Synalloy quietly undervalued and in play $SYNL

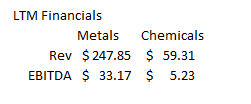

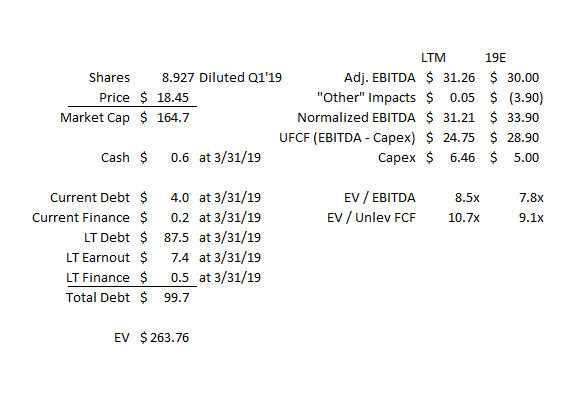

In late April, Privet made an offer to take Synalloy (SYNL; disclosure: long) private at $20/share. Synalloy quickly rejected the offer, and with SYNL's shares currently trading for ~$18.45/share, the market clearly doubts the odds of Privet successfully taking Synalloy private are good. I disagree with the market; I think there's a very good chance (>50%) Privet's offer is the first step to SYNL going private at a price significantly above both today's share price and Privet's initial bid. In addition, even without a take private, I think SYNL is likely undervalued and would see its share price appreciate as the year goes on and the results of their recent acquisitions (and some possible end market strength!) fully shine through their income statement. I'm going to start this post off with an overview of Synalloy and a quick valuation of Synalloy. I think that stuff is all pretty vanilla; after that, I'm going to move into Privet's offer and Privet's history of making offers for companies. I think that's the most interesting piece of this thesis and where the real "edge" comes in here, so I'd encourage you to push through to that part. Some background on Synalloy. The company has a long history, dating back to 1945. Today, the company operates in two segments: Metals and Specialty Chemicals. Metals is, by far, the more important segment, with revenue >4x and EBITDA >6x chemical's financials.

