Over the past few weeks, this blog has become all PSTH, all the time (well, with a sprinkle of meme stocks mixed in). It started with me discussing PSTH’s most likely deal targets, and then I broke down and attempted to simplify the PSTH / UMG proposed transaction (I would particularly encourage you to read the simplification to understand the different parts of the PSTH transaction). I’ve also posted clips from a bunch of industry / expert calls that I was keeping as I was researching UMG (I think that’s well worth reading to get the UMG bull thesis; it’s biased since it’s mainly music companies themselves talking about their value, but I think it does a nice job laying it out!).

Why all of this focus on PSTH?

I think PSTH is a unique and alpha rich combination of an event opportunity and a value opportunity right now.

For event investors, given the downside protection provided by PSTH’s redemption option, I think they are getting an interesting chance to buy PSTH now and bet on the market responding positively to the official UMG deal announcement.

For value investors, I think PSTH is trading below where the sum of its parts will eventually shake out. In particular, I think UMG is likely to trade much higher as investors do more work and get comfortable on it, and buying now lets investors get in front of that move.

There are plenty of reasons this opportunity exists; for example, I wrote last week how SPACs are flying after they complete their deSPAC and people can buy into the “clean” / deSPAC’d company. I suspect there’s some of that going on with PSTH right now; a lot of the natural buyers for UMG don’t want to buy into PSTH as a SPAC / don’t want to buy into a complicated deal. After PSTH signs the official deal and as we get closer to them spinning the UMG shares, I suspect that dynamic changes.

But I think the main reason this opportunity exists is we are in a weird information vacuum right now. PSTH put out a press release with the very broad outlines for their UMG deal and the remainco spin when the UMG rumors broke a few weeks ago. Since then, it’s been radio silent on PSH’s end (with the exception of Ackman tweeting out a vulgar sock puppet reviewing the proposed deal).

That information vacuum makes sense. It doesn’t behoove Pershing to come out and say, “hey, we are stealing UMG. This business is way too cheap; we’re going to make a fortune!” right now. Doing so would only hurt PSTH; it causes pushback from Vivendi’s shareholders and increases the odds Vivendi tries to recut the UMG deal (making PSTH pay more).

That all changes next week. On June 22, VIV’s shareholders vote to approve the UMG spin off. Assuming that goes through, PSTH and VIV can make the UMG deal official immediately after. Then, it behooves Ackman / Pershing to go out and shout to the world how good of a business UMG is (and how awesome the other pieces of PSTH are). My bet is that once the deal is official, Ackman and Pershing are going to go on a press offensive. I would guess you get an hour long presentation right when the deal is announced, a half hour special appearance on CNBC / Bloomberg, and an eventual multi-hour investor day featuring the UMG management team, some buzzy musicians, and Pershing’s full investment team. Heck, I wouldn’t be surprised if Bill reached out to the sock puppet to do a skit together to generate some buzz. I’ll even offer my podcast as a platform for pitching the deal; the people want to see it happen, and I’m even willing to try sock puppet’ing if that will help the pitch.

Anyway, my bet is that once Ackman / Pershing go on that press offensive and investors start doing work on the value of standalone UMG, they are going to love what they see, and PSTH’s share price is going to respond very positively.

I also like that PSTH has a little reflexivity to it; the more investors come to appreciate the UMG deal, the more value that they’ll put on PSTH’s other parts (i.e. if investors think PSTH bought UMG at a huge discount, then they’ll likely get excited about / bid up the remainco and SPARC because their value is so tied to Ackman’s deal making skills).

So that’s my high level thesis for PSTH right now. I’m going to spend the rest of this post diving into different pieces of PSTH and UMG that I think are underappreciated in some form / that drive why I think PSTH is so asymmetric right now. Below are the topics I’m covering:

UMG valuation: relative and absolute

Relative valuation: UMG is better than WMG and coming at a similar multiple

UMG’s absolute valuation is cheap versus loose peers

If UMG is so cheap, why is VIV selling? Shouldn’t I just buy VIV instead of PSTH / UMG?

Thoughts on remainco and SPARC

What happens with PSH

UMG and indexes

UMG Valuation: relative and absolute

Let me start with the headliner: I continue to believe Ackman is getting a deal on UMG. The two ways to think about UMG’s valuation are in the absolute or relative to their best peer, WMG. I think UMG is cheap on both those metrics.

