Some things and ideas: November 2022

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2022 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!)

Journaling

Every month in my monthly links post (this post!), I’ve been doing a “state of the markets” piece on where the markets sit. Nothing crazy; just taking a second to say “hey, markets are pretty fearful right now” or “here’s where I’m seeing opportunity more broadly” or something along those lines.

It’s silly, but I’ve found it’s been helpful for me. Just taking 15 minutes a month to step back and think a little bit more about overall markets has made me a little more thoughtful on portfolio composition,

Anyway, because I’ve enjoyed that, I’ve been thinking a little bit more about investment journaling (I tweeted it out earlier this month too). I’m still experimenting around, and I’m very open to suggestions or improvements if you have any.

Two tools that I’m experimenting with that might be helpful / of interest

Roam: this is going to sound crazy…. but the way I kept notes on companies until this month was I just kept a running word doc on every company I was interested in. Roam’s really changed that; it basically lets me keep a running tag of everything I’m reading during the day and keep notes on them, link them to other things, and makes it really easy to go back and see what I was looking at / seeing each day. I’ve really enjoyed this so far.

Journalytic: this is a very new tool (Beta released in the past week), and it comes very highly recommended by several investors I respect. I’m still playing around with it / trying to see how to fit it into my process, but I can definitely see the potential.

When does TWTR start to effect Elon?

Another thing I tweeted out, but TWTR seems to be consuming a heck of a lot of Elon Musk’s headspace, and it…. does not appear to be going well.

I can’t help but wonder when TWTR starts to have a real impact on the rest of Musk’s empire, particularly Tesla and SpaceX.

I know what Tesla / SpaceX bulls will say. “These companies are so far ahead of the competition that there’s no catching them.” Maybe (SpaceX certainly seems that way sometimes)! But, for Tesla in particular, it seems like a very competitive industry and their CEO seems to be spending all of his time focused on a completely different right as competition seems to be ramping up and the economy seems poised to slow.

Maybe I’m just a Tesla perma-bear, but the combination of those three tihngs (distracted CEO, ramping competition, slowing economy) would be a death knell for just about any other company (or at least a stock price death knell!), and while TSLA’s stock is down this year, it’s certainly not down as much as you’d think given the general “growth stock crash” we’ve seen this year.

One other thing that jumps out to me: Spacex is apparently buying TWTR ads, and TSLA is lending engineers to TWTR. Elon is no stranger to using one of his companies to bail another out; just something to keep an eye on going forward….

If I was an investor in one of his other companies and saw not just the time he’s personally devoting to TWTR but also that he’s using his other companies to help TWTR in some way…. well, I would have some very tough questions to ask myself about staying invested!

FinTwit board game night (Monthly recurring piece)

I am an absolute board game nut, and I’m guessing some of my readers are as well, so I’ve started hosting a FinTwit board game night. We’ve done two so far, and both have been a blast!

General idea is simple: we’ll meet up at my office (it’s in the Nomad area) around 6, play some board games, and have a good time. I’ll likely order a few pizzas for the crew, and everyone is welcome to bring some drinks if they’d like to!

I got swamped with work and unfortunately didn’t plan one for November, but I plan on doing one for December before the holidays!

Anyway, if you’re interested in joining, feel free to send me an email or slide into my DMs and drop me your email there. I’ll send an email out to everyone who’s interested later this week or early next week to plan a game in the middle of the month.

If all goes well, I plan on turning it into a monthly thing, so no worried if you can’t make this one!

State of the markets (Monthly recurring piece)

I know it’s silly… but the past few months I’ve included a “state of the markets” piece, and I’ve found it’s really helped me think through what I’m seeing. So I’m going to make this a monthly recurring piece.

Honestly, November felt a little boring. After markets dropped ~10% in the month of September and then rose ~10% in October…. the major indices were basically flat in November. Yawn!

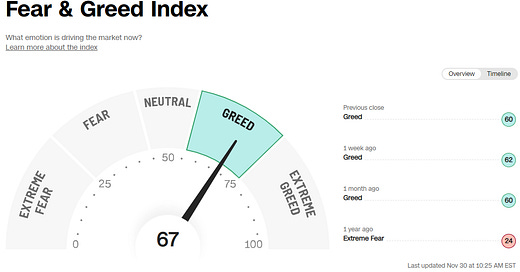

Where’s that leave the markets? I’ve taken to using CNN’s fear / greed index as a short hand for where the markets are. That index still has markets tipping into the “greed” territory. Honestly, that feels a little aggressive to me; major averages are still down 15-20% YoY, there are still lots of cheap stocks out there, and with crypto imploding I’d say the last pockets of speculative excess are rapidly getting removed. But things definitely aren’t as cheap as they were two or three motnhs ago; I don’t want to anchor to those prices, but I do certainly miss those prices!

One thing that scares me? The area I’m most consistently seeing value in is cyclicals and particularly commodity / energy related. I can point you to multiple pockets of things that tough energy in some way that are currently minting really strong results yet trade for extremely low multiples of “normalized” earnings. It’s always scary as a generalist when your best ideas are consistently coming up in energy.

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). Plus, I was an eager supporter of the Brandon Sanderson Kickstarter (yes, I splurged and went for the hardcover books).

Anyway, I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

I read a few different books this month, but honestly nothing I’d recommend. Mistborn book 7 / Wax and Wayne book 4 is came out earlier this month and I cannot wait to read it; generally I’d read it the weekend it came out but I’m giving it to myself as a Christmas present and reading it for some flights / travel around there!

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

Podcasts (Monthly recurring piece)

I launched the YAVP (Yet Another Value Podcast) in August 2020; the goal of the podcast is to do a deep dive into a high conviction idea from a sharp investor. No talking about the investor’s philosophy or history; just one well researched idea broken down (I provided a longer piece on my vision for the podcast at the start of 2021). They've been a blast so far.

A big update: I moved the podcast to a dedicated section of this blog. If you already subscribe to the podcast, no need to do anything. If you don’t….. well, you should!

This month’s podcasts:

Other things I liked (Monthly Recurring Piece)

Why an aging casino company embraced barstool’s david portnoy

Blue Apron sinks after pulling forecast due to delayed funding

Feels like the SEC should get involved here….