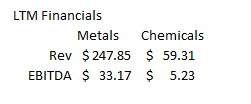

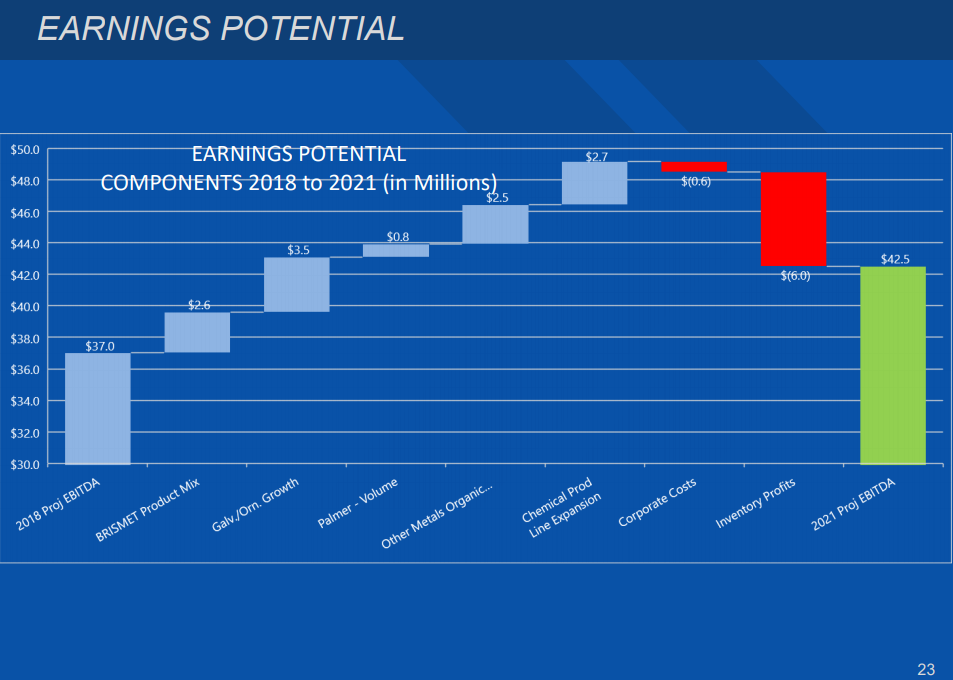

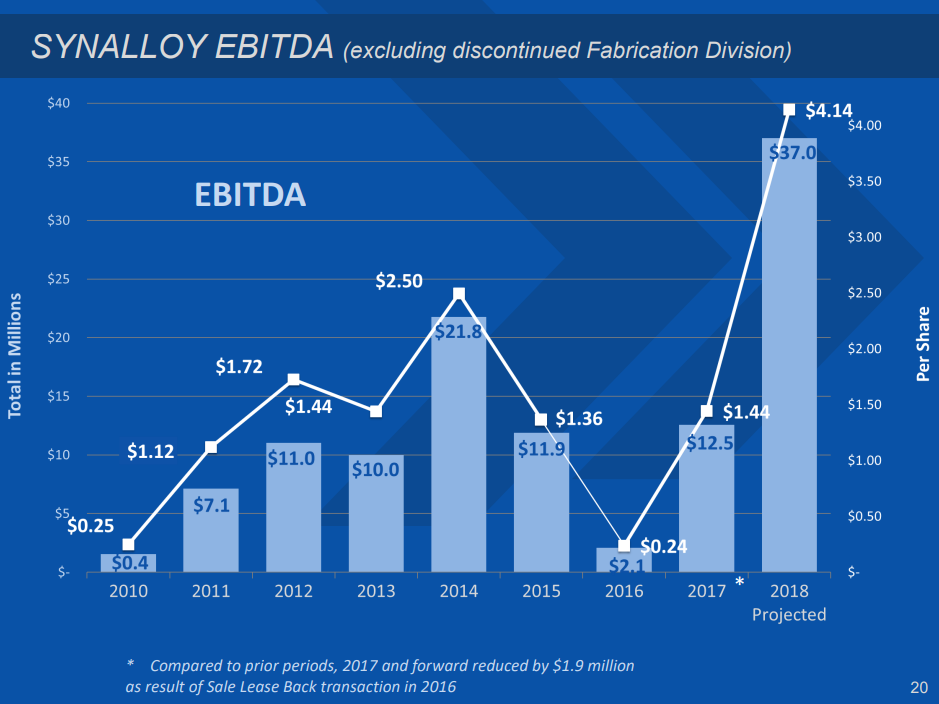

The metals segment consists of four different subs. Each of the subs makes something different (you can find descriptions at the bottom of p. 3 of their 10-K and pictures of everything they make in their 2018 investor presentation, slides 10-13), but some products include welded pipe from stainless steel (they say they're the largest producer in North America) and fiberglass and steel liquid storage tanks (mammoth storage tanks that are generally used for waste water capture in oil and gas; this segment is conveniently located in the heart of the Permian basin). The chemicals segment owns two facilities that make lubricants, defoamers, and a bunch of other specialty chemicals that are sold as critical ingredients for larger chemical products (Specialty chemicals customers are mainly larger chemical players like Ashland, Lubrizol, and BASF). I could dive a bit deeper into the individual segments here, but I don't think there's a lot more to say. In my mind, these are relatively cyclical / commodity businesses. The trick here is that you're buying them cheaply and with an interesting catalyst from the take private, not that the businesses are long term winners that are going to compound or anything. That's not to say the businesses don't have some advantages / interesting pieces: Palmer (the steel storage tank unit), for example, benefits from its location near the Permian basis, as the tanks it makes are huge and heavy and burdensome to transport. Specialty chemicals is the sole producer of some of their chemicals, and those chemicals can have long sales cycles because once a customer decides to use their chemical as a piece of their business, the lock-in costs are large (see 10-k p. 10, "purchasing the products of the specialty chemicals segments is a major commitment on the part of our customers"). So I'm not saying these are awful businesses; I'm just saying that they're relatively cyclical and I think organic growth earning in excess of their cost of capital over a full market cycle is probably going to be difficult. That said, let's turn to valuation. Before we do that, just a quick note on their accounting. SYNL carries a large metals inventory (particularly nickel). This is a simplification, but Synalloy basically charges its customers a nickel surcharge with prices that adjust monthly. Because they generally buy their nickle ~six months in advance, when metals prices rise steadily Synalloy will realize a gain on the nickle they bought at lower prices a few months prior (you can see more details on p. 9 of their 10-k). That can cause big swings in their income statement. Make no mistake: the gains and losses from the nickle surcharge swings are real, but the company thinks those gains can mask (or amplify!) how the core business is performing, and they present an adjustment that pulls out those gains/losses. You can see the adjustment in the "inventory price change gain" line in the slide below (from their August 2018 investor deck); in this case (the 2018 forecast), the nickle surcharge boost results in the company reporting an extra ~$6m in profits. So while the company is forecasting $37m in 2018 adjusted EBITDA, the core business is probably more properly measured at ~$30m.

