Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I'm going to start putting this piece in at the start of every month. I just want to highlight two things

I do four things publicly: this blog / substack (the free side), the premium side of this blog, my podcast (Spotify, iTunes, or YouTube), and my twitter account. You can see my vision for the podcast here, and my vision for the blog and premium site here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

Peacock, The Olympics, and the WWE

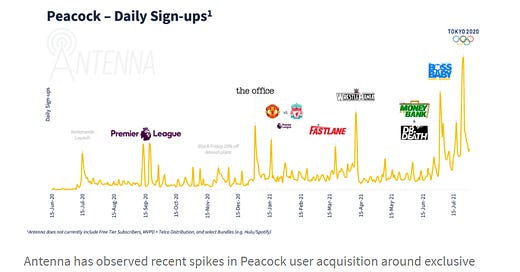

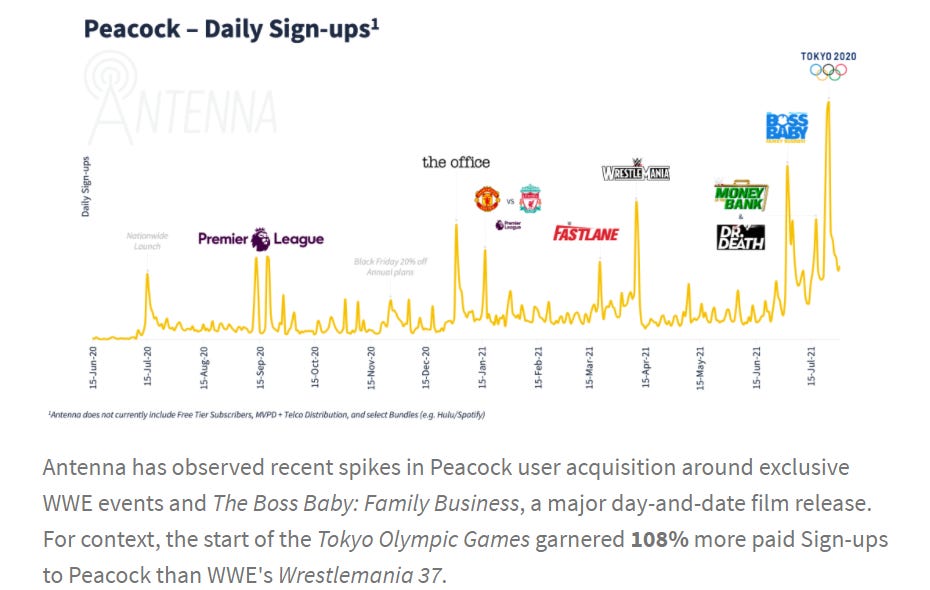

This Antenna article was really interesting around the Olympic’s driving Peacock sign ups. It included the chart / screenshot below:

I just thought that was an interesting comparison. NBC’s current contract pays ~$1.25B/Olympics. NBC’s contract for WWE’s PPV costs ~$200m/year; the budget for Boss Baby 2 was ~$82m. Yes, the Olympics has lots of sponsorship and advertising revenue… but for it to only drive ~2x the subs as Wrestlemania is legit insane at that price. Remember that the Olympics occur once every two years (normally), while Boss Baby has lifetime / library value (people / kids can rewatch Boss Baby or watch it for the first time years from now; no one watches old Olympics clips!) and the WWE’s PPV’s occur every month. From a churn and lifetime value, Boss Baby and WWE have the Olympics completely dominated (also, the production costs associated with the Olympics are enormous!).

Anyway, it’s a thought bubble that’s been floating around a lot for me recently: I think buzzy one time events (like the Olympics, or the Oscars) are going to really struggle going forward as I think they were way overmonetizing in the legacy bundle world (plus they’re just flat boring / have lots of downtime; they’re not really well suited for the internet / streaming age). Going forward, I think streamers value things that can create consistent audience ton in behavior (like a weekly wrestling show or sporting events with long seasons) or things that can both drive subs and have lifetime value (like a movie).

Nothing crazy new from me here; just the view of how little the Olympics outperformed things that were much, much cheaper than it emphasized the point to me (and, as a WWE bull and shareholder, I could be a bit biased here!).