Let’s start with relative valuation. In breaking down the complex PSTH deal, I said:

this is a reasonably attractive deal. They’re buying UMG for ~21x EBITDA. WMG, their best comp, trades for ~20x. However, UMG is a better business than WMG (UMG is a bigger label with a better catalogue and it’s growing faster), so it probably deserves a premium to WMG. In addition, WMG is a controlled company with a dual share class structure (only ~25% of their shares float, and the float is entirely the low vote shares), so WMG probably trades with a couple of turns of multiple discount due to their governance. Put the two together, and I think you could easily argue that if WMG is trading for 20x a fair multiple for UMG is in the 25-28x EBITDA range. Ackman / PSTH are buying UMG at 21x, so they’re getting a nice discount to fair value in exchange for helping solve VIV’s tax problem and lending Ackman’s shine to the deal.

Let me give a tangible example of why UGM is a better business than WMG.

Olivia Rodrigo has taken the music world by storm. Her single and album are shattering records, and Bloomberg has her rated as the #1 music artist right now. The whole article is interesting, but for our purposes let’s consider the top 10 artists list in that article and who their labels are:

Olivia Rodrigo: Universal Music Group (UMG)

BTS- Independent / Big Sky, though Big Sky has a partnership with UMG

Justin Bieber: UMG

J. Cole: UMG

Billie Eilish: UMG

Due Lipa: Warner Music (WMG)

The Weekend: UMG

Doja Cat- Sony Music Entertainment (SME)

Ariana Grande: UMG

Giveon: SME

Fall Out Boy: WMG (I’m just kidding; Fall Out Boy didn’t make the list. What an oversight on Bloomberg’s end!)

So, of the top ten artists in the world:

UMG reps six (including four of the top five)

SME reps two each (none of the top five)

WMG reps one (none of the top five), though they also have Fall Out Boy

One (BTS) is independent, though their label has a partnership with UMG.

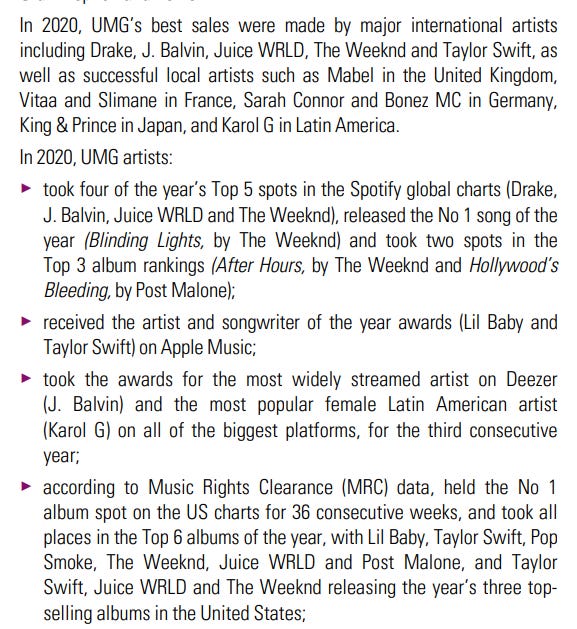

Obviously, that Bloomberg list is just a moment in time snapshot…. but UMG is consistently at the top when it comes to most streamed / popular artists. Here’s how UMG discussed their record in VIV’s 2020 AR:

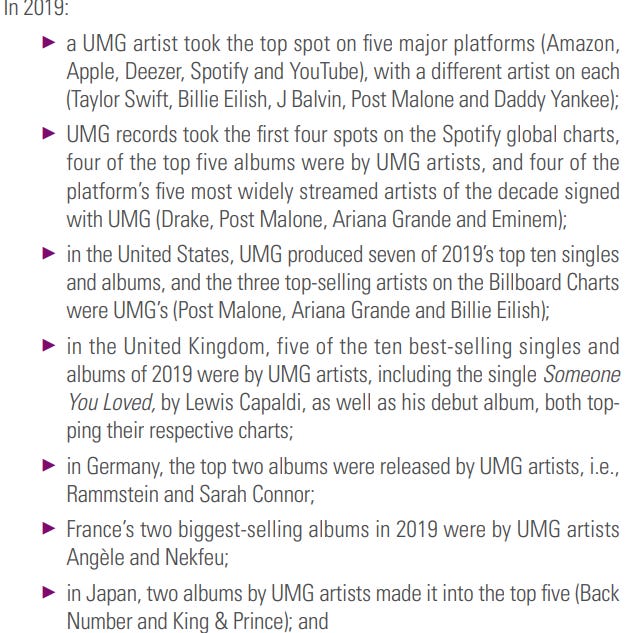

Here’s their discussion from VIV’s 2019 AR:

