Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2022 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!). If you do launch a substack, please let me know so I can try to be helpful.

State of the markets (Monthly recurring piece)

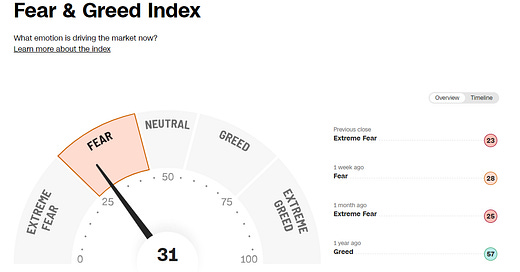

I did a piece ~10 days ago (Weekend thoughts: interest rates and climbing the wall of worry). I don’t have a ton to add to that piece. To sum: fear is pretty widespread right now; stocks on the whole look on the cheap side but if you’re willing to do a little digging I think you can find some very cheap stocks out there. The area I think I see the most opportunity in right now is banks (I posted a few of my favorites on the premium side), but that’s just my personal favorite and I think there are lots in interesting tags to pull on right now.

Interest Rates

My friend Byrne Hobart of the Diff (which is one of the view things I’m sure to read every day) had an interesting post on the “long, long view” of interest rates and how they’ve tended to decline over time (and I do mean a long time; the first data point dates back to ~1300). The money chart (from this BoE paper) is below, but I’d encourage you to read the whole thing as Byrne dives into some of the different factors in a really interesting way.

Anyway, this may be the dumbest thing I’ve ever written on this blog, but I’ll throw out my half baked theory: I actually think natural real interest rates are low, possibly negative, and I wouldn’t be surprised if a few generations down the line people look at the 1900s and 2000s when interest rates were positive and say “damn, I can’t believe you could get a return from just giving your capital to governments at no risk.” It’s easy to say “you should get a return from parking your money somewhere,” and I generally agree with that…. if you’re taking risk on. But for taking no risk on (like lending to the U.S. government or putting your money in a bank)? I think the interest rate there should be zero or possibly negative. Why? When you’re doing something risk free, the safety is paramount. Being able to transfer consumption from today to tomorrow is literally magic (if you think of hunter gathers, you were better to consume today because waiting till tomorrow risked food spoiling or being stole), and I think as our world ages and the desire to save some of today’s consumption for retirement increases (and remember- as lifespans increase, that desire gets more important!), I think the risk free rate goes lower and lower, possibly negative.

And, again, I’m no expert, and that might be the dumbest thing I’ve ever written. But, if you believe that paragraph (or just the trend in the chart), it does suggests interest rates and risk free rates are biased lower over time, and today’s brief inflation / deficit driven interest rate spike is a gift (though I suppose you could take issue with me saying U.S. governments are risk free given the fiscal and political state of the world / country today).

Maybe I’m right, and the push back is the short term risk free rate is negative while the long term is low but still positive to reflect some incentive to park money for a longer term (so a negative rate covers the benefits of risk free / safe transfer from today to tomorrow, while you get positive rates over the real long term to incentivize to lock up longer against other options). IDK; it’s half baked but directionally I think it makes sense.

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). Plus, I was an eager supporter of the Brandon Sanderson Kickstarter (yes, I splurged and went for the hardcover books).

Anyway, I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

It was a very on brand month for me; I read two Brandon Sanderson books and the tenth Wandering Inn book.

The Sanderson books were his third and fourth “secret projects” (Yumi and the Nightmare Painter and The Sunlight Man, respectively). They were good (all Sanderson books are!) but not my favorite.

The tenth wandering inn book (the Wind Runner) is fantastic. This is the third month in a row I’ve recommended this series, and I’ve gotten emails from dozens of readers who have started the series and gotten completely hooked. If you like fantasy, seriously…. give it a try! The first ~150 pages of the first book are extremely slow, but if you can power through them you’ll discover a fantasy world and worldbuilding unlike anything else I’m aware of.

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

The Wandering Inn series isn’t for everyone, and the first ~150 pages of the first book need to get powered through…. but, if you can power through them, the world building here is incredible, and I’ve had so many friends get hooked by this series. If you like hard fantasy, I can near guarantee you’ll like it.

Other things that caught my eye / links

how baseball’s data-driven scouting machine missed the rangers’ rookie sensation

Eye on the markets looks at NYC (podcast)

FCC revives ‘Net Neutrality’; proposes new regulation for internet services

How a vegas whale, nd many more, tap billions meant for US housing

Chevron’s (CVX) Mike Wirth: We are not selling a product that’s evil

Food halls, a hot real estate investment, conquer the suburbs

Posting both because it’s interesting and because the Hugh is one of my favorite places in NYC to meet up!

I loved your reflection on US govt. bonds. I also think they are really attractive at this level but I would add that there are two and very important other factors to speculate about.

1. The value of the US dollar relative to other currencies.

2. The US inflation rate over the holding period. ->(which determines your real return).

The value of the US dollar is driven by demand/supply for the dollar. The demand/supply dynamic is largely driven by the balance of payments, which can be roughly thought of as Exports - Imports.

Inflation is much less of an exact science. But I will agree with Bob and say that the savings rate is a very important factor and that it is inversely correlated with interest rates. I will also add that the savings rate is directly correlated with avg. population age (aging population = more savings). And I will point to Japan as the archetypical case of an economy with stubbornly low inflation despite immense increases in the supply of the Yen, and argue that its high savings rate is not an insignificant factor holding rates down.

So what's my speculation about 1. and 2. for the future?

For 1. I would say that I think the US dollar will appreciate over the next 10 years. It will appreciate as the factors that led to its previous decline reverse. Notably the balance of payments will reverse as a result of US's increased energy independence, on-shoring of chip manufacturing, and stable or slightly more protectionist policies on trade. For a good chart of balance of payments: https://tradingeconomics.com/united-states/balance-of-trade . I speculate that the increase in exports relative to imports starting around 2012 was driven by the advent of fracking in the US and lower oil imports.

And for 2. I would say that inflation will return to low levels (about or less than 2%) over the long run driven in part by an aging population and thus higher savings. Having said that, I think this is my weaker argument. The fears of a long term shortage of labour, driving wages up, could be legitimate. Still, if I were to gamble, I would argue that whatever mysterious factors kept inflation low over the last 10 years, will return.

All this to conclude that, yep, I think long duration US govt. are very attractive at their current levels.

Side note: the relative value of the dollar is important when buying US govt. bonds because unlike companies that adjust prices to maintain profitability on a constant currency basis, bond prices stay un-adjusted.

Read that paper too. Money has to go somewhere. As large corporations have become more disciplined about profitability in my longish life time and as we 1% ers (or close in my case) have more and more investable capital - rates have gone down. I see nothing to suggest that this process is ongoing. More supply of investable cash drives down rates and inflates the prices of investable assets.