Critics might point out that the Olympics are largely available on the legacy bundle, decreasing the incentive to sign up for a streamer, and that the Olympics are consumer more by an older audience more likely to have the legacy bundle. I hear you, but think this point still stands (and it’s not like viewership on the legacy bundle was that great!).

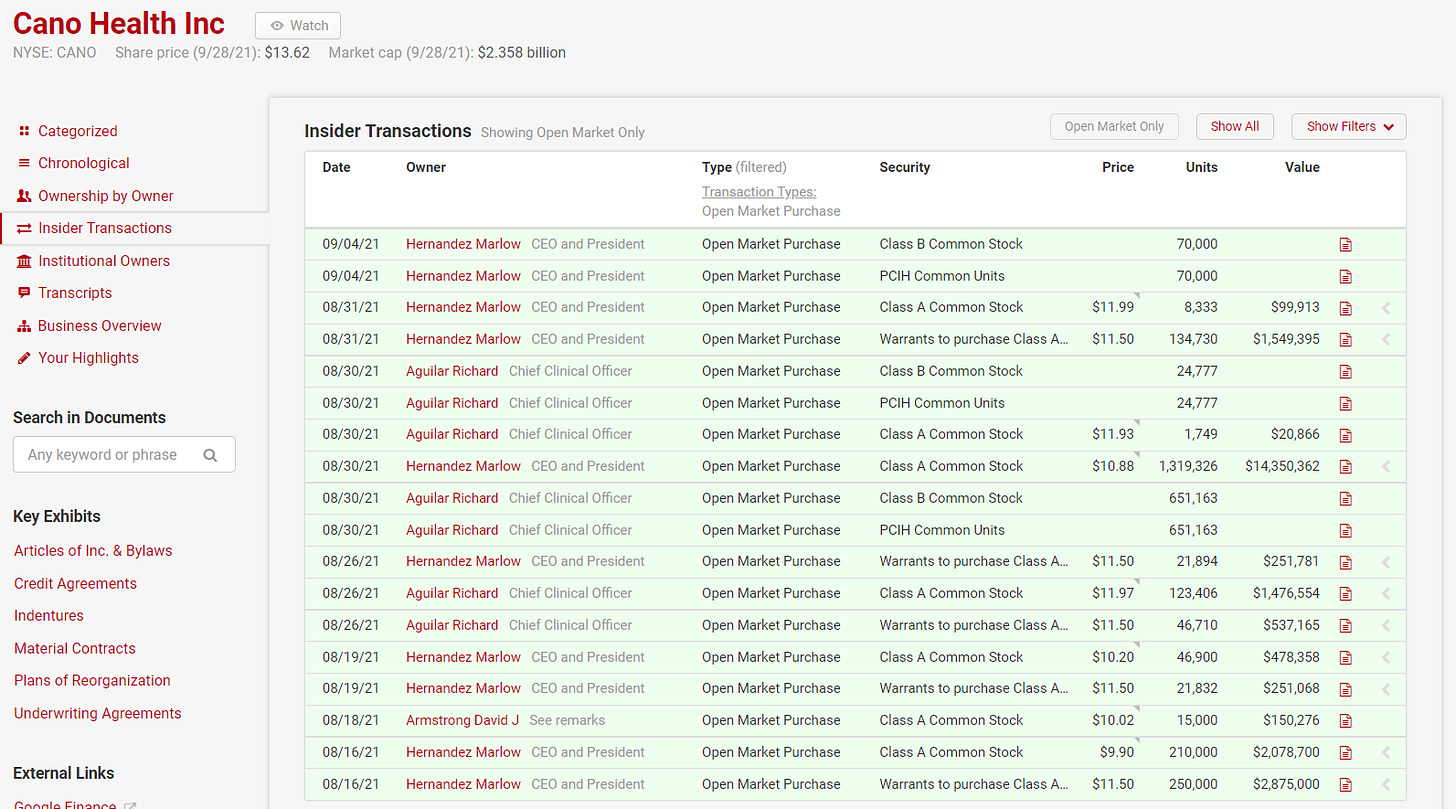

Insider buying, Part 1: Aggressive insider buys at CANO

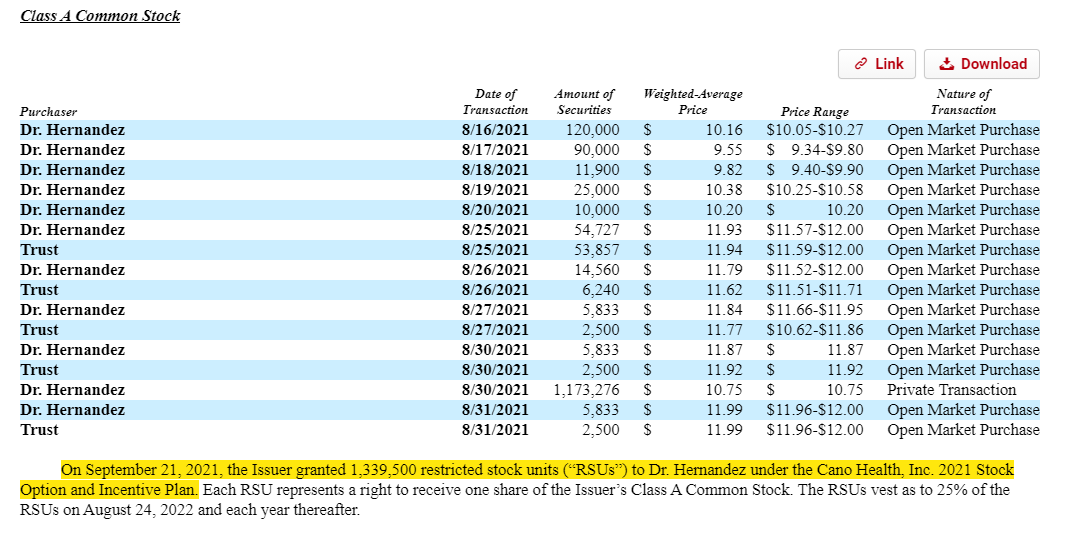

One of the more interesting insider buys I’ve seen recently comes from CANO. Cano merged with Jaws, a SPAC, earlier this year, and in the past month insiders have been pretty aggressive buying shares:

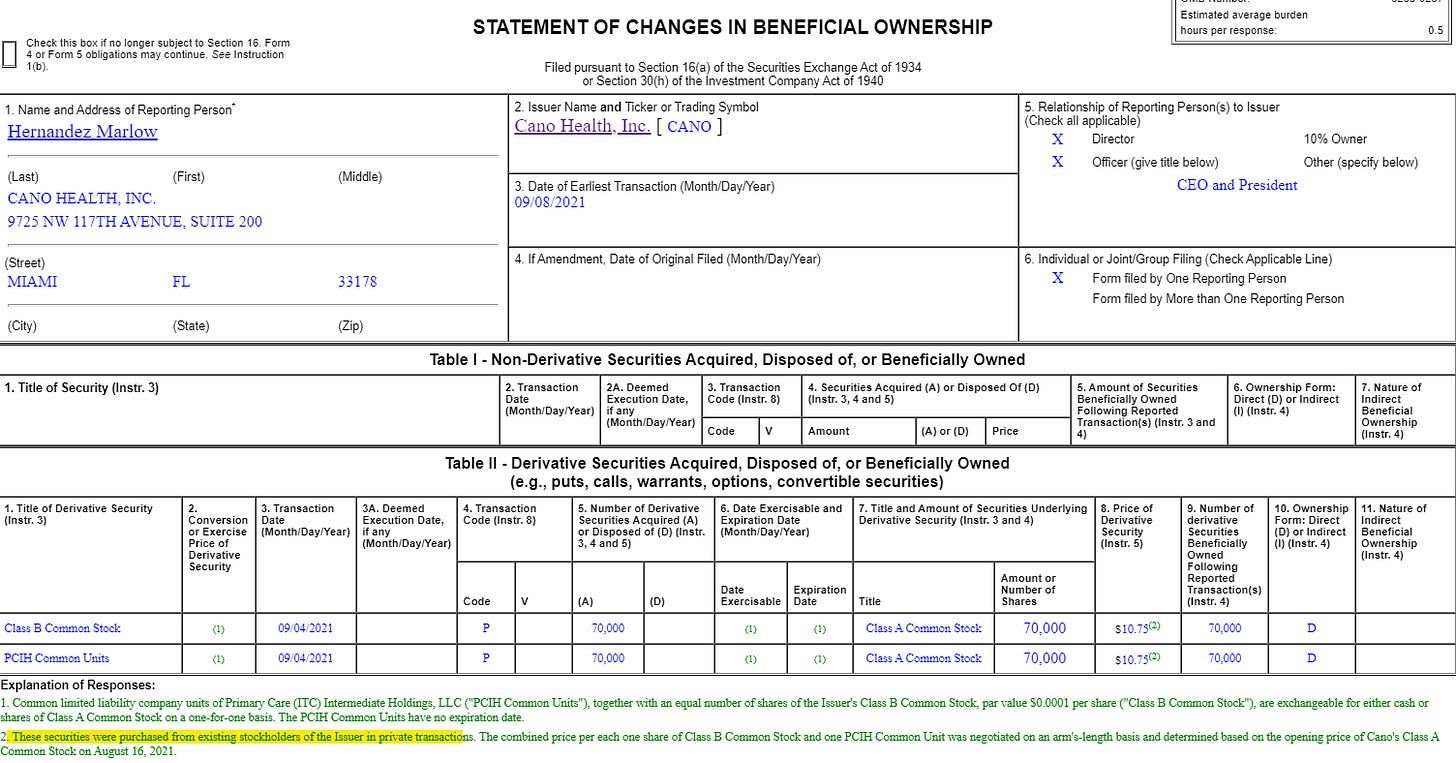

Even more interesting, if you look through the form 4s, you’ll see some of this buying was the CEO buying the non-traded share class in private transactions from other insiders.

On top of that aggressive buying, the company just granted the CEO a pretty nice RSU block (from his 13-d)

Why do I mention all this?

Well, first, it’s interesting! There could be value here; yes, it’s a deSPAC, but this was a top tier SPAC sponsor (Barry Sternlicht) and the PIPE included some great investors (Third Point, Maverick). Combine that with the aggressive insider buying, and you’ve got a potentially interesting stock.

But I also mention because the degree of insider buys strikes me as somewhat aggressive and strange. If you just think about it, Cano struck a deal to deSPAC at $10/share, and the SPAC obviously has a bunch of warrants (struck at $11.50) associated with it. As part of the deal, Cano shareholders rolled 90% of their equity, but they did get 10% out. It just seems strange to me a CEO would agree to merge at that lower price, dilute himself, and take some money off the table… then turn around and aggressively buy shares in the open market at a higher price. IDK, maybe the recent string of acquisitions and