This is part 4 of my deep dive into cable threats (sponsored by Tegus). This part will dive into one of the buzziest companies threatening the broadband market: Starlink. If you’re looking for background on what this series is and why I’m doing it, please see part 1 here. You can find part 2 on FTTH risks here, and part 3 on fixed wireless here.

Before we get to part 4, let me again highlight the three Tegus expert calls I used for the foundation of this series. Most Tegus calls are behind paywall, but for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub! The three calls are:

That out the way, let’s dive into Starlink.

Starlink is the satellite broadband play from Elon Musk’s SpaceX. The goal is to launch literally thousands of low-earth orbit (LEO) satellites and use them to power a global broadband network. Cable bears have been pointing to Starlink as a massive looming threat; the company won almost $1B in the Rural Digital Opportunity Fund (RDOF) auction to build out to underserved / rural locations in the U.S., and every few months an article like this one will talk about how revolutionary SpaceX’s service is for the early adopters. Combine those plans / reviews with the seemingly negative cost of capital that anything Elon Musk touches seems to get, and SpaceX poses a worldwide risk to the broadband industry.

So Starlink is certainly worrying. However, when I step back, I think the threats are more “on the margins” than terminal. I’ve mentioned several times in this series that the fastest, most reliable, cheapest way to deliver broadband is always going to be have fixed infrastructure (like cable or fiber to the home) connecting to the consumer; nothing I’ve seen about Starlink (or Starry, the topic for the next post in this series) changes that belief and that’s why I think cable continues to win in the long run. In addition, I think there are serious long term issues with Starlink that will limit its market / reach in most developed markets. It’s not just me who thinks that; even Elon Mush has said Starlink is not some huge threat to telecos (maybe I should have just skipped all the interviews and writing and ended the article there?).

As mentioned above, Starlink is aiming to use LEO satellites to blanket the globe and offer high speed internet around the world. High speed satellite internet is nothing new; Viasat and HughesNet have been offering satellite broadband internet for years. Heck, if you zoom out, competition for telecom players from satellite is nothing new; Dish and DirecTV were formidable competitors to cable television in the 90s and 00s.

So the threats from satellite internet are nothing new. However, Starlink represents a unique beast. Viasat and HughesNet offer undoubtedly inferior products; speeds are limited (for example, HughesNet seems to offer ~25 megs down / 3 megs up), and you’ll get capped if you use too much data. So, in almost all cases, if someone has the option of a “normal” broadband provider like cable or fiber, they’re going to go with that over satellite internet.

Starlink is different. Their base service is 100-200 mbps, and they just rolled out a premium service that’s 150-500 megs. Those speeds are comparable to the base packages cable / fiber offer today, and Starlink is clearly planning to use those speeds to attack the broadband market. One of my expert calls was with a former Starlink manager, and he was clear that he thought legacy telecom should be afraid:

So, I think the theme, I guess, what I'm trying to message to you is SpaceX will attack its market incredibly quickly, and they're going to rapidly outpace anyone else in the satellite telecommunications game, and they're going to rapidly put the infrastructure on orbit that would compromise other traditional terrestrial service providers. So that's what SpaceX does. That's what Elon does. They move really quickly, and you should expect the same thing here.

That’s a scary backdrop. If there’s one thing equity investors have learned over the past decade, it’s that you bet on legacy companies and against Elon at your own peril.

So this is not a risk I take lightly… but I still think history and the physics suggest that even Starlink / SpaceX are going to run into a wall when it comes to taking on domestic broadband. No doubt there’s a place for it; Starlink is going to be a godsend for connecting a lot of very rural locations. But I struggle to see how Starlink makes a real dent into the core broadband business.

Why?

First, I’d note that history suggests LEO businesses tend not to work. Again, Starlink seems to further along than many of their predecessors, but history is littered with satellite internet businesses that were going to take over the world and went bankrupt.

Second, I have lots of questions on Starlink’s speed and how it holds up as more people hop on the network. Again, for rural people this won’t be a problem, but I suspect Starlink’s speeds are really good because there aren’t a lot of people on the network currently. If you ever got multiple people in the same region on the network, speeds would likely suffer. The experts seemed to agree with that,

The problem with Starlink right now is, you've seen the articles about how difficult it has been and how temperamental it has been. I mean that's growing pains, but the reality is that 100 meg or the speeds that they can offer today they can offer because there's a little contention on the network. Congratulations, you have been successful and your speeds go down as a result.

And remember- I mentioned in part 3 (on fixed wireless) how the demand for broadband is constantly growing. Right now, you might look at Starlink’s 100 megs and say “that’s a reasonable amount of speed.” But roll forward five years and there’s a good chance that speed level isn’t going to be close to enough to support all of the different data demands a household has (9k video, VR games, etc.). Cable and fiber can offer 1 gig today, and they have a much cleaner path to upgrading that speed over time. I think it comes back to this quote,

Here's what we know. We know that demand is going up. and is going to continue to go up. We know that the fiber capacity increases essentially in parallel with Moore's Law. And we know that there is no other delivery mechanism that can say that. End of discussion.

