My monthly post with random thoughts on articles or market stuff that caught my attention in the last month (as well as some fantasy book recommendations and some other monthly recurring reminders!).

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2022 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!). If you do launch a substack, please let me know so I can try to be helpful.

Subscription / Premium price increase

I mentioned this last month, but I try not to market the subscription / premium side of the blog too much; it’s meant for sophisticated investors looking for my best stock ideas (I rarely put up public individual ideas anymore). If it’s for you, then it’s for you! If not, there’s plenty of other content on the blog! But I’m proud of the work and recommendations on the premium side, and given that pride (plus with podcast transcripts now exclusive to the premium side!), I think the premium side is a huge value. I haven’t increased prices on it in some time, so I’ll be increasing prices on it in the new year (to be specific, on January 4th). If you’d like to sign up ahead of the increase to get in at the old rate, I’d encourage you to (I don’t do any form of discounting or run promos or anything, so this would be the last chance to get in before the price increase)!

A minor health note and programming update

I tore my pec bench pressing ~10 days ago. Complete freak accident. It’s not exactly a ton of fun, but overall I’m fine; surgery was Tuesday and I’m recovering quickly. However, my left arm is immobilized, meaning I’m typing everything one handed currently. So apologies if there’s a few extra typos today, and I leaned a bit briefer than normal given difficulty typing!

Shohei Ohtani and Tax Arbitrage

I can’t believe how much ink was spent freaking out about Shohei Ohtani’s new contract. For those who aren’t familiar, basically Ohtani is the best hitter and pitcher in baseball, and he signed an enormous contract: 10 years, $700m in total. However, he agreed to defer most of the contract; he’ll collect just ~$2m/year and then a huge payout on the backend. I’ve heard all sorts of crazy takes on it, but look: the dude is making >$40m/year in endorsement revenue. I’m sure he had great advisors, and it seems like part of the reason for taking the deferral is to tax arb (if he gets the deferral and is no longer a California resident, he can dodge California state taxes) and to help the Dodgers build a better team. And remember: he benefits from a better team! A better team burnishes his legacy in the long term and increases endorsement opportunities in the short term.

Anyway, again, I can’t believe how shocked or affronted so many people were by the huge deferral….. but I do love tax arbitrage!

So here’s my question: as I noted a few months ago, I just had my first kid. Which got me wondering: any good tax arbitrages that come from having kids?

I’m not looking to run afoul of the IRS, or spend fifteen hours in order to save $20! So no need to come at me with the most crazy things. But so far the only really tax break I’ve seen is the 529 plan for saving for college (and it seems 529 plans are getting better); is there anything else out there reasonably simple that I should be thinking about?

State of the markets (Monthly recurring piece)

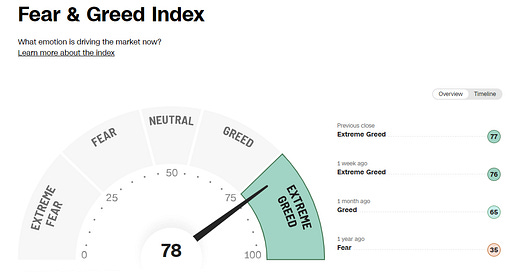

Man what a wild two months it’s been. It’s easy to forget now, but at the end of October equity markets felt bleak; people were calling for cascading budget deficits and interest rates to hit double digits…. equities simply can’t work in that environment. The snap back from those lows has been something; the Russell is up ~25% in two months!

With the benefit of hindsight, things were just too cheap / bleak back in October. Today, things feel just a touch frothy. A lot of speculative stuff is catching a bid, and I’m seeing most companies priced at pretty fair / full multiples. One thing I’m trying to be better about is selling ok or good stuff in order to have capital available when great stuff comes along; I think now’s a better time to be pruning than anything else!

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). Plus, I was an eager supporter of the Brandon Sanderson Kickstarter (yes, I splurged and went for the hardcover books).

Anyway, I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

Reading time increased exponentially this month as I tore my pec and could do basically nothing other than read. I’m finishing up Will of the Many as we speak; it’s great. I also did Wandering Inn book 11 and the second book in the last horizon series, both of which I thoroughly enjoyed.

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

Other things that caught my eye (monthly recurring)

Robinhood woos wealthier clients from bigger brokerages

Decent match! I don’t really trade a PA (all my focus is on my main job), but I do have an account with some stocks I can’t sell due to taxes. I’m tempted to make the switch from IBKR; anyone have experience with Robin Hood?

Chinese e-cig titan behind ‘Elf Bar’ floods the U.S. with illegal vapes

Our regulatory system astonishes me sometimes; no clue how this wasn’t instantly shut down or how the FDA shuts down a safer, domestic controlled competitor only to late a foreign competitor launch with reckless abandon

Behind the scenes of the most spectacular show on TV (Sunday night football)

Alaska-Hawaiian merger faces DOJ skeptical of airline mergers

‘Sleep No More’ to Close in January

This makes me sad; I’ve seen it 3 or 4 times and it’s really one of the most unique things out there.

Macy’s billion dollar question: what’s more valuable, real estate or the business

Note to Investis clients: Tesco does not request that you go f*** yourself

I got one of these (from Vistry) and honestly it cracked me up

Robinhood is decent for most people but a sophisticated investor like you might find it weak in some ways. I only hold two assets there, which are highly appreciated assets like you are considering. Might be worth a try.

Custodial Roth IRA as long as your child makes under the federal minimum there is no need to file a w2. Think about what 65 years of compounding looks like 😉. Also am loving The Wandering Inn. Thanks for the recommendation.