This is part 2 of my deep dive into cable threats (sponsored by Tegus). This part will dive into the risk Fiber to the Home (FTTH) poses to cable. If you’re looking for background on what this series is and why I’m doing it, please see part 1 here.

Before we get to part 2, let me again highlight the three Tegus expert calls I used for the foundation of this series. Most Tegus calls are behind paywall, but for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub! The three calls are:

This post (like everything in this series or anything I write about cable) is going to run long. If you’re looking for the tl;dr version, it’s this: I think the threat to cable from FTTH is more than manageable. I expect markets where cable competes with fiber will trend towards a 50/50 market share over time (with cable retaining a slight edge simply because of the inertia in people switching providers), and there are plenty of markets where cable will not face FTTH competition where they will continue to have a dominant position.

Let’s start by defining the risk from FTTH and the threat it lays out. Honestly, it can look different, but the overall situation looks like something like this. In most markets over the past decade, consumers had three choices for internet. Those were

Getting high speed broadband from their cable provider. Speeds varied, but recently this route has included speeds approaching 1 GIG down.

Get DSL from the legacy telecom company. Again, speeds varied, but at the high end you’d be talking about 25 megs down or something.

Go without a home internet connection. You could do this by disconnecting completely and becoming a hermit (and honestly, given the news flow over the past few years that option seems pretty nice) or by using exclusively your cell phone service for internet. The later choice sounds appealing, but in a modern / connected world you quickly run into data cap problems, reliability problems, and issues with running all the devices that require always on connection (if you’re only using your cell phone as a hot spot, good luck supporting a smart TV connection, a Peloton, and running Zooms).