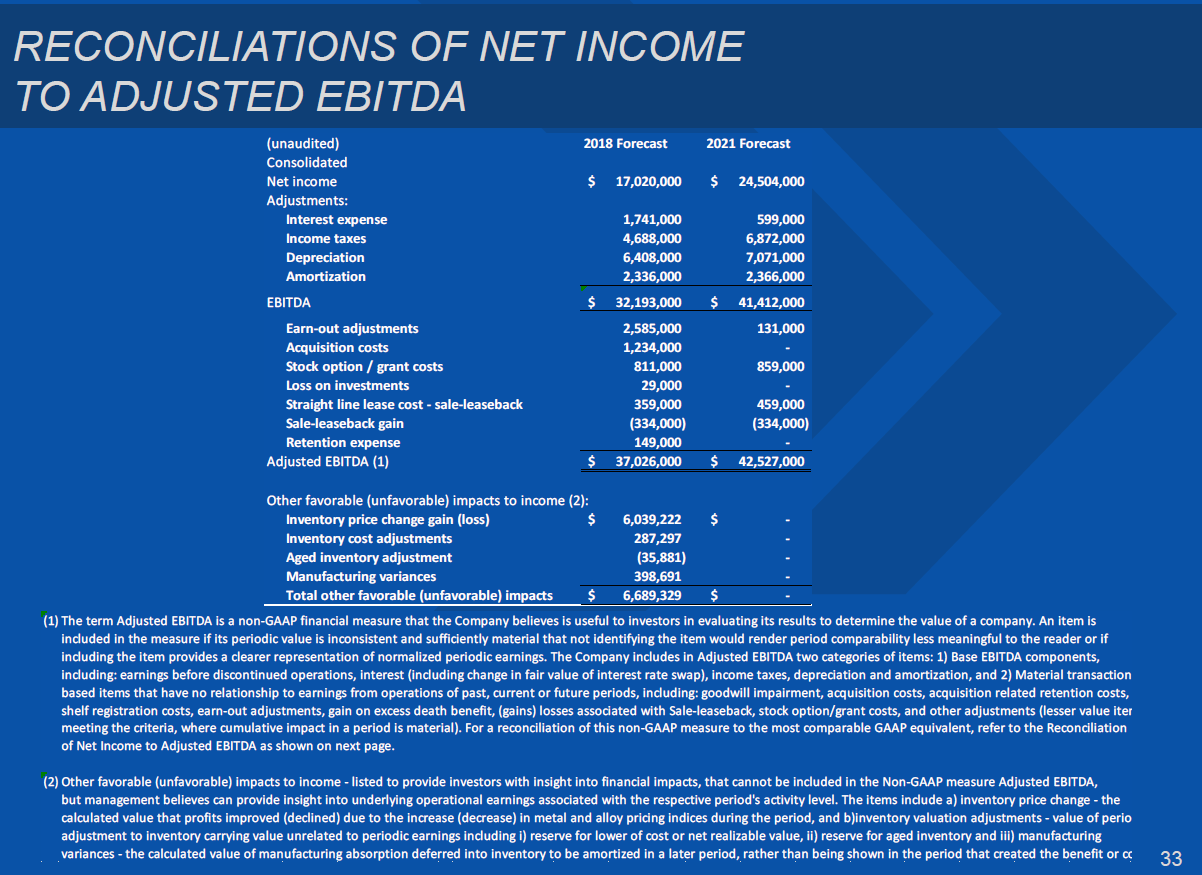

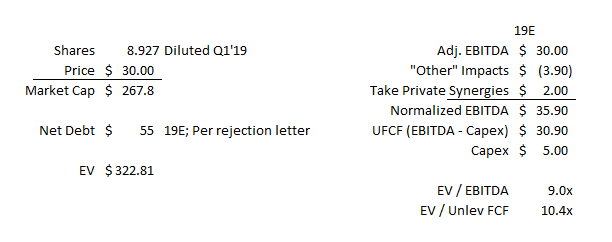

Alright, so valuation. At today's price of $18.45, Synalloy has a market cap of ~$165m and an EV of ~$265m. The company is projecting $30m in EBITDA for 2019 (per Q1'19 earnings); however, that includes $3.9m in unfavorable metals charge. Backing that charge out, the core business would earn $33.9m in EBITDA, so the company is trading at just under 8x EBITDA. The company guided to ~$5m in capex in 2019 on their Q4'18 call (roughly in line with what they've done over the past few years), so unlevered FCF is ~$29m and the company trades for ~9x unlevered free cash flow.

On their Q4'18 call, SYNL's CEO noted that their peer group traded in excess of 9x EBITDA, and a quick check of their peer group from p. 17 of their proxy suggests their peers are currently trading ~10x EBITDA. Admittedly, none of their peers are perfect comps, and there's a wide range of multiples in that peer groups (with several trading at or above 20x EBITDA and a few trading in the mid-single digits). Still, SYNL seems cheap on both a relative and absolute valuation. I also think it's reasonable to argue that those earnings numbers understate Synalloy's earnings potential. Synalloy has made two major acquisitions in the past year: the purchase of Marcegaglia in July 2018 for $14.5m (the 10-K says this acquisition was $10.4m, but I'm going with the numbers from their August investor deck; see slide below) and the purchase of ASTI in January 2019 for $28m (~$22m in cash and ~$6m in earn outs at fair value (see p. 11)). Yes, the majority of earnings from those acquisitions should be captured in their 2019 outlook, but integrating acquisitions takes time and I would guess there's still significant room for improvement as the acquisitions are fully integrated (for example, on the Q1'19 call SYNL noted ASTI wouldn't convert to SYNL's ERP system until June 1st).