There’s also questions on the reliability of the service. Have you ever had a broadband outage? I live in a giant apartment building, and like once a month my cable will go offline for maybe two minutes. Why? I have no idea, but I know when it happens because my Bloomberg immediately disconnects, whatever I’m streaming stops, all my smart devices go bonkers, etc. It’s insanely frustrating, so much so that I can remember specific instances of when it happened. Now, imagine that frustration, except apply it to every time there’s a storm or the wind pushes some trees the wrong way so they interfere with your house’s line of sight to the satellites. That’s what can happen with satellite,

Above the tree line, Starlink may be a great decision, and congratulations, 100 meg is all you can do.

And for what you're going to be doing above the tree line, that's great. For the curves and where things are going, it isn't going to work. I mean, you're not going to be doing the Metaverse above the tree line. I'm sorry

Even putting all of those concerns aside, regulations and physics are going to serve as a big moat for legacy broadband players in suburban and urban markets. The former Starlink manager noted that regulations meant their network could only service 300-600 users in a city sized area.

And it turns out, with the current satellite design, roughly approximating here, for an area the size of like Seattle or Toronto, that large of a surface area, you can really only put like 300 to 600 users. So, this isn't, as you've said, honestly, that big of a competitive threat to like raw servicing of highly dense areas, it's a spatial play.

The Starlink manager framed that as a big part of the Starlink appeal; they could attack a couple of customers in every region across the globe

And it turns out, with the current satellite design, roughly approximating here, for an area the size of like Seattle or Toronto, that large of a surface area, you can really only put like 300 to 600 users. So, this isn't, as you've said, honestly, that big of a competitive threat to like raw servicing of highly dense areas, it's a spatial play.

So, in a lot of ways, a big competitive advantage that SpaceX has is, they're attacking every customer, every competitor a little bit, because as you know, the telecom broadband fixed cable community is highly nonhomogenous, heterogeneous or whatever the word would be.

It's very diversified and there's a lot of different owners that all own their fight to them. Well, SpaceX is attacking those guys just a little bit everywhere. So, we're talking a lot of different people, but nobody directly that's going to cause them to have a lot of competitive backlash.

I have my doubts. I’m with them that a lot of telecom is a game of scale and leveraging your fixed costs, but I struggle to understand how it’s a good thing that Starlink can only attack a couple of hundred consumers in a market with millions of households. If you think back to the FTTH overview in part 2, it takes years for a new network to scale up because taking customers from their existing service is a literal battle that often involves lots of marketing, going door to door with sales, and capturing people when they’re most likely to switch (i.e. when they move). Obviously Elon carries a marketing touch that no other company has (Tesla doesn’t advertise and instead relies on word of mouth and Elon’s Twitter), but that game gets a lot more difficult when you’re trying to get people to switch a service that is basically a utility to them. How is Starlink going to capture people when they’re most apt to churn? And how is Starlink going to turn people down when their local networks start getting too crowded?

And this isn’t just a short term issue; the Starlink manager suggested that they’d be able to service some extra people in an area over time, but they’ll still always have a big cap on how many households they can service in a particular region:

Yes, I think five years from now, totally guessing when I'm speaking, three years from now, five years from now, you're getting to the point where you have enough satellites in orbit and there's a newer generation with the larger aperture diameters antennas where you can fit, call it, 3,000 to 6,000 people in the same service territory where you only used to be able to fit 300 to 600.

Anyway, put it all together and it’s hard for me to look at Starlink as a serious competitor to cable / fiber in the majority of the United States. It’ll be great in rural areas that are currently underserved and Starlink can easily reach them, but I suspect Starlink will make almost no inroads in urban and suburban markets and that the vast majority of people who have access to both a traditional fiber / cable internet provider and have starlink as an option will chose to go with the traditional option because it’s faster and more reliable.

By the way, it’s not just me and the general consensus of the experts I talked to who believe that. Elon Musk suggested over the summer that Starlink is “a nice complement to fiber and 5G,” and he’s also tweeted Starlink is designed for “low to medium population density.” Elon isn’t exactly known for being conservative with his projections, so for him to say it’ll be a complement and won’t completely eat their lunch suggests to me he knows the physics overwhelm Starlink in urban / suburban markets.

A few last Starlink things

Right as I was finishing this article, I saw this summary of a Cowen report. I haven’t seen the actual report (which makes linking to dangerous), but it’s a great summary and very supportive of everything in here (plus with some references to reports and primary sources I haven’t seen / linked here).

I quoted from it extensively throughout the article, but I can’t recommend the Starlink Expert interview enough for thinking through all the different parts of Starlink.

