I mentioned this in my May links post, but recently I’ve been seeing an interesting trend in the SPAC-land: SPACs are absolutely flying higher as soon as they pass their vote / redemption date and/or complete their merger and officially change their ticker.

I’ll give some examples of this in a second, but first I wanted to give some quick thoughts on that trend.

First, I’ll reiterate what I said in the May links trend: It’s really illogical that shares are trading up substantially post deSPACing. Until the redemption date passes, investors have their downside protected by a $10 put because they can redeem their shares at the meeting to approve the deal. While that might not matter for a great deal, you never know when something crazy will happen in the world. That $10 put is valuable, but for some reason these SPACs are trading significantly higher once it’s gone. And it makes no sense for the new buyers either: most of these deSPACs are jumping from ~$10/share before their vote to $12.50 or $15/share (or higher) in a week or two after the deSPAC. It just makes no sense that investors aren’t willing to step in front of the vote and buy the shares at $10; instead, they’d rather pay a 25% or 50% premium to buy the stock a week after when the deal has completed? Weird.

Second, why is this happening? Again, I find it really illogical, but I suspect what is happening is SPACs have a really bad name, and some major investors don’t want to buy into a SPAC in any form. However, once the merger is done and they can buy into the “real” company with a proper ticker, they can just evaluate the company on normal multiples without that SPAC overhang. Plus, a lot of these SPACs are gaining analyst coverage right after they complete their deSPAC, so it probably doesn’t hurt that after the deSPAC portfolio managers can look at the company as a real business and maybe have an analyst report to guide them in looking at the stock. I think it’s really illogical and strange, and I’m not fully satisfied by that answer, but I think that’s it.

Third, is there opportunity here? I think the answer is undoubtedly yes. I’ve been saying for months that in the past ~one year, we’ve had ~500 SPACs go public. The vast majority of those are going to announce deals; if I had to guess, I’d say 100 of those deals are going to be flat awful / hyper promotional that end with some type of shenanigans, ~350 of them will be fine companies but the SPAC overpays / can’t overcome the huge value drag from the sponsor promote to some varying degree (i.e. some will way overpay and be worth $5 post deal, some will only a little overpay and be worth $9 post deal),and ~50 of them will buy interesting companies at good prices and actually create value. So I continue to think one of the best places to look for value in the current market is to find a SPAC that’s announced a deal that you think is interesting, dig in, buy the stock below trust before the vote if you like it, and cross your fingers for a post deSPAC pop (or just do the normal investor thing and hold the stock while waiting for the market to recognize its value in the long term).

