SPAC sponsors don't give a fudge about their reputations (and neither should you)

Some quick thoughts on a bonkers SPAC earnings season

I’m not sure how many times I’ve said “I swear I’m going to talk / write about something other than SPACs” in the past few months (most recently here)….. but here I am, writing about SPACs again. Whoops!

I just wanted to quickly put something out because this earnings season has been absolutely crazy for de-SPAC’d companies (companies the went public through a SPAC). I’ve had a few takeaways and trends I wanted to quickly highlight, but my overwhelming takeaway is this: SPAC sponsors do not give a single fudge about their reputation. All they care about is making money. In general, that means all SPAC sponsors care about is getting their deals done and unlocking their founders’ shares / risk capital. Are there exceptions that prove that rule wrong? Initially I was going to say yes…. but no, there are not any exceptions. SPAC sponsors only care about making money. If you want to invest in a SPAC, you need the sponsor to be aligned with you; in general, that means the SPAC sponsor is writing a big check into the PIPE at terms similar to what minority shareholders / SPAC holders are invested at. The SPAC sponsor can be aligned in other ways, but if you’re betting that a SPAC sponsor who isn’t writing a check into a deal is aligned with you in any way…. well, good luck!

There is value to be found in deSPAC’d companies, but it is a risky bet and you better be very convicted that the sponsor and company are reputable and aligned, because if you are wrong you are going to get your face ripped off.

Some background will help set the stage: SPAC-mania hit its peak in February this year, but the manic cycle really ran from ~mid-December of last year till mid-March of this year. Basically any SPAC that announced a deal during that time frame was seeing their shares pop 10% at minimum, and, if they announced a deal with a buzzy EV SPAC, pops of 50% or more were pretty common. Sponsors responded to the incentives they saw in the market and rushed to announce a string of deals with “companies” that fit a lot of buzzwords but didn’t have much in the way of a real business.

That’s made this earnings season so interesting because all of the deals that were announced while the SPAC-mania was at its peak in Feb/March started closing in June/July, so this earnings season is that first time those former SPACs are reporting earnings as a standalone company. And my god, has it been a doozy.

The most common move I’ve seen is what I’m calling the “Guidance? What guidance?” move. I detailed this move in my post on ATIP, but the basics of this move are:

A SPAC uses an aggressive projection when they announce their SPAC merger

All through the merger, the SPAC points to their rosy guidance and projections in order to get the deal through

Once the merger is done, the now deSPAC’d company announces disappointing earnings and pulls their guidance, often citing “COVID uncertainties” as a reason (never mind that the merger and projections were made while COVID was a very real, very known issue).

A bonus on this piece: the deSPAC’d company often pulls guidance citing COVID uncertainty or supply chain issues….. but if you go check out any of their competitors, none of them are experiencing the same “uncertainties” (at least not to the degree the deSPAC’d company is talking about). In fact, many times their competitors will say they are benefitting in some form from COVID.

ATIP is a great example of those shenanigans, but there are plenty of others. Katapult (KPLT) is maybe my current favorite. They completed their deSPAC in early June, and basically simultaneously announced Q1’21 earnings where they provided 2021 guidance that was more or less in line with the projections they gave when they announced their deal in December. They announced Q2’21 earnings yesterday and pulled all of their guidance, noting “many new developments” that have caused “meaningful changes” in their forecasts, in particular given “new policies from the COVID-19 variants”.

If you were an investor in KPLT, you could be forgiven for being blindsided. Here’s a quote from their Q1’21 earnings call (which, remember, happened in mid-June!): (PS I tweeted these and a few extras out here)

We first introduced annual guidance for 2021 in April of this year. Given the data we have today, we continue to believe that this guidance is reasonable and appropriate, and we plan to provide a more detailed update on our Q2 earnings release. To reiterate, the guidance is to achieve originations of $375 million to $425 million, revenue of $425 million to $475 million and adjusted EBITDA of $50 million to $60 million. And as we have said previously, we anticipate the majority of our growth to be concentrated in the second half of the year with a heavy weighting to Q4 2021.

Compare that to their (lack of) guidance in Q2’21

Coupled with all of these factors the backdrop of COVID-19 and the emergence of new variance and there is uncertainty of how the federal and state governments will respond. On our previous earnings call, we believed our guidance for the year was appropriate and reasonable, but a lot has changed since that call. But it is especially challenging for our projections at the current time is that the visibility of strange and there are multiple conflicting factors at play. When looking forward to the balance of the year, there is just too much uncertainty right now that try to predict Gross Originations and revenue in a highly specific way. We expect to have more insight into these new and evolving trends by our November earnings call, but for now we feel it's best to remove explicit guidance the rest of 2021.

