Quick notes on an interesting spin $SN (part 3: bear thesis and wrapping up)

This is part 3 of my three part thesis on SharkNinja (SN) and why it could be interesting on the heels of their spinoff. If you missed them, you can find part 1 here and part 2 here. Today’s post is going to wrap the series up by discussing the bear thesis.

There are lots of different things to a bear thesis for SN, but I think the main piece of all of them could boil down to one thought:

Appliance domination? Seriously?

Step back a second. SharkNinja makes blenders, vacuums, and other appliances.

These are famously hyper competitive categories; your largest customers are going to be retailers like Amazon and Walmart who are famously brutal on forcing price reductions from their suppliers, and any product innovation is going to be rapidly copied by a wave of foreign knock-off products who will drive prices into the ground. Ultimately, a vacuum is a vacuum, and you’re probably only going to buy one every five or ten or fifteen years (I have no clue how long a vacuum lasts or what the replacement lifecycle is!). It’s really hard to build brand loyalty when you only buy something once a decade, and when it’s a simple product that can easily be copied it’s hard to keep knock-offs from driving prices down and eating into sales and particularly profits.

So the bear case is simple: sure, SN has relied on product innovation to grow rapidly and create a great business on current metrics….. but product innovation can only last for so long, and the category will catch up to them eventually. These categories are synonymous with “commodity business” and “unlimited competition;” there’s only so much innovating SN can do, and as competitors catch up to them, their returns will fall off a cliff.

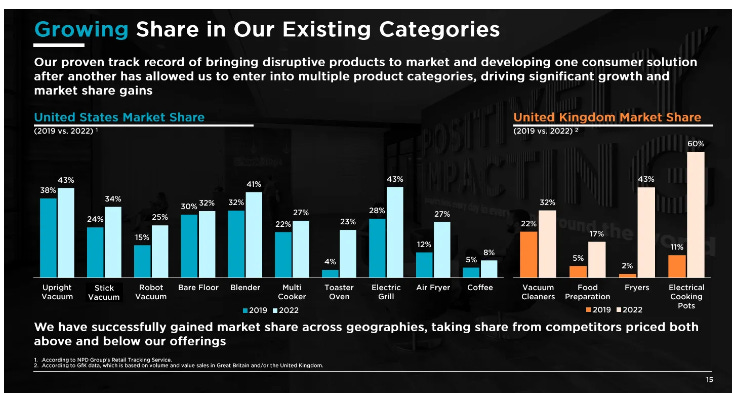

Bulls do have an easy response to this: the proof is in the pudding! Maybe you think knock-offs should copy SN’s innovations and eat into market share while driving down margins, but that’s simply not what has happened. SN has maintained (or grown) category dominance in all of their markets….

