Quickie Idea: $ADT might not be secure, but it might be a steal....

This post is the second in a new series I plan on doing on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. A pretty simple hypothetical example: If Buffett bought out Coke at 25x earnings and Pepsi was currently trading for 15x earnings, a quickie idea would be “Why isn’t Pepsi a takeover target now, or at least interesting as a potential value investment?" Today's company is ADT (disclosure: long). ADT is a home security company; you probably know them best from the blue octagon "secured by ADT" sign that so many houses put in their front yard (side note: I'm sure homeowners put that sign out to discourage robbers, but is there any evidence the sign actually works for anything other than marketing ADT? I feel like I saw a study once that said it did but I can't find it, and I'm curious if the study is actually scientific or was company funded). The home security business should be a pretty good one given ADT's scale and brand. Consumers pay monthly, creating great revenue visibility and working capital dynamics, and customers should be reasonably sticky for a variety of reasons (mainly laziness; once you've had a home security system installed and turned autopay on, why go to the trouble of switching providers outside of something like moving?). There should also be decent scale benefits here that should provide some barriers to new entrants: for example, alarm systems need to be monitored 24/7, so you need some degree of scale to afford call / service centers that are running 100% of the time, and given we're dealing with personal safety and security here, having a brand consumers know and trust is probably a nice selling point versus a start up (as the company put it, "ADT is to security what... Kleenex is to tissue"). Brief business overview out the way, let's turn to corporate history, because it's instructive here. ADT was a public company until Apollo bought out ADT in 2016. Apollo's plan with ADT was to "act as a strategic buyer" and combine ADT with two smaller rivals Apollo had purchased in July 2015. Apollo combined ADT and then brought the new, larger ADT public again in early 2018. Interestingly, the ADT IPO was not Apollo's way of fully exiting ADT; they didn't directly sell any shares (of course, by having the company sell shares Apollo did reduce their overall ownership!) and Apollo continues to own >80% of ADT's shares. ADT has had a rocky go of it in this round of being public: the company hoped to get $17-19/share when they went public, but "subdued public interest" caused them to price the IPO at $14/share. Public interest has remained subdued since the IPO, and today shares trade for just over $5/share. I think that's an interesting price for a few reasons.

