My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2024 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!). If you do launch a substack, please let me know so I can try to be helpful.

Housekeeping: YAVE 2025, 2025 YAVB IOTY, and a finance book club

A few quick housekeeping notes with a whole bunch of acronyms:

Book Club: I read a lot. I’m guessing most of my listeners / readers read a lot (ironic, I know). I think I’m going to explore a finance book club in 2025. Here’s the current approach I have: my friend Byrne Hobart (from the Diff) and I are both reading more than a numbers game. On January 13th, we’re going to hop on a zoom, talk about the book, and we’ll release that as a podcast in some way, shape, or form. If we like the output (and there’s demand) we’re going to do it ~once a month. If it’s horrible… well, I don’t think it will be!

I’m particularly excited to try this with Byrne because I’m a giant fan boy of his. Don’t believe me? Well, too bad because I have receipts: I mentioned in October 2023 that the diff is one of the few things I try to read every day, and if you look through my historic writing you can see how frequently I link to his posts for proof!

How can you participate in the book club? Simple! As I tweeted out, read the book and send in any questions / comments / thoughts you have on it (as well as suggestions for what the February book should be if we keep going at this!).

YAVB IOTY: I will be releasing the 2025 YAVB IOTY (2025 Yet Another Value Blog Idea of the Year) as a video podcast on January 2nd at ~9 AM ET.

YAVE in 2025: As mentioned in this post, I’ll be putting up my plans / vision for the Yet Another Value Empire (YAVE) in 2025 early next week. If you have suggestions for how to improve the empire, I’m all ears.

I’ll release my premium year in review and plans for 2025 the day after. Speaking of premium side, the annual price of a subscription is going from $555/year to $619/year on January 51. I don’t do any discounting, so if you’d like to subscribe at the old price I’d suggest subscribing before then!

State of the markets (Monthly recurring piece)

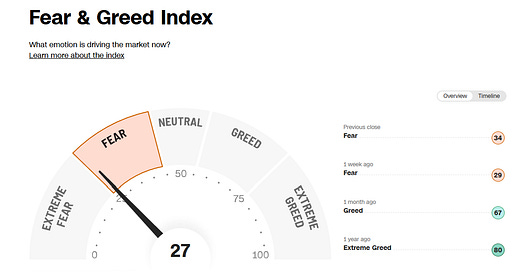

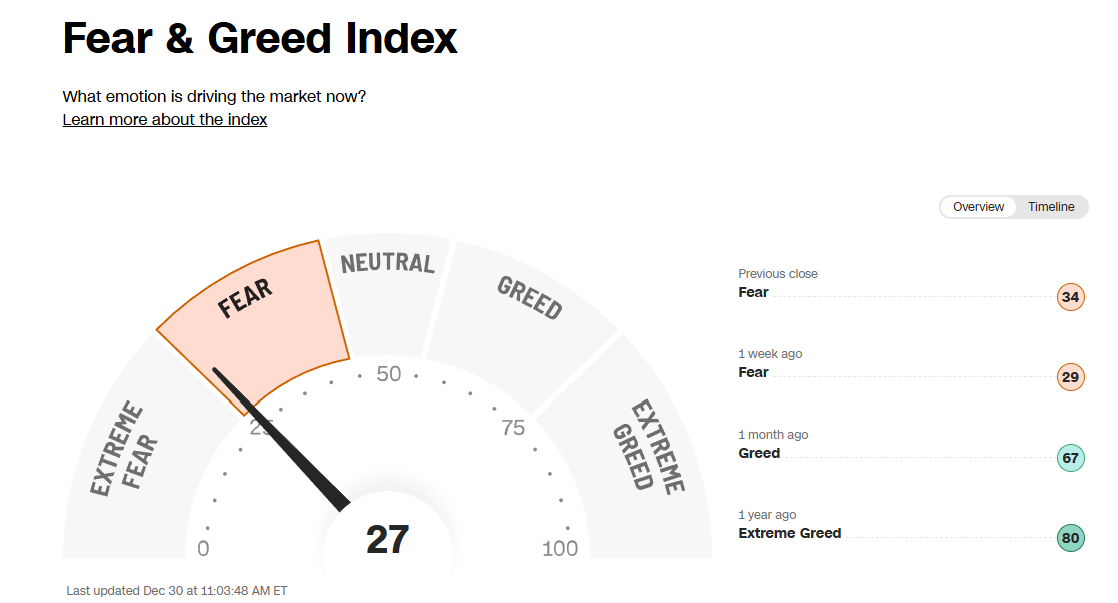

It’s not a perfect indicator, but I like to use the CNN “Fear & Greed” Index just to quickly quantify where the markets are.

I posted last month that it was hard to match that month’s “slight greed reading” with what I was seeing. My lord what a difference a month makes:

To put this in perspective: at the beginning of the month we had some pretty wild quotes from this article on short sellers “throwing in the towel”; as I write this, the Russell is down almost 10% on the month!

And, I’ll be honest…. it feels worse. Maybe this is anecdata or me just putting my feelings into words, but tax loss selling seems much harder than normal. Some have suggested to me that’s because there are so few sectors that are down on the year that the ones that are down are getting aggressively mined for tax losses…. and that seems kind of right to me.

If you believe that tax loss thinking (and I think it’s at least partly true), I think you could look at the market and see a weird dichotomy: most of the things that are down this year are cyclical / energy related in some way, and they have been getting sold most aggressively in the current drawdown. So you’ve got this weird combination where most stocks are forecasting a benign future (to use one example: it’s very hard to find a bank trading under tangible book value) while energy / cyclical stocks are pricing in an imminent and substantial recession.