What we think it's prudent to offer you is what we've seen thus far in Q3 and provide some additional color to help frame how things might develop. To be clear, this is not guidance, but instead is intended to give you a directional sense. While we expected significant year-over-year growth, July 2021 Gross Originations were flat from the same period last year, as our existing merchants experienced larger than anticipated declines in retail transaction volume. On a positive note, we have been able to offset these outsized declines that are new merchant additions and we are cautiously optimistic that as the summer winds down, people return from their vacation and school begin, the demand will increase.

All of that was bad. But the single worst was absolutely this quote. I’ve never seen an excuse for missing guidance this bad. It’s the equivalent of “my dog ate my homework”, except if you blamed it on the neighbor’s dog breaking into your house in the middle of the night and then eating your homework. (full quote here)

If I can add, many of the discussions and I think I've mentioned this on our previous call that July and August are our biggest months in terms of retailer additions and preparation for the holiday. And resoundingly what we've heard and, I'll give an example. I was speaking with one pretty large retailer, who is requiring everybody to come back to work soon, and many of their IT resources have quit because they have moved to another area, they can work from home. And so there seems to be across the board at many of these retailers just an IT constraint issue that is up -- that is unforeseen and that they can't get enough resources on the tech front and that the ones that they are leaving for work from home, if necessary. And so, well we normally see a really big uptick on new retailer additions and we've had quite a few smaller ones, some of the larger ones are a little bit tougher to get done because of those IT constraints.

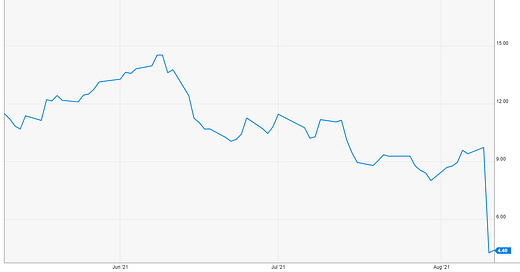

The stock responded…. about how you would expect to maybe the dumbest thing I’ve ever heard on an earnings call.

(PS- I’m not claiming to be a genius, but I was always curious why KPLT was so hyped when it announced the SPAC deal. Much of their business comes from a “waterfall” BNPL, where a “prime” BNPL like Affirm rejects a loan, and then offers KPLT the opportunity to take it instead. That system seems absolutely fraught with risk for KPLT; if those loans proved profitable, it seemed inevitable that AFRM would stop handing them to KPLT over time. If the loans proved unprofitable, then AFRM would happily keep giving them to KPLT and eventually KPLT would have credit issues. All that said, it’s entirely possible the stock is an opportunity down here; it’s trading >50% below its trust value, which doubles as the price point Tiger and Neuberger PIPE’d in $150m. It’s EV is currently <$500m, and LTM EBITDA is >$40m, so you could make an argument you’re buying way below where credible investors put money in and it’s way too cheap if their potential customers end up hiring a new IT staff, but it’s not a bet I want to make).

KPLT (and ATIP) are far from alone in their shenanigans. Metromile (aka Chamath’s GEICO) results looked very similar to KPLT; I haven’t done a ton of work there but yikes:

AppHarvest (APPH) is more of a promotion than a real company, so I almost didn’t include it in this post, but the company cut their 2021 revenue guide by more than half (from ~$22.5m to $8m) while increasing their projected losses by 50% (from ~$50m of losses to ~$72.5m). The stock has held in surprisingly well; I guess because they reaffirmed their 2025 estimates. Good luck with that.

Anyway, there are plenty of examples like these four (actually, there are plenty of worse ones when you consider the shenanigans going on at EV deSPACs!), but I wanted to highlight all of them to show a general trend: SPAC sponsors will do anything to get their deals over the finish line. If you’re buying a deSPAC thinking “O, it got its deal done at $10/share, now it’s at $8, and that creates an attractive multiple on the near term earnings number they deSPAC’d with”…. well, you’re (probably) going to get your face ripped off.

Investors may be best served by just stopping right here and not reading any further. In general, SPACs are a land mine that will destroy value….. But I still think there can be some value in deSPACs, and there is one particular group of SPACs that I think are performing better than average and will likely perform well going forward: SPACs where the sponsors committed serious capital into the PIPE. In particular, I’m thinking of SPACs where the sponsors actually stepped up and backstopped redemptions.