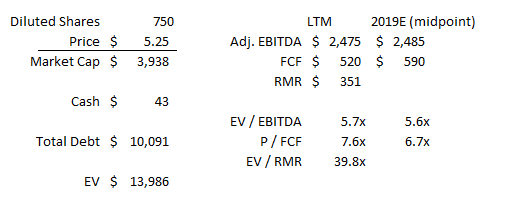

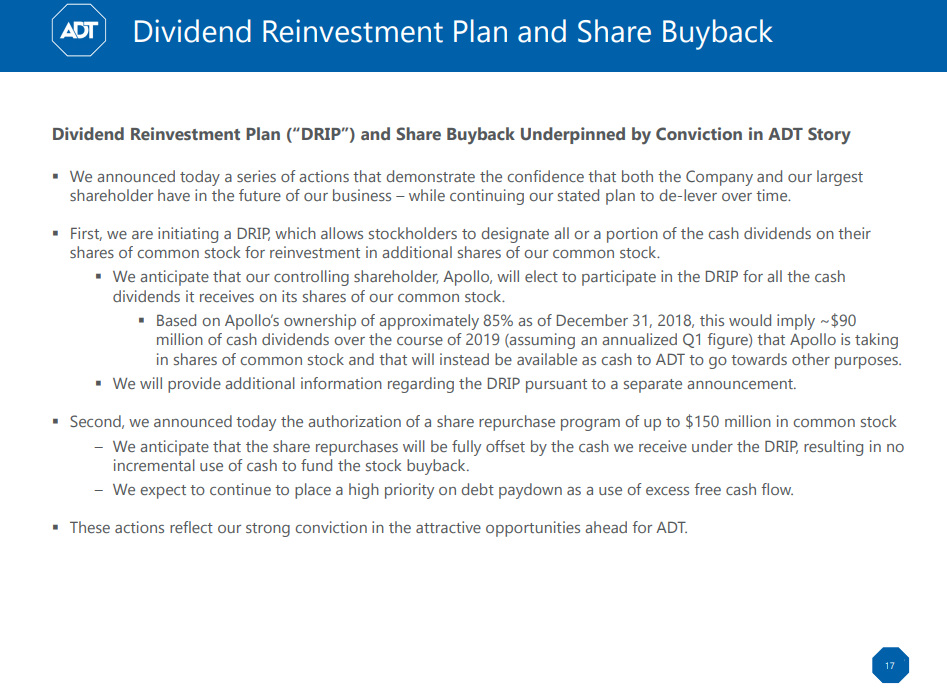

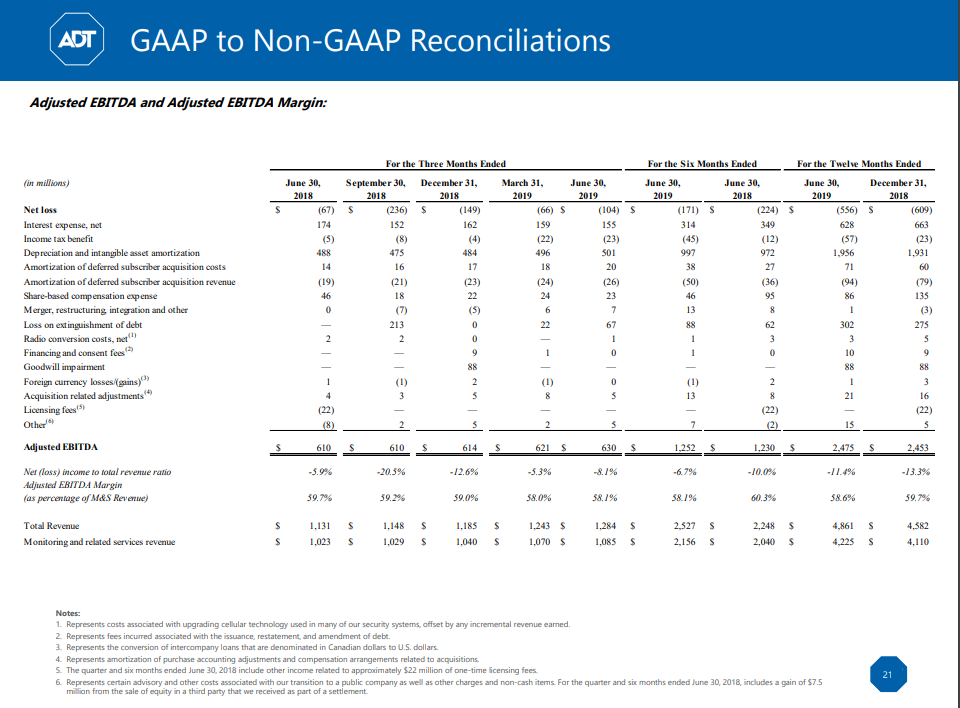

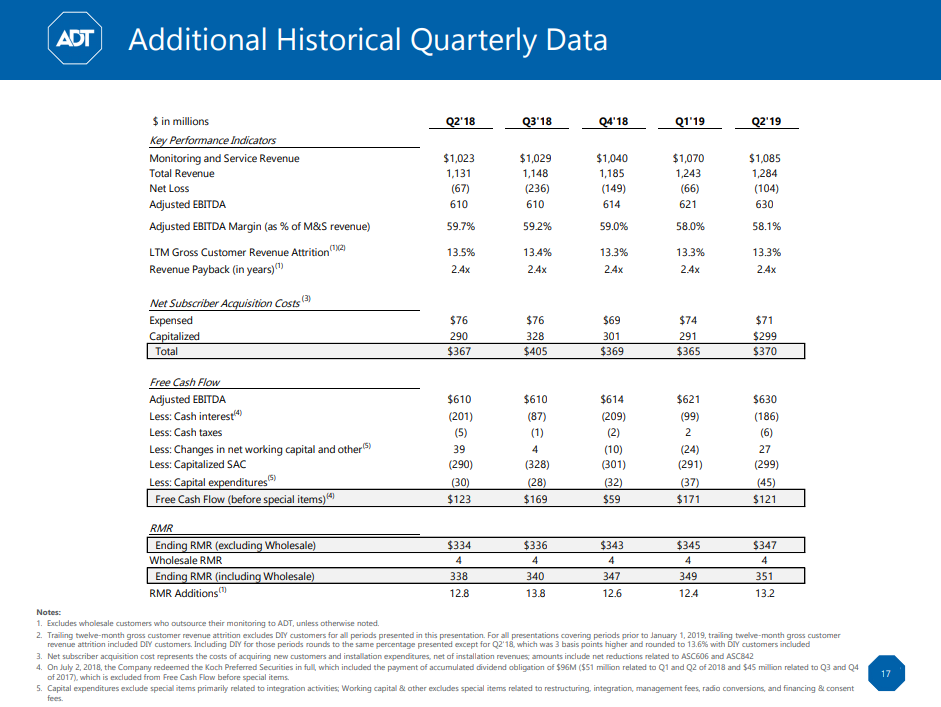

First, it's cheap on a variety of metrics. ADT trades for <6x EBITDA and <7x Price to Adjusted Free Cash Flow (I'm using ADT's given adjusted numbers, which as I'll mention I think might be too rosy, but they're fine for a starting point). ADT also trades at <40x RMR (Recurring Monthly Revenue), a common industry valuation metric. If we go back to ADT's 2016 buyout proxy, we can see that Goldman thought the right buyout multiple for this business was 45-50x RMR (see ~p.55), and as the largest company in the sector I think it could be reasonably argued ADT is a better business than the average takeout candidate. (Note that EBITDA should translate pretty well to unlevered free cash flow; most of ADT's capex is growth capex and cash taxes are minimal given a huge NOL balance, though you need to balance that growth capex number by noting the business would run off some without that spend given customer churn).