One thing I’m really interested in for 2025: in 2024, we saw the AI boom lead to a huge upswing for power producers (TLN, CEG, etc.) as America suddenly became short power…. but we haven’t seen that boom extend to the people upstream of them (i.e. energy, oil, nat gas, and the infrastructure that supports them). I tend to think oil and nat gas have trouble getting a sustained lift just because there’s so much of it domestically….. but I do wonder if a drill baby drill mentality plus huge demand for power starts giving the infrastructure that services oil/gas/energy some operating leverage / pricing power (and you know big energy is looking for ways to get into the AI boom!).

QSR follow up

I got lots of feedback and thoughts on my piece on QSRs and the stickiness of scaled brands. In particular, readers were eager to point out examples of failed chains that they thought I had missed (including Boston Market, sbarro, kenny rogers roasters, arthur traechers, and roy rogers, among others). I may be thinking of this a bit differently, but the only one that I think has any interest for my from my “QSR sticky” thesis is Boston Market; let’s review:

Kenny Rogers peaked at <400 restaurants; that’s big, but I wouldn’t say that’s as large / engrained as the chains I’m talking about.

Roy Rogers peaked at ~600 restaurants, which is getting closer to the size I was thinking about…. but it’s still well below the 1k box count I laid out in the post, and Roy Rogers really started failing in the late 80s / 90s…. that’s so long ago and the world has changed so much that I’d argue it’s pretty irrelevant

Similarly, there was a Burger Chef chain that peaked over 1k units in the 70s but had failed by the 90s; I just don’t think things that had failed or peaked before the internet was invented are really applicable!

This was a really interesting piece on the history of Burger Chef

Arthur traechers peaked at just over 800 restaurants in the 70s as well

Sbarro was mainly mall based pizza; I think that’s closer to the Subway / sandwich chain competitive levels / lack of logistics than the QSRs I’m discussion.

Plus they appear to be surging / coming back!

Lum’s peaked at <500 restaurants and failed in the 70s, so I think it’s both too small and too stale

Boston Market is the most interesting comp IMO, and one I’m going to spend more time thinking about

This comment suggested Boston Market had multiple flaws that lead to their rapid growth and quick decline….

Long John Silver’s peaked at 1.5k stores and is down to 500, so it probably qualifies

Between LJS and Arthur Traechers, perhaps seafood belongs with sandwiches on the “watch out!” list

Speaking of sandwiches, Au Bon Pain peaked at over 200 restaurants and is around 170 now, and Blimpie peaked at around 1,750 in the early 2000s and is around 100, so Au Bon Pain is probably too small while blimpie is another example of sandwiches being a tough game

Humorously, there were a lot of chains that were thrown out to me as examples of failing / failed chains that had more just stalled out / might actually be growing a bit.

For example, I had a few people ask about Rally’s / Checkers, which appears set to grow!

Ditto Hardees, which has actually grown nicely (note: i’m not sure if this is reporting just Hardee’s or the parent company (which also owns Carls Jr and some other stuff), but either way I don’t think Hardees has shrunk / diminished))

A common theme in some of the franchisees people asked if had failed? This might be me anecdoting, but I think a lot of these franchises aren’t on the coasts, so people who are on the coasts (or particularly who moved to the coast) forget about them / think they’re dead.

Also this list of failed chains got sent to me; it’s interesting because there are so few on the list!

AI follow up

Last month, I mentioned how I was spending a lot of time thinking about AI and investing. Just wanted to call out this really interesting article that got sent to me that notes how AI can actually be a big detractor if used in the wrong way…

Also- Human player outwits Freysa AI agent in $47,000 crypto challenge (and Matt Levine’s take on it) are very much in the spirit of this discussion

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I was an eager supporter of the Brandon Sanderson (original) Kickstarter (yes, I splurged and went for the hardcover books).

I didn’t support Sanderson’s DND-style board game…. but only because my wife would murder me if I bought another board game when I have a whole Dungeon Master kit collecting dust. Still, I wanted to highlight it because between the two Kickstarters Sanderson will have raised >$50m for new projects; if you’re a fan of fantasy and that type of fan enthusiasm doesn’t encourage you to give him a try, I don’t know what will! As I mention below, if you’re trying him out, I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written

Anyway, I figured a few of you are nerds like me, so I started this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

It was honestly an insanely busy month for reading. I got halfway through Wandering Inn book 14… but then had to put that down for Stormlight book 5. It’s a masterpiece… but I’m only ~halfway through. I still need to get around to Dungeon Crawler Carl book 7, and I’m trying to find time to read my friend Alex Morris’s new Buffett book as well as prep for my new fintwit book club I mentioned above (we’re reading More Than a Numbers Game)…..

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

The Silvers Epic (Flight of the Silvers, Song of the Orphans, War of the Givens) is more sci-fi than fantasy, but it’s one of my favorite series I’ve ever read and I think is wildly creative in how they use time travel / multiverse as a plot point (the last book was a little slow, but the ending wrapped everything up beautifully / it got a little dusty in the room I was reading).

Other things that caught my eye (monthly recurring piece)

behind bitcoin’s rally is a simple fact: supplies are limited

Will Trump Cut Short the Biden Clean-Energy Boom? Investors Are Nervous.

Volato Disrupts $2.4 Billion Market with Patent-Pending Bitcoin Innovation

For my fellow math nerds: I’ve decided the premium side of YAVB will always be priced at a prime number going forward

What's wrong with the first 150 pages of The Wandering Inn?