Every month, I put out a “some things and ideas” post with random thoughts on articles or market stuff that caught my attention in the last month (as well as some fantasy book recommendations and some other monthly recurring reminders!).

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2024 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!). If you do launch a substack, please let me know so I can try to be helpful.

State of the markets (Monthly recurring piece)

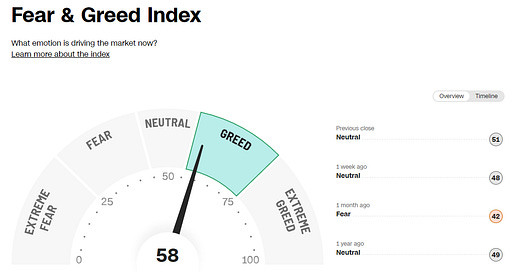

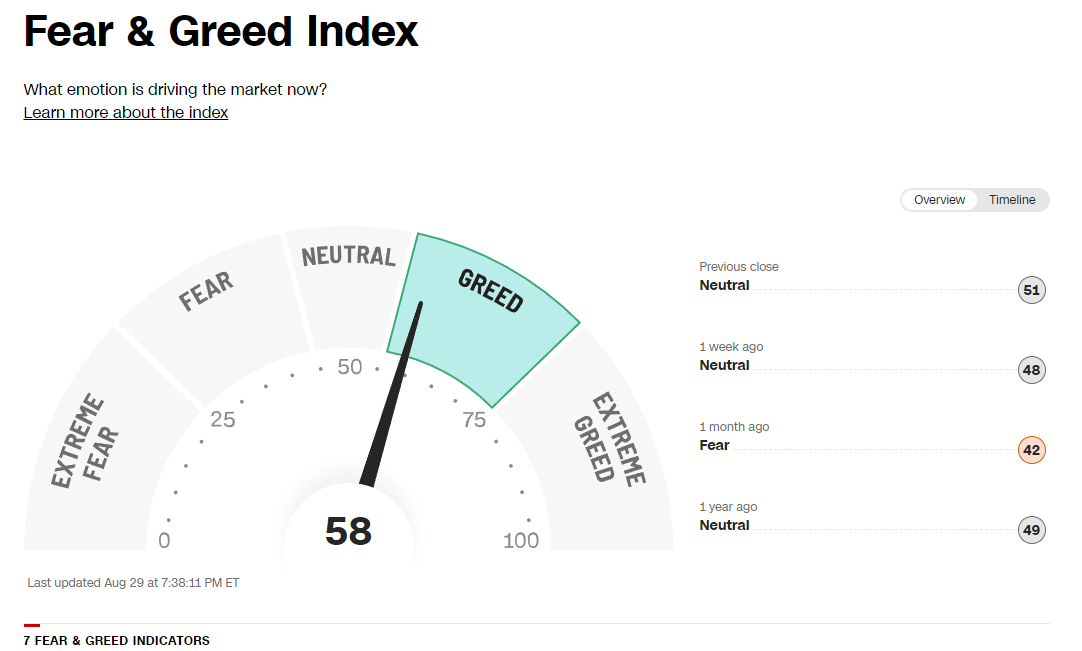

It’s not a perfect indicator, but I like to use the CNN “Fear & Greed” Index just to quickly quantify where the markets are.

We’ve been firmly in neutral territory for the past two months, but I’ve noted that hadn’t felt quite right given the roaring move in small cap / value in July. This month, we’ve pushed into slight greed territory