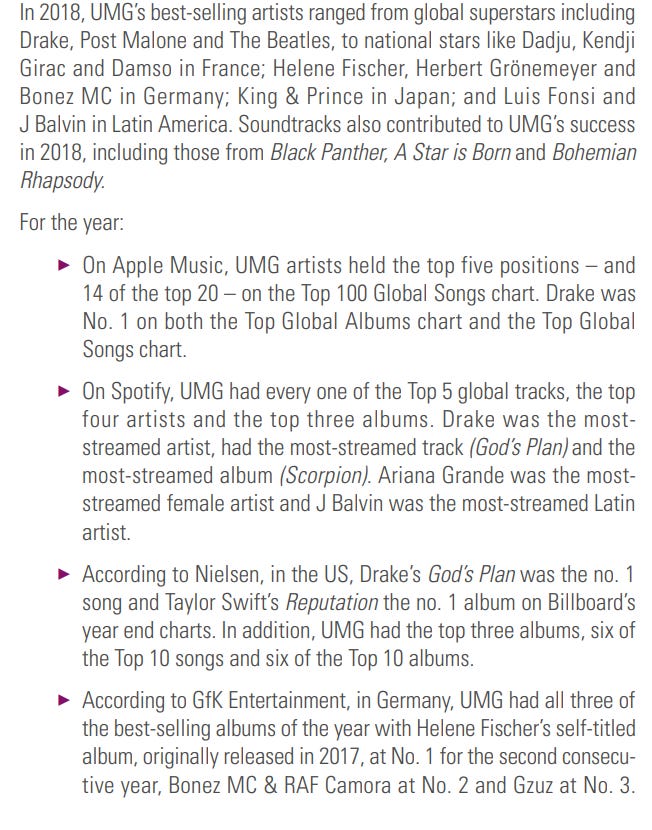

And here’s how they talked about it in 2018’s AR:

Bottom line: it’s not just a moment in time snapshot of June 2021’s records that had UMG as the largest / most important music label. They have consistently represented the world’s most important / biggest artists, and that’s a huge edge.

Music has always been a power law business, where the top superstars took home the bulk of the earnings, but that edge has only increased as the world has gotten more global. In 1982, the top touring acts took home 26% of revenue from yours; in recent years, that number went all the way to 60% (source). And it’s not just touring revenue that the superstars dominate; superstar / smash hit music released today is much more likely to have a long live getting played on streaming services (i.e. a modest hit released today is unlikely to make a lot of playlists ten years from now, but a smash hit will get included in tons of “best of” playlists and will generate streaming revenue for years) as well as be much more likely to get played on TikTok videos, in Peloton classes, get licensed for movies, etc.

Anyway, to loop back to the initial point, the Ackman / PSTH / UMG deal is priced at a similar multiple to WMG. WMG is a worse company; they are smaller in a business where scale matters, and UMG has consistently shown an ability to sign / book the most important musicians in the world. Plus, WMG is a controlled company, with only ~25% of their stock free floating, and a dual share class structure that gives their majority shareholder voting control. Post-spin / PSTH deal, UMG will be a company with normal corporate governance and no controlling shareholder (though Ackman will be a major shareholder, and Tencent Music will control ~20% of the stock). Even ignoring that they’re a better business, UMG would deserve premium multiple to WMG for their corporate governance alone. I think Ackman is getting a relative steal by buying UMG at ~the same multiple as WMG.

In addition, I think UMG is undervalued in the absolute sense as well. I discussed this in my further break down post (see particularly the piece on WDFC), and I had lots of quotes on the appeal of the business in my music execs quotes piece, so I’ll try not to repeat myself too much here, but UMG is a leading market label whose key revenue source (streaming music) makes up ~50% of their revenue, is underpenetrated globally, and has grown >25% annually for the past five years. Plus, they have massive upside from their “emerging” revenue streams (like revenues from TikTok or Peloton) that are seeing insane growth rates (WMG’s emerging revenues went from $150m annualized in Q1’21 to $200m annualized in Q2’21).

