Last week, I posted an article with some thoughts on Liberty’s investor day. I meant to end that article with some quick thoughts on Charter (CHTR), but those thoughts quickly morphed from “quick thoughts” to something approaching a novella, so I figured I’d break them into a separate post.

My overall thoughts on Liberty Day for Charter? Honestly, nothing new here, but I thought Liberty and the Charter team did a great job laying out the bull case for the company, and honestly I’m probably more bullish on the company’s future than I’ve ever been. While there are concerns with competition and regulation, I think those are very manageable and the mobile opportunity is going better than I ever expected.

But I got slightly triggered (in a fun way!) by a tweet saying Charter isn’t cheap, so I figured I’d take a second to lay out some updated Charter valuation thoughts.

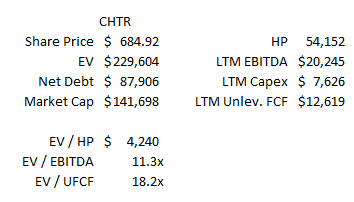

As I write this, Charter is trading for ~$685/share. With ~$89B in net debt, that gives Charter an EV of ~$230B. LTM EBITDA is ~$20B and Unlevered FCF (EBITDA less capex) is ~$12.6B, so at current prices Charter is trading for ~11x EBITDA and 18x unlevered free cash flow.

In an absolute sense, I think that’s about reasonably valued. I don’t know why the right multiple for a cable business isn’t 20-25x unlevered free cash flow given where interest rates are. Cable should benefit from tax shields (all of their capex gives them great depreciation), and they can borrow quite cheaply (Charter’s most recent debt issuance was ~13 year debt at 4.25% interest rates; remember that interest is a tax shield so the after tax cost is even cheaper!); if you’re paying 20x unlevered cash flow for the whole company, I think that’ll translate to <25x levered cash flow to the equity, which seems about right to me for an economically resistant business that should continue to grow their top line through pricing power, increased penetration, and unit growth.

I’m not saying Charter is the cheapest business or stock in the world. I’m sure you could find plenty of good businesses that are growing faster and a little cheaper than that. But cable is an infrastructure asset that doesn’t have much (any?) obsolescence risk (we can have the SpaceX / satellite broadband argument another time!); a lot of the businesses people pitch as cheaper / faster growing do have obsolescence risk. For example, the person dunking on Charter mentioned Visa as better growing with a roughly similar unlevered multiple. Visa could be an opportunity; I’m not an expert, but it’s definitely a great business and it seems like a reasonable price. But I can dream up a host of competitive threats for Visa (BNPL, crypto, amazon) that present some terminal value risk that I don’t think cable has. Again, I’m not an expert; maybe saying BNPL is a threat to Visa sounds as silly to a Visa expert as saying satellite broadband is a threat to cable sounds to me! But Visa’s earnings all come from their network effects; if the network effects break, Visa’s earnings break fast. Charter’s earnings come from their infrastructure assets; I just think those are much more stable / dependable than almost anything else in the world.

So I think Charter’s cheap-ish to reasonably valued in an absolute sense. But I think the story is even better if you’re willing to pull back the onion. I mean this in four ways:

Industry relative valuation

LTM (last twelve months) economics are understated

Mobile optionality

Levered buyback / capital allocation

First, industry relative valuation. Look at Charter versus industry deals / private market value. WOW, an overbuilder, sold assets for 11x EBITDA over the summer. Cable One paid >17x pre-synergy EBITDA (~13x post synergy) for Hargray. Charter is a way better business than WOW, and, at absolute worse, its assets are similar to Hargray (they’re almost certainly better, but I’m trying not to by hyperbolic!). Charter’s trading for the same multiple that WOW sold overbuilt assets for; that’s legit insane. If WOW is worth 11x, Charter is easily worth >15x.

Second, looking at Charter on LTM earnings isn’t fair. Charter’s LTM includes ~$310m in EBITDA losses and ~$510m in capex investment into their mobile business. I’ll discuss mobile more in a second, but at worst that investment should be value neutral / could be stopped if it was destructive, so you should probably add it back to earnings at minimum (I think it’s creating value, so it’s better than that). Adding mobile back is not an enormous swing, but that’s ~$800m in unlevered cash flow. If you believe cable is a 15x unlevered cash flow business (I think it’s worth more), that’s ~$12B of hidden value right there, or ~$60/share, right there.

