Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2022 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack.

State of markets

What a difference a month makes. When I wrote this piece last month, the market felt absolutely despondent…. with most indices up almost 10% in July (the S&P was up ~9%; the Russell was up ~10.5%) and having their best month since November 2020 (when COVID vaccines came out), things certainly aren’t as fearful…. but I feel like there’s still a lot of value out there.

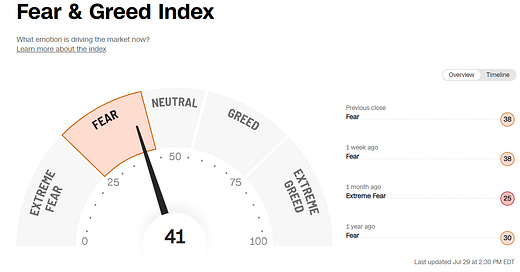

To use one very simple indicator: the CNN Fear & Greed Index is approaching neutral versus an “extreme fear” last month. The VIX is also still above 20; not panic levels, but certainly not “all clear” levels either.

There are two particular areas in the market I think are interesting: energy and retail. I like that they’re on completely opposite ends of the spectrum; energy (which I’ve discussed extensively and will mention some more below) is currently minting money and generally trades at a valuation that reflects huge skepticism of where strip prices are currently, while retail is struggling but I think a wide swath of them trade for a huge discount to a reasonable estimate of normalized earnings.

But those clearly aren’t the only areas of the market that are trading cheaply. I think there’s lots of opportunity for investors willing to look beyond the next earnings report / CPI print and buy companies trading at a discount to fair value. Despite that, most people I talk to are still really, really bearish.

One person who’s not? My friend Jon Boyar; he’s releasing a report on August 1 on 12 companies that are trading cheaply. I have not seen an early copy of the report, but I just wanted to highlight the timing of the report; the last time he did one of these was April 2020, so when he’s done one of these special reports it’s generally been a great time to be looking at stocks. (PS- for full disclosure, the link to Jon’s report is a referral link, but it’s just a link that gets you a discount and tracks it back to me / I don’t get any economics from it. I just know Jon and want to support him!).

A little more on energy

Again, I’m a broken record on energy; I mentioned it in last month’s link post and did several posts on it this month, but I wanted to do a few quick follow up thoughts.

First, one of my biggest fears with energy companies is many of them were hedging everything when prices were low but are now “letting it ride” with prices high (i.e. they’re not hedging and betting on prices going up or at least not dropping). Byrne from the Diff pointed out this article (“oil companies got their hedges clipped”) which shows that energy companies are absolutely awful when it comes to "timing” the energy markets and taking directional hedge bets. It’s probably the thing that makes me most bearish energy companies: if energy companies are the worst when it comes to timing, and all of them are betting prices go up…. well, isn’t that a sign prices are set to come down?

Second, I wanted to highlight two quotes from EQT’s Q2’22 call because I think they do such a good job of showing the bull case for energy. Let’s start with the quote below

In total, our updated framework allocates roughly $4 billion towards shareholder returns by year-end '23 and leaves approximately $3.5 billion of retained free cash flow flexibility on recent strip. With the continued resiliency of longer-dated natural gas prices, we now see approximately $22 billion of cumulative after-tax free cash flow from 2022 through 2027 at current strip. This is up from the prior $17 billion we highlighted last quarter and equates to approximately 140% of our current equity market cap, underscoring the tremendous value opportunity embedded in EQT shares.

As I write this, EQT’s market cap is <$18B, and their EV is <$23B. They’re forecasting $22B in after tax-free cash flow over the next ~5 years at current strip. That’s legit insane.

Moving on to the second quote:

Moving over to hedging. During the quarter, we opportunistically restructured our hedge book for 2023. Specifically, we converted the bulk of our remaining 2Q through 4Q '23 swap positions into costless collars. For the summer, we placed approximately $4 floors and $6.25 ceilings; and in the winter, $7.30 floors with $11 ceilings. The positive market skew at the time enabled us to set $3 of upside with only $1 downside, tying to our plan to provide stakeholders with strong risk-adjusted upside.