Just this month, Starlink introduced a premium tier that offers 150-500 mbps. It’s $500/month, plus a $2.5k hardware fee. When you look at those costs, I think you can see the issues Starlink is going to have. Those speed ranges are in line with Charter’s base plans of 200 mbps, which costs $50 - $75/months (depending how you factor the promo rates in), has no data costs, and I believe has no installation or hardware fees. Starlink is just dominated by good cable / fiber.

The base Starlink package has a terminal that costs >$1k; Starlink charges consumers ~$500 for that terminal, so they lose money on it. Those costs will come down over time, but it’s another expense / area that Starlink will struggle with if they actually try to take on cable.

Musk sent an email out late last year noting SpaceX was at risk of bankruptcy. I think that’s hyperbole; I near guarantee there would be 100 private equity and sovereign funds lining up to write SpaceX 10 figure checks if they ever asked (again, it sometimes seems Elon has a negative cost of capital). But the history of satellite and space internet companies is they go bankrupt, so I do think there is some base rate that suggests a BK is possible!

Starlink won almost $1B in subsidies from the Rural Digital Opportunity Fund in late 2020. That grant has proven very controversial. I can’t claim to be an expert so I’ll refrain from taking a view, but most of the people I’ve talked to who are knowledgeable seem to agree that there are real issues with the SpaceX bid, but I do think reading through some of the push back competitors are giving the SpaceX bid can help show some of the areas SpaceX is going to struggle with as they try to scale.

Ok, that’s it for part 4. I’m going to return next week to wrap this series up by talking about Starry and some closing thoughts on the cable industry. Why next week? Well, Altice reports earnings next week, so I might grab a few quotes from their call / comment on their earnings a little bit. And, while this series has been a blast, it’s taken up a ton of time, so finishing it off next week lets me focus on a few other things in the meantime.

See y’all then!

This series has been illuminating, thanks Andrew.

I have to say though, even though I think I agree with most everything you've said, I'm still skeptical of the medium and long-term risk/reward for investing in cable. It just feels like there's competitive threats on multiple sides and many ways to lose, even if each individual threat has low-odds of unseating cable in any given market. Even though much of the competition is on the margin, growth happens on the margin. As a relative noob, this is how I'd summarize what I'm hearing (again, I'm a noob, so please correct me if anything I'm saying is off base):

1) Fiber, admittedly, is a superior product at a lower cost than cable, but cable is good enough to meet customer's needs in all but the most explosive growth in bandwidth demand scenarios and so the natural end state of market share in competitive markets will be a 50/50 split between cable and fiber, because inertia.

2) At the same time, cable is insulated from the competitive threats of both fixed wireless and Starlink because those products do not and potentially cannot have the capacity to keep up with the explosive growth in demand for bandwidth.

3) FTTH will only compete in dense urban markets, which only represents about 50-55% of cable's footprint.

4) Fixed wireless and Starlink will only compete in rural markets.

So cable is threading this needle between having superior on performance AND cost (FTTH) competition in urban markets and superior on performance (Starlink) OR cost (fixed wireless) in rural markets, leaving them only with a competitive advantage in suburban markets that are too dense for Starlink or fixed wireless AND where telcos choose not to compete with FTTH.

At the same time they are threading a needle of being in a relatively good competitive position if demand for bandwidth continues increasingly rapidly (making Starlink and fixed wireless less competitive) but not so rapidly that customers are compelled to upgrade to FTTH where they can get better speeds.

A quick google search shows about 75 million total broadband subscribers in the US vs. about 132 million households, or 56% penetration. I have to think a majority of the incremental growth in broadband subs for cable cos is coming from rural markets (please correct me if I'm wrong) at the same time that two new competing products (Starlink & fixed wireless) are entering the rural market, providing competition for the marginal broadband sub for the first time.

And let's say cable hits the goldilocks scenario on all sides...what's the upside? If the bear case is one or more of these competing technologies takes significant share, and the base case is status quo, what's the bull case?

Thanks again for sharing your thoughts on this industry!

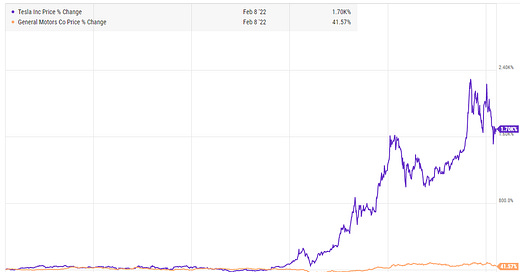

Andrew - I was wondering if you have any thoughts on the route taking place in cable stocks?

Do you think the cause is primarily macro (combination of market beta + taking an extra markdown because of the extra cost to service the debt at higher rates going forward), or micro (lack of subscriber growth, TMUS fixed wireless product taking share).

Surely it is some combination of the two, but I'm interested to hear your opinion on what the more impactful driver is for Charter at this stage, and what drives the outlook/stock from here.

TIA!