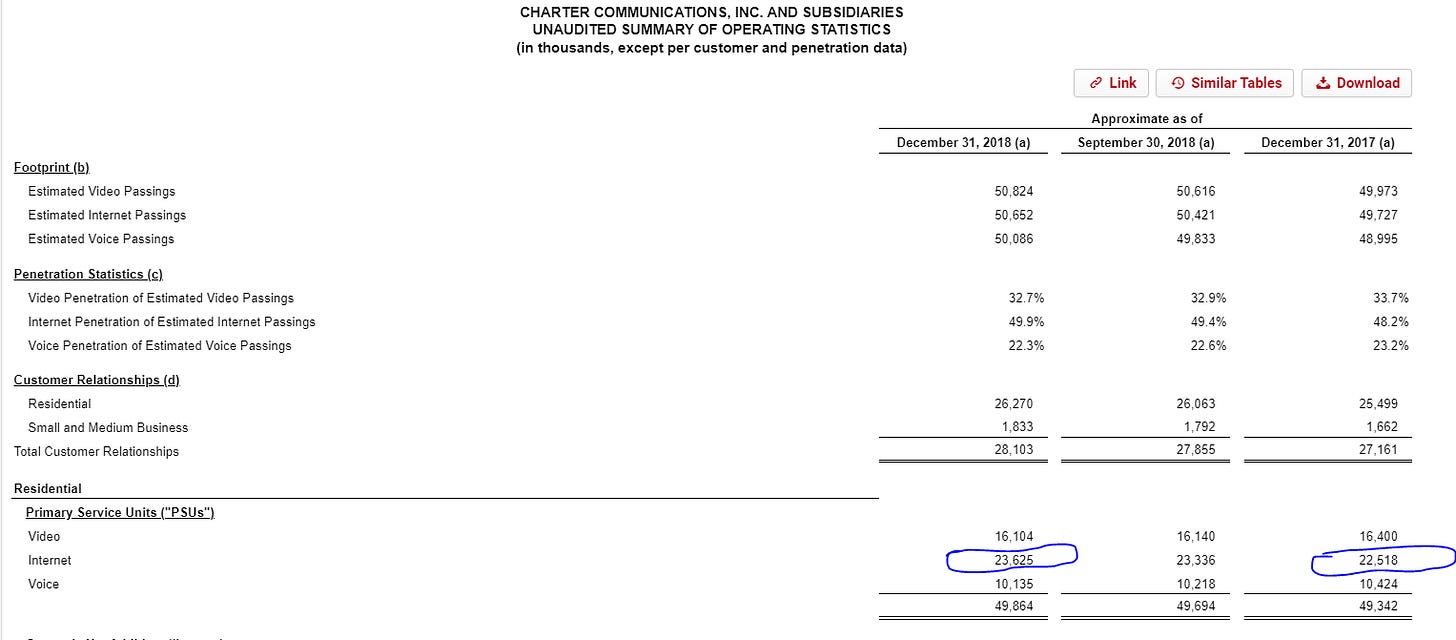

As data usage has exploded, getting DSL was increasingly the same as not having an internet connection at all, so cable was approaching a monopoly position for broadband in anywhere that they didn’t have FTTH competition. In most years, cable was taking more than 100% of industry gross adds, meaning they were adding basically every new consumer or household who signed up for internet as well as taking share as the last consumers who still had DSL slowly upgraded. I’m sure some investment bank has better data than me, but a quick glance at AT&T and Charter’s earnings show this story nicely.

In FY18, AT&T lost ~20k internet subs overall (they gained ~260k fiber subs and lost ~290k internet subs).

In the same year, Charter gained 1.1m internet subs.

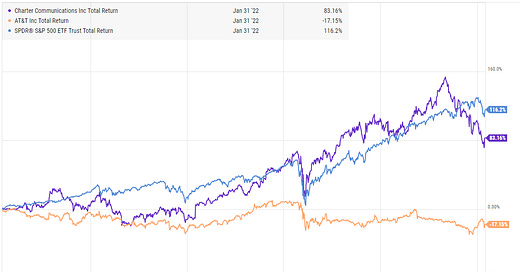

That’s not a perfect data set since T and CHTR markets aren’t fully overlapped, but honestly you could look at any random legacy telecom play and comp them to any cable player and come to similar conclusions: cable was soaking up every new household as well as taking share from legacy telecom. It was a fantastic set up for cable: growth delivers huge margins as the incremental cost of serving a new sub is negligible, so you were seeing the cable companies growing quickly while margins were expanding (CHTR’s EBITDA margins went from ~37% in 2017 to just under 41% in 2021, and at the same time free cash exploded upward as capital expenditures declined). The combo of solid growth and expanding margins set the cable companies up for great stock runs while their telecom peers generally struggled.

Fast forward to today, and you’re seeing a wave of legacy telecom companies making FTTH investments. A FTTH investment for a legacy telecom is simple: take the copper network you’re currently running for DSL and replace it with fiber. Fiber is a slightly superior asset to cable; it’s a bit faster, more reliable, and costs less to operate. So, by upgrading to FTTH, legacy telecom can go from a position of bleeding share to a product that has a fighting chance to split the market.

Frontier (FYBR, a current favorite of mine) actually publishes a slide that nicely lays out the accretion math of upgrading a home from copper to fiber (I’ve pasted the slide below; the whole deck is worth checking out though). Fiber assets tend to trade for >$3k per home passed (HP), while copper assets trade for ~$500/HP. Cost varies based on a variety of factors, but all else equal it takes ~$1k/HP to upgrade a copper home to fiber (both Lumen and Frontier have disclosed that number, though you can find plenty of others mentioning something in that ballpark). So legacy telecom can invest $1k to turn a declining asset worth ~$500 into a future proof asset worth $3k. That’s an incredible trade for these companies if you believe that math. Clearly, the legacy telecom companies do, and you’re seeing them rush to upgrade their networks (Lumen, for example, sold 20 legacy states to Apollo for ~$7.5B to give them the financing to jump start upgrading their remaining assets).

