just a bit more fun for an analyst or a PM to “diligence” a Ninja Creami Ice Cream maker than it is for them to diligence Exact Sciences products), I’d suspect multiple large firms are going to have a lot of incentive to pick up (favorable) coverage.

I also think this matters when it comes to guidance. If you’re a new public company, the #1 rule is do not miss your first set of numbers. Why? Because investors are just getting to know you, and if the first thing you do is provide guidance and then miss, that’s how every investor will remember you. You’ll have instantly burned all of your credibility, and credibility (like reputation) takes years to build and can be lost in an instant. If you lose it at the beginning, you’ll probably never gain it back / anytime you put any numbers or guidance out in the future there will be a skeptical whisper “you can’t trust these guys; remember when they missed their first guide?”

Which brings us to this year’s guidance. The 2023 full year guide (provided in their Q2 earnings) is fantastic, to put it lightly. YoY revenue up ~10%, EBITDA up >25%, etc. To hit those numbers, the business will have to be firing on all cylinders… but I’d posit that management was incentivized to provide guidance that is easily achievable and likely beatable. It’s a volatile world, so anything can happen…. but SN’s IR strikes me as quite sophisticated, and I think the whole team understands that it works best for everyone if they meet (or likely beat) their initial guidance. I would not be surprised if SN easily beats the numbers they provided; it gives them credibility, it makes it easier for them to tell their story as a new company….. and it gives them a glide path into liquidity for the chairman to sell down (some) of his stake over the next year or two.

To wrap this up, if I had to tl’dr the SN bull thesis, it would be: “SN spun in a super weird format that no one is paying attention to, it’s trading like a no growth business despite more than a decade of history of >20% growth, it’s probably even cheaper than it looks if you really backed out all of their growth investments, and the management team who orchestrated all of that growth is going to be insanely incentivized to quickly gain coverage and drive the stock higher (or just increase value in the long run if you’re into that thing) given massive (and possibly underreported) stock ownership.”

As far as bull thesis go…. well, you could do a lot worse!

But there is, of course, a bear thesis, and we will discuss that in part 3. See you then!

PS- there was one other SN write up out there that I forgot to link in part 1, so including it here as it does a really nice job explaining some of the quirkier spin dynamics here.

PPS- I just wanted to back up a little bit to SN’s roots in infomercials. If you think of what worked in infomercials, it was good story telling that hooked you in (stopped you from flipping the channel) and products that offered nifty little innovations that they could use for that hook. Perhaps I’m just projecting, but that type of brand innovation / story telling seems perfect for a social media / Tik-Tok world, and I don’t think it’s a surprise that SN is focusing on and frequently seeing products go viral on social media while, to the best of my knowledge, none of their competitors have had any success doing that or are even trying. Again, that’s pretty soft, and I have nothing to back it up / I’m not sure I fully believe it, but in my gut it seems like “company culture around virality” is a muscle that would take a long time to build (a lot of consumer companies are very sleepy; I doubt a 45 year old who’s been in charge of blenders at some stodgy conglomerate for twenty years at one company is really focused on TikTok virality, and after how many brands have stumbled on social media I’m not sure if that manager is even incentivized to try as the best case is a pat on the back and the worst case is they get fired and publicly shamed forever) / a moat that bulls could point to.

Great stuff Andrew, and great find on the massive RSU grant.

Great insights Andrew! THe infomercial gene transfering to TT is very interesting.