Separately, as we've seen signposts of global economic slowdown, we thought it would be prudent to add floors to our 2023 hedge book, buying approximately $4.55 puts with premiums that we were able to defer into 2023. With these actions, we are now approximately 50% hedged on our 2023 volumes, predominantly with wide collars and puts. As an illustration of the resiliency of our forward outlook, if NYMEX retraced to approximately $3 per MMBtu in 2023, we would still expect to generate approximately $1.6 billion of free cash flow next year or a 10% free cash flow yield. Conversely, if natural gas averaged $7 per MMBtu level, we would expect to generate almost $6 billion of free cash flow in 2023 or nearly a 40% free cash flow yield.

I’ve highlighted previously how EQT’s hedging seems a little pro-cyclical, and I’d stand by that…. but man you’ve got to hand it to them that hedge structure is pretty sweet. If gas drops back to ~LT averages next year, they’ll print 10% of their market cap in free cash flow. If gas stays tight or moves higher, they’ll print a heck of a lot more. (PS- as I write this, gas is ~$5.45 for 2023, so they will print a heck of a lot more at current levels)

Anyway, I just wanted to highlight some other stuff in energy with this segment. I’ve said it before: you don’t need energy to go higher to make a lot of money in energy stocks from here. These things are priced like management will destroy a lot of value and for energy prices to drop significantly. As long as both don’t happen, energy stocks should work.

PS- while you don’t need energy prices to go up from here to make money in energy stocks, Josh Young makes a compelling case oil is very tight right now / energy is probably upside biased.

Online ad spend dropping like crazy

I wasn’t investing in the dot com bubble, but I have heard lots of stories of investors getting burnt by investing in Yahoo! back then. As I understand it, the basic Yahoo thesis was simple: every other dotcom high flyer was way overvalued, but Yahoo was making a profit so people thought they had some valuation support / protection there. Then the bubble bust, and it turned out a ton of yahoo’s revenue / profit was coming from ads for these overvalued bubble stocks and it all went away quickly.

I’ve been thinking about that a lot this month as the major online players report earnings. For years, it seemed like the easiest thing in the world was to own Google, Facebook, Amazon, and the other big tech companies. And maybe it still is! But, for all of them (though Facebook is the real focus here), I wonder how much of their earnings were tied to a growth boom / VC bubble that is never coming back?

Owning Google / Facebook and the others does still seem pretty easy. As I write this, Facebook is trading for ~13x this year’s EPS, and that’s despite burning tens of billions of dollars on their “reality labs” project and having tens of billions of dollars of excess cash on their balance sheet that I haven’t adjusted for. Google is <20x, and again they’ve got tons of excess cash and plenty of science projects that drag down their reported earnings numbers but could and should probably be adjusted. I get it: these are great businesses that look cheap. But if you’re long Facebook + Google + whatever other tech giant on the thesis “they are cheap and the market doesn’t get it”…. well, I don’t know. It just seems the height of arrogance to think the market is missing the boat across the board on some of the largest and most visible companies of all time. It seems likely that the market is forecasting two things: 1) competition happens fast in tech (and Tik-Tok might eat everyone’s lunch) and 2) it might look cheap on trailing earnings, but earnings can evaporate in a heart beat (a la Yahoo in 2000).