This fiber investment effects cable in a bunch of ways. Obviously there’s the “we were a monopoly in the market, and now we’ll compete in a duopoly” factor, which is a bummer as a cable investor. But I think the main concern with FTTH is what I mentioned in the overview: Altice is, by far, the cable company with the most fiber competition currently, and they are starting to bleed broadband subs. Cable investors look at all of the fiber overbuilds coming today and don’t just say “O man, our monopoly is gone and growth is going to slow.” They look at all the looming fiber competition and say “are Altice’s results today what we can expect from all cable operators in a few years when the fiber builds fully season? Are we going to stall out or even lose subs while needing to cut pricing to retain our current base?”

I think the answer to those questions is definitively no. The problems Altice faces are very Altice specific (read: mismanagement), and the rest of cable is in a fine position (I will refer you to my tl;dr here: I think the threat to cable from FTTH is more than manageable).

Why do I believe that?

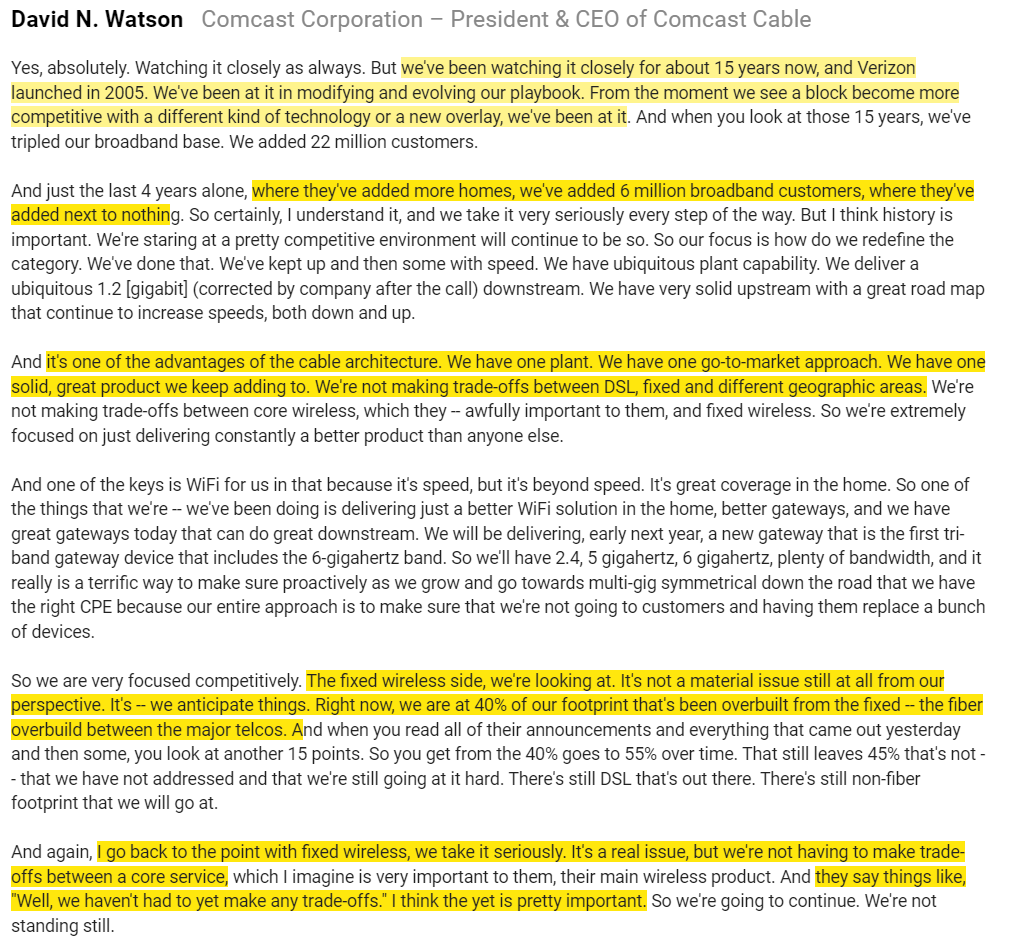

Well, let‘s start with something simple: fiber overbuilds are nothing new. From Google Fiber to Verizon FIOS, cable has been competing with fiber overbuilds for years, and they’ve done fine. The quote below is from Comcast in December; it’s long, but there’s a lot of good info in there (and I hope you like it, because you’ll be seeing it again in the fixed wireless discussion tmr!)

