This is part 6 (the final part!) of my deep dive into cable threats (sponsored by Tegus). This part will just wrap up with some concluding thoughts. If you’re looking for background on what this series is and why I’m doing it, please see part 1 here. You can find part 2 on FTTH risks here, part 3 on fixed wireless here, part 4 on Starlink here, and part 5 on Starry here.

Before we get to part 6, let me again highlight the three Tegus expert calls I used for the foundation of this series. Most Tegus calls are behind paywall, but for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub! The three calls are:

That out the way, let’s dive into the wrap up of this series.

First, I wanted to note this series has been a blast, but it’s been a lot of work (it took over a month to complete!). It was a labor of love and very related to my day job (which includes a huge investment in cable!), so I’m not looking for your pity on my efforts. Instead, I mention it because I really want this series to work for you (the readers); if you have feedback on how to improve the series going forward, I’m all ears!

Second, and very related to the above, I want this series to be on companies / sectors that are interesting to me. The next company I’m doing is Regneron (REGN); I’ve already done the expert calls for them, and that post should be out in the next few weeks. But I haven’t chosen a target beyond that; again, if you’ve got suggestions or ideas for companies or sectors I should do this on, please lob them in. I’m currently leaning towards doing something related to retail, synbio, or online gambling, but I’m far from locked down on any.

Moving on from general housekeeping items, there were a few things I didn’t address in the cable series or that popped up after I had written them that I wanted to quickly address here.

I wanted to start with the opening quote from this interview.

If you’ve followed me for a while, you know I love share buybacks and financial engineering (podcast listeners seem to know it too!). But it does worry me a little bit when industry insiders (i.e. not investors) start to get bullish on a company in part because of their financial engineering. Just a little humorous / strange / slight red flag.

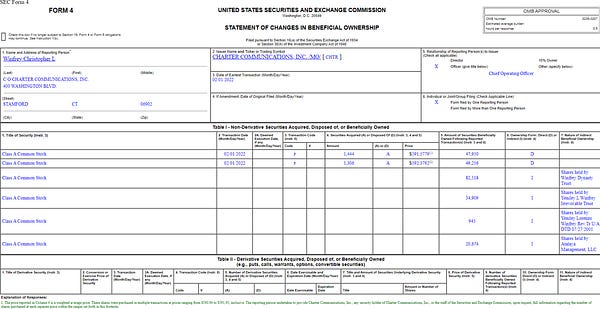

Of course, that slight red flag doesn’t change the overall takeaway for me: I came away from the series as bullish as I’ve ever been on the cable companies overall. And it seems insiders agree with me:

Charter had their first insider purchase of the stock in years early last month.

Altice is a dumpster fire, but insiders stepped up in decent size after the November stock swoon. Again, nothing earth shattering, but it was decent size, and I think this is the first set of insider buys at Altice since the stock went public (plus the stock is down another ~40% since these buys, so it's much cheaper now!).

If you’re interested in ATUS, my friends at Daloopa have a free ATUS model if you’re interested in brushing up on them; I’ll disclose I’m friendly with the team but worth checking out if you build out lots of models!