Similarly, it’s not as quite bad as it used to be, but Charter’s economics are still well below Comcast’s. The best way to judge this is generally on a homes passed basis; so, for example, CHTR’s LTM EBITDA is ~$20.2B, and they pass 54.2m homes, so they’re EBITDA / HP is ~$370. Comcast EBITDA / HP is over $430 (note that I include a corporate G&A allocation in Comcast’s EBITDA; without that, the EBITDA / HP difference is even large). Comcast also spends slightly less in capex / HP than Charter. Put the two together, and Comcast’s FCF / HP is ~30% higher than Charter’s.

For years, one of the bull cases for Charter has been “there’s no reason why they can’t get to Comcast’s economics over time.” I think that’s proven true over time, though honestly I thought Charter would close the gap with Comcast faster and, to date, the gap has remained relatively steady as Comcast’s economics continue to improve. For example, back in 2017, Comcast was doing ~$360/HP in EBITDA, and Charter was doing $308. The argument then was “Charter will get to Comcast levels.” Sure enough, this year, Charter is finally doing what Comcast did in 2017, but the gap has stayed steady as Comcast’s gone from ~$360/HP to over $420.

I think the trend is pretty clear; in three years or so, Charter will get to where Comcast is today, and Comcast will probably be approaching $500/HP in EBITDA. I’d love if Charter could close that gap quicker, but still I think we have clear line of sight to Charter getting to where Comcast is now. Run Comcast’s economics on Charter’s homes passed, and they’re trading for <10x “Comcast adjusted” EBITDA and ~14x UFCF.

Third, we get mobile optionality. Right now, Charter’s mobile business is losing money as they invest in growth. That will change in the near future (Comcast’s mobile business is already EBITDA positive); eventually, mobile should generate healthy profits for cable. Mobile is already growing quickly; they were taking ~10% share of all adds in Q2’21, and that was before they slashed their prices on wireless.

I don’t know exactly where mobile ends up. But, right now, the cable companies are offering a superior mobile product at lower prices than the traditional mobile companies. That combination will inevitably take market share over time. The mobile industry is enormous; TMUS’s EV is ~$250B and VZ’s is approaching $400B. Obviously, the big mobile telecos own all sorts of stuff (spectrum, networks, etc) that cable doesn’t, and there’s real value there. But cable was taking serious share in Q2 before they cut their prices, and I expect them to continue taking share (possibly at a faster rate) going forward.

Right now, mobile is small; I think ~10% of Charter’s internet customers take mobile from them. At the height of legacy voice (landlines), >50% of Charter’s customers took voice from them. There is a lot of penetration left for Charter’s mobile product, and as they get there I think the upside could be enormous. Over time, Charter’s mobile business should be pretty high margin as they leverage fixed costs and get most of the network costs offloaded on to their own network.

What’s mobile worth? IDK, most models I’ve done turn into garbage in / garbage out and are too sensitive to small assumption changes. But let’s try for the heck of it; say Charter can get to 15m mobile subs (~50% of their current internet base) with $20/month pricing and 25% EBITDA margins. The margins are the big question; I’m not sure why they wouldn’t be higher given how Charter can leverage their current fixed network, but at the same time the pricing is pretty low so there’s not crazy amounts of room for margin! So, IDK, but at those assumptions mobile would be a ~$3.6B annual revenue business putting up $900m in EBITDA. That should be relatively capital light (again, most of the capex should be leveraging existing cable infrastructure), so you could argue for an aggressive multiple, but slap a ~10x EBITDA multiple on it and Charter’s mobile business is worth $9B, or ~$45/Charter share. Again, right now mobile is a drag on trailing financials (I estimated it at a $60/share drag above), so taking it out of the LTM financials and giving Charter some option value for it probably is a >$100/share value swing all in. Not bad against a <$700/share price currently!

The last thing I want to talk about is Charter’s levered free cash flow model / capital allocation.

Let me note one thing that I’m going to come back to: I’m about to throw a ton of numbers at you. Maybe too many. But when you’re reading them, just keep in mind point #1 of this post: inferior cable assets are trading for multiples in excess of what Charter is trading for right now. Why’s that matter? I think every assumption I’ve made in here is conservative, but together they support a share price that compounds nicely from here. And, when backed up by the multiple inferior assets are trading for, I think it supports that Charter remains stubbornly undervalued and the capital allocation I’m about to discuss will help solve that.

Most Liberty stans know this, but Charter is a classic John Malone company in that it pursues a levered buyback model. This means that, as the company grows earnings, they take out more debt, which they then use to buyback shares. An example might show this best: say EBITDA this year is $10, and the company commits to 5x leverage. That means they need $50 in debt. If EBITDA grows to $12 next year, the company needs $60 of debt. That means they’ll go borrow an additional $10 of debt to bring their debt from $50 to $60, and they’ll give that $10/share to shareholders in the form of a share buyback. On top of that, they’ll generally give whatever free cash flow they generate to shareholders as well.