There’s tons of interesting stuff in there, but at a high level the important takeaway is “we’re been competing with fiber for 15 years and we’ve been adding tons of customers.” But there is one other interesting nugget in there: Comcast says that right now, 40% of their footprint is overbuilt with fiber, and if you add up all of the FTTH announcements they think their footprint goes from 40% fiber overlap to 55% over time.

From an investor’s standpoint, that’s enormously good news. Based on my talks, I think a lot of investors are internally thinking about FTTH competition like cable companies are about to go from competing with fiber in ~20% of their footprint to 100% of their footprint in the next 5 years. That’s completely off; again, Comcast is telling you they already compete in 40% of their market. Look at how Comcast’s cable business is performing currently: EBITDA is growing at ~10% annually, and free cash flow is growing faster than that as they get operating leverage and capex comes down. If they’re doing that with competition in 40% of their markets and you held everything else constant except moved competition to 55% of their market instantly, that’d probably imply EBITDA growth slows to ~6-7% (with FCF growing above that). Obviously faster growth is better, but those metrics are far from a disaster.

And, BTW, Comcast is pretty adamant that they are growing in all markets, regardless of if they compete with fiber in those markets or not.

That’s Comcast. What about Charter? At the same conference, they disclosed that ~35% of their network competes with Fiber. I don’t believe they’ve said how much of their homes are getting targeted for upgrades, but I’d assume it looks similar to Comcast and they get to 50-55% fiber competition in the next few years.

So the first takeaway from FTTH I want to give you is this: a lot of investors think of FTTH risk and think we’re going from a pure monopoly environment for cable to one where cable competes with fiber in every market and growth is just going to fall off a cliff. That couldn’t be further from the truth: cable already competes with fiber in more than a third of their markets, and they do just fine.

Let’s build on that later point: cable does just fine in markets they compete with fiber.

This is a really tough one to build on because cable doesn’t give you market by market data, but I think we can do a reasonable job of building out the case that cable does just fine in markets it competes with fiber.

