Quickie idea: did $HHC teach us anything about other landbanks ($JOE, $CTO)?

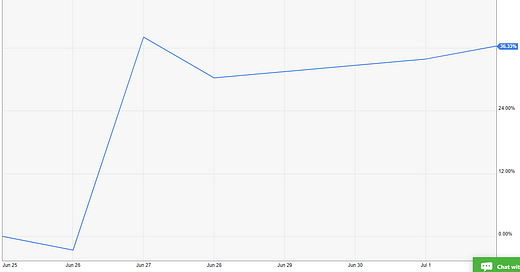

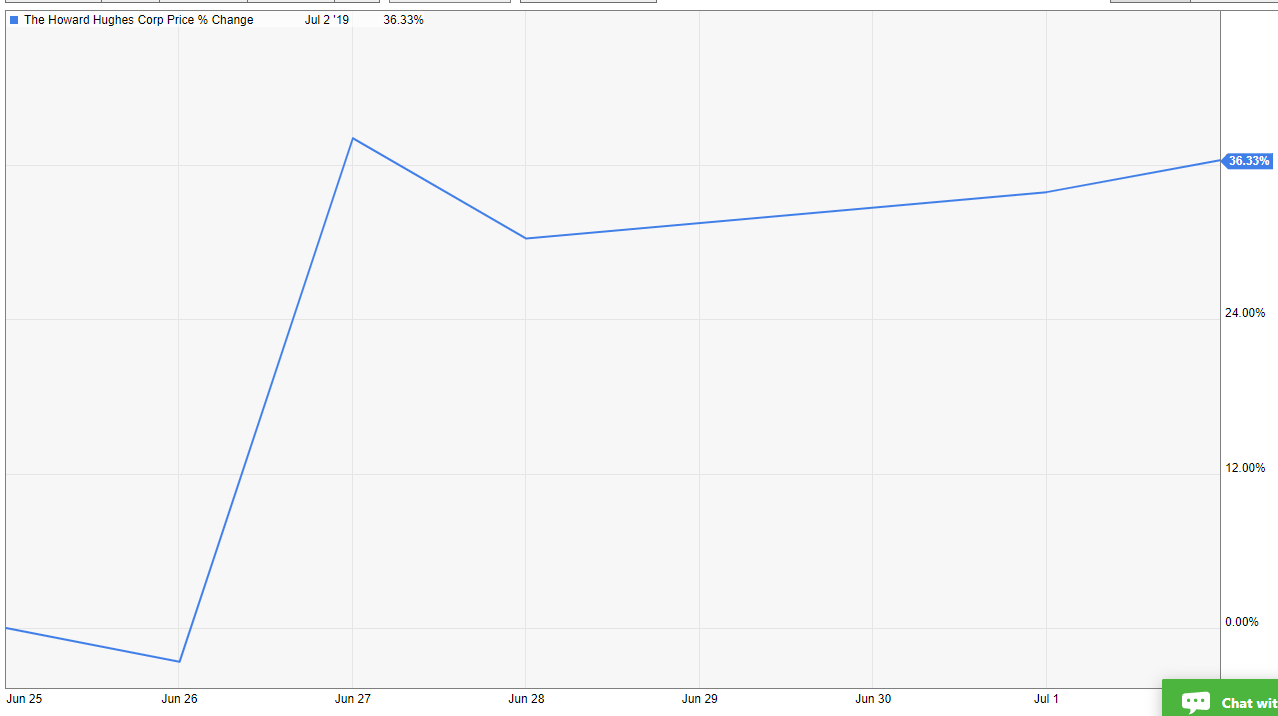

This post is (hopefully) the first in a new series I plan on doing on an irregular basis. A "quickie" idea is an investment specific idea that I've been mulling over and find interesting, but haven't dove fully into yet. A pretty simple hypothetical example: If Coke got a hostile takeover offer, a quickie idea would be "Why isn't Pepsi a takeover target now?" I originally planned on doing this series in my monthly links column, but as I started writing the post I realized so much of it could go stale in between writing and posting that it would be better to just post if/when an idea came to me. Anyway, the idea / thought that lead me to creating this series was HHC's (disclosure: long a tracking position) announcement they were pursuing strategic alternatives. HHC's shares shot up ~35% on that announcement, which made me wonder if it's possible that the market is currently undervaluing "land bank" type opportunities (I'm defining land bank as a publicly traded company whose main asset consists of undeveloped / non-income producing real estate).

