Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview

I put this blurb at the start of every monthly links to highlight two things:

I do four things publicly: this blog / substack (the free side), the premium side of this blog, my podcast (Spotify, iTunes, or YouTube), and my twitter account. You can see my vision for the podcast here, and my vision for the blog and premium site here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work.

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good/appreciated/helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

Speaking of being helpful……

Some new event driven newsletters

There aren’t a lot of specifically event focused newsletters / substacks. I tend to think of Nongaap and Raper Capital as the Lebron / MJ of event driven newsletters… but, aside from those two (and, if I might no-so-humbly throw in my own premium service, though I tend to straddle the line between event driven and value), I’m not aware of a ton of quality pure event driven newsletters. It’s certainly possible I’m forgetting or misclassifying a few (i.e. I really enjoy On Beyond, but I think of it as “quirky deep value” though I guess you could kind of call it event driven), but on the whole I know of dozens of really good “quality business / value investing” substacks and only a few event driven ones.

Anyway, I wanted to highlight five other newsletters that lean very event driven that I enjoy and think are under followed. Note that I highlight all of these purely because I enjoy them / am a subscriber. I don’t get referral fees or anything; in fact, I don’t believe any of these authors know that I’m pitching them!

Value situations: This is a much newer substack; as I write this (June 18th), he’s only posted one idea (Total Produce / Dole Foods). I’m a little hesitant to recommend such a new blog because new blogs have such a high attrition rate…. but that first idea was so damn good that I know this blog is going to be incredible if it keeps going, so I wanted to highlight it both to make you (the reader) aware of it and to get value situations (the blog / author) a little bit of an audience to build momentum to keep them writing!

Ian’s Insider Corner: A paid blog on Seeking Alpha; I’ve been a sub since he pitched Renn on the podcast a few months back. It’s excellent. Mainly North American focused ideas, but lots of eclectic event driven ideas across several interesting spaces!

Special Situation Report by Bram de Haas: Another paid SA blog; I’ve known Bram for a while and consider him a friend…. but I didn’t even know he had a paid service on SA until earlier this month. It was an instant subscription for me, and I haven’t been disappointed. If you enjoy this blog, I’m positive you’ll enjoy Bram’s service, as a lot of his recent posts have high overlap with what I’ve been writing about recently (PSTH and the opportunity in busted SPACs). Note that I do not mean that in a bad way; Bram does his own work and comes to his own conclusions. I honestly just mean “he is writing about a lot of the same stuff I find interesting; if you like my stuff you’ll like his!”

Kuppy’s Event Driven Monitor (KEDM): KEDM highlights literally dozens of interesting situations each week. This is more of a “here’s a situation that is probably interesting; get to work on it if you’re intrigued” than a “here’s a full write up that you don’t need to do much over and above to build off”, but it presents screens in really interesting ways and I’ve already found a lot of interesting ideas out of it. It’s been free for the past few months; I believe it’s going paywall starting next month. I can’t vouch for how the product will evolve under paywall, but I can say I loved the free product!

Plum Capital: This substack started less than 24 hours ago; in fact, I haven’t even read their first post yet! So it’s tough to recommend something this new…. except for the fact I know the author in real life and have been emailing / swapping with him for months. He is very, very sharp; if he commits to the substack, I guarantee it is going to become a must follow.

PS- if you know of any other event driven newsletters I should be following, please let me know. I’d love to follow a few more, and I might even recommend some in next month’s links if I get some good new ones.

SPACs SPACs SPACs

The rise of SPACs: IPO disruptors or blank check distortions (from musings on markets)

SPAC surge may benefit targets that can play a waiting game

I said it in my links last month and I’ll say it again here: as the wave of SPACs that went public at the end of 2020 / early 2021 approach their expiration dates, we are going to see them offer to pay some wild prices to attempt to take companies public and save their promote.

Sportradar IPO in works as SPAC deal with Horizon falls apart

Spacs are inefficient, exhibit 102: redeeming for $10.05 when FSRV is trading at >$13

PSTH PSTH PSTH

Obviously I’ve been a little obsessed with PSTH lately. One framing I like: the PSTH deal is valuing UMG at ~$40B. That doubles as (roughly) the EV of Spotify today. The investing universe is wide, so you don’t have to own either…. but one question I keep coming back to is would you rather own SPOT or UMG at that valuation (or I guess Dogecoin, whose market cap is just a hair shy of $40B). I put up a Twitter poll asking the same question; the results close this afternoon, but you’re free to vote till then if you’re interested (as I write this, it’s a very close call!)

I’ve done several expert calls on the music space, and I’ve asked a similar question to all of them. Remembering that experts are experts on the music industry, not valuation, so their answer can be taken with a whole pile of salt, but so far every expert has responded UMG. That was surprising to me; the experts I talked to (who generally have music label backgrounds) actually seemed a little bearish on the labels in our discussions, but when asked what they would prefer to invest in across the board they went for a label. Their reasoning was generally pretty simple: label’s back catalogue is an incredible asset, and given the rise in streaming the value of that asset is only going to continue to increase.

My personal answer? At this point, I like both…. but, as I’ve done more work on the industry, I’m starting to lean a little heavier towards SPOT. There are a lot of reasons why, but it basically comes down to SPOT owns the consumer, and I believe owning the consumer is almost always the best place to be.

That said…. I like both!