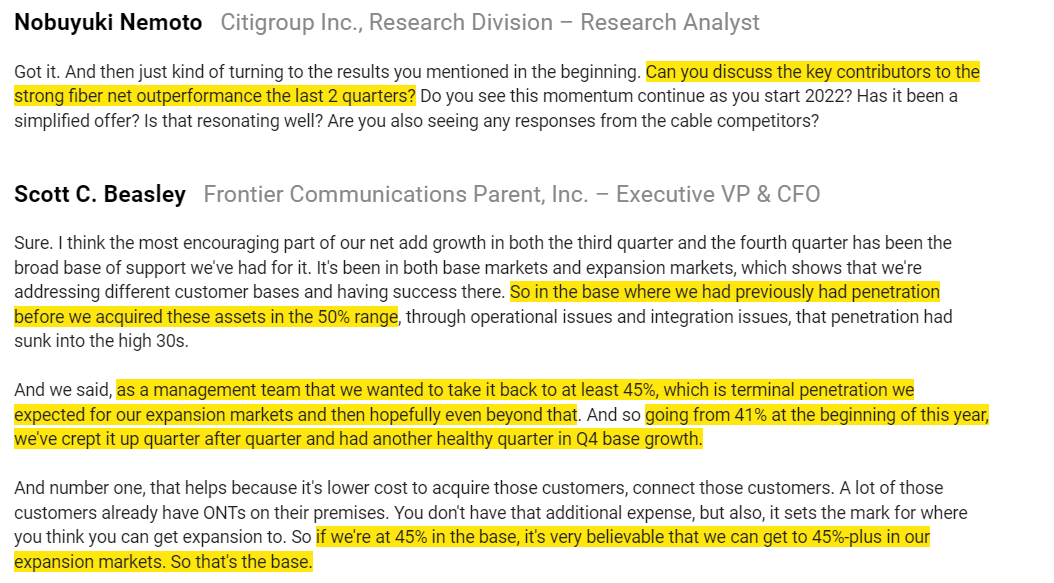

I think the best place to start with building that case out is by (again) looking at Frontier. A full breakdown of that company’s history is beyond this post, but what you need to know about Frontier is that they acquired a bunch of fiber assets from Verizon ~a decade ago. They used a lot of debt to acquire those, and they horrifically mismanaged those assets (in part because they had to prioritize debt service above all else). They eventually filed for bankruptcy, and they used the bankruptcy to clean up the balance sheet and install new management. New management is focused on upgrading legacy copper assets to fiber (their “expansion” assets) and improving operations at the old assets they acquired from Verizon (the “base”).

Why is that important? Because Frontier gives lots of data on their targets for the expansion markets and uses their experience with the base to back them up, so we can use them to see how fiber is doing.

So something like the quote below (from this conference) is rich with data for our purposes:

Here’s what we learned there:

When FYBR acquired their fiber assets, they had ~50% penetration

After huge mismanagement, those assets had 41% penetration

Going forward, FYBR plans to get those base assets back to 45% penetration, and they believe they can get expansion markets to that level as well.

Why is that important?

Well, the worry with fiber competition is that it’s going to roll into cable markets and steal every consumer. But that’s not the reality. The reality is that cable and fiber are roughly similar products, and it takes a long time to take share. In the end state, cable and fiber likely settle into roughly 50/50 market shares. And it takes a while to get there. Here’s a slide from Frontier’s Q3’21 earnings; look how fiber penetration in base markets barely budges as they start to make operational improvements and how long it takes to improve penetrations in newly upgraded markets.

You can see this in my call with the Former FCC chair. Altice is in distress, and I know a lot of people who wonder why Verizon doesn’t just try to smash them on price and put the company in real distress. I think there’s lots of reasons Verizon doesn’t try that, but a big one is that it just takes time to gain share in the cable market. The natural end state is to roughly split the market, and if you try to do better than that by getting really aggressive on pricing you destroy the profitability of your current consumer base just to take a little extra share. Would you rather have 50% of a market with $75/ARPU, or cut your price to $30/month and pick up an extra 5% share every year for five years if you’re really lucky. I know some of you wise guys are going to say “the later, because I’ll bankrupt my competitor and jack up prices then,” but I promise you that’s not going to work (your competitor might go bankrupt, but their assets remain in the ground. You’ve destroyed your markets’ profitability only to face a newly emerged competitor with a completely clean balance sheet).

BTW- I didn’t just pull that ~50/50 cable/fiber split out of a hat, or cherry pick Frontier for it. The 50/50 number is roughly consistent with the market share rate I’ve seen every fiber player discuss, and, again, it makes sense. High speed internet is a commodity, and fiber and cable are roughly similar products (fiber’s a little better, a bit cheaper and symmetrical, but who really needs 1 gig upload speed?), so it makes sense the natural end state for a duopoly market with interchangeable products is a 50/50 split. Just to hammer that point home; here’s AT&T confirming that 50/50 is what they target for their fiber markets.

Now, I think bears would respond to those arguments with a few points:

Broadband adds have been awfully weak for all of cable in 2021. Not only were they weak, but adds deteriorated throughout the year and came in way below initial projections. On top of that, someone like Charter traditionally gives full year broadband subscriber guidance on their earnings call; they didn’t do that this year. That’s a notable break from tradition, and probably suggests they are worried adds are going to continue to weaken. If fiber competition is such a nothing burger, why are adds weakening materially just as fiber competition is ramping up?

Even if I’m right that fiber competition isn’t impacting cable today, fiber is a superior product, and demand for broadband is always growing. Fiber can handle way more speed than cable can. Maybe that doesn’t matter today, but 20 years ago no one thought we’d ever need speeds faster than 1 meg. Today, that’s laughable. Cable can deliver ~1 gig today, but whose to say we don’t need 10 gigs in 10 years?

