Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview (Monthly recurring piece)

I consider YAVB my “empire” with four core pieces: this blog / substack (the free side), the premium side of this blog, my podcast (also on Spotify, iTunes, or YouTube), and my twitter account. You can see my 2022 vision and goals for the empire here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

A bonus note: I get asked from lots of people about how to break into the finance industry. I detailed it more here, but my top advice would be to go out and start a substack (substack recently gave me a referral code if you start one; if you use that, awesome! But I’ve been recommending starting a substack long before they offered referrals!)

State of the markets (Monthly recurring piece)

Man what a difference a month makes. Major indexes have been demolished this month (as I write this, the S&P is down ~4.8% on the month and the IWM is down ~5.8%). You can point to lots of reasons for the sell off: oil rising, a near 50 bps rise in the 10 year (from ~4.11% to start the month to ~4.57% now), government shut down fears, etc.

The rough September comes on the heels of a soft August, and its wiped out most of the IWM’s YTD gains (the SPY is still having a nice year!).

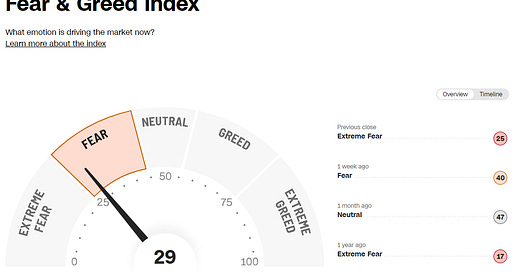

And the “fear & greed” index is pushing solidly to “fear” levels……

Go on to fintwit and you can find plenty of people talking about “small caps are historically cheap” and the like. I hate to join the chorus…. but they’re probably right. Small cap land is overflowing with value, particularly if you’re willing to stomach some cyclicality. For example, plenty of banks are trading below tangible book value again. Could they get wrecked by a huge recession or continued deposit flight? Sure! But, historically, if you can buy good bank franchises below tangible book value, you end up doing pretty well. Or consider energy: oil is screaming higher, and while a lot of energy stocks have gone up, I can find plenty of energy stocks that have gone up way, way less than the cash flow they’ll generate from higher energy prices. The market is putting a huge discount on either the energy curve or management’s capital allocation (or perhaps some combination).

That’s just two examples. Obviously there are assumptions and risks behind each of those (quick) theses; for the banks, you’re betting tangible book value is solid and a recession doesn’t blow everyone up. For the energy companies, you’re betting management doesn’t do something silly and the energy curve doesn’t collapse. Any of those risks could happen!!!… but, on the whole, I think those are good bets to make.

Nerd Corner (Monthly recurring piece)

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite pastime is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). Plus, I was an eager supporter of the Brandon Sanderson Kickstarter (yes, I splurged and went for the hardcover books).

Anyway, I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy. This month’s recs:

I mentioned it last month, and I don’t think enough people took me up on it, so rather than recommending some of the subpar books I read this month, I’m going to repeat my plea….. Someone just please read the Wandering Inn for me. I got obsessed with this series ~a year ago. I’ve read all nine of the kindle books that have come out; that might not sound like a lot, but each book is well over a thousand pages (the ninth book comes in at a brisk 1,652 pages!). I’ve been hesitant to recommend it on the blog because it is such nerdy fantasy, but the world building in the book is absolutely unbelievable and I really just need some people to read it with me. I will admit the first book starts a little slow, but I’ve now given it to about 10 friends and I’d say about 7 of them got quite hooked after they got through the first ~150 pages (one managed to read 4 books in 10 days!).

PS- outside of my monthly recs, I constantly get asked what my favorite fantasy books are. So I’m just going to throw this list out monthly:

Anything Brandon Sanderson writes; he’s by far the best fantasy author out there. I’d probably start with Mistborn, though Tess and the Emerald Sea is basically a standalone book and might be my favorite book he’s written. The Frugal Wizard’s Handbook for Surviving Medieval England is also a standalone book and a very fun and fast read.

Kingkiller is probably the best series I’ve ever read; waiting for the third is agony.

Gentleman Bastards is right up there with Kingkiller; the mix of fun and world building is outstanding.

Red Rising series is more sci-fi, but my god is it good. I would literally stay up all night to read every book the day they came out (note: I’ve only read the first trilogy; I’m going to read the second when the last book comes out later this year).

If you’re looking for something a little more under the radar (most of the books above are widely regarded as some of the best fantasy books / series ever), the Licanius Trilogy was fantastic.

First Law trilogy is excellent. It can get a little brutal / graphic though; there are a bunch of sequels and spins, but I’ve never been able to finish them because one of them got so brutal I just put the book down and never picked it up again. But the first trilogy is really, really great.

The Cradle series probably isn’t as “good” as the books above, but I binged them and every fantasy fan I’ve recommended them to has said something along the line of “I read all ten books in two months after I opened the first one.”

I’ve also really enjoyed that author’s newest series, Last Horizon!

Other things that caught my eye / links

The $53k connection: the high cost of high-speed internet for everyone

US pump prices hit highest seasonal levels in more than a decade

The longer your involved in the stock market, the more you realize that stock buybacks can be done for a lot of reasons. RH’s aggressive intra-quarter buyback is (potentially? Allegedly?) the most striking example of that I’ve seen.

Adam Jonas explains why Tesla will be better at being Nvidia than Nvidia

T-Mobile in talks to make big broadband bet with move into fiber (TMUS)

New York’s hottest steakhouse was a fake, until Saturday night

CoinBase CEO slams JPM for banning crypto payments in UK; suggests UK government should act

I can't believe another month is over. Your end of month editions are now a tradition for me to mark the passage of time!

I hope you're doing well, Andrew. Cheers 💚 🥃

Hi Andrew!

I subscribed your service recently, just after reading your analysis on SN. I also bought the stock - it's up 30%+.

I am surprised SN isn't in your list. Did I misread your analysis, that seems to be very bullish?

Anyway, I am more than happy to be a subscriber.