regulatory environment change has him convinced intrinsic value is materially higher today than it was a year ago. If so, good for him for having the flexibility to buy higher! But the combo just illustrates to me why it’s hard to buy into a SPAC; if you’re buying, you’re buying higher than insiders were willing to sell / dilute themselves not too long ago. Actually, given the founder’s share dilution, you’re buying materially higher than insiders were willing to dilute themselves (unless the SPAC share price has really gotten crashed!)

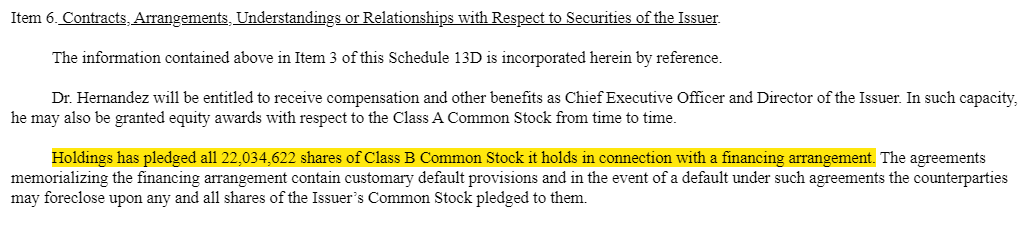

The other strange thing about the insider buying (and you could read this bullish or bearish) is that it appears to all be done on margin. The clip below is (again) from the CEO’s 13-d. It says that all of his shares are pledged in a financing agreement. Most companies have policies that prohibit execs from pledge more than a small amount of shares to financing, and for good reason: you don’t want the CEO stressed out and making stupid decisions because he’s going to get margin called and forced to sell a huge piece of his position if the stock goes down a little bit. So kind of insane that not only has he pledged all of his shares, but that he’s continuing to buy more on leverage.

