Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I'm going to start putting this piece in at the start of every month. I just want to highlight two things

I do four things publicly: this blog / substack (the free side), the premium side of this blog, my podcast (Spotify, iTunes, or YouTube), and my twitter account. You can see my vision for the podcast here, and my vision for the blog and premium site here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

Judges / the Fed / Politicians trading stocks

Five years ago, I would have described myself as a libertarian. I’ve probably gotten a little more progressive as I’ve gotten older, but I’d still say my core ideology is “government should let markets work, and only step in where markets fail.” Maybe I haven’t changed a ton; I’ve just gotten more progressive because I’m seeing lots more market failures, externalities that the market doesn’t properly account for, etc.

Anyway, I know lots of people who fall much further on the libertarian side who think all politicians and leaders are some combination of corrupt, power hungry, or incompetent. There’s plenty of that and a lot of politicians who I think are flat evil, but in general I’ve generally thought most leaders are good people who are just trying to do their best and have fundamentally different world views on the world than me.

But I’ll tell you that view has taken a real hit over the past two years. I’ll leave the politics out of it and just point to the rampant insider trading that’s been taking place across both sides of the aisle and at all levels of government. You’ve got congressional members on both sides of the aisle trading on companies affected by laws they pass or national security briefings (Nancy Pelosi trading Big Tech; Republican Senators trading on COVID news), the Fed board members trading interest rate futures, and now judges trading stocks for cases in front of them.

That stuff just absolutely infuriates me. I think a lot of the resentment of “the elites” I see on both sides of the aisle is that the elites are making a mockery of the rules that everyone else plays by, and this type of insider trading just emphasizes it. I can’t believe that these trades are going on without serious investigations; honestly, I feel like all of them should face jail time and massive penalties. They’re placing their personal interests ahead of decisions that literally affects the fate of our entire country (or, in the case of COVID, the world). Awful.

Nintendo adrift

In my piece on IAC buying MDP, I mentioned Nintendo as a company that perennially trades at a discount to its private market / strategic value. I got lots of push back on that point; the Nintendo bulls are certainly a passionate crew!

So I just wanted to highlight and say I agree with (most of) what my friend Aaron Edelheit says here: Nintendo has great assets. Their strategic value is enormous…. but I worry they are moving too slow and their strategic direction is off.

The world of media moves very fast; if Nintendo’s IP remains behind a closed garden (only available on Wii), and Nintendo refuses to evolve the way they make / release games, then Nintendo’s relevance is going to diminish over time and their strategic value will shrink. Yes, middle aged people have great attachment to Zelda, Mario, etc. But every year that Nintendo refuses to make games that younger people live in is a year that the audiences for those games grows smaller and smaller. Right now, it’s not a big issue…. but if Nintendo refuses to release world’s people can invest hundreds of hours in and today’s youth instead spend all of their time in Roblox or Fortnite or something, then ten years from now Nintendo’s strategic value is going to look a lot worse.

Insider buying and share repurchases as a signal

Every investor has heard “insiders sell for a thousand reasons, but they only buy for one” at some point. Recently, I feel like the “insider buy” signal has been a little funky; in particular, I’ve seen some insider buys where the stock just gets slaughtered right after and you wonder “why did management buy right before announcing that?” I mentioned two interesting insider buys last month, and I wanted to follow up with a few more here.

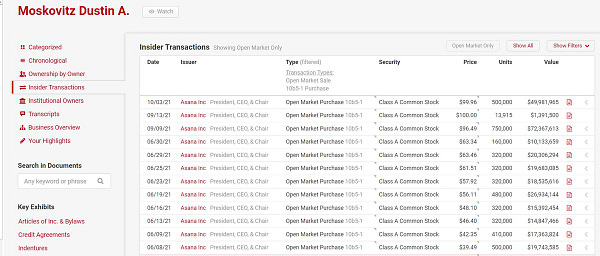

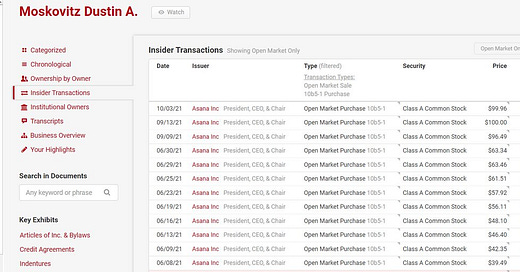

Let me start with one of the most epics buys I’ve seen: ASAN. The CEO / founder went on a buying rampage this year; $200m in June at ~$50/share, and then another $150m at $100/share in September / OCtober. With the stock currently sitting at $135/share, that’s a pretty good trade!

This isn’t quite a buyback, but I wanted to highlight WIX’s repurchase over the summer. The Chairman publicly highlighted a $200m buyback, and the stock has pulled back ~20% since they completed it. I get it’s a short term price movement, and these repurchases could be really accretive in the long term…. but it’s still pretty interesting!