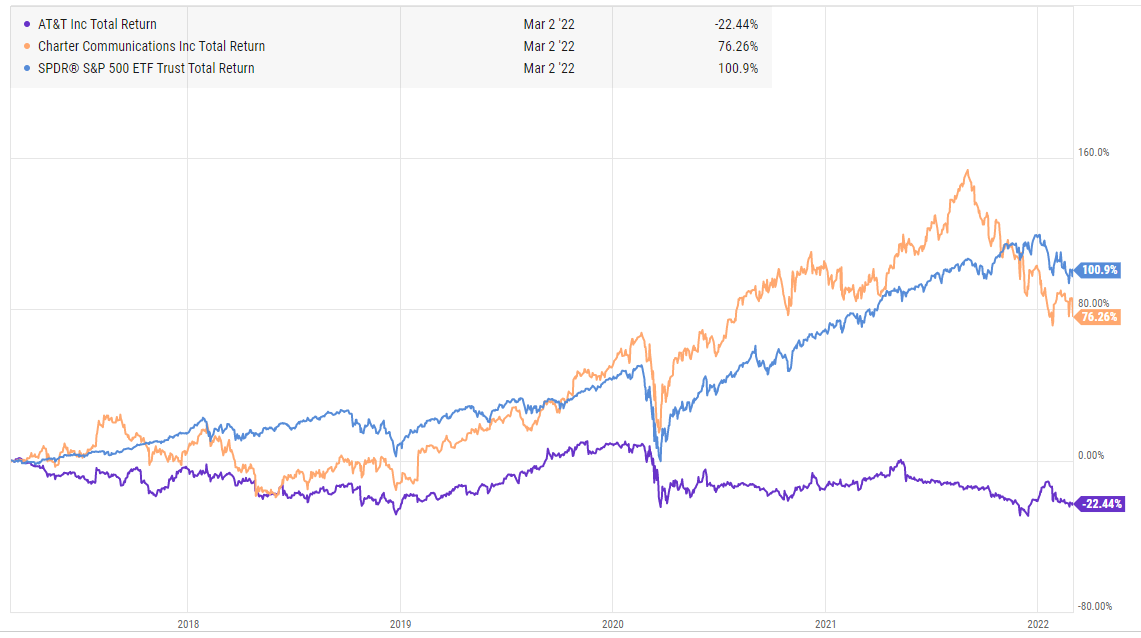

Moving on, probably the most pressing concern for cable investors currently is FTTH overbuilds. AT&T says they “feel bad for cable companies competing with their fiber.” I disagree; I feel bad for AT&T’s shareholders given the value destruction that’s taken place over there.

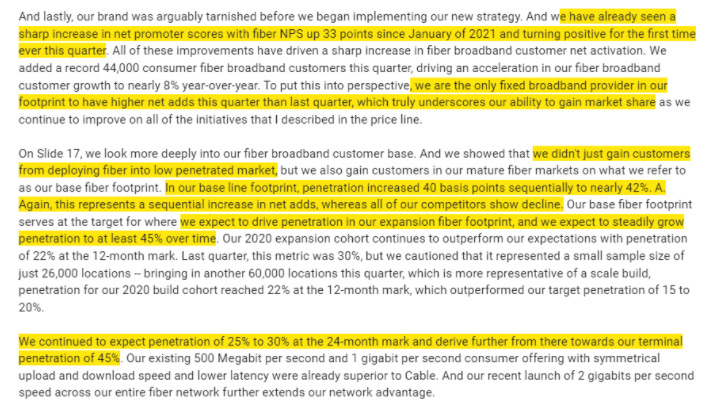

More seriously, I addressed FTTH extensively in part 2; my overall conclusion was the risks were manageable (though, obviously as a cable investor I’d prefer less competition to more!). Frontier (FYBR, a current favorite of mine) reported earnings late last month, and I wanted to highlight two quotes from their earnings calls.

First, the quote below. Lots of juicy nuggets in there, but the main ones I wanted to highlight were their targets for FTTH penetration after build out (25-30% in 24 months) and over time (45% terminal penetration), and how they back that penetration up with where their mature fiber is penetrated.

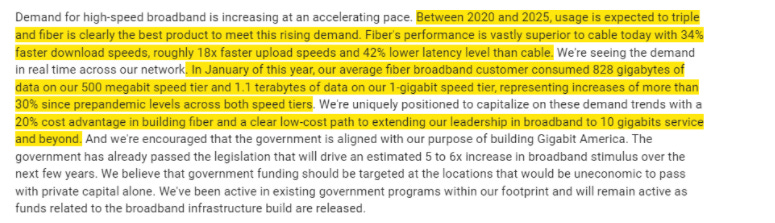

Second, again lots of interesting nuggets in the clip below, but wanted to highlight the bit on cost advantage (20% cost advantage in building fiber thanks to their legacy assets) and how they’re expecting usage to continue to go up (which, as discussed in the fixed wireless section, will form a continued moat for cable and FTTH against fixed wireless companies).

Speaking of cost advantage in building FTTH, one of the most interesting moves I’ve seen recently has been WOW’s move to build out greenfield markets. For some background, WOW is historically a cable overbuilder, and they’re now targeting growth by going into greenfield markets (places where they have no current infrastructure) and building out FTTH (here’s the PR for their first market).

