My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2025 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!). If you do launch a substack, please let me know so I can try to be helpful.

Fintwit Book Club

My friend Byrne Hobart (from the Diff) and I did our first fintwit book club last month (on More Than a Numbers Game). We’ve already taped February’s episode (on Advanced Portfolio Management); that should be out early next week.

I’m just crowdsourcing two things as it relates to this endeavor:

We’d like to make the book club a bit more interactive. For example, I’m considering starting a discord for intra-month discussion as we read the book, but I’m open to any and all thoughts / ideas

Have an idea for what book we should do in March? I’ve got a long list, but always looking for interesting new ones!

Fitness

Like every Joe Schmo, at the start of the year I try to eat clean / lose some weight. I did an Inbody (a body fat scan) on January 8th and came in at 222 pounds with 22.6% body fat; obviously I was not super thrilled with those numbers / that’s just not healthy. So I’ve been trying to improve my diet, mainly by completely cutting out sugars (I don’t drink so alcohol has already been removed) and being pretty regimented on my diet (I eat three meals a day, and I try to keep it really structured and just have breakfast be Kreatures of Habit overnight oatmeal, lunch be a high protein Factor box, and dinner be a salad with a heck of a lot of grilled chicken. Between that plus a protein shake, a protein bar (I’m an enormous fan of the David protein bars; they’re the perfect balance of don’t taste terrible and packed with protein with no filler…. though they ain’t cheap!), and maybe some greek yogurt, I’m between 180-200g of protein and ~2k calories every day).

The results so far have been excellent. My second inbody read was Feb 19; I’m down to ~214 pounds with 18.7% body fat (also gained almost a pound of muscle, which ain’t easy in a month!). Still far, far too high, but significant progress. My goals is to get to around 12% by the summer, but that might be a bit aggressive on timing.

My third inbody is towards the end of the month; will report back results (I’ll spare you the weekly shirtless photos!).

A quick Berkshire Hathaway1 rant

Look, I’m a Buffett groupie, and I read his letter every year. But I will admit to wanting to tear my hair out at a specific line from his shareholder letter (clipped below):

The Japanese investments have been great. No doubt about it. But framing the Japanese investments as a positive carry trade like that seemed a little off; I’d expect someone on Twitter who was trying to get a mass following of retail dividend investors to make that framing, not Buffett.

Let me give you an example of why I find that framing so frustrating. You can see interactive broker’s margin rates here; for big loans (which BRK would obviously qualify at), they’ll give you margin at 4.83% right now.

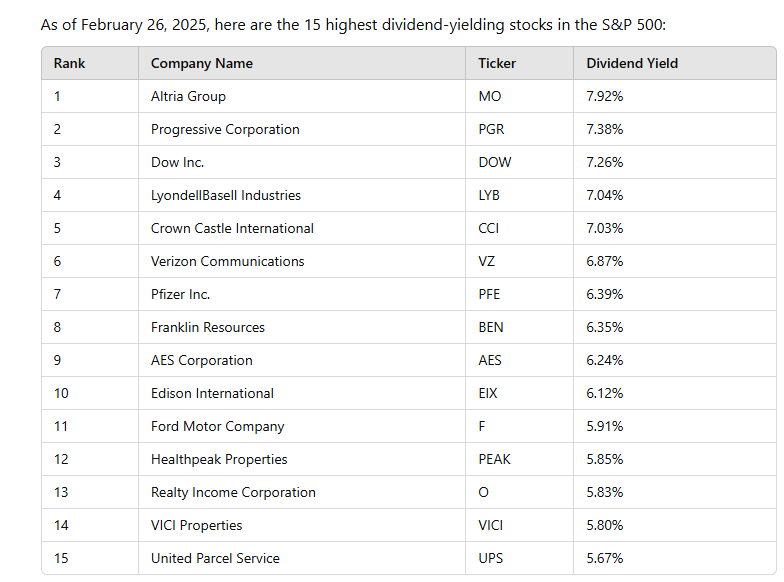

Say Buffett decided to take $100m of equity and lever it up with $100m of margin loans from IBKR (obviously none of this is financial advice; I’m just walking through a hypothetical). So he could use that margin to lever up the $100m and buy $200m of the top yielding stocks in the S&P; I had ChatGPT make me that list:

So if he did that with $100m of equity, he’d buy ~$200m of stock with a ~6.5% dividend yield, generating ~$13m/year in dividends against <$5m of margin expenses.

I don’t think anyone would be celebrating that trade….. but it is very, very similar to the Japan trade Buffett is bragging about here! Yes, I understand there are nuisances, but the fact that the Japanese trade has been absolutely fantastic doesn’t really change based on the financing costs or the positive carry. He could do something similar in a lot of different areas!