Charter’s always tried to grow EBITDA by double digits annually. They’ll probably lag that a bit in the near term (driven by the COVID pull forward in 2020 impacting this years growth), but I still think EBITDA growth will be solid. Let’s say they grow it more in the mid-single digits over the next few years. By 2025, EBITDA should be approaching ~$25B (up from >$20B in 2021). Charter’s target leverage is 4.5x, so that ~$5B increase in EBITDA will call for an additional ~$22.5B in debt to be taken out.

Charter’s current market cap is ~$140B; over the next four years, modest EBITDA growth alone will call for Charter to take out >15% of their market cap in debt to keep at their leverage target. That cash will almost certainly be returned to shareholders in repurchases.

On top of that, Charter will be generating serious free cash flow. 2022 EBITDA should be >$21B; that’d translate to at least $7B in free cash flow to equity (taking out ~$8B of capex, ~$4B in interest expense, and ~$3B of taxes). That number should grow substantially over the next few years as capital intensity continues to come down and capex goes up.

Anyway, put the two together, and Charter will have >$10B/year in excess cash flow from free cash flow + leveraging EBITDA growth. That will almost all go to share repurchases; it’s very dependent on the stock price, but I think Charter will easily be retiring ~8% of their shares every year. Diluted shares out should go from ~205m currently to <150m by 2025.

Right now, Charter’s got 205m shares out. 2022 free cash flow to equity should be ~$7B for ~$35/share in free cash flow to equity. By 2025, EBITDA should have grown to ~$25B. Capex will still probably be in the $8B range, interest expense will be ~$5b, and taxes will be ~$3B for maybe $9B of free cash flow to equity. If their share count is ~150m, that’s $60/share of free cash flow to equity (and growing as EBITDA continues to grow and they continue to pursue the levered buyback model).

If that’s right, at ~$680/share right now, you’re paying <11x 2025 free cash flow to equity. Sure, there’s plenty of assumptions in there, but honestly I think everything I laid out was pretty conservative (if you think about it, more than half of the earnings growth I’m projecting comes from Charter closing the earnings gap they have with Comcast. Not exactly an aggressive prediction!), and if you run that model forward another year or two the numbers get really silly. You can easily recreate the numbers above and play with them on your own if you want (I tried to walk through the largest assumptions, and the remaining ones are pretty easy to recreate).

At some point, Charter’s stock is going to need to go up by a lot. The levered buyback model just demands it.

Of course, all of that is dependent on earnings continuing to grow; if you’re worried about FTTH or fixed wireless or something just savaging the cable industry, this whole thing falls apart. Again, I’ve done lots of work on the cable sector and I’m convicted that it’s an infrastructure like business that continues to get more valuable over time, but that’s the crux of the thesis and that’s the big risk.

I know that was a lot of numbers and word salad thrown at you, so let’s go back to point #1 of this post: inferior cable assets are trading for less than Charter currently trades for, and I think I made a bunch of conservative assumptions in here that support a share price materially higher than where Charter currently trades.

One last thing on capital allocation: I’ve assumed Charter pursues a levered share buyback model, but there’s always the off chance they buy something. Altice has basically thrown in the towel on the Altice model that they said would change the U.S. cable industry; going forward, they’re pursuing a model that looks a lot like Charter’s. Could Charter announce a deal for Altice or another cable company (Cox and Mediacom have been rumored over the years)? Probably not, but if they did the synergies would be large (cost synergies, programming synergies, and wireless business synergies) and the value creation likely enormous. Nobody’s building that into a model (and I’m not sure cable deal would fly in the current regulatory environment), but it’s just another upside option that exists in Charter.

Anyway, I realize I’ve started rambling when I’m writing whole paragraphs that describe an excel model more than an actual business, so I’ll wrap it up here. My bottom line is that I see a clear path for Charter to rapidly grow free cash flow per share over the next few years, and I don’t think many market participants realize how silly the numbers are going to get. By ~2025, I expect Charter’s free cash flow per share to exceed $60/share, and with the continued growth runway Charter will have I expect the stock will trade for >20x free cash flow. That combo would put Charter over $1,200/share, or just shy of a double from today’s share price. That’s a very nice IRR for what I view as a largely de-risked story, and the returns should be even higher over at Liberty Broadband given their leverage and continued share buybacks at discounts to NAV.

Good stuff. I like to keep an eye on how much headroom there is in the latest DOCSIS tech, and seeing a clear path to 10G makes it seem pretty solid competitively for the foreseeable future.

Very thoughtful, as always. Small nit, but I'm building to ~186mm diluted shares from the Q3'21 common and FY20 stock comp numbers.