Businesses growing that quickly with dominant market share and great visibility don’t trade for 20x EBITDA.

This is literally an insane comp, so I’m not saying to use it, but here’s an interesting thought exercise: Netflix is projected to grow revenues ~15-20% for the next two years; that’s slower than UMG’s streaming revenue. And NFLX’s EBITDA margins are in the low 20s, similar to UMG. Netflix trades for >35x EBITDA.

Again, I’m not saying Netflix is a perfect comp in any way, shape, or form. And all of UMG’s business isn’t growing as quickly as their streaming revenues. But, outside of WMG, there are no great comps for UMG, and I’m just trying to drive home a simple point: businesses with economics, visibility, and growth rates like UMG do not trade for 20x EBITDA. Businesses with lower growth, worse moats, and less visibility trade for almost twice that multiple!

PS- one more thing while I’m here. WMG trades at ~20x EBITDA, and I’ve listed a bunch of reasons above why I think UMG should trade for a higher multiple than WMG. I’d add one more detail: WMG right now is a unique company; there’s no other pure play music companies. Often, it takes a while for a “new” industry on wall street to get a full multiple. For example, look at the private equity players; for years, every player would shout how cheap their stocks were and how stupid the multiples were. But it took a few years of them all being public (and, eventually, all of them converting to C-Corps) for them to start getting “full” multiples. I wouldn’t be surprised if the same thing happens with music; right now, there’s only one smaller, controlled publicly traded comp. But once UMG comes, there will be two companies and a lot more attention on the industry (given the light Ackman will shine and how big UMG will be). I think that could drive the whole industry’s multiple higher over time (to a place closer to what I think it deserves!).

If UMG is so cheap, why is VIV selling? Shouldn’t I just buy VIV instead of PSTH / UMG?

I’ve gotten lots of questions along the lines of “Bollore (VIV’s controlling shareholder) is really smart. If UMG is so good, why is he selling? Isn’t it likely Ackman’s the patsy at the table? And VIV’s EV right now is only ~$40B; given that’s what UMG is valued at and they currently own 80% of UMG, it seems like VIV is too cheap. Why not just buy VIV instead?”

Lots of good questions in there. Some piecemeal thoughts

Is VIV too cheap? Probably! But I’d suggest that investors are simply looking at VIV’s parts and tax effecting the UMG stake as well as applying a big corporate governance discount to VIV given how Bollore has used VIV to pursue some interesting deals in the recent past. (Update: right before I pressed publish, reports crossed that Third Point had bought a stake in Vivendi. I think their involvement is confirmatory of everything I’ve discussed here; VIV is too cheap, and part if it is due to a governance discount that Third Point is likely planning to attack).

Why is VIV selling UMG now? Is Ackman the patsy at the table? We won’t be able to answer these questions for years, but I would note that VIV has been involved in UMG for years. Spinning it out now leaves a much smaller company behind, which will let them focus on growth and aggressively attacking that controlled company discount if it won’t go away. On the patsy question, I’d just note that lots of people asked the same question when VIV was dumping their Activision Blizzard shares a few years ago. ATVI is up almost 10x over the past ten years and ~3x over the past five, so those sales don’t look great with hindsight. I wouldn’t be surprised if this deal looks similar with hindsight; VIV gets a nice headline multiple for the company in the near term, but in the longer term the price proves too cheap given the growth trends and industry structure.

It’s definitely right to look at one smart investor selling to another and say “what if my side is the patsy here.” Certainly possible, but I just think VIV and PSTH / UMG have different endgoals, and this transaction allows them to solve for what they want. VIV gets reasonable price for UMG and a boatload of cash to aggressively buyback shares / attack their conglomerate discounts, while PSTH gets to make a bet on the music industry’s long term growth at a reasonable price.

Thoughts on remainco and SPARC

Let’s talk about Remainco and SPARC. I think each of these are going to be very interesting.

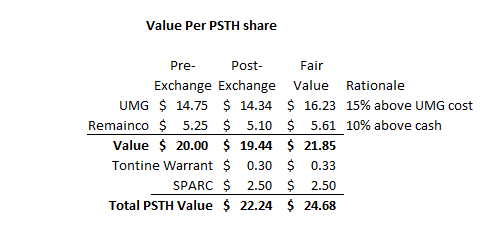

For background, I discussed what remainco and SPARC are in my “further breaking down” PSTH piece, so I’d encourage you to read that. That piece also included a SOTP table which I have recreated below:

There are three things I want to build off:

First, I want to highlight that I like the reflexivity here. Remainco and SPARC are going to trade based on investor’s confidence in Ackman’s ability to source and create value in future deals. So, if investors come to love UMG and think it should trade at a 30x (or more!) EBITDA multiple versus the ~20x multiple Ackman is paying, then I think they will start applying a big premium to Remainco and SPARC as they factor in the possibility for big value creation there.