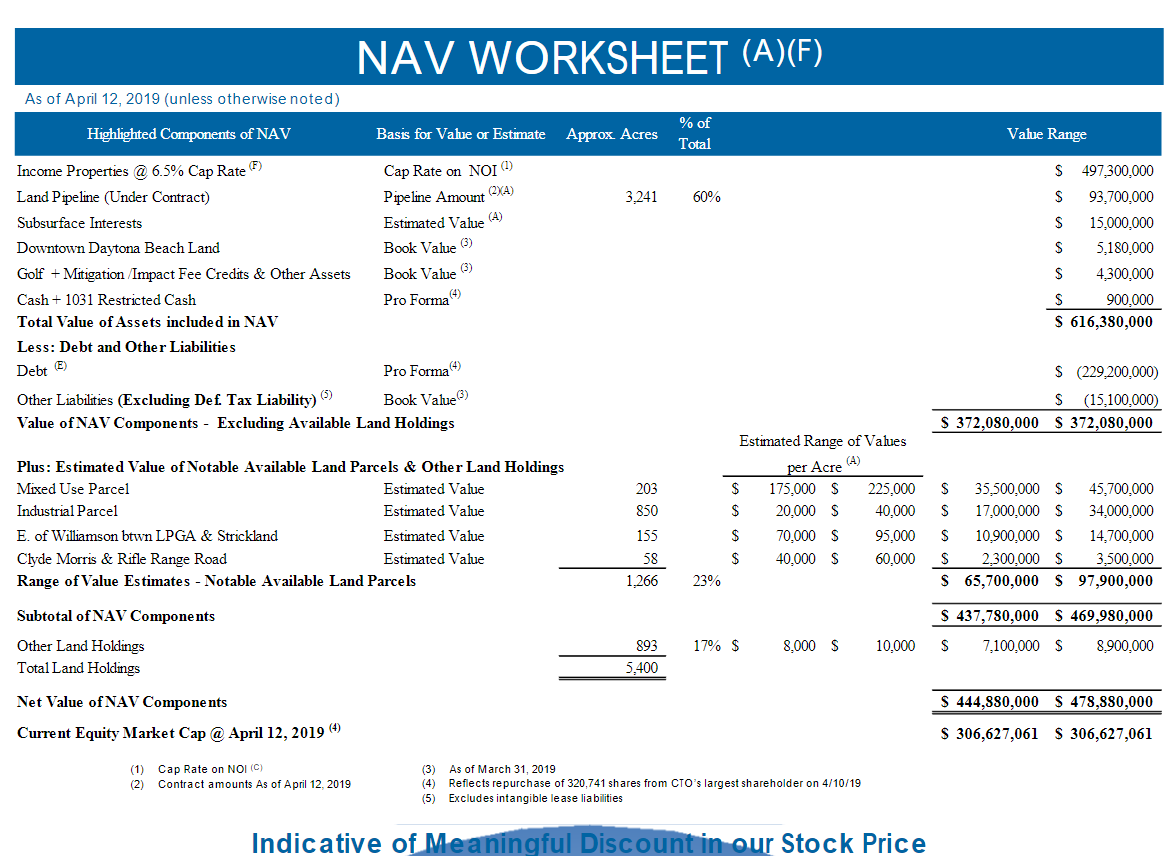

Let me take a step back on HHC. HHC isn't exactly an unknown company among value investors; it's a large position for Pershing Square / Bill Ackman (disclosure: long PSH), and Ackman has talked about the company and its value pretty frequently (in both his shareholder letters and in a 2017 pitch at Sohn... which he did when shares were trading around their current price in the mid-$120s). HHC's management has also frequently suggested shares traded below NAV, and many investors (myself included!) liked how management used their own money to buy LT warrants on HHC stock, as it seemed to reasonably align management with shareholders. Anyway, what's so interesting to me is that HHC had a huge "pop" on their strategic alternative announcement, with shares up ~35%. That's the type of pop I'd expect to see from a company announcing a signed, definitive merger agreement. To go up 35% simply on announcement of reviewing alternatives suggests the market was valuing HHC for significantly less than their private market value. Of course, there is an argument to be had about why the market was undervaluing HHC's assets (i.e. was the market discounting the assets too heavily, or was the market skeptical of HHC's capex / investment plans?), but with that type of pop it's tough to argue that HHC was fairly valued pre-announcement. Bulls have long argued that HHC was mispriced because it didn't fit neatly into any bucket. HHC wasn't a REIT with huge cash flows and a high dividend payout like most other real estate companies, so a lot of natural real estate investors didn't look at it. HHC's assets were a hodge podge of unrelated assets (prime Hawaiian real estate, a downtown NYC development, master planned communities in Las Vegas and Houston) that had no real reason to be together and that demanded very different valuation methodologies, and while many of those assets would have significant value in the long term, in the short run they were an earnings drag and (you could argue) the market was failing to fully value the assets given how far away the payday for those developments were. HHC's stock was also a bit on the illiquid side given a few longer term value type funds (Horizon Kinetics, Pershing, etc.) had decent sized positions in it, and some institutions may have been scared to step into the stock given that relative illiquidity and the potential for short term share price weirdness if a large block decided to liquidate (as happened last year when Pershing trimmed their stake). That HHC pop makes me wonder: is/was the HHC undervaluation HHC specific, or is it specific to all land bank type companies? The two companies that "pop" into my mind are JOE and CTO (disclosure: long a tracking position in JOE), as both have huge similarities to HHC. All of them have the same "doesn't fit neatly into any bucket" issue. All have ties to famous value investors who have struggled recently (HHC obviously has Ackman as a large shareholder and chairman; Fairholme owns just under half of JOE's stock and Berkowitz serves as Joe's chairman; Wintergeen owned ~30% of CTO for years but sold all of their shares in the middle of last year after several failed proxy battles), all control huge swaths of land and are actively developing them, all have seen their share prices more or less stall out over the past five years despite continued progress in developing that land, and all have relatively consistently argued that their shares trade far below