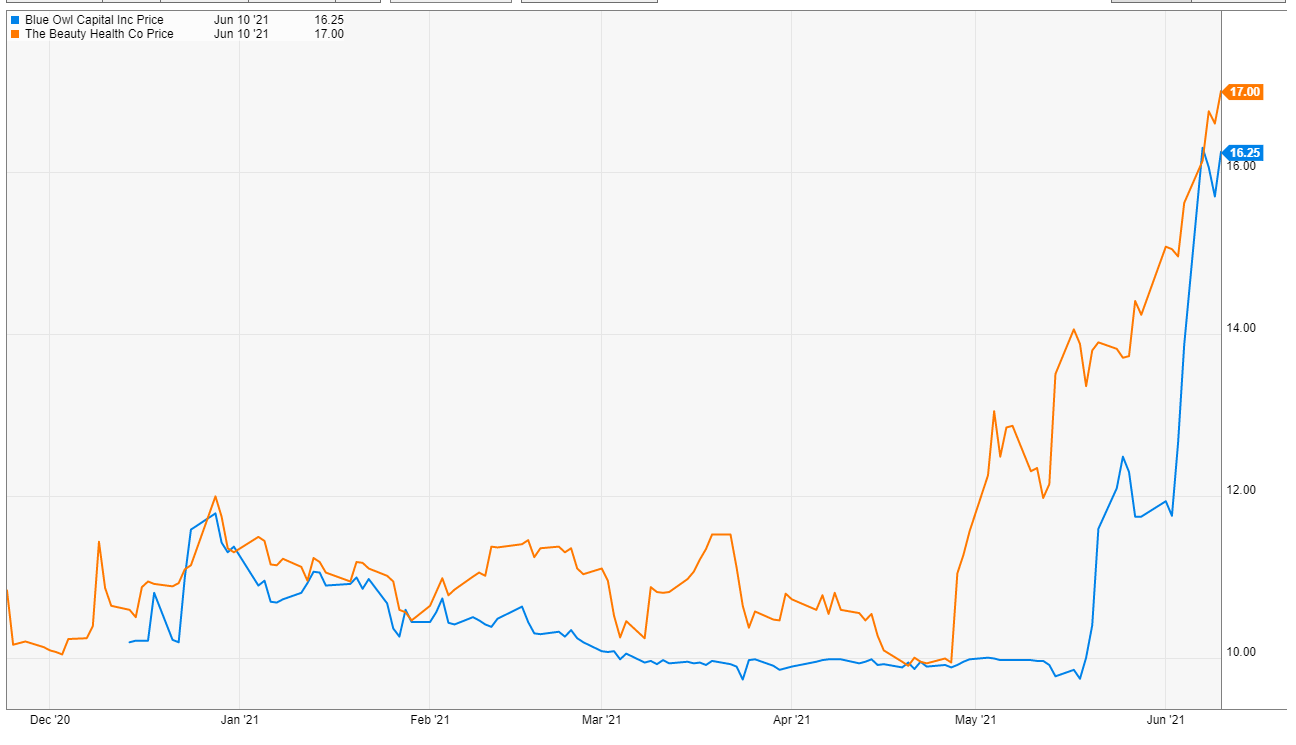

Alright, enough of an overview; let me give an example of this phenomena. In my May links, I mentioned OWL and SKIN as good examples, and the stocks have continued to run this month. I’ve posted their 3 month charts below; see if you can guess when their deSPAC happened.

Now, I think OWL and SKIN both would fit into ~10% of SPACs that are merging with real / interesting businesses that I mentioned above. I’m not saying either are value candidates (particularly at these prices), but these were real businesses with real managers, not fly by night EV startups desperate for capital.

Maybe you think OWL and SKIN are cherry picked deals, so I’ve done something different below. SPACresearch.com (which, incidentally, is by far the best site I know of for tracking SPACs; I can’t recommend them enough and I say that only as an enthusiastic sub (i.e. they are not paying me to talk them up)) has a list of SPACs that have just completed their deals. Below, I’ve pasted the 5 most recent closed / voted upon deals that were trading around trust heading into their vote (i.e. something like FSRV / KPLT voted around the same time, but it was well above trust so it doesn’t get included here). Remember, these are just deal votes; several of these still haven’t even closed. That said, if you look hard enough, I think you might be able to identify a pattern here….

All of them spike right at the end of the charts, even GIX (one of the silliest / most desperate deals I’ve seen; I talked about it here) gets a little spike (though it seems to have faded quickly). What happens at the end of those charts? You guessed it; the spike coincides with all of them holding their (successful) investor votes on their deals.

I’m not saying this trend is sustainable. And, in the grand scheme of things, a couple of SPACs popping into their deal votes isn’t blowing anyone’s mind or a sustainable source of alpha.

But it is an interesting trend. I’ve been a longtime SPAC skeptic, but I’ve also been saying for months the current market is so washed out that some babies are going to be thrown out with the bathwater here. The current post-deal pop is confirming my prior biases; I think one of the most interesting / alpha rich places to be investing in right now is SPACs that have announced deals but have not held their votes yet. That gives you an interesting time frame to do a lot of fundamental work and buy the stock before the vote date, and then maybe get a big pop after the vote / when the merger completes and other portfolio managers can buy into the same story you were buying into a few months prior (but at a much higher price!).

Topps looks like it will fall in this group: "~50 of them will buy interesting companies at good prices and actually create value". Earnings are booming. Sports collectible NFTs will be a big catalyst for them from this point forward. Would love to see your thoughts on $MUDS and Topps.

Merger date announced yesterday. Set for August 25. 🙂

Another great write up Andrew. Really appreciate your analysis. In this case maybe the answer is much simpler. All the arbs have either sold at $9.98-10 or redeemed and there are simply no sellers left. Thoughts?