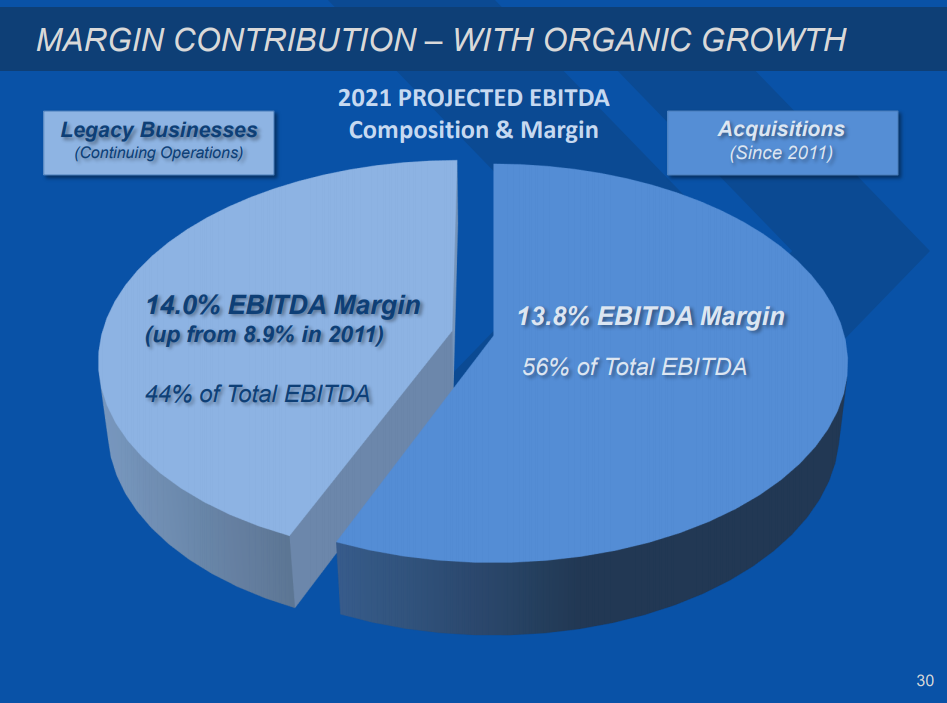

In addition to the upside from fully integrating and run rating their acquisitions, I think there's upside to Synalloy's financials from some operating leverage over time. Looking at EBITDA margins, the overall company (~10% both trailing and FY19E), the metals segment (~13% LTM), and the chemicals segment (<9% LTM) are all at or below the low end of their historical margin range. The company has suggested their LT target is to get low to mid double digit EBITDA margins, and based on both their operating history and peer margins I see no reason why that isn't achievable. Obviously a decent piece of the "operating leverage / margin expansion" thesis overlaps with the "fully integrating acquisitions" thesis above, but it's worth highlighting it because both analyses suggest that Synalloy is currently under-earning. If we look at Synalloy's 2019E revenue and assume they could do 13% margins in the long term, EBITDA estimates would go from ~$34m to $44m and the company would be trading for just 6x EBITDA.