Second, ADT is crazy levered, so small changes to ADT's multiples would result in large changes to the stock price. Simply taking the EV / RMR multiple from ~40x (today's levels) to 45x (the low end of GS's range from the proxy) would take the share price to ~$7.50, an almost 50% increase in value.

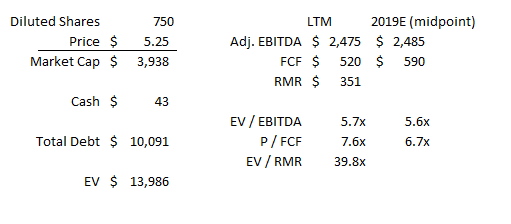

Third, ADT and Apollo aren't just talking about how cheap ADT is (though they are both talking; see links)... they're both acting on it. ADT announced a $150m share repurchase plan in February 2019 and proceeded to execute basically the whole thing by the end of Q2'19. In total, ADT repurchased ~24m shares. Given they had <800m shares outstanding at the start of the program, that's a pretty impressive repurchase program (around 4% of shares outstanding). However, I think the repurchase is even more impressive if you dive deeper. Apollo owns >600m of ADT's shares, so ADT's free float at the start of the year was <200m shares. By going that aggressive into share repurchasing, ADT repurchased a huge swath of their free float (well over 10%) in less than five months. So the aggressive share repurchase is ADT's way of acting on their cheap share price. What about Apollo? Well, first, they control >85% of the stock, so their implicitly acting on how cheap ADT is by allowing the company to aggressively repurchase shares and not participating in the repurchase (i.e. not selling their stock as part of the buyback). However, they also set up a dividend reinvestment plan (DRIP) as part of ADT's dividend, and Apollo has been participating in it recently. By doing so, Apollo naturally takes up their ownership stake in ADT (shareholders who elect shares instead of cash will increase their ownership %, while shareholders who elect cash will see their stakes diluted slightly). Combine the buybacks with Apollo's participation in the DRIP, and Apollo's ownership of ADT continues to increase (slide below from ADT's Q4'18 earnings slides). Sure, it's a small increase given how much they own, but they own so much that it's interesting to see them taking a lot of different angles to continue to edge up their ownership %.

Anyway, my bottom line is that ADT is seems pretty cheap and insiders (both the company and Apollo) are making moves that suggest they see value in the company. Given the huge leverage here, if ADT does rerate higher shares would see a significant jump. Are there risks here? Absolutely. The most obvious is the leverage; if results take a slight turn worse, the leverage is going to consume the equity. In their Q2'19 guidance, ADT took up their forecast of full year customer churn, which is a huge concern on a variety of levels. If that increase in churn is a sign the business is starting to deteriorate, it's not going to be pretty for the equity no matter how cheap it looks on trailing numbers. Another, somewhat related risk, is that home security seems to be an obvious area for a lot of larger tech players to target as they try to take over more and more of our lives. Amazon's already bought "smart doorbell maker" Ring, and Google Nest has security features as well. It feels like Amazon / Google could justify selling you home security basically at cost to get you into their product ecosystem (i.e. Amazon could use security to get echos all over your house, which would drive prime subscriptions and retail sales). ADT would counter that these concerns have existed for decades and haven't really impacted their business, but I think the concerns are real and more intense than 10/20 years ago. It wouldn't surprise me if in 10-20 years Amazon or Comcast or Google were the largest home security provider in the country. The last two risks I'll mention are somewhat interconnected. First, I've been using the company's given numbers for adjusted EBITDA and free cash flow, and those numbers include heavy addbacks. I don't see anything crazy controversial in the addbacks (stock comp is a very real expense, but it's easy enough to add that back, and I would prefer they just expense instead of capitalize subscriber acquisition costs as capitalizing the costs makes EBITDA a less useful number over a multi-year period, but it all washes through the free cash flow statement eventually so whatever), but the sheer degree of the addbacks is a bit concerning. In addition, AT&T is sunsetting ADT's 3G network, and ADT is going to need to invest ~$200-325m to replace those systems over the next few years (per Q2'19 call). ADT is planning on adding the cost back as a one-time cost in their financials, and I'm not sure how to think about that cost (obviously there's a real cost here, but by adding back ADT is treating it as just a one-time outlay, while I can't help but wonder if it represents more of an ongoing maintenance expenditure).

Anyway, this is a quickie idea, so I'm going to wrap it up here. I don't feel like I have any particularly differentiated insights on the business, but the combination of the cheapness (you're basically buying at Apollo's cost basis today, except you're getting a larger and improved business so you get at a much reduced multiple), the insider bullishness, the overhang from ADT's low float / Apollo's ownership (I'll note I don't view Apollo's ownership as an overhang; I actually like it because I think they'll force reasonably rational capital allocation on ADT), and the GAAP financials looking like a mess (the accounting for acquiring new subs makes the business look substantially worse than it actually is) are enough for me to take a small position. If you've done work on the company and want to dive deeper, I'd be happy to swap thoughts.... but only if you've done work on the company (some people have recently attempted to turn this offer into an opportunity for me to walk them through the 10-k)!