Second, I wanted to talk remainco and SPARC in general for a second. I think these will be fantastically interesting stocks to watch / follow because they are completely unique. In my experience, things that are unique can often trade funky / hide value, so I’m eager to monitor them; I would not be shocked if they go through periodic bouts of mania (where the stocks trade for a significant premium) or depression (where they trade with no premium or, in remainco’s case, trade below cash value). Why are these so unique? I don’t believe we’ve ever seen a security exactly like SPARC; rights offerings are reasonably rare beasts in the corporate markets (there are only a handful every year), but I’ve never seen a publicly traded right to invest into an unknown future deal. And, for remainco, while we’ve seen cash shells in the public markets before, I don’t believe we’ve ever seen a stock that, from day 1, was created as a long dated cash shell in search of a deal. Cash shells generally trade at a discount to their cash, but given how visible remainco is going to be, I would not be surprised if it trades at a premium. It’ll also be interesting to see what happens if remainco does trade at a discount; will remainco have an active share repurchase plan to buyback shares if they trade at a discount? If you look at Ackman’s history at PSH (which I’ll discuss further in the next section), he’s been reasonably aggressive buying back shares to attack their discount, so I suspect the answer will be yes.

Third, I just was to talk about deal timing. Remainco will be a permanent life vehicle, while SPARC rights will expire after five years. I think there are two ways you could look at this structure:

Ackman just talked to a ton of companies with PSTH1. He likely found some interesting companies that were too small for PSTH1; remainco lets him quickly go back and try to merge with them while keeping SPARC as a longer dated play on finding a tech unicorn.

Remainco is a completely unique beast; a publicly traded ~$1.5B cash shall. The play that would create the most value is to just keep remainco outstanding while waiting for the next crisis, and then use remainco to rapidly deploy a ton of money when there is blood in the streets. You could then use SPARC like a normal SPAC, just going and talking to companies and trying to find a good merger/acquisition target regardless of the environment.\

My read of the situation just based on the limited wording so far is that Ackman is going to go route #1 above (quickly use remainco for a smaller deal, and then pursue a whale with SPARC), but I think #2 would be more interesting.

PS- a bonus point here. I believe SPARC is getting structured where each right entitles you to invest in SPARC’s eventual deal at ~$20/share, allowing SPARC to raise >$5B from minority shareholders. I wonder if a better way to structure it would be to guarantee each rightsholder equal participation but not fix the share amount. THat way, SPARC could go after any target. An example might show this best: as structured, SPARC can’t reasonably go after businesses <$10B because SPARC would just have too much cash / ownership demands. As we saw with PSTH, there aren’t a ton of those businesses, and the market for them is pretty deep. If SPARC could flex how much money they called from the rights offering, then they could target smaller companies if they found something smaller.

PPS- Don’t forget that Ackman made an early investment in Coupang. Do I think he’s going to go off and do VC investments with remainco? No. But I highlight it because there is a decent chance remainco merges with something a lot growthier / buzzier than I think most investors expect on the heels of a more borign / traditional investment for UMG with PSTH1.

PPPS- I’ve said several times that remainco / SPARC are most likely to create the most value by announcing a merger with a company in some type of crisis. For a while, I worried SPARC’s unique structure would make it difficult to merge with a company in crisis, as you generally need cash very quickly during a crisis and SPARC would have none. I no longer believe that’s a big issue; PSH could make a bridge loan to any company SPARC targetted, and Ackman’s name and reputation would probably be enough for any target company to get enough cash to bridge a few months till an announced SPARC deal could get completed.

What happens with PSH?