I think there are simple responses to both points. In fact, the responses are so simple I can point you to one quote from Comcast’s Q4’21 earnings call to handle both!

Let’s start with the former risk: broadband adds for cable are deteriorating. Cable’s argument is that the issue isn’t competitive intensity picking up; the big issue is that cable is a market share gainer, and the best time to grab a customer is when they move. Because the housing market is so hot right now, moving is way down, and that means there are less customers to “gain” as they move. To back that claim up, cable points out that their churn is at record lows (Comcast’s Q4 earnings notes they “Benefited From the Highest Level of Customer Retention on Record for a Fourth Quarter”); if fiber was crushing cable, cable would see both net adds drop and churn increase as customers fled in droves for fiber (quote below from Charter)

Bears would note that it’s easy for cable to say that churn is low, but since cable companies don’t disclose churn we don't have numbers to back that up. I hear bears, but the only rebuttal I can give is this: I think I read every telecom and cable earnings call / conference appearance, and while everyone likes to say “O yeah, we’re definitely gaining some share and we compete well,” I have not seen a single company nor a single piece of data that suggests some player is all the sudden vacuuming up share and demolishing cable. Again, go back to what the fiber players are saying: they’re targeting 50/50 market splits when they build fiber, not saying “o yeah, we’re crushing cable where we compete with them, and we think we can get to 70/30 share in all of our markets”.

The other risk bears point to is that fiber is a better asset that delivers better speed, and while that may not matter today eventually people will need faster speed and fiber will take share.

I think that’s a silly argument; no doubt people will need faster speed, but cable has a proven clear path to upgrade their infrastructure cheaply and get faster speeds. It cost Charter $450m over 2 years to upgrade to DOCSIS 3.1; that’s <$10/HP to go from a product that maxed out at 1 Gbps down to one that maxes out at 10 Gbps. Cable spends billions of dollars on capex every year, and some of that capex is going to making their network more fiber-rich and making sure they’re ready for a world that requires faster speeds. The endgame for all cable is likely that they eventually run fiber so deep in their networks that they’re just fiber to the home across their whole networks, but that’s years away and until then it doesn’t cost much to keep upgrading their network and making sure it’s capabilities are far, far in front of what consumers need so that there’s effectively no difference between getting broadband from a FTTH player or cable.

There’s one last point worth mentioning. I’m going to discuss cable’s wireless play later in this series, but I think it’s worth bringing up here. In markets where cable competes with a FTTH offering like VZ or T, I’d expect them to trend to 50/50 splits over time. But there is a chance cable is going to have a big leg up on FTTH in markets where they compete with a smaller player (someone like Frontier or Lumen) because of cable’s mobile offering.

Why? Providing data over a wireless network is much, much more expensive than providing it over a wired network, and most consumers consume the majority of their network over a wired network (because most data is consumed at home and in the office). Cable is undercutting mobile players on pricing because of those dynamics (they can offload most of your data on their fixed network through things like WiFi hotspots, which is much cheaper for them). Over time, this could be a sales advantage for cable in places where they compete against a fiber player that doesn’t have a mobile offering. An example might show this best: say right now you get home broadband for $50/month and have a $50/month wireless offering. What happens when Charter says, “Get both from us and it’ll cost $70/month?” That would save the consumer ~$360/year…. and, in fact, that undershoots how much Charter thinks they can save the average consumer by bundling internet and wireless (from their Q4’21 earnings call).

If you’re T or VZ, you have both a wireless network and wired network so you can try to price match Charter and compete with that offer (in markets where you have FTTH). But if you’re Frontier or Lumen, how do you match that offer? You can’t! Eventually, you’ll need to get an MVNO, but I doubt you can get terms close to as good because cable has so much more scale and scale helps them get better MVNO deals. So, over time and as the world becomes more converged, I think cable’s wireless deal becomes a competitive advantage against smaller fiber players. My expert interviews tended to agree (“cable’s in the catbird seat”).