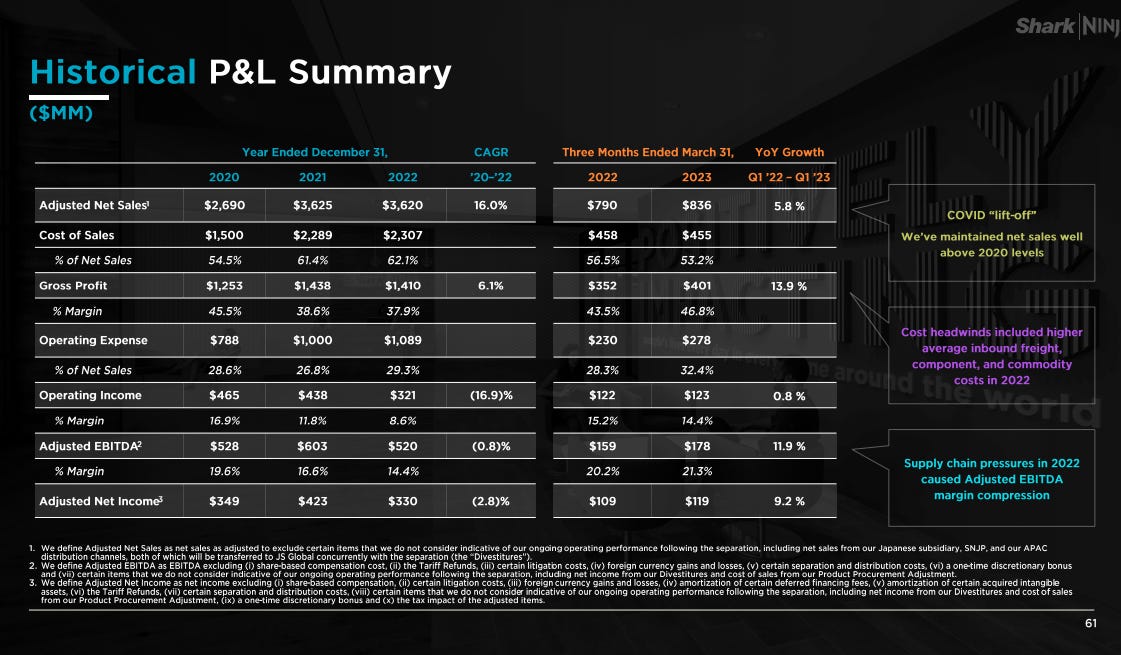

….and SN hasn’t really had to sacrifice margins to do so (yes, margins are down since 2020, but I think you could rightly say this is supply chain driven issues plus some investment in growth, not a huge price war destroying the industry).

So a bear might say these categories should be insanely competitive and any market share SN gets from product innovation should be quickly competed away, but a bull can just point to results and say that’s not how it works in practice.

Why aren’t knock-offs catching up / destroying SN’s business?

I’d suggest two possibilities.

The first is that SN is constantly a step ahead. The company argues that they upgrade their products with new features every ~18 months. It probably takes ~18 months for features to get copied, so by the time their old product is having knock-offs hit the market, SN has a new and improved product with a feature the knock-offs don’t have. For example, if SN originally “wins” the vacuum market with a vacuum that doesn’t clog with hair now, in 18 months competitors will be rolling out non-clog vacuums…. but at the same time SN will be rolling out a non-clog vacuums that also can be emptied hands free.

There is certainly something too that…. but I’m skeptical. Many of SN’s categories are in products that have been around since the dawn of the electric age. For example, one of SN’s categories is toaster ovens (where they have 23% share). How many incremental product innovations can you really make in toaster ovens? It seems to me that there shouldn’t be that many gains to be made, and even if there are those gains should be rapidly copied and thus fleeting.

The second possibility is that Ninja and Shark have some brand power / equity built in that give them pricing power. People will pay up to buy a Nike branded product because they know it’s a quality product and they have some brand association with it; in a similar way, perhaps people have come to associate Shark and Ninja with “when I buy this, I know I will be getting great quality at a reasonable price and it will be easier / more fun to use than any competitor".” Again, I will be honest that I’m a little skeptical of this; you generally form brands through something you frequently buy or wear. It’s hard for me to imagine a brand forming from something as rote as hair drying or vacuuming. But I could be off here; I will tell you that I’ve received dozens of responses to this series along the lines of “my wife loves their hair dryer” or “I bought the air fryer and I’m obsessed.”

Again, I’ll admit that I’m a little skeptical of the sustainability of SN’s growth and SN’s ability to build any brand strength here. It just seems so obvious to me that appliances should have literally zero brand strength and all profitability in the sector should get competed away….

But I could easily be wrong. The best proof is that SN has been able to hold dominant category share for years, and that their margins haven’t collapsed while they’ve continued to grow. And brand strength can come from really strange places: I would have never imagined you could build a multibillion dollar brand around coolers and mugs like Yeti has.

A secondary bear thesis is that, even if you believe the margins and market share are sustainable, the growth has to stop eventually. SN is in ~25 different verticals right now. If it launches into one new vertical today (and we assume every vertical is the same size) and successfully takes its normal market share, that single vertical will drive ~4% growth (1/25). Let’s assume SN launches three new verticals a year and fast forward ~3 years. In the hypothetical future, SN is now in 35 verticals, and a new vertical launch will drive <3% growth.

There simply aren’t endless verticals for SN to launch into, and a launch takes management time / effort / money. SN is going to run into growth limits pretty quickly; what has historically been a ~20% grower is going to quickly become a <10% grower just as they hit their natural category limits (and that, of course, assumes that the brand / sustainability issues I mentioned as the first bear thesis don’t come into play).