their NAV (CTO even publishes an estimate of their NAV in their investor presentations; I've included a screen shot below), all argue that their NAV is continuing to grow at an impressive clip (despite what their stalled out share prices say), and all argue that they are realizing really attractive returns on their growth / development capex (for example, JOE has argued 10% unlevered returns on their growth capex, which obviously creates tons of equity value, and I believe HHC made similar arguments on the returns from their growth capex). I'm not saying any of these companies are perfect comps: HHC's assets are far better than JOE and CTO, and CTO appears much further along in having fully developed their asset base versus the other two (I haven't followed CTO as closely as JOE or HHC, so that's a more 30k foot observation), but nonetheless there are significant similarities between the three.

Anyway, my quickie idea is this: does the massive HHC pop mean there's opportunity in the other land bank plays? Is it possible the market is systematically undervaluing these companies, and HHC's announcement will either spur the market to reassess its valuation of JOE / CTO or spur the companies to go private? Companies and investors are trend followers; if one company pursues a successful strategy of some form, you can be sure that any other related companies will be pursuing the same strategy in relatively quick order. And I can guarantee you that Berkowitz / Fairholme noticed the pop over at HHC. I don't expect JOE to sell (I think Berkowitz wants to hold JOE forever; the 2019 JOE investor day presentation ended on a slide that said "expect multi-generational value creation." Berkowitz is the chairman, so I'd assume that he's looking at the company as a multi-generational value creator), but with JOE making up a huge amount of Fairholme (it was ~30% holding at YE2018) the HHC pop might make him think about selling JOE / taking it private so that he could get liquidity on a mammothly large / illiquid position for his fund.

Of course, maybe I'm counting my chickens before they're hatched. HHC hasn't even been sold yet! There's every chance the company calls off the process and shares fall back below $100 tomorrow. Still, if HHC's strategic process is a success and there turns out to be a robust bidding process for their assets, I would guess both CTO and JOE would notice, and at some point it wouldn't surprise me if either / both decided to follow HHC's path. And, if they did, I would guess their share price reaction would be similar to the one we just saw at HHC. Other odds and ends

Some random posts on HHC post-strategic alt announcement

Kuppy had previously argued he'd driven around JOE's land and thought a lot of it was pretty valuable; not sure what he thinks about it today. JOE management seems to agree with Kuppy; they repurchased ~34% of their shares over the past ~4 years.

David Einhorn was short JOE for ~ten years; he covered in 2015 (quite profitably!) around today's price while arguing shares remained "somewhat overvalued."

An interesting bear case on JOE: how much does global warming hit their beachfront properties over the next few decades?

Back when Wintergreen was trying to replace CTO's board, they mentioned being contacted by parties interested in buying all of CTO several times (here, for example). Who knows how real those indications were, but I would guess if the company were to explore a sale there would be interest from a variety of buyers.