SPAC marketing and shenanigans

The House Democrats have a plan that will largely ban Wall Street from marketing SPACs to retail investors.

In general, I’m not a fan of people being told what they can or can’t do with their money (see my discussions of libertarian leanings above). It seems crazy to me that there are some investments (hedge funds, PE funds, etc.) that are only available to “the rich”. I’m generally a fan of “it’s your money and you can do / invest where you want” and legal protections exist to make sure the risks are clearly laid out and that your money isn’t flat out stolen. So I’m not a big fan of this plan, though given all the shenanigans in the SPAC space and the loopholes that let them give projections no other companies could make, I would be a fan of some changes to regulations!

Speaking of shenanigans (and furthering on the insider buying mentioned above), I wanted to briefly update on one deSPAC’d company I mentioned in the distant past. I mentioned GIX’s deal to buy UPH here and here; the basics of the deal is GIX was at the end of their SPAC life, announced a deal with one company to get their SPAC life extended, and then turned around and announced a deal to merge with UPH (a completely different company) after they had gotten their SPAC extended. It was all very weird, so I’ve been following them out of the corner of my eye since.

UPH’s stock has been a disaster since that deal closed… and that disaster culminated with the company announcing a hugely dilutive stock offering priced at $1.75/share this month. UPH had been valued >$10/share in the SPAC deal, and the stock had closed at >$2.50/share he day before the offering, so this was just a real salt in the wound style offering.

Humorously, the company could be interesting at the new, much lower price. The CEO and top management got a new contract w/ RSUs struck at the new, lower price right after the secondary, and their has even been a little insider buying at prices much higher as recently as September.

One more thing on SPACs: why aren’t sellers breaking more deals?

Speaking of SPACs, here’s another question I’ve had: why aren’t we seeing more SPAC deals breaking? MUDS was the headliner for SPAC deal breaks, but that was due to TOPPS losing a massive contract. We’ve seen some SPAC deals get cancelled because shareholders simply couldn’t get behind the deal; for example, Tailwind / QOMPLX cancelled their deal in August after twice adjourning their shareholder meeting to try to get more support.

Still, I’m surprised we haven’t seen more cancelled deals. Why are companies going through with SPAC mergers when the SPACs are delivering almost no cash to them? Shouldn’t the companies at least be looking to restrike the agreement or get the founders to give up a ton of founder shares?

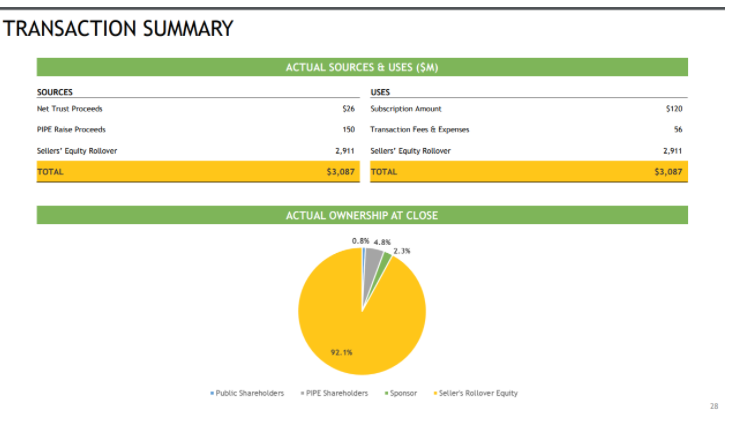

An example might show why this perplexes me so much. Consider MKTW. When that deal was announced, they thought it would bring in ~$524m in cash net of $40m in transaction fees (see slide 29). However, they faced a wave of redemptions, and transaction fees ran a little higher than they expected ($56m versus the $40m projection). All in, when they completed their deSPACing in July, and the SPAC delivered, net of transaction fees, $120m of cash (from the company’s August investor deck).

In return for that $120m, the sellers’ gave up 7.9% of their equity. They were valuing the equity at ~$3.1B all-in in the initial deal; if you believe that mark, the sellers gave up ~$244m in equity value (7.9% * ~$3.1B) in order to get $120m of cash.

Once the numbers get that small…. what’s the point of going through with the deal if you’re the company? Almost a third of the money your raising is going to transaction fees, and if you look at the net cash you’re raising it’s basically valuing the business at ~half of what your initial terms were (the initial terms that assumed no SPAC redemptions). At a minimum, why wouldn’t you go to the sponsor and demand they forfeit a bunch of founder’s shares (forfeiting founder’s shares is equivalent to buying back / retiring shares at an effective price of $0 and is a way to make the deal cheaper)?

Honestly, I don’t know the answer. Maybe they just wanted to get public and were so far a long they figured “why not?” But, as a potential investor, it worries me. The sellers have to have some idea what their business is worth; for them to let a deal go through at much worse terms than originally agreed on seems to suggest the management / sellers have concerns about their business’s sustainability and/or think it’s dramatically overvalued.