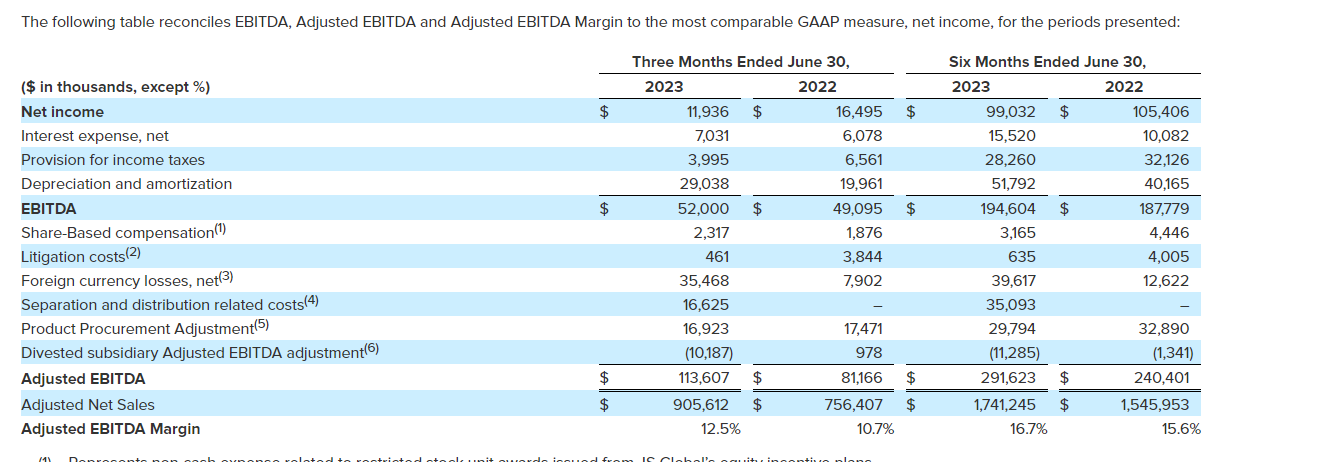

The last bear thesis here is SN is a controlled company. They were spun out of a Hong Kong listed stock, and the chairman still owns >50% of the company. That raises all sorts of different control concerns; mainly, could the control shareholders use their control to “loot” the minority shareholders? In fact, if you look at the company’s adjusted EBITDA, you can see some evidence of this. Notice the “product procurement adjustment” below:

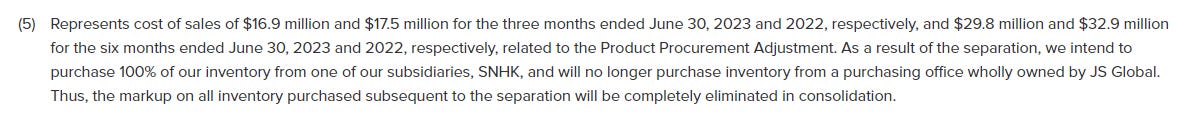

The footnote for the product procurement adjustment is screenshotted below:

That is a very strange adjustment; if you look at p. 148 of the company’s F-1 it looks like the procurement adjustment will be phased out through June 2025.

There are two arguments about this EBITDA adjustment. First, that is a big addback (~10% of the company’s EBITDA). If it’s a real expense, then the company is way overstating their adjusted EBITDA (that’s actually part of a larger concern / bear case; most of these addbacks seem reasonable, but the earnings addbacks here are large). If the expense is not a real expense, that brings us to the second concern: this is a controlled company, and they spun off with a way to distribute some extra cash to their former parent (which is owned / controlled by their controlling shareholder). As that payout goes away, what’s to stop the controlling shareholder from deciding to ding minority shareholders for some more crazy payouts?

The “control” risk is certainly real, but I think it’s ultimately dismissible. SN used to be a controlled company inside of a Hong Kong company. If you really wanted to loot SN, where do you think it would be easier to do so: as a subsidiary of a Hong Kong company, or as a separately traded, publicly listed stock in the U.S.?

The answer is obviously “option A.” If you wanted to loot, spinning into a separate U.S. listed company would be crazy…. and you probably wouldn’t give the CEO the huge RSU grant I mentioned in part 2 (as the RSUs would be worth way less as a corporate control discount setttles into the stock; better to just find a way to get cash directly to the CEO). Also, SN generates a huge amount of cash; I’d love to see them start repurchasing shares, and I’m worried they won’t be as aggressive with it as I’d like them to….. but I’ve seen no indication they plan on hitting the equity capital markets. It seems like there would be at least some plans to do that if they wanted to loot minorities; you generally can’t loot minorities without raising outside capital!

Again, control’s a concern, but I’m not sure why you’d follow the path SN took if you really wanted to do some looting. There’s just so many options that would have been way better if that’s what they wanted to do; I think the straight spin and RSU grant to execs suggests they are planning to be quite shareholder friendly. Anything can happen, but as long as things remain on track I think you can largely put this concern to bed.

Speaking of control, it’s worth briefly discussing capital allocation as a risk. I think there are two risks worth mentioning; the first is acquisitions. It’s really easy to pursue bad acquisitions in consumer and/or as a newly publicly traded company. I think that risk is easy to dismiss for SN; other than some very small technology acquisitions, I don’t believe they’ve ever done an acquisition (both of their brands are homegrown), and they’ve given no indication they want to acquire another brand. That actually makes sense; when your brand has been built on category disruption, you generally don’t want to acquire! You’re all about going into category and killing the incumbents by disrupting / out-innovating them!