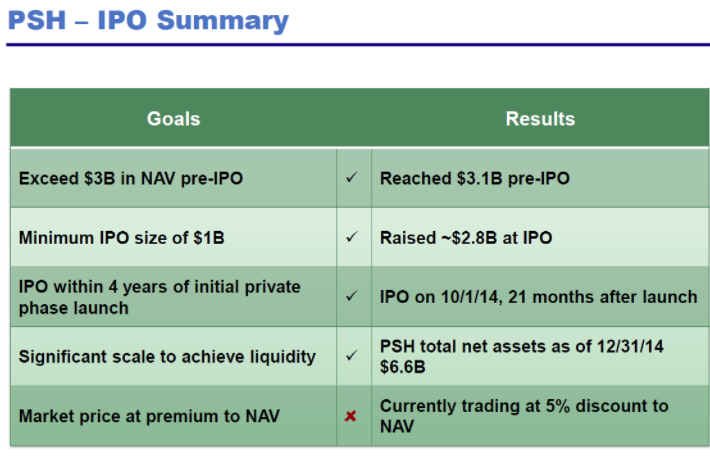

I mentioned last week that I thought PSH might be the most interesting trade here. The company continues to trade at a stubborn discount to NAV, and NAV is likely understated as it includes no value for the sponsor economics in future SPARC deals. I think it has to be really clear that the discount at PSH bothers Ackman. Since the day PSH listed in 2014, Ackman has been saying since that PSH should trade for a premium to NAV. In fact, if you go back and read the slides from when PSH first went public, one of his stated goals was to have PSH trade for a premium to NAV:

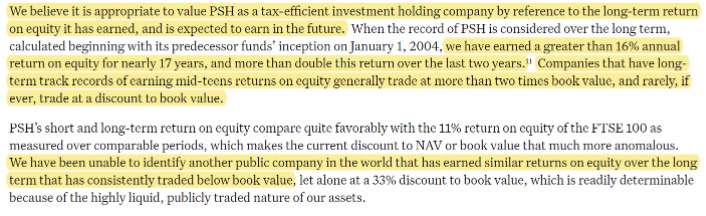

And here’s Ackman arguing further why PSH should trade at a premium in his H1’20 letter:

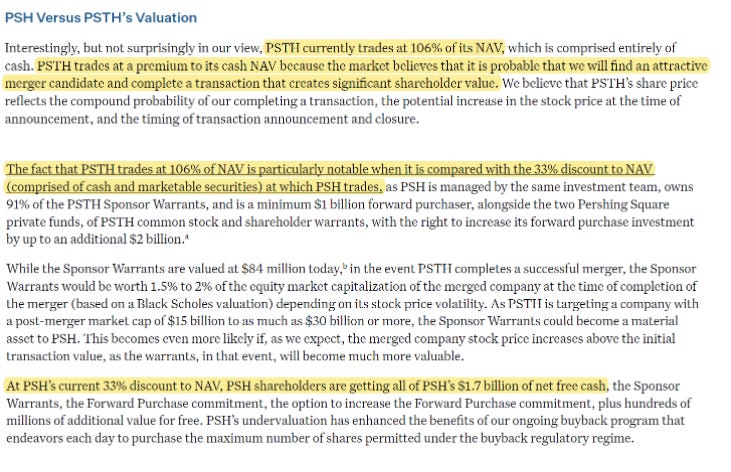

Here’s Ackman talking about how he doesn’t understand why PSTH would trade at such a big premium to cash while PSH trades at a wide discount to NAV:

Put all those pieces together and it makes me wonder: will PSTH completing their deal be the catalyst to Ackman doing something more aggressive to close the PSH discount? In particular, this is a little bit of a conspiracy theory / speculation, but I could see a scenario where remainco is used to close the PSH NAV gap, either by aggressively buying PSH shares with remainco or through a flat out merger between PSH and remainco.

I’ll note that this is a little speculative and probably too tinfoil, mainly because of the unique rules for publicly traded hedge fund vehicles. But I figured I’d mention it because remainco will be a big pool of cash, and doing something between PSH and remainco could create value for both sides, so I wouldn’t be surprised if they figured out some type of creative deal.

Why do I think some type of remainco / PSH deal could create value? PSH decided to list in London because of the U.S. rules around publicly traded hedge funds (in particular, I believe the rules on paying an incentive fee in a publicly traded company are pretty onerous); however, it’s almost unquestionable that PSH would trade much better as a U.S. listed company (its a largely domestic portfolio, so it has a more natural shareholder base in the U.S., and as a foreign company domestic investors in PSH currently pay the PFIC tax).