The two particular companies I’m thinking of here are ALIT and IS. I’ve mentioned both recently (IS here and ALIT here), but both had credible sponsors who injected a serious check into the PIPE for the company to deSPAC and then voluntarily invested more money to buy more shares when redemptions came in higher than expected.

Both companies are trading within spitting distance of where their trust was (as I write this, ALIT is at ~$10.50 and IS is at ~$8.90), so it’s not like either have been a huge home run so far…. but I suspect both will do well going forward, and it’s interesting to compare how each of them ran their SPAC process versus some of the disasters above because I think it shows how SPACs / sponsors position a company they are trying to set up for the long term (versus just hype / promote until they can deSPAC and fleece unsuspecting investors).

Let’s start with IS; where I want to comp them versus peers is in how they did guidance. When IS announced their deal in March, they guided to $455m in revenue and $130m in EBITDA for this year. They upped that guidance to ~$485m rev / $152.5m EBITDA when they provided guidance in May 2021. Their deSPAC closed in June, and they reported their first set of public results last night… where they again raised guidance ($515m in revenue; ~$175m in EBITDA).

I would near guarantee that IS knew the guidance they gave when they presented their initial projections back in March was conservative and easily beatable. They could have tried to get investors excited by giving a much more aggressive target. But TBA (IS’s SPAC sponsor) was writing a huge check into IS alongside the deSPAC. They’re trying to build a business for the long term. I think it was Barry Diller who said rule #1 of being a newly public company is that you do not miss your first set of numbers / guidance because it just absolutely destroys management credibility. I’m sure TBA / IS were following something similar; give an initial guide that was easily beatable, then go out and beat them so that your management team can build up some credibility.

It’s neither huge nor sexy, but I think it shows the difference between sponsors injecting lots of capital into a SPAC and actually trying to build a business for the long term versus sponsors looking for a quick pop.

Let’s turn to the other company I wanted to discuss, ALIT (again, I mentioned them quickly last month). They report earnings tomorrow, so it’s entirely possible that they completely whiff and I look foolish for writing this. But I wanted to highlight it because I think it’s a nice example of why looking for sponsors who inject a ton of capital into a SPAC, particularly to cover redemptions, can be interesting. Recall that ALIT is sponsored by Cannae (CNNE), who wrote a $42m check to cover redemptions when they came in higher than expected a few months ago. Remember a SPAC sponsor can write a check to cover redemptions with asymmetric information; they can talk to the management team, be privy to internal strategy discussions, and then chose to write a check while having lots of material nonpublic information.

Anyway, likely armed with that information, CNNE chose to write a big check to cover ALIT’s redemptions. And then in their Q2 earnings report, CNNE called ALIT “the most compelling risk-weighted value in our portfolio.” (see quote below)

Cannae wrote that $42m check to cover redemptions in late June / early July, and then called ALIT the most compelling risk-weighted value in their portfolio in their Q2 earnings in early August. Last night (August 10), Bloomberg broke a story that Voya was considering acquiring ALIT.

Will an acquisition happen? Who knows! But I would near guarantee that Foley / CNNE wrote that redemption covering check and called ALIT their most compelling risk reward with at minimum knowledge that the business was performing well and would be strategically valuable to a variety of acquirers. I would not be surprised if they wrote that check / shareholder letter knowing that a VOYA acquisition was a possibility (i.e. VOYA had sent some preliminary feelers); it’s entirely possible CNNE wrote those knowing they had a bid from VOYA on the table.

There are a few other takeaways and trends from deSPAC’ing I found interesting, but I’ll save them for another day / another post where I can break my “I swear I’m going to talk about something other than SPACs” rule.

The bottom line I want to leave you with: deSPAC’d companies are dangerous. Sure, there’s value to be found, but I’d argue the majority are overpriced and/or overhyped. Sponsors could care less about their reputation; they only want to make money. If you’re buying a deSPAC, it’s important to make sure the sponsor is going to make money the same way you will: from the stock going up.

For the vast majority of deSPACs, that’s simply not the case.

“Never, ever, think about something else when you should be thinking about the power of incentives.” - Charlie Munger

Andrew, as the "king of bumpitrage", what do you think about the Avast/NortonLifeLock merger? It is a strategic deal with a 3% spread plus the option that NLOK has to bump the offer. Avast is cheap anyway with low downside in my eyes.