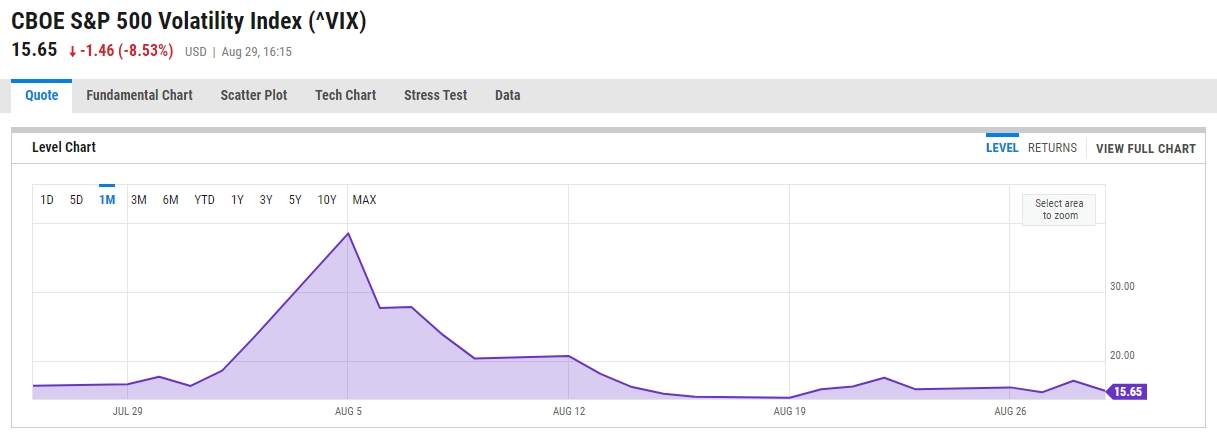

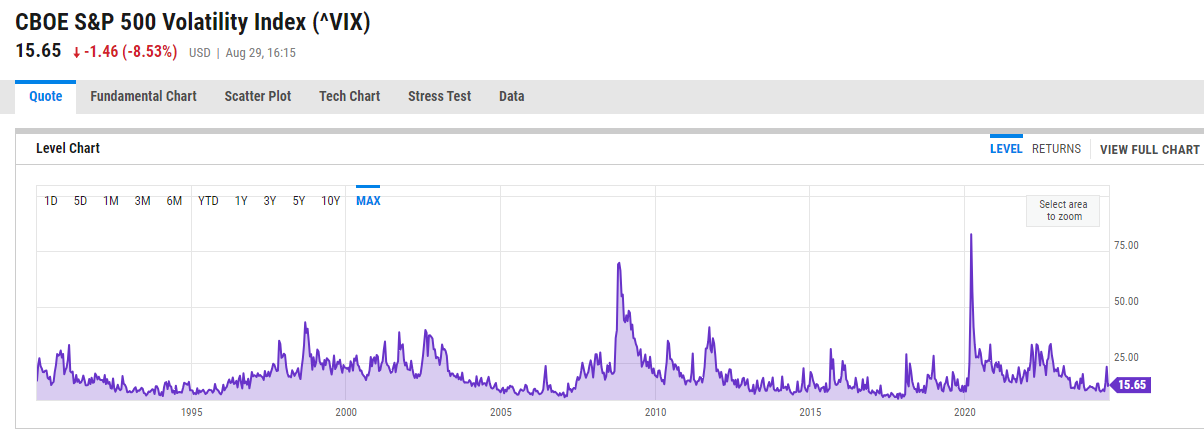

That is kind of a wild reading…. It’s easy to forget that at the beginning of the month the VIX approached 40 (while briefly touching >60 intraday)…..

A level that’s normally reserved for real market panics like COVID, the GFC, etc.