There is a smaller capital allocation risk: suboptimal allocation. A company can be too conservative in their capital allocation; if you run a business with an enormous cash balance it will act as a big drag on equity returns. I worry there is a chance SN proves too conservative with capital allocation; they are currently ~1x net levered, but they are gushing cash flow. The company has given no indication they plan to buyback shares or pay a dividend. Most spins provide some capital allocation guidance at the time of spin; I’m worried SN will just let the cash pile up on their balance sheet (and maybe pay a token dividend at some point).

As far as risks go, having too much cash is certainly not the end of the world, but it could prove a big drag on equity returns.

The last risk I’ll mention is company culture / innovation. It’s kind of a combo risk and upside thesis.

SN is a company with a 20 year history of rapid growth. I mentioned in the risks earlier how that growth has been fueled by innovation and how the growth gets harder and harder to continue to sustain as the company gets larger and each new category can’t drive the same returns.

But there is also risk that, as the company gets larger, that “innovative” culture goes away. SN’s innovations aren’t the “we invested $100m and 10 years of R&D” type innovation; it’s innovations that cost very little money and are centered in a deep understanding of customers and how they use products. SN’s proven that type of innovation can be very profitable, but it’s also very hard to keep doing. As your executives get richer and the company gets bigger, it’s harder and harder to stay so close to the customers. It’s easier to get bogged down by bureaucracy, with each sequential “innovation” taking longer and longer to roll out and being less of a customer enhancing “innovation.”

Consider something like the George Foreman grill; 20 or 30 years ago I feel like I heard about people using them all the time (I had one in college!). Maybe I’ve just aged out of the demo, but I don’t ever hear about the George Foreman grill anymore (and some quick googling suggests that, while the brand is still around, I’m not the only one not thinking about George Foreman anymore!). That brand was innovative when it came out, but eventually it got stale, the market got saturated, and the brand stalled out.

So there’s risk of something similar happening with SN (losing innovation and the brand stalling)…. but I think that risk also relates to the opportunity. SN is run by the same CEO who has overseen their explosive growth over the past 10+ years. I think you could argue he should be more incentivized than ever today; for the first time, he’s got hundreds of millions in stock riding directly on his decision making and innovation.

The opportunity is that SN’s founder is the type of “category killer” / “founder led” / “compounder bro” CEO that everyone loves to invest in, and those types of CEOs defy traditional economic laws of competition. Everyone thought cars were where capital went to die…. until Elon and Tesla changed the world (and wrecked a whole lot of short sellers). You could make similar stories about retailing and Sam Walton, or online retailing and Jeff Bezos, or mobile phones and Steve Jobs, or any other number of companies led by visionary founders.

Am I comparing SN and their CEO to any of those legends? Absolutely not….. but I am saying that there’s a 15 year track record of SN delivering this type of innovative growth when it probably shouldn’t, and when you’ve get a long track record defying the odds like that, it’s probably at least time at acknowledge the chance you’re dealing with a special company / executive who breaks the odds.

I think that’s as good a place as any to end this series. In the short term, the story of SN is going to be defined by everything this series talked about: as the “spin seasons”, the near term questions will be if SN can garner a premium multiple to their peers given their premium growth.

But, in the long turn, SN is going to be driven by that last question: can they really keep dominating their category based purely on innovation? Is there anything else here? Can competition catch up to them?

Is their CEO one of those legends who traditional economic rules don’t apply to?

Wrapping up

I was sorely tempted to end it on that last line…. but there are two follow up thoughts I wanted to hit before wrapping up.

First, the bull thesis in part 2 noted that SN would likely garner (favorable) coverage in the short term, which could help it a bit with their multiple. Sure enough, just this morning Jefferies initiated with a buy target above what even the most bullish investors I’ve talked to have been targeting.

Second, there were some questions if the SN spin qualified for “normal” spin dynamics / mispricing given it was the vast majority of their parent company’s value. I think the answer is absolutely “yes”; check out the paragraph below from SN’s prospectus. Remember, insiders own ~60% if SN’s stock, so this paragraph alone says that >10% of SN’s free float needed to be force sold on the open market after the spin due the complexity / international nature of the spin. And that’s just the shares that had to be force sold! I’m sure there are some additional shareholders that wouldn’t want a U.S. stock for some reason, and the different nature of the spin would certainly cause it to attract less buyers than a normal spin (as detailed in part 1).

With Jefferies initiating this morning, the SN thesis is no longer quite as underfollowed as it was last week, so I’ll wrap it up here. It’ll be interesting to see how it plays out over the next few years, and if SN can keep the innovative culture that let them grow so quickly or if the growth introduces bureaucracy that sees their “moat” crumble.