I went on the intelligent investing pod on June 7; we mainly chatted PSTH.

Ackman’s Planned Universal Music Deal Includes His Grandfather’s Hit Song (WSJ TikTok on the deal)

An underrated thing about the PSTH deal? Ackman has a put since he knows there’s a buyer for all of UMG at ~$33B

He also might have another “put” in John Malone if he ever revived his interest….

Spotify and K-Pop Label Kakao settle licensing dispute

Article on Spotify’s initial pull of K-POP

Some more DISCA / T ramblings

Lost in my obsession with PSTH this month has been my ramblings on DISCA! I still love it and wanted to highlight the two tweets / screenshots below. Why? Because I think they show the potential power of the combined platform.

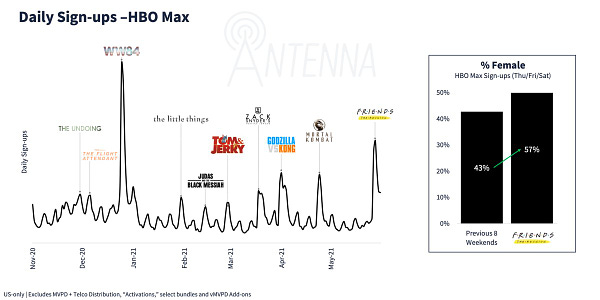

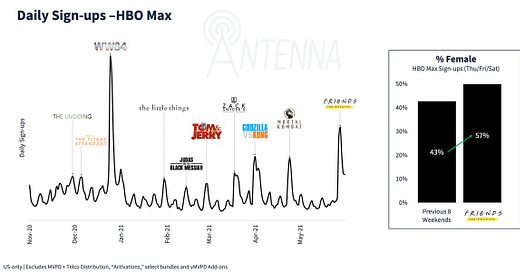

The first tweet (the antenna data) shows how HBO Max sign-ups spike during big events (Friends reunion, WW84 premier, etc.). Why does that matter? Because HBO / Warner have big, blockbuster events that get people in the door and watching….. what they don’t have (right now) is a fantastic library that can keep people engaged / minimize churn. You know who has that? Their merger partner, Discovery!

The second screenshot is App Downloads on a monthly basis. I think it’s interesting; HBO Max is consistently towards the top of download activity. Yes, that number should be taken with a grain of salt; for some reason, Disney+ isn’t on there, and I suspect most people already have Netflix on their phone. Still, it shows that HBO Max does have some momentum / appeal. And the Discovery numbers are interesting, as they appear to be significantly outpacing things like Starz or Paramount+

All of that data should be taken a little skeptically. It’s just point in time data and much of it estimated, and media is a global game at this point so U.S. downloads are important but not the end game. Still, to me it’s just another data point that suggests the combined strength of WB / DISCA is going to create a competitive / global scaled media player.

Podcast

I launched the Yet Another Value Podcast in August 2020 and provided a longer piece on my vision for the podcast at the start of 2021. They've been a blast so far. You can follow on Spotify, iTunes, or YouTube (and please be sure to subscribe and rate them if you enjoy them!). This month's pods:

As always, if there’s a company you’d like highlighted on the podcast or a guest you’d like featured, I’m always open to suggestions (even if that suggestion is “I would be a great guest!).

Other things

Cnn ramps up streaming push as Discovery Merger Looms

Pretty sure a standalone CNN app is a dumb idea and DOA, but would be happy to be proven wrong!

Thomson Reuters reclaiming the family’s bastion

Very good new (to me at least) investment blog

The Netflix of Wellness: Inside the Hollywoodization of Peloton

Why ambitious people have unrelated hobbies

Reminded me a little of The Hard Break, which I very much enjoyed and have started practicing

Comcast’s CEO built a cable giant; can he build a streaming giant?

The American eater wins again with flavortown.

DeFi is helping to fuel the crypto market boom and its recent volatility

Barry Diller’s IAC isn’t a bad gamble

It’s really funny to reread this article on Diller / Malone from 2007 and look at it now. IAC spun off VMEO and IAC’s stub is trading with a positive value, while LSXMK and a few of Malone’s other trackers seem to be trading with a Malone (or maybe Maffei?) discount.

Scuttleblurb update on IAC (paywall, but well worth it!)

The memes are taking over (AMC, GME, PLUG make up just shy of 2% of the IWM!)

Mudrick AMC bet backfires after meme frenzy wrecks hedge funds

They broke the cardinal rule of investing: do not sell naked calls on meme stocks (and, honestly, you could probably just drop the “on meme stocks” from that sentence)

Mark Cuban calls for stablecoin regulation after trading token that crashed to zero

VIRT is minting money right now

No real takeaways, but the stock is cheap and I think my February investment thesis holds up well. The CEO thinks so too; they’re going to buy back shares and he takes his grants in gross shares (meaning he pays cash taxes so he can hold on to all shares!).

And the meme stock volume shows no signs of slowing down…

Of course, Gensler (the new SEC chair) seems to want to crack down on them, so there is regulatory risk…. but I thought VIRT’s response was reasonable, and it might just be groundhog day to Flash Boys.

High-speed trader virtu fires back at critics amid meme-stock frenzy

Checks UpHealth stock price just above $6 per share.....

Yep, GIX shareholders got what was coming to them if they didn't redeem -4 weeks ago.... Worse terms on a subpar target... Double whammy..

Good stuff! Thanks Andrew