I think we’re seeing early signs of wireless giving cable an advantage. Again, it’s early, but cable is already saying that customers who bundle wireless with broadband see significant improvement in churn. There’s almost certainly some selection bias there (customers who hate you are most likely to churn, and if you hate your cable company you’re probably not adding their wireless offering to your home broadband), but it makes sense that the bundle should reduce churn and I think we’ll continue to see cable benefit from wireless (both from reduced churn and market share wins) over time.

The one caveat to that “wireless gives cable an advantage against small fiber players” line of thinking is that it means the smaller fiber players are natural acquisition targets for larger players with a wireless business. If you’re a smaller player with a fiber offering and find yourself losing to cable’s dual offering, selling to a national wireless player is a natural endgame. And, if you’re the wireless player, buying the fiber player makes sense too; again, scale is the name of the game, and the smaller player’s local fiber will improve your network in their markets. Again, the experts seemed to agree; consolidation is always the endstate in telecom!

Alright, this article is running insanely long, but before I wrap I want to note one thing. I spent this entire article discussing FTTH as a legacy telecom upgrading their DSL to fiber. There is another type of FTTH play: a “greenfield” play where a newcomer comes in and builds an entirely new network to compete with an existing network. Building a completely new network in a market that already has a competitor is known as being an overbuilder, and being an overbuilder is much more expensive than upgrading a legacy network for a bunch of reasons (for one, you don’t have the legacy infrastructure or licenses an established player already has, and going to get those is expensive!). One of the experts suggested the low end cost of a greenfield is $1.8k, but that the true cost is probably almost double that. That’s probably right, and it just doesn’t leave a lot of room for value creation from a complete greenfield project (remember, a fiber HP is probably worth ~$3-4k; if you’re spending $3k to build that home out and then need to market to grab subs, have overhead, etc., there’s just not much room left for value creation!). Google shut down Google Fiber for a reason; if Google and their brilliant engineers and unlimited budget couldn’t figure out a way to make greenfield fiber builds work, I think it’s safe to dismiss greenfield as a risk (that, and the fact I’m not aware of anyone pursuing greenfield overbuild strategy).

Threelast things:

On the overbuilder point: I know a lot of people who think the current wave of fiber overbuild announcements is as much about preventing people from uneconomically overbuilding markets as it is about actually upgrading to fiber (i.e. the local DSL player looks at their market and says “there’s a lot of cheap infrastructure capital out there; let’s announce a FTTH upgrade both because it’s a good use of capital and because it’ll signal to potential overbuilders that this market is not attractive to build in”).

I couldn’t quite fit this quote in perfectly, but I wanted to include this quote from AT&T that their fiber growth has barely offset their copper decline. I think it highlights lots of things, but in particular I think it highlights that these things just take a long time: you don’t get to 50/50 split in a cable/fiber market overnight. It takes time to grab consumers, and even if you upgrade your entire footprint over time it’s going to take years for those results to bleed in.