While the rules are onerous, there are ways around them. For example, Icahn Enterprises (IEP) manages to pay out a hedge fund like incentive fee. The trick IEP uses is to not be qualified as an investment company; they have several wholly owned businesses that they consolidate so they’re treated as an operating business that can comp their mangers however they want, not an investment company.

So what I would imagine is something like this: remainco or SPARC buy sa whole business or three. From there, they could do a stock for stock deal with PSH that would result in them acquiring PSH and turning the newly combined PSH / remainco (or SPARC) into a holding company with a big investment portfolio (a la Berkshire Hathaway). Alternatively, remainco could just use their big cash balance to buy PSH whenever it traded for a predefined discount to NAV (say, 10%); over time, remainco would own an increasingly large percentage of PSH’s float and they could eventually do a cleanup takeover once remainco owned enough of PSH.

Again, there are complications. In order to not qualify for the Investment Company Act, no more than 40% of your assets can be through investment securities. I’m not sure exactly how the 40% rule is defined, but PSH has ~$12B in NAV and remainco will have ~$1.5B in cash initially. It’s probably too small to do an immediate merger to close the gap right out the gates. But Ackman is very aware of the discount PSH trades at, and remainco gives him a credible path to reducing that discount while creating value for both sides. I would not be surprised if that’s the road this goes down eventually.

UMG and indexes

The slide below is from PSH’s 2021 investor presentation.

I highlight this to drive home one thing: Ackman knows the importance of getting your stock in indexes in today’s world. Post-spin, he will make sure that UMG is eligible for inclusion in every relevant index, and I would guess it gets added to the major ones reasonably quickly given UMG’s size and Ackman’s likely lobbying.

So, in the medium term, I think you’ll have a mini-catalyst of UMG getting added to the indexes. More importantly, I mentioned above that I thought WMG wasn’t trading at a “full” multiple because it was kind of a unique beast and not a lot of analysts were incentivized to cover it. UMG going public will add the incentive to get more eyeballs on the space. UMG getting added to indexes will guarantee that every fund manager benchmarked to an index needs to pay attention to UMG and the music space. In time, given the underlying growth and economics here, I think that’s going to be really good for music industry multiples.

Odds and ends

I went on Eric Schleien’s pod to discuss the PSTH / UMG deal if you’re interested in hearing some bull points in podcast form!

Just this morning, SIRI filed an 8-K noting the CRB had raised their music royalty rates pretty significantly.

Speaking of podcasting and royalties, I do think an interesting risk factor over time is the Spotify / Apples of the world will be incentivized to tip more of your listening from music to podcasts (because they pay basically nothing for incremental podcast plays but have to pay for incremental streaming plays). They can do this subtly (making podcasts recs the thing you open to / top of your app), but I do think it’ll be a trend worth watching over time.

Along the lines of rights, I enjoyed this breakdown of the Roblox / NMPA lawsuit. As companies get more creative offering users ways to make their own content (and assuming music will play a big role in that), there are lots of monetization opportunities for music rights holders!

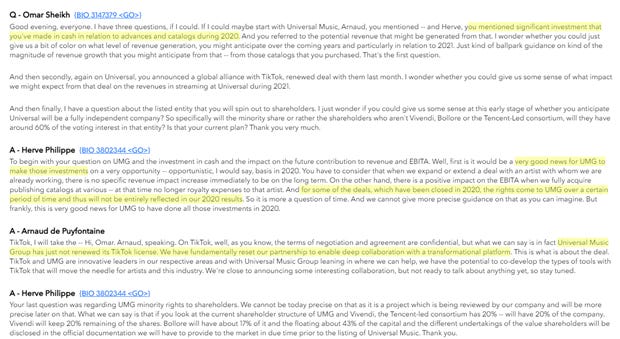

I mentioned above that UMG’s artists have consistently been at the top of the charts; that should drive better than average growth for UMG in the long term. Another interesting this is that UMG appears to have made “significant investments” in 2020 that will be “very good news” for UMG in the long term. Again, it’s small, but it’s just another long term growth driver that I don’t think UMG is currently getting credit for but that will eventually flow through to shareholders.

I highlighted this previously (see odds and ends), but I just want to drive home one more time that I think music has massive, massive tail winds going forward. U.S. spend on music peaked in ~2000. I would argue music is dramatically more entwined in our lives today (we carry around the world’s global music library in our pockets every day!); I continue to think that “monetization down / usage up” combo suggests long, long tailwinds for music deep into the future.