State of markets (Monthly recurring piece)

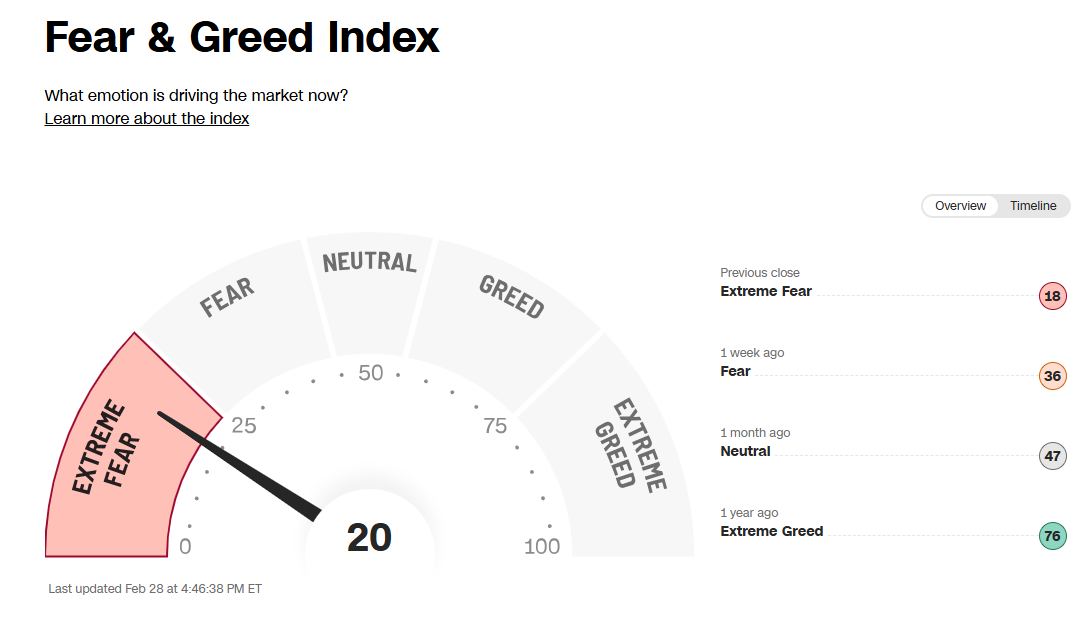

It’s not a perfect indicator, but I like to use the CNN “Fear & Greed” Index just to quickly quantify where the markets are.

Last month, the indicator was perfectly neutral; my how things change in a month

As I’ve mentioned a few times, I continue to find the market really strange; if you touch any of the growth areas (namely AI, though there are several others), you continue to trade for a pretty solid multiple for the most part. But most other things are trading like we’re due for an imminent and deep recession; I follow several energy companies, and I think all of them are trading for levels that imply oil is closer to $50 than $70 (where it currently trades). Anything cyclical is trading like it’s a BK risk, even though many of them have used the cash gushes they got in 22/23 to significantly restructure their balance sheets. Etc etc. I suspect the seeds of a lot of alpha for fundamental stock pickers are being generated right now, but I’ve felt like that for several months and things have just gotten worse and worse!

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I was an eager supporter of the Brandon Sanderson (original) Kickstarter (yes, I splurged and went for the hardcover books).

I didn’t support Sanderson’s DND-style board game…. but only because my wife would murder me if I bought another board game when I have a whole Dungeon Master kit collecting dust. Still, I wanted to highlight it because between the two Kickstarters Sanderson will have raised >$50m for new projects; if you’re a fan of fantasy and that type of fan enthusiasm doesn’t encourage you to give him a try, I don’t know what will! As I mention below, if you’re trying him out, I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written

Anyway, I figured a few of you are nerds like me, so I started this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

Phew, just a ton of reading this month! Finally managed to finish Stormlight book 5; it was great, though the world is getting a little sprawling. On top of that, I finished the rest of Wandering Inn book 14 and am almost done with Dungeon Crawler Carl book 7. Both are top notch (and, of course, covered Advanced Portfolio Management with Byrne).

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read. Most of his works are interconnected through something called “the cosmere;” if you’re feeling crazy, here’s how to read the cosmere in order.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

The Silvers Epic (Flight of the Silvers, Song of the Orphans, War of the Givens) is more sci-fi than fantasy, but it’s one of my favorite series I’ve ever read and I think is wildly creative in how they use time travel / multiverse as a plot point (the last book was a little slow, but the ending wrapped everything up beautifully / it got a little dusty in the room I was reading).

Other things that caught my eye (monthly recurring piece)

Disclosure: Have a very small position in BRK

I think his point was that the yen denominated dividend income is more than the yen denominated interest cost ... but he translated those figures into USD because that's the reporting currency for Berkshire. It's not really a carry trade in the "Mrs. Watanabe" sense.

I want to point out that Buffett’s Japanese loan is long term fixed (i think decades?) at less than 1%. It’s like a mortgage for house except a lot cheaper. This is very different from the margin loan from IBKR where you could get margin call anytime 24hr/day. Buffett will never get margin call and his cost of borrowing yen will never go up and he’s not doing a carry trade because he’s buying Japanese stocks not high yielding US stocks