Hopefully at this point I've shown that Synalloy is somewhere between reasonably cheap and quite cheap as a standalone company, with the potential for significant earnings growth as they improve margins / integrate acquisitons. With that out the way, let's turn to Privet and their offer. Privet is a value fund focused on small caps; note their website calls them event driven but I think it would be fair to say they're a concentrated activist fund. In addition to Synalloy, Privet is currently active at Potbelly, where they own ~6% of the company and have a board seat. They don't file a 13-F, but it seems Synalloy is by far their largest public position (their SYNL stake is valued at ~$24m; Bloomberg lists their total public portfolio at $61m in value with their second largest holding at Startek at ~$10m and then their third largest is Potbelly at ~$8m). It's also worth noting that when markets were semi-crashing in late 2018, Privet was buying more of Potbelly and Synalloy (~160k shares for ~$16.50/share (~$2.5m all in) in ~3 tranches: purchase 1, purchase 2 and purchase 3). Privet was buying more SYNL as recently as March, when they bought another 55k shares for ~$15/share. Again, Privet doesn't really file publicly, but as far as I can tell Synalloy is the only stock Privet has bought more of this year and SYNL and Potbelly were the only stocks Privet was adding to late last year. Generally I don't care about what other shareholders are doing with their portfolios, but I highlight it here to emphasize how important Privet's investment in Synalloy is to them: Synalloy is their largest public position and one they have enough confidence to continue adding to at prices not much lower that today's, even when stock markets were semi-crashing and everything appeared cheap late last year. That confidence matters, as it lends credence to the belief Privet's bid for Synalloy is real. More importantly, Privet's history suggests that not only is their offer to buy Synalloy credible, but they are likely to bump their bid substantially in order to take the company private. A review of Privet's history is instructive here. Since the beginning of 2016, Privet has filed 13-Ds on seven companies: Synalloy, Potbelly, Summer Infant (sold out in 2018), Frequency Electronics (sold out in 2018), Hardinge, Norsat, and Great Lakes Dredge (they also filed on Noble Roman's and Izea in 2016, but as they were selling out of those positions they're probably not worth mentioning). The Hardinge and Norsat investments are particularly of note here, as both of them involved Privet making multiple, escalating offers to take the companies private. The crux of my thesis is that Privet's offer to buy Synalloy will mirror those previous offers and see Privet raise their offer from here. So let's turn back the clock and review Privet's history with Norsat and Hardinge. I'll start with the Norsat offer. Privet first invested in Norsat in early 2015. In September 2016, they made their first offer to buy Norsat for $8/share. They then bumped that offer to $10.25/share in March 2017. Norsat soon signed a deal to sell themselves to someone else for $10.25, so a month later Privet raised their offer to $11/share. In June 2017, Privet raised their offer to $11.50, where they would bow out after that offer was also matched. Turning to Hardinge: Privet first invested in Hardinge in December 2014. In early March 2015, Privet sent a letter to Hardinge's board blasting them. Privet joined the board in October 2015, and in August 2016 and August 2017 Privet continued to increase their position in Hardinge. In November 2017, Privet offered to buyout Hardinge for $17.25/share. In February 2018, they raised the bid to $18.50 and successfully bought Hardinge. So what are our takeaways from Privet's history of trying to take companies private? First, Privet's initial bids should probably be looked at as opening offers, not "best and final" bids. They bumped their Norsat bid by ~43% from first bid to last bid (and even more once you factor in their last bid would have required them to pay a break up fee because Norsat had accepted a competing bid between Privet's first and last bid), and they bumped their Hardinge bid by ~7%. Second, Privet is willing to pay big premiums when they see value: Norsat was trading for ~$6.30/share before Privet's first bid; when you factor in the breakup fee Norsat would've been on the hook for, Privet's last bid for Norsat was basically a 100% premium to their unaffected price. Third, Privet can recover from some initial bumpiness in the process: the March 2015 Hardinge letter was pretty brutal on the management team and board, yet Privet managed to join the board a few months later and (a few years later, and with a new CEO) managed to reach a consensual deal to take the Hardinge private. Fourth, even if there's nothing going on in public, Privet is probably quietly negotiating behind the scenes. Both Norsat and Hardinge announced receipt of the Privet bids and then neither the companies nor Privet commented on them again.... until Privet bumped their bid a few months later. I think the first two takeaways (that Privet is very willing to bump their bid and pay big premiums where they see value) are the most important and exciting points, but I want to dive a bit deeper into the last two points because I think they're important to the investment thesis. I think most investors would look at Synalloy's public language on Privet's offer since the offer went public as pretty negative; Synalloy has pretty openly dismissed the Privet offer, and it doesn't seem like the company wants to go private. Investors would probably be even more disappointed that Privet hasn't made any follow up communication public. That's understandable: in most hostile offer cases, you want the potential buyer to be applying pressure to the management team to get them more likely to sell. But Privet's history reveals that's not a huge concern: they managed to offer come some initial hostility in their Hardinge investment to eventually reach a deal, and in both Norsat and Hardinge they opted to work behind the scenes to raise their bids and reach a deal, only going public with a raised bid when they thought they were close to reaching a deal (Norsat) or when they had a successful deal (hardinge). The Norsat bid is particularly interesting to look at in light of Synalloy's response to Privet that revealed Privet had told both Synalloy's CEO and board that they believed Hardinge "should be trading at $30.00, or more." Privet was willing to bid a huge premium for Norsat and then bump their offer substantially to get a deal done and as Norsat's fundamental performance continued to improve. Privet's initial offer for Synalloy was a nice premium to the current share price, but with Privet apparently seeing substantial value in Synalloy and Synalloy's continued solid financial performance (Synalloy's response and their subsequent Q1'19 earnings saw "every business unit met or exceed its forecast"), I think there's plenty of room for Privet to bump their bid and reach a deal that works for both Privet and Synalloy's shareholders. My bottom line here: I think a review of Privet's history suggest the odds are overwhelmingly in favor of Privet coming back with a higher offer for Synalloy in the next few months, and given Privet currently owns ~15% of Synalloy and will be offering a substantial premium to Synalloy's unaffected price, if Privet raises their offer for Synalloy I think it will be very difficult for the board to justify remaining a standalone company. They'll either need to find another bidder willing to pay a higher price than Privet or eventually take Privet's bid. Before wrapping up, let's spend a second to talk about why Privet wants to take Synalloy private. Privet is a financial buyer, so I think the answer is pretty obvious: they think Synalloy is undervalued and they can make a bunch of money by buying them. But why does Privet think that? I think there are three main reasons here: undervaluation, growth potential / market tailwinds, and acquisition / platform potential (all of these tie into each other to some extent). Note that I'm not saying I fully agree with any of these; rather, I'm just pointing out that it's likely Privet believes in all of these to one extent or another and Privet's belief is what really matter here!