Anyway, overall, an interesting situation. It reads wildly, wildly bullish to me, but it was strange and quirky enough that I wanted to point it out there. I might take a small position at some point (I used to cover healthcare in a previous life, and I’ve seen how quickly regulatory changes can crush Medicare providers or anything touching Medicare, so I’m a little daunted by the degree of work I’d need to do here to get to what I believe would need to be a small position!)

Insider buying, Part 2: PR’ing the insider buy

Earlier this month, REE PR’d that their SPAC sponsor had bought shares on the open market.

Putting out a PR on an insider buy is rare but absolutely not unheard of (a few years ago, I highlighted STNG putting out PRs when their CEO bought short term call options on their stock; I also highlighted SDC putting out a statement when analysts initiated on their stock)

One of my favorite things to see in companies is insider buying…. but I always wonder if there is signal in insider buying followed by a press release. Is the insider actually convicted on the company, or are they just trying to drum up interest / boost the stock price ahead of a potenital offering or something else?

I don’t know. I’m sure a lot of it comes down to how big the buying was (in REE’s case, each insider bought ~$1m of stock; that’s pretty decent size!). So I don’t know, but just figured I’d throw it out there!

Podcasts (Monthly recurring piece)

I launched the Yet Another Value Podcast in August 2020 and provided a longer piece on my vision for the podcast at the start of 2021. They've been a blast so far. You can follow on Spotify, iTunes, or YouTube (and please be sure to subscribe and rate them if you enjoy them!). This month's pods:

A thought I had on the heels of this: I posted this old quote from Cogent (CCOI)’s CEO that said every fiber overbuild in the world has generated negative IRR. We’re seeing a wave of domestic telecos announce fiber overbuilds / upgrades currently; has something about the economics changed in the last few years that justifies these upgrades? Or are management teams and investors deluding themselves and these are going to burn tons of capital?

Ben was kind enough to post some corrections / clarifications

As always, if there’s a company you’d like highlighted on the podcast or a guest you’d like featured, I’m always open to suggestions (even if that suggestion is “I would be a great guest! Why not have me on?”).

I’ve been dying to do a podcast on Peloton but none of my Peloton bull friends have agreed to come on, so I’d particularly like to figure one of those out!

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite past time is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy.

Generally this is going to mean giving book recs, but if I find a board game or movie or something else I really enjoy, I’ll recommend that too!

This month’s recs:

Book: Project Hail Mary. New book from the author of The Martian. I try to do more niche / undercovered stuff when I recommend something, but this book is quite good. It does make scientists a little too much into super heroes, but that small nit pick aside I really enjoyed it and I’d suspect just about every reader of this blog will too.

Nothing else crazy nerdy this month. I read a few other fantasy books but nothing worth recommending. As always, inbound suggestions are welcome!

Other things I liked (Monthly recurring piece)

I really enjoy Net Interest and was an instant subscriber.

Fanatics: the spoiler (really interesting look at Fanatics; great read but must read if you’re at all interested in sports, media, or IP. Obviously, I loved it)

Universal Music: how much is the world’s biggest label worth?

I tried to discuss my concerns on tether last month, but my god this piece does it so much better

In loosely related news…..

Good write up of an interesting merger arb break story

Crazy story of a fake high school football team that got a nationally televised ESPN game and got blown out

Over 66% of US music listening is catalogue, not new release

Dogs may know when you’ve done something on purpose or accidentally

CANO is one of the most exciting deSPACs out there, IMO. Regarding 10% of shareholders cashing out– 95% of these proceeds went to the financial sponsors. It's not surprising InTandem would cash some out, and they still hold a big position. And just 5% was to the management team, and I quote , "which is using the money to pay off loans, primarily taken by Marlow to start the company 10 years ago." Max Bid Marlow loves betting on himself, haha.

Regarding merging at a lower price– remember, the SPAC market was very tight when CANO was pricing their PIPE in Oct/Nov. Plus CANO has done a lot of executing in the past year, raising guidance multiple times.

Been meaning to check out Hail Mary at some point... rarely read fiction anymore, I miss it. enjoyed Weir's Martian a few years ago, fun read.