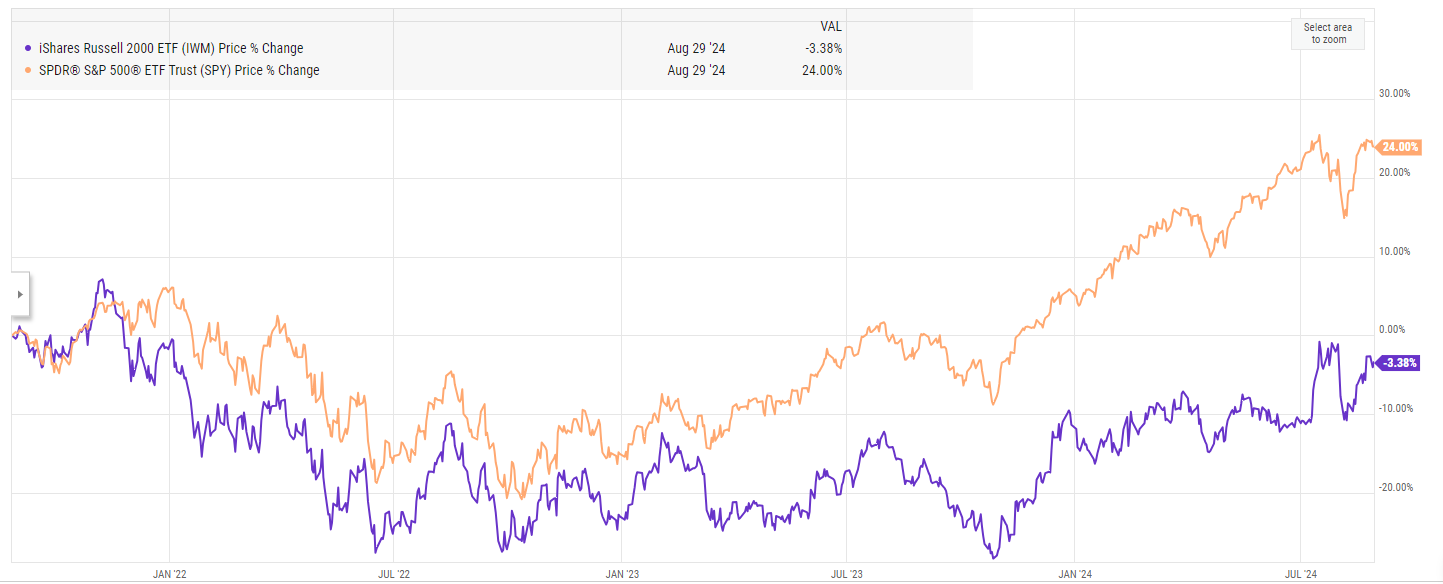

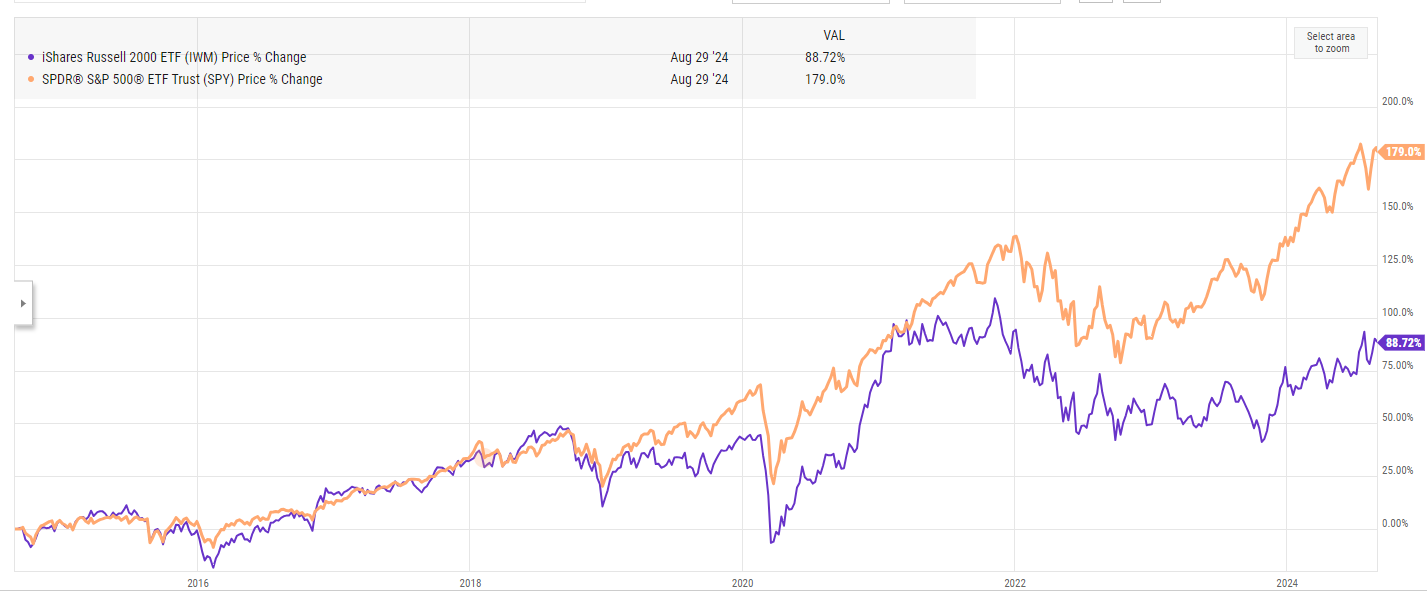

Anyway, as we sit here today (August 29), slight greed feels about right. There are still a few markets that feel a bit too optimistic, but it’s hard to point to any one swath of the market and confidently proclaim “bubble.” I can still point to plenty of areas that look ostensibly cheap-ish, and while the general market is up nicely this year on a longer term basis it’s probably around trend (neither the S&P nor IWM have covered themselves in glory over the past three years, and over the past 10 years the SPY is probably a bit above trend with the IWM a bit below, but nothing to get crazy).

I’m a broken record on this… but I continue to find particular value in things that have some cyclicality on them or in things that are a bit more illiquid / not participating in enormous passive flows.

Credit card rewards (a minor anecdote)

I find everything about credit card rewards and the credit card ecosystem fascinating… but wanted to share a minor story that might be of interest. I was on a business trip (visiting some regional casinos in Colorado. It was gorgeous; here’s a photo). On my way back, my flight was delayed and cancelled; I was booked on a flight later that night…. which promptly got delayed and cancelled. Fortunately, I got rebooked to a flight the next day…. but I suddenly needed a hotel room, and the closest one that wasn’t out of this world expensive was a ~45 min drive from the airport. So, all of the sudden, I needed to pay for a hotel room, two 45 mins ubers, etc. ~$500 of added costs out of no where!