Undervaluation: Let's say Synalloy is right and Privet really does think Synalloy is worth $30/share right now. What is Privet seeing that the market isn't? Well, some of it could be the market tailwinds and platform potential I'll discuss in a second, but even on their 2019 financials I don't think it's crazy to argue Synalloy could be worth $30/share to a financial buyer. Synalloy's rejection letter noted they planned to get net debt down to $55m by the end of the year, and that they thought getting taken private would result in $2m/year in cost savings. Let's accept both those numbers at face value. At $30/share and using their year end debt number, Synalloy would have an EV of ~$320m and be trading for ~9x EBITDA and ~10x unlevered free cash flow. As noted above, there are no perfect peers and their looser peers trade in a decently wide range, but most of trade for >10x EBITDA. So even at $30/share, Synalloy would look reasonably cheap on both an absolute and relative basis.

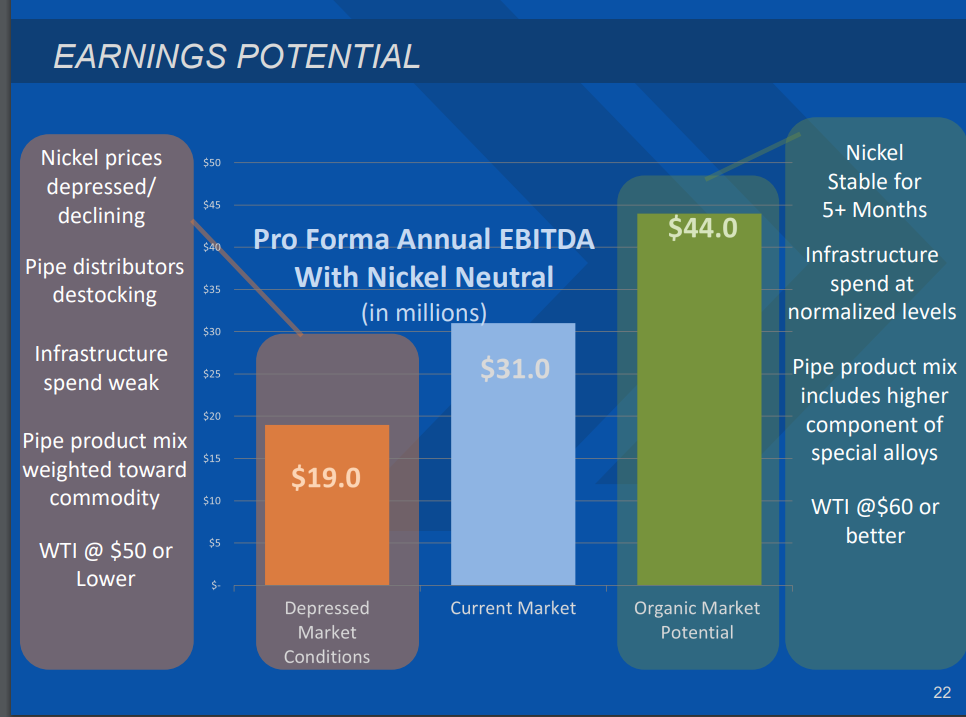

Growth potential / market tailwinds: Synalloy's products have a lot of exposure to oil and gas, both in the Permian basin (particularly for Palmer) and in offshore drilling. The Permian basin is a huge area of growth for tons of major oil and gas companies (the Anadarko bidding war being the best example), and offshore drilling has been relatively weak since oil prices crashed a few years ago but at some point offshore is likely to pick up again. Several of Synalloy's acquisitions were done when the oil and gas markets were tanking, so if we do see increased oil and gas exploration I'd expect a significant benefit to Synalloy's earnings. How much would a cyclical boost improve earnings? Synalloy presented the slide below in their August 2018 investor deck that suggested they could earn $44m in EBITDA with not crazy assumptions; note that this assumption was before the ATSI acquisition so I don't think it would be crazy to suggest Synalloy's earnings could approach $50m in a somewhat favorable (but by no means crazy) environment.

I've tended to focus on the metals business when talking about market tailwinds, but it's very possible that's underselling the chemicals business. The chemicals business grew 20% in 2018 and their 10-K noted that chemical saw "the initial ramp up of seven significant customers." Given these products appear quite sticky and specialty chemicals tend to get more profitable over time (as the manufacturing process improves), it's very possible specialty chemicals is going to see strong growth and significant operating leverage going forward. Specialty chemicals is probably a much higher multiple segment than metals given the stickiness of their products (I chose not to break the valuation up into segment multiples simply because the chemicals business is so much smaller than the metals business its not worth splitting hairs over), so if it did ramp it could be a huge boost for the company and its multiple.