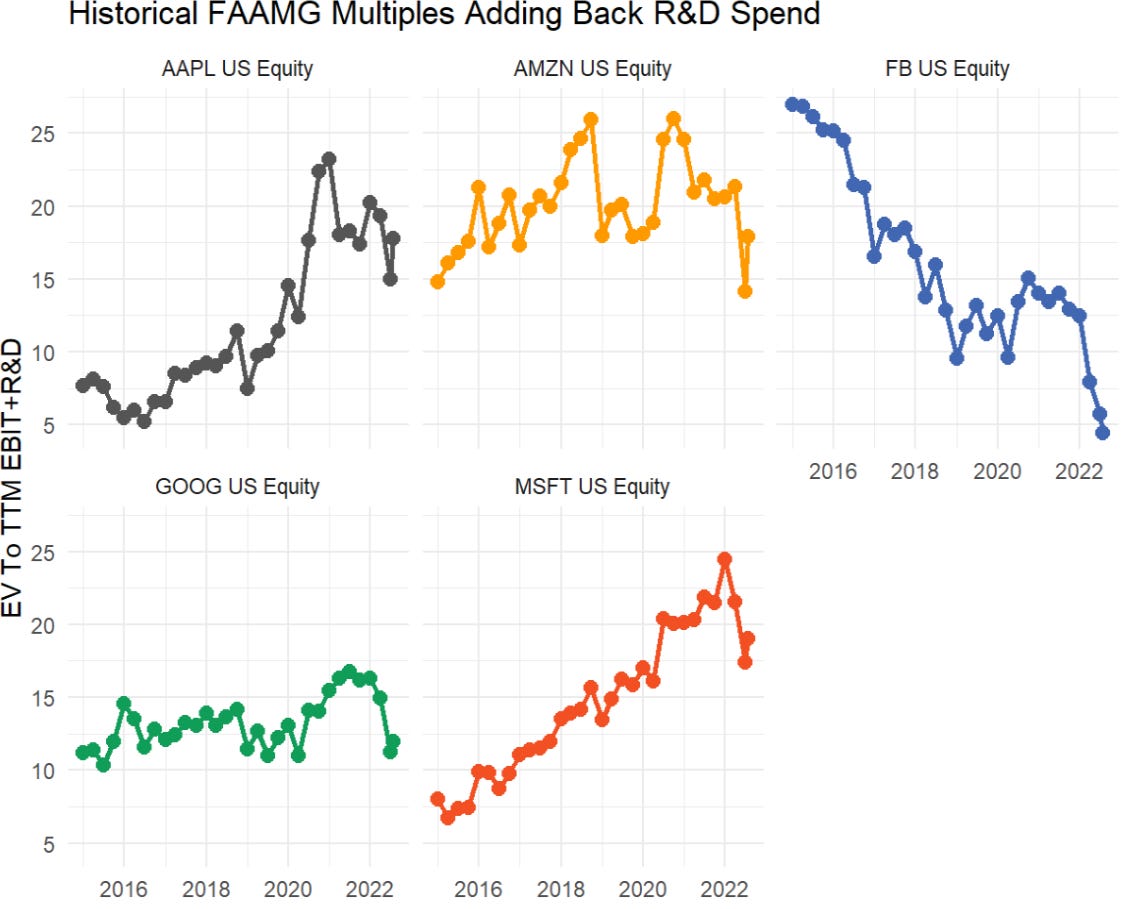

Catapult Cap had a great tweet that showed the big tech companies on an EV / (EBIT + R&D) valuation. Obviously, this is a little extreme; these businesses absolutely need some level of R&D to sustain themselves. But if you think a lot of the R&D goes to science projects not core to the business / that will be shut down in the medium to long term if they don’t create value, then this is a really interesting way to think about valuing these companies and highlights how cheap Facebook is.

Twitter vs. Elon

Speaking of the height of arrogance, I realize this will be one of the most analyzed court cases of all time…. but I continue to think the market is materially mispricing the odds of Twitter losing at trial (I.e. I think TWTR is a near lock to win). Some links / thoughts I enjoyed this month:

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). Plus, I was an eager supporter of the Brandon Sanderson Kickstarter (yes, I splurged and went for the hardcover books).

Anyway, I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

Mentioned last month that I’m DEEP into the Stormlight series and it is unbelievable. About two thirds through Oathbringer (book #3); the series remains incredible.

Honestly, normally I read more than a book or two a month, but these books are big. 1k+ pages per book (and I threw in a few hundred extra pages of legal filings this month thanks to the TWTR case!). But it’s well worth it; the worldbuilding and plotting Sanderson is doing with this series is just incredible.

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn.

Kingkiller is probably the best books I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up agia.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

Podcasts (Monthly recurring piece)

I launched the Yet Another Value Podcast in August 2020; the goal of the podcast is to do a deep dive into a high conviction idea from a sharp investor. No talking about the investor’s philosophy or history; just one well researched idea broken down (I provided a longer piece on my vision for the podcast at the start of 2021). They've been a blast so far.

A big update: I moved the podcast to a dedicated section of this blog. If you already subscribe to the podcast, no need to do anything. If you don’t….. well, you should!

This month’s podcasts:

Other things I liked

Great stuff, thanks Andrew!