Why do I mention this? Well, a ton of cards have things like rental car insurance, trip cancellation protection, etc. And I always wondered why a credit card would offer those; after all, it’s added cost for no benefit I could see…. but it turned out that I had booked my trip on my business card, which doesn’t have trip cancellation protection. If I had booked it on my personal card, which does have trip cancellation, my hotel and those ubers plus my food would have all been paid for by the credit card.

A trip costs the same whether I put it on one card or the other, so, in the future, guess which card I’ll be trying to book travel on?

So I mention it because it’s just a really interesting example: it’s a benefit that I never thought about or, to the extent I did, one I wondered why a card would offer. That’s a lot of potential expense for a card to take…. but once you’ve seen it in action or thought about it, you realize why a card would offer it. It’s a way to take huge wallet share; if I book all of my travel with one card over the other going forward, that’s thousands of potential dollars in bookings that I’m switching from one to another all because I want the piece of mind of having an insurance protection that I may use once every ten years.

Speaking of credit card competition, here’s the WSJ: “The Hottest Club in Town Is… Run by Your Credit-Card Company?”

Starbuck’s new CEO

It’s since been well covered… but I still remain impressed by how much the market seemed to think SBUX’s new CEO (who they hired from CMG) was worth.

I often complain about management and board comp; I find them for the most part to be real “heads I win; tails I don’t lose” while shareholders really pay. I can’t tell you how many stocks I’ve invested in (or, preferably, researched but not invested in!) where the stock performance over multiple years is a disaster and somehow everyone in the top brass and board makes life changing sums of money….

Anyway, I do think the absolute best CEOs are likely to be underpaid. It’s kind of a sticker shock thing; let’s just make the numbers simple and say that hiring the new CEO swung ~$30B of market cap between SBUX’s gains and CMG’s loss. SBUX is paying him ~$100m, so they’re getting a 200-300x return on their investment ($20-$30B of market cap increase for a $100m investment). That’s the best investment they’ll ever make; what other profession or job has someone capture <1% of the value they deliver?

Yes, I am simplifying and being a bit hyperbolic here…. but I would not be surprised if ten years from now there is a group of CEOs who are widely regarded as complete game changers who companies will throw $1B+ packages at to come and turn them around.

Of course, for a long time Jack Welch was looked at as the best CEO in America, so whether the market is right that the “top” CEOs are the top is another question…..

Related: WSJ with a behind the scenes look at the hiring process and some analysis (there’s a new $27B CEO; he may actually be worth it).

PS- with hindsight, how underrated was Satya!?!?!

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I was an eager supporter of the Brandon Sanderson (original) Kickstarter (yes, I splurged and went for the hardcover books).

I didn’t support Sanderson’s DND-style board game…. but only because my wife would murder me if I bought another board game when I have a whole Dungeon Master kit collecting dust. Still, I wanted to highlight it because between the two Kickstarters Sanderson will have raised >$50m for new projects; if you’re a fan of fantasy and that type of fan enthusiasm doesn’t encourage you to give him a try, I don’t know what will! As I mention below, if you’re trying him out, I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written

Anyway, I figured a few of you are nerds like me, so I started this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

Sometimes, you have to kiss a few trolls before you find a princess (or prince, depending on your taste)…. and this month I kissed some trolls. Nothing worth recommending.

I am irrationally pumped about the Dungeon Crawler Carl movie / TV series potential though!

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

The Silvers Epic (Flight of the Silvers, Song of the Orphans, War of the Givens) is more sci-fi than fantasy, but it’s one of my favorite series I’ve ever read and I think is wildly creative in how they use time travel / multiverse as a plot point.

Other things that caught my eye (monthly recurring piece)

I’ve only done pilates once and it wrecked me; I’m thinking about adding it to my program once a week on recovery days though!

Kroger Albertsons deal heads to court with food prices in focus (KR / ACI)

Tech industry taps old power stations to expand AI infrastructure

Secretive dynasty missed out on billions while advisors got rich (JAB / Reimann)

what makes good chemistry? for chat podcast, it’s fundamental

B. Riley’s money machine ensnared retail investors $25 at a time

you will grow old waiting for your favorite tv show to come back

In ‘Only Murders in the Building,’ This Actor Is Above Suspicion

In the Wake of Tragedy, CrossFit Faces an Identity Crisis

Very sad story. I’m a big fan of crossfit, but I don’t understand why the Games has any swimming in it given that no regular crossfit that I know of does. It’d be like adding a three point shooting contest to the Superbowl.

Offtopic but who else here listens to substack posts and has your female reader gotten uncannily more human just now? Press play for a minute if you’ve never heard her. I kind of love it but it does change my mental image of Andrew into a sassy elder millennial NYC woman recording a rough take in a podcast studio.