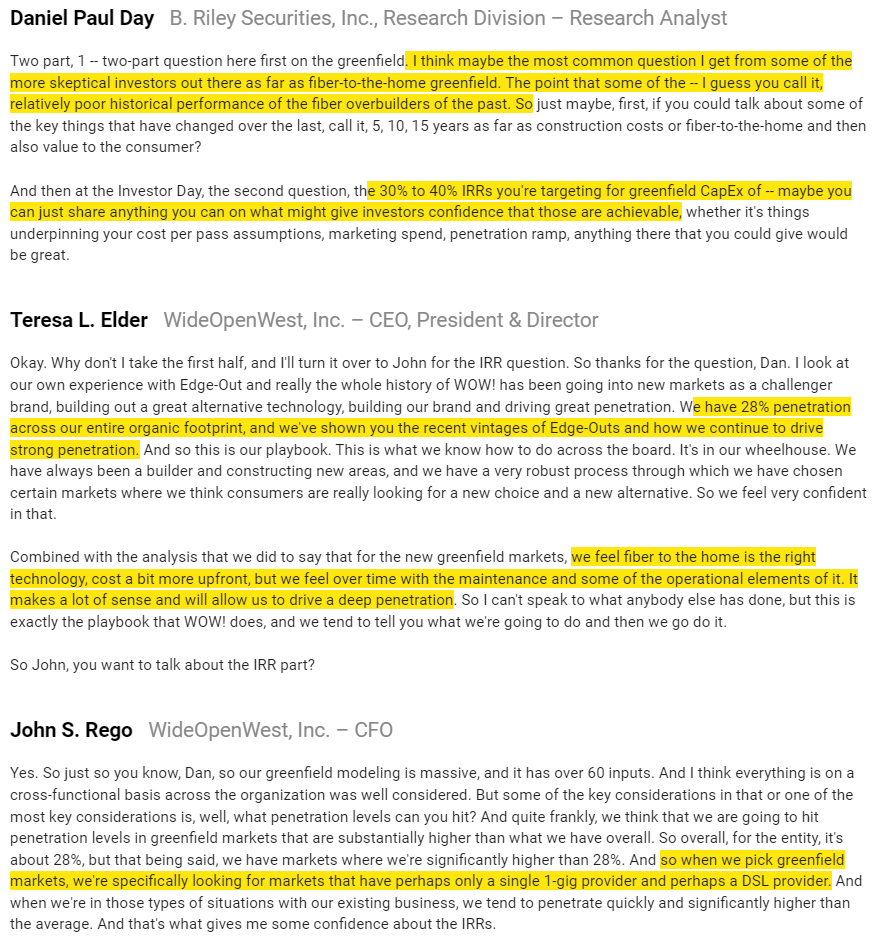

Why’s that so interesting? Well, historically, the returns from greenfield FTTH programs have been low, so it’s both interesting that WOW would try greenfield builds and that they’re choosing FTTH instead of cable. I’m extremely skeptical of the greenfield program from WOW; the clip below is from their Q4’21 earnings call and I think does a good job of laying out why I’m skeptical and the company presenting why they think this is a good idea. Time will tell.

PS- notice at the end of that clip the CFO says WOW is targeting markets where there’s a single 1-GIG provider (read: a cable player) and maybe a DSL provider. A lot of investors, including myself, think the huge push for legacy players to upgrade their copper to FTTH is not just an offensive move to take share and grow, but a defensive move to tell potential competitors “do not overbuild this market; we are going to upgrade our DSL and your overbuild will be a disaster!” I think the WOW quote emphasizes the wisdom of that signaling strategy.

Moving on, I didn’t mention cable’s wireless play a ton in the series, but I remain a big wireless bull for cable. I liked how Maffei framed it on LBRDA’s Q4 earnings call:

Other players are taking notice of the appeal of an MVNO for cable players; WOW announced a partnership with Reach late last month.

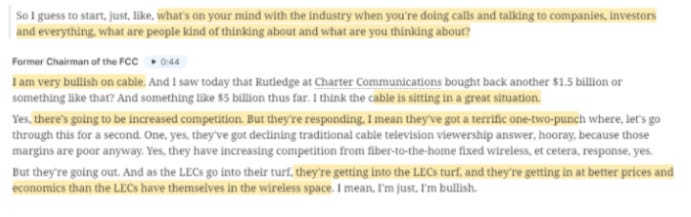

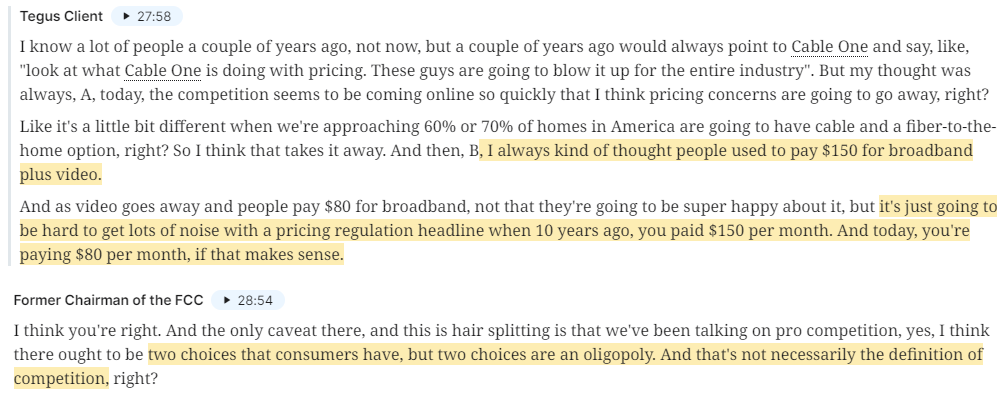

I also didn’t address regulation a ton in the series. Regulation is always a concern, but I think at this point we’re in a regulatory environment that works fine for cable and it’s hard for me to see something coming down the pipe that really destroys cable franchises or something. The Former Chairman of the FCC seemed to agree:

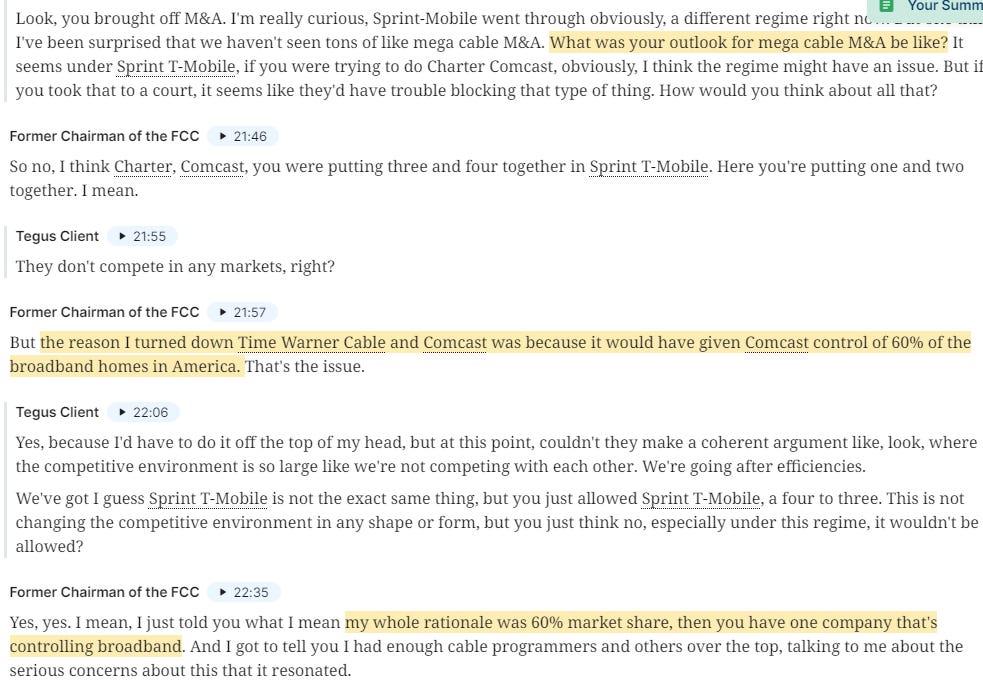

Regulation could be a more meaningful worry if we ever saw some M&A in the industry. Personally, I think the TMUS / Sprint precedent means all cable players should be allowed to merge if they wanted to; after all, the cable players don’t compete directly with each other. But I understand I might be an outlier with that view; the Former Chairman of the FCC suggested CHTR / CMCSA would be off limits, but ATUS / CHTR could probably get through.

On fixed wireless, I don’t have much to add since part 3. I continue to find AT&T being “quiet” on fixed wireless interesting; it suggests to me they know Fixed Wireless has a place in the future but the real money and opportunity is in using your spectrum for wireless and using infrastructure (like fiber) for broadband. TMUS continues to expand their fixed wireless plan, but I continue to think if you look at how they’re expanding it and read between the lines they’re really focused on using excess spectrum in the short term and it won’t present a true long term threat to cable.

Anyway, this concludes my deep dive into cable threats (sponsored by Tegus). Obviously, cable’s a huge priority for me, so I’m certain we’ll be talking about the industry again on the blog in the near future. I’m looking forward both to talking cable again and to the next deep dive on REGN (and, again, please lob in suggestions for how I can improve this series or companies / sectors to cover for the next one!).

See ya then.

Just an anecdote, after reading your first or second post, I looked online and it turns out I have T-mobile available in my area, T-mobile for home, $50 a month 5G unlimited, fixed price on autopay, opposed to my Cox which was $112, I called them, they sent me a box, 15 day free trial and guess what, I canceled Cox and saved $60 a month, every friend I told that had T-mobile for home available in his area, switched right away, they all hate Cox monopoly, every one with T-mobile not yet available, signed up for alert to when it is available. One other person I met just switched to Century link new Fiber, $60 a month. When I returned the box at Cox store, three other people did. I think cable monopoly is over in certain areas, and the heavy debt and buybacks will backfire for the current monopolies, these stocks will not get high PE rating if competition intensifies, and likely dead money at best, I live in Vegas by the way. Cheers!

Fantastic series. Curious on your point re Starry being victim to the backhaul of both towers and fixed networks. Do you see a similar risk in CHTR's MNVO agreement for its mobile opportunity?