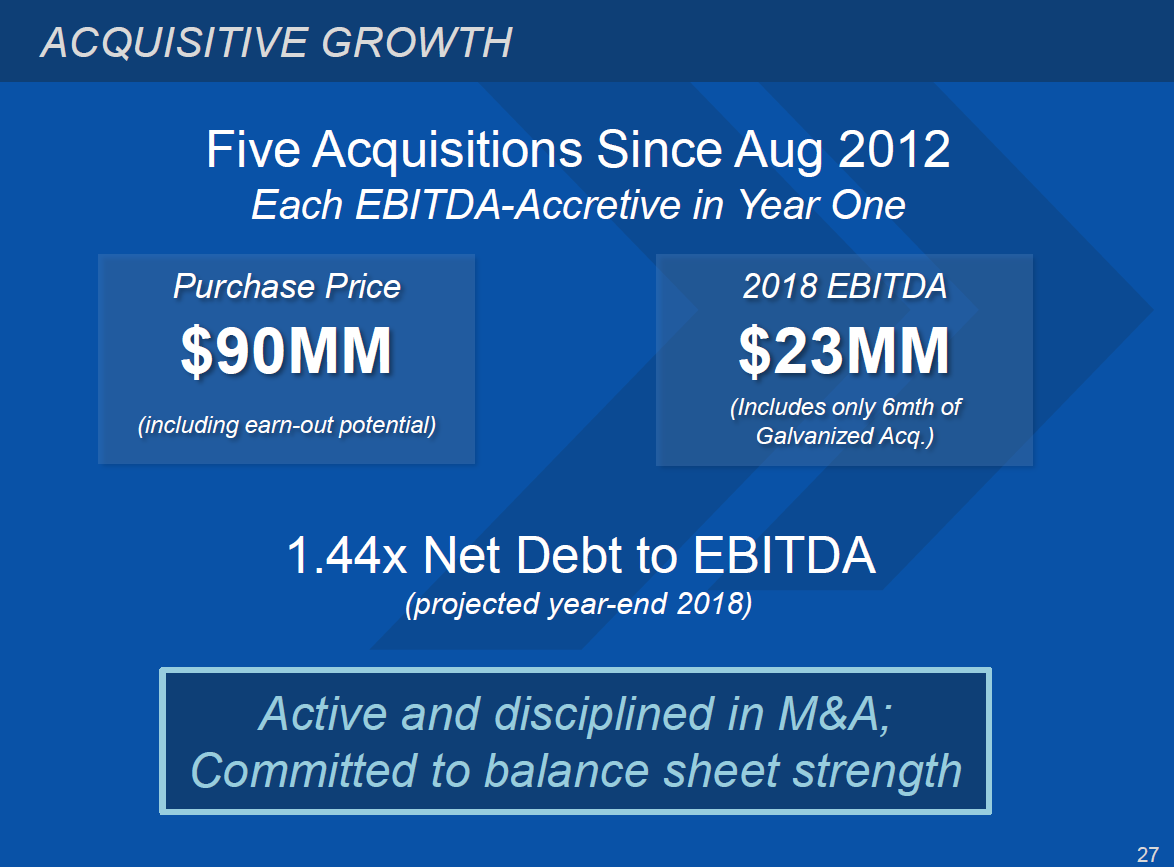

Acquisitions / platform potential: This is the piece of the thesis I believe least in, but Synalloy clearly thinks they have some skill as an acquirer. Their rejection letter to Privet noted the "management team has continuously demonstrated its skill in acquiring and integrating acquisitions," and the slide below suggests that they've acquired companies at reasonable multiples. It's hard for me to look at the company's results and see any real value creation from acquisitions, but it's possible some value creation has been hidden by weak end markets or they simply haven't fully integrated yet. If Synalloy does have potential as an acquirer / platform, Privet could pay up for the core Synalloy business and look to realize value from pursuing a string of acquisitions over time.

Synalloy's Chairman called one of their acquisitions (the 2016 acquisition of Marcegaglia's steel pipe business, not to be confused with the 2018 acquisition of Marcegaglia's tube operations), the "opportunity of a lifetime" at their 2018 shareholder meeting; if he's right, it's very possible that earnings are simply cyclically depressed right now and they'll shoot higher in the next few years.

Speaking of the shareholder meeting, at the 2019 annual meeting (done just a few days ago in mid-May), the CEO mentioned that Synalloy remains in active M&A discussions and is working on two opportunities that could each add ~$100m in revenue and $15-20m in EBITDA (their 2018 10-K also mentions they are set to do another acquisition by mid-year; see p. 29). That's exciting if you think the company has skill as an acquirer or as a platform company. That's a bit scary as well; those are pretty large acquisitions for a company this size.

Just to wrap this up: Synalloy appears reasonably cheap as a standalone company, as both its absolute and relative valuation are attractive even without assigning any value to potential growth through acquisitions or simply a better end market environment. Synalloy is, by far, Privet's largest public position, and history suggests when Privet has a large public stake and makes an offer to take the company private, they are willing to get very aggressive in bidding for the company. My bet is Privet's bid will ultimately push the company to go private, either with Privet or to a different buyer, and shareholders will get a significant premium when that happens. Failing a new bid at a premium, I don't see much fundamental downside to Synalloy; in fact, I think their operating momentum and value suggests a good chance shares will be higher a year from now even without a Privet bid.