One thing I like about UMG (and that investors will like as well): the library for top hits has long legs. H/t to investing501 for pointing this out, but check out the top movies and top songs from 1973. I doubt you’ve heard of most of the top 10 movies, and I would bet you haven’t watched any of those in years. But I guarantee you’ve heard of almost all of the top 10 songs from 1973, and that you’ve heard the majority of them reasonably recently. Obviously we’re comparing a little bit apples to oranges, but I like that visibility, and the fact UMG continuously owns so much of the top songs / artists of they years speaks to just how long they’ll be monetizing the stuff they’re releasing right now.

One thing I’ve been wondering: does “catalogue” music (the stuff that is >5 years old) get increasingly more valuable in a streaming world? Think of something like Spotify; I listen to their daily mixes constantly. A lot of those daily mixes are made up of my liked songs. 10 years from now, let’s say I’m still a Spotify member. Yes, my mixes will have new songs…. but they’ll have a lot of those old songs. And whenever I listen to my “liked” songs playlist, it’ll include the stuff I’ve liked today (and previously!). It just seems like in a streaming world with saved playlists / likes, older stuff is likely to get played / discovered much more than it used to be. I’m sure the PE firms who are buying catalogues have thought about that and modelled it, but it’s a trend that would increase the lifespan of cash flows for UMG’s catalogue.

PPS I’ve been using the term “catalogue”, but I’ve noticed all the transcripts and such say “catalog”. Which serves as a nice reminder: nothing on here is investing advice. Seriously, would you even want investing advice from a guy who doesn’t know how to spell catalogue?

I would not be surprised if UMG or WMG got meme’d at some point. WMG is probably more likely, as it’s a controlled company with a smaller float, which is really helpful for meme’ing, but either is possible. BTS’s label soared on its debut. It’s definitely not impossible that the stars align and UMG/WMG backs some label that really strikes a chord with the meme lords, and they bid the stock to the moon to support their artists.

UMG appears to still own a lot of their Spotify stake (if you read the first quote in the “on UMG spin tax complications” section, they confirm UMG holds their stake in SPOT, TME, and Vevo) . At current prices, that stake would be worth ~$2B. Given Ackman’s buying into UMG at a $42B EV; UMG’s SPOT position is a reasonably material piece of the valuation. I wonder how they’ll talk about the stake and their plans for it when the PSTH / UMG deal is finalized.

This is nothing new, but the thing I will be most interested in the Pershing / UMG eventual call is their discussion of the risks from increasing negotiating power from both the streamers (SPOT / Apple music) and the artists (like Taylor Swift) against the labels over time. There were lots of quotes on that in the clips I posted here; I think the main takeaway is that labels are losing incremental negotiating leverage to both labels and artists over time. That doesn’t mean that the labels won’t do well; it’s possible to be bullish labels and Spotify, and the streaming pie is growing so quickly that I think all participants can benefit, but it is going to be a long term concern and the first thing managers are going to be talking about when considering a UMG investment.

I was really interested in how WMG talked about managing portfolios of rights that financial buyers had bought recently (see “private capital competing for rights”); I do wonder if there’s some financial engineering possibilities with UMG and the labels at some point The most basic version would be for the labels to sell all of their rights to pension funds at huge multiples given the demand for yield, and then the labels would charge a management fee to continue to manage the rights. Doing so would result in a huge capital return for the labels and eventually turn them into a private equity like rights manager.

Thanks for the write up. I looked at this space from a PE perspective a few years ago. A few points: First, one additional positive is that actually the long tail is very significant. Especially for publishing, but also for Recorded Music. Only a very small % or revenue is any one artist or album in any given year. Also, the % or new music in any give year is also quite small. As such, as the streaming % increases, this will be both recurring and highly diversified. Second, the give and take between artist and label is not really a new thing and I don't think it has changed all that much, despite the headlines. Established artists will always cut a better deal, can always threaten to go indie, and keeping more of their revenue and retaining more IP vs newer artists. The labels just make a much smaller cut on a bigger pie for established artists and always have. Again, the market is mostly the long tail of many artists in many niches, and thankfully for the labels, most actually don't have negotiating leverage like Taylor Swift.

great write up! Taking a step back, if UMG asset is attractive, one can simply buy WMG, the valuation and growth profiles are very similar and with WMG get ready liquidity and US listed stock. If the SPARC is the real juice here for the deal, then I think there are too many uncertainties.