Short squeezes, gamma, and fiduciary duty $GME

I'm not that old (I'm 32). I can't remember the dotcom bubble, but I have some memories of the financial crisis (it happened when I was first starting to invest) and can remember plenty of weird markets including the drawdown in early 2016 (which hammered growth / tech stocks), the meltdown of late 2018, the pandemic sell off in March 2020, and several other weird moments (remember when the U.S. got downgraded!?!?! or Brexit?)

Nothing, and I mean nothing, comes even close to how crazy the market is today (speaking of nothing: nothing on this blog is investing advice! buyer beware!).

The headliner for craziness is obviously GameStop (GME). I've been tweeting out tons of fun facts about them (their stonk now massively outperforms Berkshire going back decades, their largest shareholder could become the richest man in the world by next week, and the Switch I bought last month would be worth way over $5k if I had bought stonk instead).

But honestly- Gamestop's stock price isn't that crazy. It's a short squeeze. A truly epic short squeeze, but a short squeeze nonetheless. This is what happens during short squeezes; the GME short squeeze hasn't even approached Porsche / Volkswagen levels yet.

What's so crazy is what the GME short squeeze is doing to other stocks. Every other stock that has any type of short interest is blowing out. The headliners here are obviously the other high interest stocks (AMC, TR, etc.). But the current squeeze goes way beyond that. Any parent / stub type trade is getting demolished Liberty Sirius (LSXMK) is down 5% while SIRI is up 5%. Dell is down 1% while VMW is up 4%. IAC is flat while ANGI is up 12%+.

Is there opportunity there? Probably. But there's also risk. So, while reminding you that nothing on this blog is investing advice, a word of caution: you might see those spreads blowing out and be tempted to trade around them. Maybe you see the insane vol at AMC or GME and are tempted to sell some naked deep out of the money calls.

The word of caution? Don't.

You absolutely cannot be short anything with any potential for a squeeze in this market.

People thought there was no way GME could hit $100. Then there was no way it could hit $200. Now it may hit $400 by the time I post this.

Similarly, you might be thinking "how big can the LSXMK / SIRI spread get? I should put some of the spread on" The answer is it can get bigger. A lot bigger. If SIRI really rips, there's no reason it can't trade to $20 while LSXMK drops to $25 or $30. If that happens, you're going to get your face ripped off.

Do not short anything that can get squeezed.

You're probably thinking, "thanks for the advice, gramps. I thought you said there was opportunity." And the answer is there absolutely is! If you believe in the Liberty team, buying LSXMK down 5% while SIRI is up is a gift. They will absolutely buy back shares and close the gap at some point. If you like the ANGI story, having IAC flat while ANGI is racing is a gift. You know they'll spin ANGI out at some point! If you think you can trust Michael Dell, have Dell down while VMW is up is awesome. He promised to spin it off later this year; having VMW up gives Dell more options for the spin off (like selling some shares in front of the spin).

Heck, the opportunity doesn't even have to be in the parent / stub trades. Hedge funds across the board are clearly degrossing. Plenty of popular hedge fund longs are way down for no reason other than they are popular. Or there are plenty of popular hedge fund shorts that are ripping as they get frantically covered. If you're long one of those situations, take advantage of the price weakness to add a little (if it's one of the names down), or maybe take advantage of the rip to trim some or sell some super high vol calls (if it's one of the names that's ripping). Either way, I suspect you'll be happy with that move when things normalize.

So pick your shot if there's one you like and take it. Just don't short.

That covers the shorting and hedge fund degrossing / spreads blowing out. But this post title included gamma and fiduciary duty. What am I talking about there?

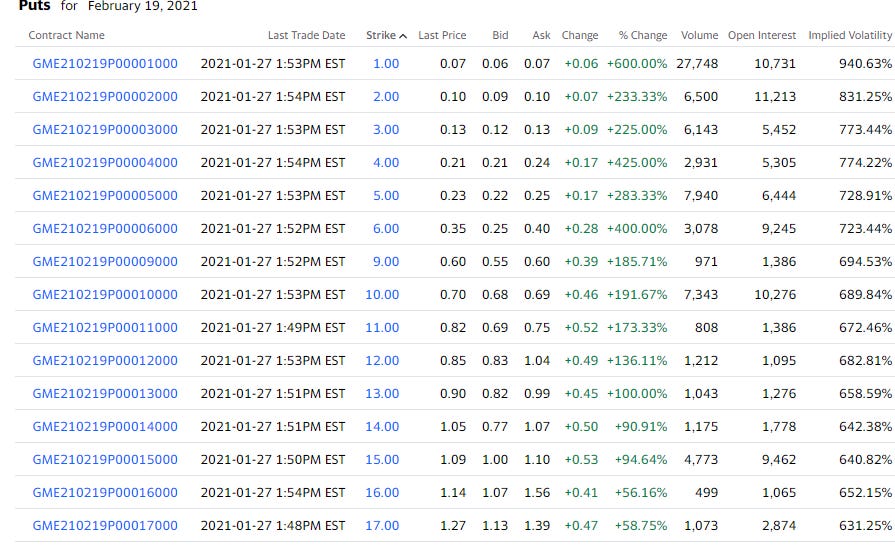

I'm talking about the deep out of the money puts for some of these high interest names. Take GME. The stock is up a stunning ~120% today. Somehow, the Feb. puts (which expire in ~3 weeks) are screaming higher. I'm not sure I've ever seen a stock increase significantly and have their put options increase in value, but GME's stock has doubled and their super deep out of the money puts have doubled or tripled in value.

It's an absolutely stunning move. While reminding you that nothing on this blog is investing advice and trading options is incredibly risky and should only be done by the most sophisticated investors (and maybe no one at all), I do think there's opportunity there.

The thought here is simple: consider the Feb. $10 puts. GME stock would have to drop by >95% for those puts to be in the money. You're getting paid ~$0.70, or 7% notional, to sell them. Assuming they expire worthless, that's a 7% gross and, given they expire in less than a month, an IRR that is so insane I can't bring myself to put it to paper

Of course, that assumes they expire worthless, and at this point, I'm not ruling anything out for GME. But the board has to be aware that there's an opportunity to raise an epic amount of money and transform the company (if they don't, they should get sued for breach of fiduciary duty).

Selling those puts is basically a bet that GME does its fiduciary duty and raises money. Whoever buys those puts is basically buying bankruptcy protection; GME could raise enough money right now to take any potential bankruptcy off the table for the next 100 years. They could raise enough money that they would have enough net cash to cover those strike prices 5 times over.

The moment GME does, the stock probably drops significantly, but the volatility collapses and those puts are worthless.

Selling those puts (or any deep out of the money puts on these high short interest stocks) is basically a bet that the company's board does their fiduciary duty and takes advantage of the market to raise cash. That's a bet I'm willing to make (in reasonable, measured, cautious size!).

Of course, given today's move, the puts have ~doubled since the first time I thought this idea was interesting, and I've had people start to ask if puts can trade through their strike price (I would have said no three days ago, but in this market I'm not sure!), so buyer (or I guess seller in this case) beware!.

Again, nothing on this blog is investing advice. But if you leave with one thing, please leave with this: do not give in the temptation of looking at these prices and thinking "that's crazy; I'll short a little bit." That's a great way to blow up. There's plenty of opportunity out there; just make sure you're around to take advantage of it!