Why mention all this? Because, if you just look at the MKTW numbers, it’s a screaming buy. The business model absolutely spits off cash, the customer retention and other metrics are great, etc. Heck, there’s even been some insider buying. But I can’t look at the SPAC deal, the valuation they initially agreed to, and particularly the valuation they ultimately accepted (much lower than the initial valuation given the redemptions) and match that up with the numbers the company puts up and how bullishly management talks about the business.

Three more quick SPAC things

Twenty somethings with fat checkbooks join the SPAC rush.

This trend is…. hilarious? Concerning? I don’t know, but it’s something.

LOKB announced an interesting forward purchase agreement to cover redemptions; I think this is a trend we’ll be seeing more of.

Starry’s deal with FMAC includes a unique tontine like structure to discourage redemptions; I think this is the first time I’ve seen a tontine like structure introduced at deal announcement. I’ll have to see how the structure plays out, but I think this is a good structure for teams to keep in mind going forward.

Uniquely, the holders of FirstMark Class A common stock that do not elect to redeem their shares in connection with the transaction will share in a pool of one million additional shares based on an exchange ratio between 1.0242 and 1.2415, to be determined based on the number of unredeemed shares. Assuming a price of $10.00 per share of FirstMark Class A common stock at the closing of the transaction, each share of FirstMark Class A common stock would receive shares of the post-combination company with a value ranging between $10.24 (assuming no redemptions by FirstMark's stockholders) and $12.42 (assuming redemptions resulting in the maximum exchange ratio).

Podcasts (Monthly recurring piece)

I launched the Yet Another Value Podcast in August 2020 and provided a longer piece on my vision for the podcast at the start of 2021. They've been a blast so far.

A big update: I have created yetanothervaluepodcast.substack.com; I’ll be posting each podcast there as well as a transcript of the podcast. Would very much appreciate feedback on the site if you have any; I’m still trying to figure it out!

This month's pods:

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite past time is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy.

Generally this is going to mean giving book recs, but if I find a board game or movie or something else I really enjoy, I’ll recommend that too!

Nothing new really jumped out to me this month; however, I did finish the Unhewn Throne series (which I mentioned first here), and I really enjoyed it!

Other things I liked (Monthly recurring piece)

DIS shift to streaming puts ESPN in position of clinging to past

The inside story of how softbank backed Zymergen (ZY) imploded

Deep sea mining group left in lurch after $200m disappears

Good coverage of TMC, which I have written up extensively

Good piece on cannibals (no, not the human type. the companies that continuously repurchase shares)

A flood of unknown products is making online shopping impossible

Squid games is Netflix’s first Korean Hit. A Japanese show is next

Disagree with some of the stuff in here, but I thought the stuff on marginal advantage was just incredibly written

HBO Head Casey Bloys talks Succession, DC Comics and International Programming

Former NBA players charged in $4m healthcare scheme

Ignoring the legality, this just seems like a bad trade. Glen “Big Baby” Davis is (allegedly) involved here. He made >$32m in salary in his NBA career, plus endorsement deals and the like. Darius Miles, another player mentioned, made >$60m (though he filed for BK). Defendants, in total, kept $2.5m of proceeds from the alleged scheme; there were 18 of them so we’re talking <$150k/player (assuming proceeds were split evenly). Feel bad that guys who earned that much money would become a felon for such a small sum.

Trump tightens grip on social media company after SPAC deal success

Obviously DWAC and the spac market have been popular thought bubbles the past week!

One person buying into the mania? Rep Marjorie Taylor Greene

Meet the guy who spends just $150/year to eat all his meals at six flags

Are There Enough Strawberries in a Kellogg’s Strawberry Pop-Tart? A Court Might Decide

A&W turns its worst marketing failure into a new burger (short math?)

Inside Nick Rolovich’s downfall at Washington State over COVID-19

Ignore the article if you want. I’m just pulling a quote out to remind you of one thing: please go get vaccinated.

“Like Rolovich, Patrick Lane was hesitant to get vaccinated. He wasn't against vaccines, his daughter said, but despite pleas from her to get vaccinated, he told her he felt safest waiting for full approval from the Food and Drug Administration. The Pfizer-BioNTech vaccine received full FDA approval on Aug. 23, three days after he had tested positive. On his deathbed, he told his wife via FaceTime he didn't want to die and that he should have gotten vaccinated.”

I know you’re following LSXMK/SIRI. Pro-forma for shareswap with BRK, LSXMK is now over 80%. Good for Liberty holders.

In Berkshire news, their 3q came out today. The buyback came in very nicely and cash continues to build in spite of it. I’m not sure, even now, the market understands what a value driver the buyback is for BRK.

Always great post. I wish I had seen ASAN's insider buy since it is on my watchlist. Since you linked Peloton's article and you've written about Peloton several times, what's your thoughts on their earnings this q?