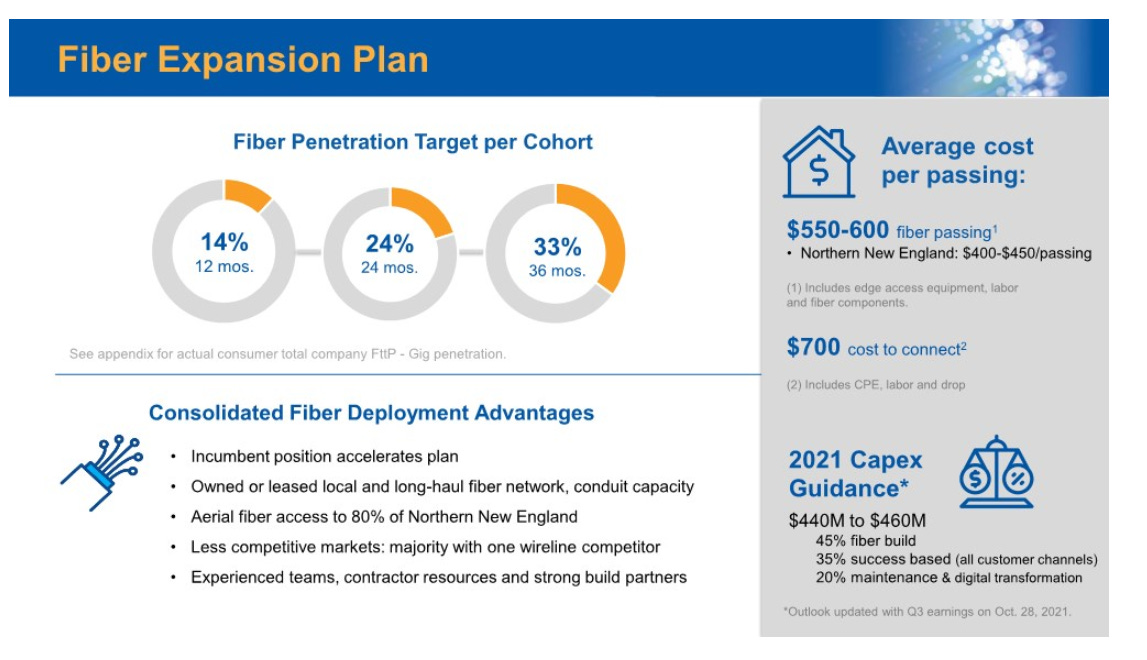

I mentioned I think Fiber and Cable will get to a 50/50 split in markets they compete in over time. But I just want to stress the over time in that sentence. It takes at least five years to get to that equilibrium, and probably more if the cable player is good (again, inertia is a powerful thing!). I highlighted AT&T and Frontier suggesting they’re targeting ~50% penetration over time, but there are other companies pursuing similar builds that emphasize how how long it’ll take to get there / that maybe even those penetration stats are a reach. Consider, for example, Consolidated (CNSL). They’re targeting 33% penetration after 36 months.

Anyway, my bottom line is that fiber is certainly a competitor to cable, but it’s a manageable one and I think investors fear it much more than they need to.

I look forward to seeing you tomorrow for part 3 of this series: fixed wireless risks (which will hopefully run a little shorter than this piece!).

Really great article. The one thought that occurs to me is where all this leaves the growth propsects for the core cable businesses of Comcast and Charter. Because they're about 50% penetrated on their footprints currently, as I understand it. So if the end state is 50/50 market share then there's zero growth there. Does that mean all growth comes from pricing/margin improvement? Surely that upside gets capped if in the new world you have a competitor with an equal/superior product, no?

Fantastic article.

I have a similar observation to @JF below. The arguments for total cable destruction are great. But the reality was that at a $600+ stock price on CHTR, for example, the market was assuming strong penetration gains to something like 65-70% of the footprint with a continued 4-5% price increase over time. However, with the unit economics of fibre becoming better (or at least the telco's thinking they are better) the fibre overbuild will stop CHTR from reaching those penetration levels and also likely put a brake on the 4-5% pricing growth. The market was also assuming that the capital intensity of CHTR would decline post the DOCIS 3.0 upgrades. However, CHTR continues to set out a long-term capex plan only to renew it in a few years with yet more capex plans to continue keeping pace with fibre. Post the more recent announcements there will be another in 3-5 years for another upgrade. We can't assume capital intensity will decline. The combined effect is that FTTH does have a large impact on CHTR's stock valuation because the transition from monopoly to duopoly is an intrinsic value decline. Finally, the long-run 30 year end state has to be fibre (with the cable companies basically all fibre by then anyway). Fibre is substantially cheaper to maintain and so once installed, there will be a cost advantage (and performance advantage) over the long-term. Side note, no one seems to discuss how the transition to the public cloud is making upload speeds so important. Cable can talk about symmetry but the reality is that their real world performance / capacity for 1Gbps symmetry isn't as good as they claim it to be. At the right price I am still bullish on CHTR but don't think we can dismiss FTTH's impact.