Other odds and ends

Synalloy announced a stock repurchase program in February. If fully executed, it would have them buy back just under 10% of their shares over the next two years. They haven't executed any of it yet (the Privet offer came pretty close on the heels of the program), but it does suggest management shares the view their shares were undervalued in the teens (where they were trading the program announcement) and would be willing to buyback shares at the right price. We'll see if they ever end up executing on the program: they don't have a history of share repurchases, so I'm a bit skeptical they would aggressively repurchase shares in the future, but I also don't think they'll be a standalone long enough to get the chance.

Synalloy had an at the market stock offering they tried to execute when their shares were in the low $20s late last year (see p. 55), but they cancelled it in November when their stock was freefalling as markets collapsed. So Synalloy's clearly got some openness to being flexible with capital allocation based on where their shares are trading.

In addition to the repurchase program announced in February, there was a wave of insider buying in early March from a bunch of different insiders, including the CEO (buy #1 and buy #2), the president of one of their divisions (he also bought in February), and several directors. These aren't crazy huge buys, but they're meaningful. The CEO's salary is <$500k and he makes ~$1m/year all-in, and he bought ~$150k shares earlier this year. That's a meaningful amount for him.

Speaking of the CEO, he owns a decent amount of shares (~300k shares, around 3% of the company). He's 60, and if the company got bought out he'd be entitled to ~$3.4m in change of control payments. His shares are worth just under $6m (more if the stock gets a big premium from Privet's first bid), and he makes ~$1m/year. Currently, I think he'd rather stay with the company and keep building it up, but I've found CEOs in their 60s often look pretty fondly on deals at nice premiums that let them cash out and hit the beach.... (Or he could just look to roll his equity if he wanted to stick around).

Synalloy's working capital is probably a bit elevated right now. On their Q4'18 call, they guided to working capital normalization freeing up $7-14m during 2019. They seem to have caputred some of that in Q1'19 (it's tough to track given the acquisition), but there's probably still at least $5m in potential working capital drawdown over the rest of the year which, in addition to continued FCF generation, will pull down SYNL's multiple by a decent bit by the end of the year.

As noted above, Synalloy's rejection letter said they planned on bringing net debt down to $55m by year end; working capital would likely be a big piece of that reduction (I'm not sure how they could get there without a huge WC draw-down to be honest). Worth noting my valuation is using their current net debt of ~$100m. If they could get net debt down to $55m by year end, that would result in a >1x reduction in multiple.

Synalloy's shareholder base is reasonably concentrated. Privet owns ~14.5% and Royce owns ~10.6%. Behind them there are four 5% shareholders (Van Den Berg, BlackRock, Dimensional, and Vanguard). That's probably a good mix: it's concentrated enough that if Privet makes a very accrettive offer shareholders can force management to the table or resist Privet if Privet tries to steal the company without paying a fair price.

An open question is how Synalloy would perform if we got into a real recession. You can see on the earnings potential slide above that Synalloy forecast $19m in EBITDA in "depressed" market conditions; I think that might be generous. Synalloy's worst years (2009 / 2010 and 2016) have generally seen them operate around break even. Synalloy's obviously made some acquisitions since then, so the business is a decent bit different. Overall, I think the evidence suggests Synalloy could comfortably weather a down market, but the results probably wouldn't be quite as strong as that slide would suggest.

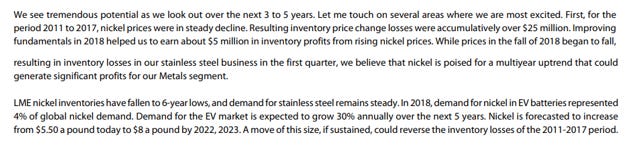

A bit more on the company's metal exposure. The quote below is from their 2019 annual meeting; I don't put a ton of weight into a "rising metals price lifts the boat" thesis but it's clearly an interesting angle to think about how much a continued rebound in nickel prices could help them (FWIW Bloomberg shows nickel prices up ~15% so far this year, though they're down ~20% over the past year and there's no guarantee SYNL's nickel exposure comps to the index I'm looking at!).

I've highlighted that I think Synalloy is undervalued as a standalone company, but I think it's fair to ask what price Synalloy would trade at if Privet put out a public statement tomorrow saying "Thanks for considering our offer; we're walking away." It's tough to say; Synalloy was trading $14-15/share before Privet's offer was made public, but I doubt they would fall back there because Synalloy's announced strong earnings and reaffirmed their outlook since the Privet bid went public. All in, I'd expect the share price would be decently weak if Privet publicly pulled their offer, but given Synalloy's operating momentum and that I think it's undervalued as a standalone, I think that weakness would be an opportunity. Also, I'd be surprised if Privet publicly pulled their bid; it's more likely the company announces on an earnings call six months down the line "we have not engaged in sale discussions with Privet or anyone else in the past few months," and that would hopefully be done in conjunction with continued strong earnings!